Cheapest health insurance in NYC sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Navigating the healthcare landscape in a bustling metropolis like New York City can be daunting, especially when it comes to finding affordable health insurance.

This guide provides a comprehensive overview of the options available, from understanding the different types of plans to accessing public programs and financial assistance.

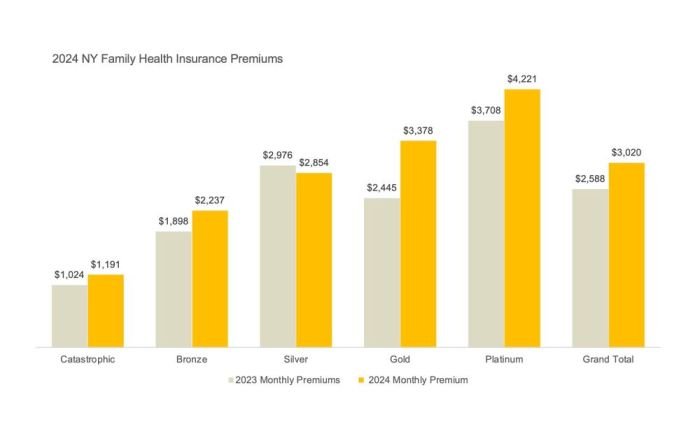

From individual and family plans to employer-sponsored options, the variety of health insurance plans in NYC can be overwhelming. Factors like age, health status, location, and plan coverage all influence the cost of insurance. Understanding these factors is crucial for making informed decisions about your health insurance needs.

This guide will help you navigate the complexities of the NYC health insurance market and find the most affordable coverage that meets your individual requirements.

Understanding NYC Health Insurance Landscape

Navigating the world of health insurance in New York City can be overwhelming. With various plans and providers, understanding the nuances of the NYC health insurance landscape is crucial for finding the best coverage at the most affordable price. This guide will help you understand the different types of plans, factors that influence costs, and key features to consider when comparing options.

Types of Health Insurance Plans

New York City offers a variety of health insurance plans to cater to different needs and budgets. These plans can be broadly categorized into three main types:

- Individual Health Insurance Plans:These plans are purchased directly by individuals, typically through the New York State of Health Marketplace. They are a good option for self-employed individuals, freelancers, or those who don’t have access to employer-sponsored coverage.

- Family Health Insurance Plans:These plans are designed to cover multiple family members. They often offer lower per-person costs than individual plans, especially for families with children.

- Employer-Sponsored Health Insurance Plans:Many employers in NYC offer health insurance as part of their benefits package. These plans are usually more affordable than individual or family plans due to economies of scale. They can be offered through a variety of mechanisms, including traditional group health plans, self-funded plans, or health reimbursement arrangements (HRAs).

Factors Influencing Health Insurance Costs

Several factors contribute to the cost of health insurance in NYC. These include:

- Age:Generally, older individuals tend to have higher health insurance premiums due to a higher likelihood of needing medical care.

- Health Status:Individuals with pre-existing conditions or chronic illnesses often face higher premiums, as they are considered higher-risk by insurance companies.

- Location:The cost of health insurance can vary depending on the geographic location within NYC. Areas with higher concentrations of medical providers or a greater demand for healthcare services may have higher premiums.

- Plan Coverage:The level of coverage offered by a plan significantly influences its cost. Plans with higher deductibles and copayments typically have lower monthly premiums, while plans with lower out-of-pocket costs tend to have higher premiums.

Comparing Health Insurance Plans

When comparing health insurance plans in NYC, it’s essential to consider key features that affect your overall costs and benefits. These include:

- Deductible:The amount you must pay out-of-pocket before your insurance coverage kicks in.

- Copayments:Fixed amounts you pay for specific medical services, such as doctor visits or prescriptions.

- Out-of-Pocket Maximum:The maximum amount you’ll pay for healthcare expenses in a given year. Once you reach this limit, your insurance will cover 100% of your remaining medical costs.

- Network:The list of doctors, hospitals, and other healthcare providers that your insurance plan covers.

