Financial health federal credit unions offer a unique approach to financial well-being. Unlike traditional banks, federal credit unions are member-owned and operate with a community focus. This structure allows them to prioritize member needs and provide a range of services designed to support financial goals.

From savings and checking accounts to loans and financial education resources, federal credit unions are committed to empowering individuals and families to achieve financial stability. By offering competitive interest rates, personalized service, and a commitment to financial education, these institutions provide a valuable alternative for those seeking a more member-centric banking experience.

Introduction to Federal Credit Unions

Federal credit unions are financial institutions that are owned and operated by their members. Unlike traditional banks, which are for-profit entities, credit unions are not-for-profit cooperatives. This means that their primary goal is to serve the needs of their members, not to maximize profits for shareholders.Federal credit unions are regulated by the National Credit Union Administration (NCUA), an independent agency of the United States government.

The NCUA ensures that credit unions operate safely and soundly, and it protects members’ deposits through a system of insurance similar to the Federal Deposit Insurance Corporation (FDIC) for banks.

Differences Between Federal Credit Unions and Traditional Banks

Federal credit unions and traditional banks share some similarities, but they also have some key differences. Here are some of the most notable distinctions:

- Ownership and Purpose:Federal credit unions are owned and operated by their members, while traditional banks are owned by shareholders. Credit unions prioritize the needs of their members, while banks aim to maximize profits for their shareholders.

- Membership:Federal credit unions typically have a defined field of membership, meaning that only individuals who meet specific criteria can join. This can be based on factors like employment, residency, or association with a particular group. Traditional banks generally have open membership, meaning anyone can open an account.

- Services and Products:Both federal credit unions and traditional banks offer a wide range of financial products and services, including checking and savings accounts, loans, credit cards, and investment products. However, credit unions may have a more limited selection of products compared to larger banks.

Financial Health Federal Credit Union understands that maintaining a healthy lifestyle is crucial to overall well-being. If you’re looking for a top-notch fitness facility, consider checking out lifetime fitness in chanhassen. With a strong commitment to financial wellness, Financial Health Federal Credit Union can help you achieve your fitness goals, whether it’s joining a gym or investing in healthy eating habits.

- Fees and Interest Rates:Credit unions often have lower fees and more favorable interest rates on loans and savings accounts than traditional banks. This is because they are not driven by profit maximization and can prioritize member benefits.

- Customer Service:Credit unions are known for providing personalized customer service and a more community-oriented approach.

The National Credit Union Administration (NCUA)

The NCUA is an independent agency of the United States government that regulates and supervises federal credit unions. It ensures that credit unions operate safely and soundly, and it protects members’ deposits through a system of insurance called the National Credit Union Share Insurance Fund (NCUSIF).

- Regulation and Supervision:The NCUA sets regulations and standards for federal credit unions, conducts examinations, and takes corrective actions when necessary to protect members and ensure the safety and soundness of the credit union system.

- Deposit Insurance:The NCUSIF provides deposit insurance of up to $250,000 per depositor, per insured credit union, for all account types, including checking, savings, money market, and certificates of deposit.

- Member Protection:The NCUA works to protect members from unfair or deceptive practices by credit unions.

Financial Health and Federal Credit Unions

Federal credit unions are not-for-profit financial institutions that are owned and controlled by their members. They are dedicated to promoting the financial well-being of their members by providing a range of financial products and services at competitive rates.

Services and Products Supporting Financial Health

Federal credit unions offer a variety of services and products that can help members achieve their financial goals. These include:

- Savings Accounts:Federal credit unions offer various savings accounts, including traditional savings accounts, money market accounts, and certificates of deposit (CDs), with competitive interest rates. These accounts provide a safe and secure place to save money and earn interest.

- Checking Accounts:Federal credit unions offer checking accounts with features such as debit cards, online banking, and mobile banking. These accounts provide convenient and affordable ways to manage daily finances.

- Loans:Federal credit unions offer a variety of loans, including mortgages, auto loans, personal loans, and small business loans, with competitive interest rates and flexible terms. These loans can help members finance major purchases, consolidate debt, or start a business.

- Financial Education Resources:Federal credit unions often provide financial education resources to their members, such as workshops, seminars, and online tools. These resources can help members learn about budgeting, saving, investing, and other financial topics.

Examples of Financial Goal Achievement, Financial health federal credit union

Federal credit unions can help members achieve their financial goals in various ways. For example, a member might use a savings account to save for a down payment on a house, a loan to finance a car purchase, or financial education resources to learn about managing debt.

“Federal credit unions are committed to helping their members achieve financial success. They offer a range of services and products that can help members save money, manage debt, and achieve their financial goals.”

