Amazon Health Savings Accounts (HSAs) offer a unique approach to managing healthcare expenses, combining the benefits of tax savings with the flexibility of a personal health account. Unlike traditional health insurance, HSAs allow you to contribute pre-tax dollars, grow your savings tax-free, and withdraw funds tax-free for qualified medical expenses.

Opening an Amazon HSA is a straightforward process that involves selecting a plan, providing personal information, and funding your account. Eligibility for an HSA is determined by your health insurance plan and whether you meet certain criteria, such as being enrolled in a high-deductible health plan (HDHP).

Understanding Amazon Health Savings Accounts (HSAs)

Amazon Health Savings Accounts (HSAs) are tax-advantaged savings accounts designed to help individuals pay for qualified healthcare expenses. They offer a unique approach to healthcare financing, distinct from traditional health insurance plans.

Purpose of Amazon HSAs

Amazon HSAs are designed to provide individuals with a way to save for future healthcare expenses while enjoying tax benefits. They allow you to contribute pre-tax dollars to an account that can be used to pay for qualified medical expenses.

Amazon Health Savings Accounts (HSAs) can be a valuable tool for managing healthcare expenses. While exploring your options, you might be surprised to find that even something like a beast costume for a Beauty and the Beast themed event can be tax-deductible when purchased with HSA funds, as long as it’s deemed medically necessary.

HSAs offer tax advantages and allow you to save for future healthcare needs, so be sure to explore how they can benefit your overall financial planning.

Unlike traditional health insurance, which covers a portion of your healthcare costs, HSAs provide you with greater control over your healthcare spending.

Amazon Health Savings Accounts (HSAs) offer a tax-advantaged way to save for healthcare expenses. While HSAs are great for covering medical costs, you might also want to consider exploring options for dental insurance and health insurance to ensure comprehensive coverage for your overall well-being.

Remember, your HSA can be used to pay for dental expenses, so it’s a valuable tool for managing both medical and dental costs.

Opening an Amazon HSA

Opening an Amazon HSA is a straightforward process:

- Choose an HSA provider:Amazon partners with various HSA providers, offering different features and fees. Research and select a provider that aligns with your needs and preferences.

- Meet eligibility requirements:To be eligible for an Amazon HSA, you must be enrolled in a high-deductible health plan (HDHP).

- Complete the application:Once you’ve chosen a provider, complete the online application form, providing necessary personal and financial information.

- Fund your account:You can contribute to your HSA throughout the year, either through regular contributions or lump-sum deposits.

Eligibility Requirements for Amazon HSAs

To be eligible for an Amazon HSA, you must:

- Be enrolled in a high-deductible health plan (HDHP).

- Not be covered by another health plan, such as Medicare or Medicaid.

- Not be claimed as a dependent on someone else’s tax return.

Benefits of Using an Amazon HSA

Amazon HSAs offer numerous benefits:

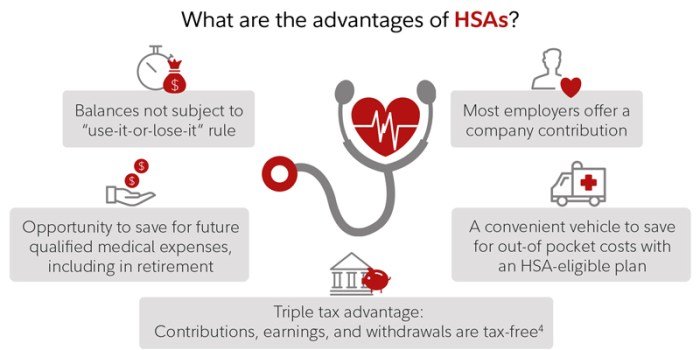

- Tax advantages:Contributions to an HSA are tax-deductible, and withdrawals for qualified medical expenses are tax-free.

- Account ownership:You own and control your HSA, allowing you to use the funds as you see fit.

- Investment options:Many HSA providers offer investment options, allowing your funds to grow over time.

- Rollover benefits:Unused funds in your HSA roll over year to year, allowing you to accumulate savings for future healthcare needs.

Potential Drawbacks of Amazon HSAs

While Amazon HSAs offer numerous benefits, they also have potential drawbacks:

- High deductibles:HDHPs typically have higher deductibles than traditional health insurance plans.

- Limited coverage:HDHPs may have limited coverage for certain medical services.

- Out-of-pocket expenses:You may need to pay for some medical expenses out of pocket before reaching your deductible.

Amazon HSA Features and Functionality

Amazon Health Savings Accounts (HSAs) offer a range of features and functionalities designed to help individuals manage their healthcare expenses and save for future medical needs. These accounts combine tax advantages with investment options, making them a valuable tool for healthcare planning.