It’s crucial to carefully compare the costs and benefits of different plans before making a decision.

Navigating Affordable Health Insurance Options

Finding affordable health insurance in NYC can be a daunting task, given the numerous options available. This section will guide you through the process of navigating the NYC health insurance landscape and finding the most suitable plan for your needs and budget.

Health Insurance Providers in NYC

Understanding the different providers available in NYC is crucial for making informed decisions about your health insurance. NYC offers a diverse range of health insurance providers, including both private and public options. Here are some of the most popular providers in NYC:

- Private Insurance Providers:

- Empire BlueCross BlueShield

- UnitedHealthcare

- Healthfirst

- Oscar Health

- Cigna

- Public Insurance Programs:

- Medicaid (NYC Health + Hospitals)

- Child Health Plus

- Essential Plan

Key Features and Costs of Popular Health Insurance Plans

To help you compare different health insurance plans, the following table Artikels the key features and costs of some popular plans from different providers:

| Provider | Plan Name | Monthly Premium | Deductible | Co-pay |

|---|---|---|---|---|

| Empire BlueCross BlueShield | Empire Plan | $350 | $2,000 | $25 |

| UnitedHealthcare | UnitedHealthcare Choice | $400 | $1,500 | $30 |

| Healthfirst | Healthfirst Essential Plan | $250 | $3,000 | $15 |

| Oscar Health | Oscar Silver | $300 | $2,500 | $20 |

| Cigna | Cigna Open Access | $450 | $1,000 | $40 |

Enrolling in Health Insurance Plans in NYC

The process of applying for and enrolling in health insurance plans in NYC can be broken down into several steps:

- Determine your eligibility:Start by determining your eligibility for different health insurance plans based on your income, age, and other factors.

- For public insurance programs like Medicaid and Child Health Plus, you can check your eligibility online or through the NYC Human Resources Administration (HRA).

Finding the cheapest health insurance in NYC can be a daunting task, but it’s essential for maintaining your well-being. While you’re navigating the insurance maze, don’t forget to check out the latest beauty trendz to keep your confidence soaring! After all, feeling good inside and out is a winning combination, and affordable health insurance can help you achieve both.

- For private insurance plans, you can use the Health Insurance Marketplace to compare plans and check your eligibility.

- For public insurance programs like Medicaid and Child Health Plus, you can check your eligibility online or through the NYC Human Resources Administration (HRA).

- Compare plans:Once you know your eligibility, compare different plans based on your needs and budget. Consider factors such as monthly premiums, deductibles, co-payments, and coverage.

- You can use the Health Insurance Marketplace to compare plans side-by-side.

- You can also consult with an insurance broker for personalized advice.

- Enroll in a plan:After choosing a plan, you can enroll online, by phone, or through a broker.

- Open enrollment periods for most health insurance plans occur annually, typically from November to January.

- You may also be eligible for a special enrollment period if you experience certain life events, such as losing your job or getting married.

Accessing Public Health Insurance Programs

Public health insurance programs in NYC, like Medicaid and the Essential Plan, offer affordable health coverage to eligible individuals and families. These programs provide financial assistance to access quality healthcare services and reduce out-of-pocket costs.

Eligibility Requirements and Benefits, Cheapest health insurance in nyc

Eligibility for public health insurance programs in NYC is determined based on factors such as income, family size, and immigration status.

Medicaid

Medicaid is a federal and state-funded program that provides health insurance to low-income individuals and families.

- Income Eligibility:Eligibility for Medicaid is based on income levels, which vary depending on family size and other factors. For example, a single adult in NYC with an annual income below $18,720 is eligible for Medicaid.

- Benefits:Medicaid covers a wide range of medical services, including doctor visits, hospital stays, prescription drugs, and mental health services.

Essential Plan

The Essential Plan is a state-funded program that provides health insurance to individuals and families with incomes slightly above Medicaid eligibility levels.

- Income Eligibility:The income eligibility for the Essential Plan is higher than Medicaid, but still below a certain threshold. For example, a single adult in NYC with an annual income below $25,920 is eligible for the Essential Plan.