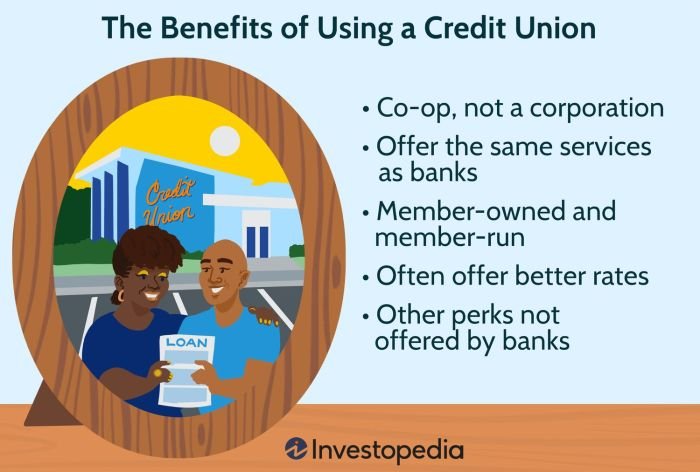

Benefits of Joining a Federal Credit Union

Choosing a financial institution can be a significant decision, and understanding the advantages of each option is crucial. While traditional banks have long been the go-to choice for many, federal credit unions offer a unique set of benefits that can be highly advantageous for individuals and families.

This section will delve into the specific benefits of joining a federal credit union and compare and contrast them with the services offered by traditional banks. We will explore key areas like loan interest rates, savings interest rates, membership structure, community focus, and personal service, highlighting the distinct advantages that federal credit unions provide.

Lower Interest Rates on Loans

Federal credit unions are often known for offering lower interest rates on loans compared to traditional banks. This can translate into significant savings for borrowers over the life of a loan.

- Non-Profit Structure:As member-owned and operated, federal credit unions are not driven by profit maximization like banks. This allows them to offer more favorable loan terms, including lower interest rates, as their primary focus is on serving their members’ financial needs.

Financial health federal credit unions offer a range of services to help you manage your finances, including loans, savings accounts, and financial counseling. It’s important to stay active and healthy, and that includes taking care of your physical well-being.

If you’re looking for a great place to work out, consider checking out castle hills fitness. Once you’ve taken care of your fitness goals, remember that a financial health federal credit union can be a valuable partner in helping you achieve your financial goals.

- Community Focus:Federal credit unions often have a strong focus on serving their local communities. This means they may be more willing to work with borrowers who might not qualify for a loan at a traditional bank, potentially offering lower interest rates as a result.

- Lower Operating Costs:Federal credit unions typically have lower operating costs than banks. This is because they don’t have the same overhead expenses, such as extensive branch networks and marketing campaigns. These cost savings can be passed on to members in the form of lower interest rates on loans.

Higher Interest Rates on Savings

In addition to offering lower interest rates on loans, federal credit unions often provide higher interest rates on savings accounts. This means your money can grow faster and earn more interest over time.

- Member-Owned Structure:Federal credit unions are owned by their members, not shareholders. This means that profits are distributed back to members in the form of higher interest rates on savings accounts, dividends, or other benefits.

- Community Focus:Federal credit unions are often deeply rooted in their communities. This means they may be more inclined to offer competitive interest rates on savings accounts to attract and retain members within the local area.

- Lower Operating Costs:As mentioned earlier, federal credit unions typically have lower operating costs than banks. This allows them to offer higher interest rates on savings accounts, as they have fewer expenses to cover.

Member-Owned and Operated

A key distinguishing feature of federal credit unions is their member-owned and operated structure. This means that members have a direct say in how the credit union is run.

- Democratic Governance:Members elect a board of directors to oversee the credit union’s operations. This board is responsible for setting policies and ensuring that the credit union operates in the best interests of its members.

- Shared Ownership:Members own shares in the credit union, which entitles them to vote on important matters and receive dividends based on the credit union’s profits.

- Focus on Members:Unlike banks, which are owned by shareholders, federal credit unions prioritize the needs of their members. This means they are less likely to engage in risky investments or prioritize profit over member satisfaction.

Community Focus

Federal credit unions are often deeply committed to serving their local communities. This commitment manifests in various ways, including:

- Supporting Local Businesses:Federal credit unions often prioritize lending to local businesses, helping to stimulate economic growth in the community.

- Community Outreach Programs:Many federal credit unions offer financial literacy programs and other community outreach initiatives to promote financial well-being within their service areas.

- Supporting Local Causes:Federal credit unions often partner with local charities and non-profit organizations, demonstrating their commitment to improving the lives of their community members.

Personal Service

Federal credit unions are known for providing personalized service to their members. This can be a significant advantage for those who value a more human touch in their financial interactions.

- Smaller Size:Federal credit unions are typically smaller than banks, which allows for more personalized attention and relationships with members.

- Local Presence:Federal credit unions often have a strong local presence, making it easier for members to access services and build relationships with staff.

- Member-Centric Approach:Federal credit unions prioritize member satisfaction and are more likely to go the extra mile to address individual needs and concerns.