Contribution Limits

Contribution limits for HSAs are set annually by the IRS. These limits vary depending on whether you have individual or family coverage. The maximum contribution amount for 2023 is $3,850 for individuals and $7,750 for families. You can contribute to your HSA up to the annual limit, regardless of your age or income.

Tax Advantages

One of the key benefits of an HSA is its tax advantages. Contributions to an HSA are tax-deductible, meaning you can reduce your taxable income by the amount you contribute. Additionally, the money grows tax-deferred, meaning you won’t pay taxes on the earnings until you withdraw them.

Investment Options

Amazon HSA offers investment options, allowing you to grow your HSA balance over time. You can choose from a variety of investment funds, including mutual funds, ETFs, and index funds. These investment options provide the potential for higher returns compared to a traditional savings account.

Comparison with Other HSA Providers

Amazon HSA compares favorably to other HSA providers in terms of features, functionality, and fees. It offers a user-friendly platform, a wide range of investment options, and competitive fees.

Tools and Resources

The Amazon HSA platform provides a range of tools and resources to help you manage your account. These include:

- Online account access for managing contributions, withdrawals, and investments.

- Mobile app for convenient access to your account on the go.

- Personalized spending and investment tracking tools.

- Educational resources and FAQs to help you understand HSAs.

- Customer support available via phone, email, and chat.

Key Features, Benefits, and Limitations

| Feature | Benefit | Limitation |

|---|---|---|

| Tax-deductible contributions | Reduces taxable income and lowers your tax bill. | Contributions are subject to annual limits. |

| Tax-free withdrawals for qualified medical expenses | Allows you to pay for healthcare expenses without paying taxes on the withdrawals. | Withdrawals for non-medical expenses are subject to taxes and a 20% penalty. |

| Investment options | Provides the potential for higher returns on your HSA funds. | Investment returns are not guaranteed and may fluctuate. |

| Rollover to other HSA providers | Allows you to transfer your HSA balance to another provider if needed. | May be subject to fees or restrictions depending on the provider. |

Utilizing Amazon HSAs for Healthcare Expenses

An Amazon HSA can be a powerful tool for managing your healthcare costs. By contributing pre-tax dollars to your HSA, you can save money on taxes and use the funds to pay for eligible medical expenses. This section will explore how to utilize your Amazon HSA for healthcare expenses, highlighting common eligible expenses and providing examples of how to use your HSA for specific healthcare needs.

Paying for Eligible Medical Expenses

You can use your Amazon HSA to pay for a wide range of eligible medical expenses, including doctor’s visits, prescription medications, and medical procedures. To use your HSA for these expenses, you’ll typically need to:

- Obtain a receipt or invoice from the healthcare provider.

- Submit the receipt or invoice to your HSA provider, either through their website or mobile app.

- Your HSA provider will then reimburse you for the eligible expenses directly from your HSA account.

Examples of Common Eligible Expenses

Here are some examples of common healthcare expenses that can be covered by an Amazon HSA:

- Doctor’s visits: This includes visits to primary care physicians, specialists, and other healthcare professionals.

- Prescription medications: Both brand-name and generic medications are eligible for HSA reimbursement.

- Medical procedures: This includes surgeries, diagnostic tests, and other medical treatments.

- Dental and vision care: Many HSA plans cover dental and vision care expenses, although specific coverage may vary.

- Over-the-counter medications: Some over-the-counter medications are eligible for HSA reimbursement, but only if they are prescribed by a doctor.

- Medical equipment: This includes items such as crutches, wheelchairs, and walkers.

- Mental health services: Expenses related to mental health services, such as therapy and counseling, are typically covered by HSAs.

Scenario: Using an Amazon HSA for Healthcare Expenses

Imagine you need to see a doctor for a routine checkup. You schedule the appointment and receive a bill for $150. You can use your Amazon HSA to pay for this expense.

- After your appointment, you receive a bill from the doctor’s office.

- You submit the bill to your Amazon HSA provider through their website or mobile app.

- Your HSA provider will review the bill and, if it’s for an eligible medical expense, they will reimburse you for the $150 directly from your HSA account.

Eligible and Ineligible Expenses

The following table Artikels some common eligible and ineligible expenses for an Amazon HSA:

| Eligible Expenses | Ineligible Expenses |

|---|---|

| Doctor’s visits | Cosmetic surgery |

| Prescription medications | Over-the-counter medications (unless prescribed) |

| Medical procedures | Life insurance premiums |

| Dental and vision care | Gym memberships |

| Medical equipment | Personal care items (e.g., shampoo, soap) |

Amazon HSA Investment Options

Investing your HSA funds can potentially help your savings grow over time, potentially allowing you to cover more healthcare costs in the future. This section will discuss the investment options available within Amazon HSAs, their associated risks and rewards, how to invest, and their historical performance.