- Benefits:The Essential Plan provides similar benefits to Medicaid, including coverage for doctor visits, hospital stays, prescription drugs, and mental health services.

Resources and Contact Information

There are various resources available to help individuals apply for public health insurance programs in NYC.

- NYC Health + Hospitals:NYC Health + Hospitals offers free enrollment assistance for Medicaid and the Essential Plan at its various clinics and community centers throughout the city.

- NYC Human Resources Administration (HRA):HRA provides information and assistance with applying for Medicaid and other public benefits.

- Health Insurance Marketplace:The Health Insurance Marketplace, also known as Healthcare.gov, offers online tools and resources to help individuals compare and enroll in health insurance plans, including Medicaid and the Essential Plan.

Enrollment Periods and Deadlines

There are specific enrollment periods and deadlines for accessing public health insurance programs in NYC.

- Open Enrollment Period:The Open Enrollment Period for Medicaid and the Essential Plan is typically from November 1st to January 15th each year. During this time, individuals can apply for coverage that begins on the first of the following month.

- Special Enrollment Period:Individuals may qualify for a Special Enrollment Period if they experience certain life events, such as losing their job, getting married, or having a baby. These events can make them eligible to apply for coverage outside the Open Enrollment Period.

Finding the cheapest health insurance in NYC can be a challenge, but it’s important to remember that affordability shouldn’t come at the cost of access to quality care. For those seeking convenient and accessible healthcare options, CVS Health Hubs offer a range of services, including primary care, mental health counseling, and prescription refills, which can potentially lower overall healthcare costs in the long run.

So, while exploring affordable insurance plans, consider the added value of these hubs for managing your health and well-being.

Finding Financial Assistance for Health Insurance

Navigating the cost of health insurance in NYC can be challenging, especially for individuals and families facing financial constraints. Fortunately, various financial assistance programs and subsidies are available to help alleviate the burden of healthcare costs.

Subsidies and Tax Credits

Financial assistance for health insurance premiums and out-of-pocket expenses is often available through government programs like the Affordable Care Act (ACA). These subsidies are designed to make health insurance more affordable for individuals and families with lower incomes.

- Premium Tax Credits:These credits reduce the monthly cost of health insurance premiums. The amount of the tax credit depends on your income and family size. You can apply for premium tax credits when you enroll in health insurance through the Marketplace.

Finding the cheapest health insurance in NYC can be a challenge, especially with the wide range of options available. It’s important to remember that during the federal health care open season , you may have the opportunity to switch plans or enroll in a new one.

This could be a great time to re-evaluate your needs and explore if there are more affordable options available in the New York City market.

- Cost-Sharing Reductions:These reductions lower your out-of-pocket expenses, such as deductibles, copayments, and coinsurance. These reductions are available to individuals and families with incomes below a certain threshold.

Organizations and Programs Offering Financial Assistance

Several organizations and programs provide financial assistance for health insurance premiums and out-of-pocket expenses. These programs often target specific demographics, such as low-income families, seniors, or individuals with disabilities.

- The NYC Health + Hospitals Corporation:This public hospital system offers financial assistance programs for low-income individuals and families.

- The New York State Department of Health:The state health department offers various programs, including Medicaid and Child Health Plus, to provide affordable health insurance to eligible individuals and families.

- The New York State of Health Marketplace:The Marketplace is an online platform where you can shop for health insurance plans and apply for financial assistance.

- Community Health Centers:These centers offer affordable healthcare services and may provide financial assistance for health insurance premiums.

- Non-profit Organizations:Many non-profit organizations, such as the United Way and the YMCA, offer financial assistance for health insurance and other essential needs.

Applying for Financial Assistance

Applying for financial assistance for health insurance typically involves providing information about your income, family size, and other relevant factors.

- Gather Necessary Documentation:This includes your Social Security number, proof of income (such as pay stubs or tax returns), and proof of citizenship or residency.

- Complete an Application:You can apply for financial assistance through the Marketplace, the NYC Health + Hospitals Corporation, or other eligible organizations.