Finding the Right Federal Credit Union

Choosing the right federal credit union can be a significant step towards improving your financial health. It’s essential to find an institution that aligns with your financial needs, goals, and preferences. This involves careful consideration of various factors that will impact your overall experience.

Financial health is about more than just managing your money; it’s about taking care of your overall well-being. Just as you might invest in a gym membership to improve your physical health, consider investing in your financial fitness with a Federal Credit Union.

A great example of this is the Life Fitness Scottsdale gym, where you can focus on your physical goals. Similarly, a Federal Credit Union can help you reach your financial goals through personalized services and competitive rates.

Membership Requirements

Membership requirements determine who can join a specific federal credit union. These requirements are designed to establish a common bond among members, which is a defining characteristic of credit unions.

- Field of Membership:This defines the specific group or groups of people eligible to join. It can be based on employment, residency, or affiliation with a particular organization. For example, a credit union might serve employees of a specific company, residents of a particular city, or members of a professional association.

- Membership Fees:Some credit unions may charge a small membership fee, while others offer free membership. This fee is usually minimal and should be considered during your evaluation.

It’s crucial to ensure you meet the membership requirements before applying. You can typically find detailed information about eligibility on the credit union’s website or by contacting them directly.

Product and Service Offerings

Federal credit unions offer a wide range of financial products and services designed to meet the diverse needs of their members. These offerings can vary from one credit union to another, so it’s important to compare and contrast what’s available.

- Checking and Savings Accounts:These are fundamental banking services that most credit unions provide. Some offer specialized accounts, such as high-yield savings accounts or money market accounts, which can help you maximize your earnings.

- Loans:Federal credit unions offer various loan options, including mortgages, auto loans, personal loans, and credit cards. It’s essential to compare interest rates, terms, and fees for each loan type to find the best deal.

- Other Financial Services:Credit unions may also provide additional services such as investment accounts, insurance products, and financial planning assistance. These services can add value to your overall financial experience.

Evaluating the product and service offerings of different credit unions is essential to determine which institution best aligns with your current and future financial needs.

Location and Accessibility

Location and accessibility are important considerations when choosing a credit union. You’ll want to find an institution with branches or ATMs conveniently located near your home, work, or frequently visited areas.

- Branch Network:Some credit unions have a robust network of branches across multiple states, while others operate locally. Consider your travel habits and preferences when evaluating the branch network.

- ATM Access:Access to ATMs is crucial for withdrawing cash and making deposits. Look for credit unions with a large ATM network or partnerships with other institutions that provide access to their ATMs.

- Online and Mobile Banking:Most credit unions offer online and mobile banking services, allowing you to manage your accounts and perform transactions remotely. These digital tools can be extremely convenient and can further enhance accessibility.

By considering location and accessibility, you can choose a credit union that offers a seamless and convenient banking experience.

Financial Stability and Reputation

The financial stability and reputation of a credit union are essential factors to consider. You want to ensure you’re banking with a reputable institution that has a track record of sound financial practices.

- Financial Performance:Review the credit union’s financial statements, such as its annual report, to assess its financial health. Look for positive trends in assets, equity, and profitability. You can typically find this information on the credit union’s website.

- Regulatory Compliance:Credit unions are regulated by the National Credit Union Administration (NCUA), which ensures their financial stability and safety. Ensure the credit union you choose is in good standing with the NCUA.

- Member Reviews and Ratings:Online reviews and ratings from other members can provide valuable insights into the credit union’s customer service, product offerings, and overall reputation. Websites like Bankrate and NerdWallet offer ratings and reviews for various credit unions.

Choosing a financially stable and reputable credit union can provide you with peace of mind and confidence in your financial decisions.

Final Wrap-Up: Financial Health Federal Credit Union

Joining a federal credit union can be a smart move for individuals seeking financial stability and a more personalized banking experience. With lower interest rates on loans, higher interest rates on savings, and a commitment to member satisfaction, federal credit unions provide a compelling alternative to traditional banks.

By carefully considering membership requirements, product offerings, and location, individuals can find a federal credit union that aligns with their unique financial needs and helps them achieve their financial goals.

Answers to Common Questions

What are the membership requirements for a federal credit union?

Membership requirements vary depending on the specific credit union. Some may require a common employment, residency, or affiliation, while others have open memberships. You can find information on membership eligibility on the credit union’s website or by contacting them directly.

Are federal credit unions insured?

Yes, federal credit unions are insured by the National Credit Union Administration (NCUA), which provides insurance up to $250,000 per depositor, per insured credit union. This ensures the safety of your deposits.

How do federal credit unions differ from banks?

Federal credit unions are member-owned and operated, while banks are typically owned by shareholders. This means that credit unions prioritize member needs and often offer lower loan interest rates and higher savings interest rates. They also tend to have a more personalized and community-focused approach to banking.