Investment Options

Amazon HSA investment options provide a range of choices to suit different risk tolerances and financial goals. The most common investment options within Amazon HSAs include:

- Mutual Funds: These funds pool money from multiple investors to buy a diversified portfolio of stocks, bonds, or other assets. They are managed by professional fund managers who aim to achieve specific investment objectives.

- Exchange-Traded Funds (ETFs): ETFs are similar to mutual funds but are traded on stock exchanges like individual stocks.

They offer diversification and lower costs than many actively managed mutual funds.

- Individual Stocks: Investing in individual stocks allows you to own a portion of a specific company. While this can offer potentially higher returns, it also carries a higher risk than investing in diversified funds.

Risks and Rewards, Amazon health savings account

Each investment option comes with its own set of risks and potential rewards:

- Mutual Funds: While they offer diversification, mutual funds can have higher fees than ETFs. Their performance can vary depending on the fund manager’s skill and market conditions.

- Exchange-Traded Funds (ETFs): ETFs generally have lower fees than mutual funds, but their performance can fluctuate based on the underlying assets they track.

- Individual Stocks: Investing in individual stocks carries a high level of risk as the value of the stock can fluctuate significantly based on company performance, market conditions, and other factors. However, it also offers the potential for higher returns.

Investing in an Amazon HSA

Investing in an Amazon HSA is a straightforward process:

- Log in to your Amazon HSA account.

- Navigate to the investment section.

- Select the investment option you want to choose (mutual funds, ETFs, or individual stocks).

- Choose the specific investment(s) within the selected option.

- Specify the amount you want to invest.

- Confirm your investment.

Investment Performance

The performance of Amazon HSA investment options can vary over time, influenced by market conditions, fund management, and the specific investments chosen.

For example, a diversified mutual fund tracking the S&P 500 index might have historically outperformed individual stocks in a specific sector, but it might underperform in certain market conditions.

It’s important to note that past performance is not indicative of future results, and investing always involves risk.

Amazon Health Savings Accounts (HSAs) are a great way to save money on healthcare costs, especially if you have a high-deductible health plan. One of the benefits of an HSA is that you can use the money to pay for qualified medical expenses, such as doctor’s visits, prescription drugs, and even over-the-counter medications.

If you’re looking for more information on how to use your HSA funds, check out health tis for some helpful tips and resources. By taking advantage of the benefits of an HSA, you can take control of your healthcare finances and make sure you’re getting the most out of your health savings.

Amazon HSA Customer Support and Resources

Navigating the world of health savings accounts can sometimes raise questions or require assistance. Fortunately, Amazon offers a range of customer support options and resources to help you manage your Amazon HSA effectively.

Customer Support Options

Amazon HSA provides multiple channels for users to connect with their customer support team.

- Phone Support:You can reach Amazon HSA customer support by calling their dedicated phone number, which is available on their website. This option allows for immediate assistance and personalized guidance.

- Email Support:Alternatively, you can submit your inquiries through email. While response times may vary, this option provides a written record of your communication.

- Online Chat:Amazon HSA also offers a live chat feature on their website. This allows for real-time interaction with a customer support representative, providing quick answers to your questions.

Available Resources

Amazon HSA aims to empower users with comprehensive resources.

- Frequently Asked Questions (FAQs):The Amazon HSA website features a dedicated FAQ section, addressing common questions and concerns about account management, contributions, withdrawals, and other relevant topics. This resource provides quick answers to frequently asked questions.

- Guides and Tutorials:Amazon HSA provides various guides and tutorials to help users understand the intricacies of their HSA. These resources cover topics like account setup, contribution strategies, and using your HSA for healthcare expenses. This allows users to gain a deeper understanding of the features and functionalities of their HSA.

Resolving Issues or Complaints

If you encounter any issues or have complaints regarding your Amazon HSA, the following steps can be taken.

- Contact Customer Support:Begin by reaching out to Amazon HSA customer support through any of the available channels mentioned earlier. Clearly explain your issue or complaint, providing relevant details and documentation.

- Escalation Process:If your issue remains unresolved after contacting customer support, you can escalate your complaint to a supervisor or a higher-level representative. This allows for a more in-depth review of your situation and a potential resolution.

Customer Support Channels and Resources Summary

| Channel/Resource | Description |

|---|---|

| Phone Support | Direct communication with a customer support representative over the phone. |

| Email Support | Submitting inquiries through email for written communication and documentation. |

| Online Chat | Real-time interaction with a customer support representative via live chat. |

| FAQs | A dedicated section on the Amazon HSA website answering common questions. |

| Guides and Tutorials | Comprehensive resources providing detailed information on HSA management and utilization. |

The Future of Amazon HSAs

The Amazon HSA market is poised for significant growth and evolution, driven by factors like technological advancements, changing healthcare landscapes, and the increasing popularity of HSAs among consumers. Amazon’s commitment to innovation and its vast reach in the e-commerce and healthcare sectors position it strategically to shape the future of HSAs.