- Review Eligibility Criteria:Ensure you meet the eligibility criteria for the specific program you are applying for.

Choosing the Right Health Insurance Plan: Cheapest Health Insurance In Nyc

Finding the cheapest health insurance in NYC is just the first step. Once you have a few options, you need to choose the plan that best meets your individual needs and budget. This involves carefully evaluating different plans and understanding the factors that can impact your overall costs.

Essential Considerations for Choosing a Health Insurance Plan

It’s important to consider a few key factors when selecting a health insurance plan. These include:

- Coverage for Specific Medical Needs:Think about your current and potential future health needs. Do you have any pre-existing conditions? Are you expecting a family? Do you require specific types of medical care, such as mental health services or maternity care? Ensure the plan covers these needs.

- Network Providers:Check the plan’s provider network. Make sure your preferred doctors, hospitals, and specialists are in-network. Out-of-network care can be significantly more expensive.

- Out-of-Pocket Costs:Understand the plan’s out-of-pocket costs, including deductibles, copayments, and coinsurance. These costs can vary widely between plans, so compare them carefully.

- Prescription Drug Coverage:If you take prescription medications, review the plan’s formulary, which lists covered drugs. Make sure your medications are covered and at a reasonable cost.

- Other Benefits:Consider other benefits offered by the plan, such as dental and vision coverage, preventive care, and telehealth services.

Comparing and Contrasting Health Insurance Plans

Once you’ve identified your priorities, you can start comparing plans. Here are some tips:

- Use Online Comparison Tools:Websites like eHealth and Healthcare.gov allow you to compare plans side-by-side based on your specific needs. This can save you time and effort.

- Review Plan Documents:Don’t just rely on summaries; read the plan’s full document to understand the details of coverage, benefits, and limitations.

- Consider Your Health History:If you have a history of expensive medical conditions, you may need a plan with higher coverage limits and lower out-of-pocket costs.

- Think About Your Lifestyle:If you’re healthy and rarely visit the doctor, a high-deductible plan with lower premiums might be suitable. However, if you anticipate frequent medical visits, a plan with lower deductibles and copayments might be a better choice.

Negotiating with Insurance Providers

While you can’t always negotiate the price of your health insurance, there are some strategies you can use to maximize your benefits:

- Shop Around:Get quotes from multiple insurance providers to compare prices and coverage options. This can help you secure a better deal.

- Ask About Discounts:Inquire about discounts for paying premiums in full, enrolling in automatic payments, or being a member of certain organizations.

- Consider Bundling:If you have other insurance policies, like auto or home insurance, ask about bundling discounts.

- Review Your Coverage Regularly:Your needs and circumstances can change over time, so it’s important to review your plan periodically and make adjustments if necessary.

Last Word

Finding the cheapest health insurance in NYC requires careful planning and research. By understanding the different options, accessing public programs and financial assistance, and considering your individual needs, you can secure affordable coverage that provides peace of mind. Remember to regularly review your options and make adjustments as your circumstances change.

With the right approach, you can navigate the NYC health insurance market and find a plan that fits your budget and provides the coverage you need.

Clarifying Questions

What are the different types of health insurance plans available in NYC?

NYC offers a variety of health insurance plans, including individual, family, and employer-sponsored plans. Each type has its own set of benefits and costs, so it’s important to compare them carefully.

What are the best ways to find the cheapest health insurance in NYC?

Start by comparing plans from different providers and consider factors like monthly premiums, deductibles, and copayments. You can also explore public health insurance programs like Medicaid and the Essential Plan, which may offer affordable options.

How can I get financial assistance for health insurance in NYC?

NYC offers various subsidies and tax credits for individuals and families struggling to afford health insurance. You can also explore organizations and programs that offer financial assistance for premiums and out-of-pocket expenses.

What should I consider when choosing a health insurance plan in NYC?

When choosing a health insurance plan, consider factors like coverage for specific medical needs, network providers, and out-of-pocket costs. It’s also important to review the plan’s deductible, copayments, and maximum out-of-pocket expenses.