Potential Future Developments and Trends

The Amazon HSA market is expected to witness several key developments in the coming years, influenced by emerging trends in healthcare and consumer behavior.

- Integration with Amazon’s Ecosystem:Amazon is likely to further integrate its HSA offerings with its existing ecosystem, leveraging its vast network of services and technologies. This could involve seamless connections with Amazon Pay, Amazon Prime, and other platforms, enhancing user convenience and accessibility.

- Personalized Healthcare Solutions:Amazon could leverage its data analytics capabilities to offer personalized healthcare solutions through its HSAs. By analyzing user spending patterns and health data, Amazon could provide tailored recommendations for healthcare providers, treatments, and wellness programs.

- Expansion of Investment Options:Amazon might expand its HSA investment options, offering a wider range of investment vehicles and strategies to cater to diverse risk appetites and financial goals. This could include robo-advisory services, curated investment portfolios, and potentially even cryptocurrency options, aligning with the growing interest in alternative investments.

- Focus on Healthcare Transparency:Amazon could play a pivotal role in promoting healthcare transparency by providing users with comprehensive cost comparisons, quality ratings, and other data to make informed healthcare decisions. This could empower consumers to navigate the healthcare system more effectively and potentially reduce unnecessary spending.

Amazon’s Potential Enhancements

Amazon could enhance its HSA offerings in several ways to enhance user experience and cater to evolving market needs.

- Enhanced Mobile App Functionality:Amazon could enhance its HSA mobile app to provide more robust features, including real-time account balances, spending tracking, and personalized health insights. This could improve user engagement and simplify HSA management.

- Integration with Wearable Devices:Amazon could integrate its HSAs with wearable devices and health tracking apps to enable seamless data sharing and potentially offer rewards for healthy behaviors. This could incentivize proactive health management and contribute to lower healthcare costs.

- Expanded HSA Partnerships:Amazon could expand its HSA partnerships with healthcare providers, pharmacies, and other relevant entities to offer exclusive discounts and benefits to HSA users. This could create a more comprehensive and rewarding healthcare ecosystem for Amazon HSA members.

Impact of Evolving Healthcare Regulations

Evolving healthcare regulations, such as those related to telehealth, interoperability, and data privacy, will likely impact the development and functionality of Amazon HSAs.

- Telehealth Integration:Amazon could leverage telehealth regulations to facilitate seamless integration of telehealth services into its HSA platform, offering users convenient and affordable access to virtual consultations and remote healthcare.

- Data Interoperability:Interoperability regulations could empower Amazon to access and share healthcare data securely and efficiently, enabling personalized health recommendations and more effective healthcare management.

- Data Privacy and Security:Amazon will need to comply with evolving data privacy and security regulations to ensure the safe and responsible handling of sensitive user data. This will be crucial for maintaining user trust and building a secure healthcare ecosystem.

Amazon HSAs in the Future of Healthcare

Amazon HSAs have the potential to play a significant role in the future of healthcare, contributing to increased affordability, transparency, and personalized healthcare solutions.

- Increased Affordability:Amazon HSAs can contribute to increased affordability by empowering consumers to manage their healthcare expenses more effectively, reducing unnecessary spending and promoting preventive care.

- Enhanced Transparency:Amazon could leverage its platform to provide greater transparency in healthcare costs, quality ratings, and treatment options, empowering consumers to make informed decisions and drive competition in the healthcare market.

- Personalized Healthcare:Amazon’s data analytics capabilities could enable the development of personalized healthcare solutions tailored to individual needs and preferences, promoting proactive health management and potentially improving overall health outcomes.

Ultimate Conclusion: Amazon Health Savings Account

Amazon HSAs empower individuals to take control of their healthcare finances, offering a compelling alternative to traditional health insurance. With tax advantages, investment opportunities, and a user-friendly platform, Amazon HSAs provide a valuable tool for managing healthcare costs and building a secure financial future.

Essential Questionnaire

Can I use my Amazon HSA to pay for my spouse’s medical expenses?

Yes, you can use your Amazon HSA to pay for eligible medical expenses for your spouse and dependents.

What happens to my HSA funds if I change jobs or insurance plans?

Your HSA funds remain yours and can be used for qualified medical expenses, regardless of your employment or insurance status.

Can I withdraw money from my Amazon HSA for non-medical expenses?

While you can withdraw funds for non-medical expenses, you will be subject to taxes and a 20% penalty.

How do I choose the right Amazon HSA investment options?

Consider your risk tolerance, investment goals, and time horizon when selecting investment options. It’s recommended to consult with a financial advisor for personalized guidance.