What is an insurance deductible health – What is a health insurance deductible sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset. Imagine yourself facing a medical bill, a significant one, and you’re wondering how much you’ll be responsible for.

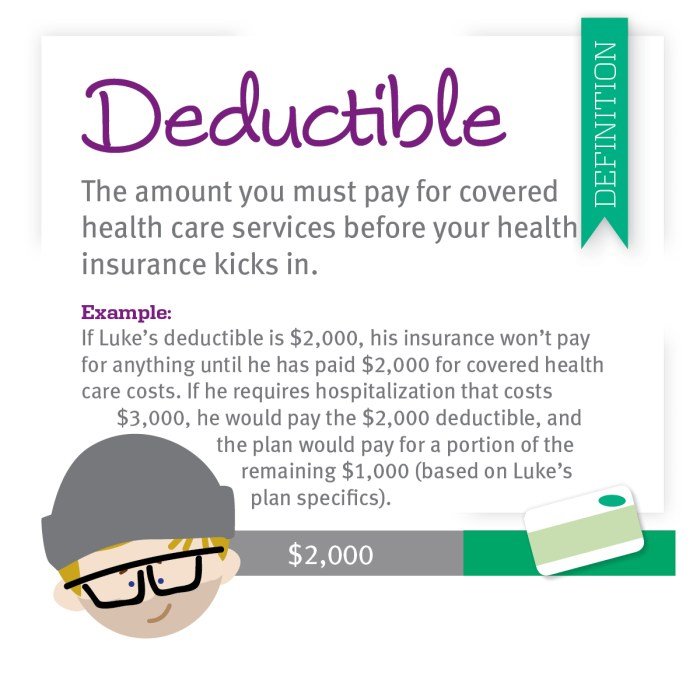

That’s where the concept of a health insurance deductible comes into play. It’s the amount you must pay out of pocket before your insurance kicks in to cover the rest of your medical expenses.

Understanding the role of deductibles is crucial in navigating the world of health insurance. This guide will delve into the intricacies of deductibles, exploring their impact on your healthcare costs, the benefits and drawbacks of different levels, and how they interact with other aspects of your health insurance plan.

Understanding Insurance Deductibles

Imagine you have a car insurance policy with a $500 deductible. If you get into an accident and the repairs cost $2,000, you’ll have to pay the first $500 out of pocket. Your insurance will then cover the remaining $1,500.

An insurance deductible health is the amount you pay out-of-pocket before your insurance plan kicks in. It’s a way to share the cost of healthcare with your insurer, and it can vary depending on your plan and the type of service you’re receiving.

While it’s important to be aware of your deductible, remember that true beauty comes from within, as explored in this insightful article on truly beauty. By focusing on your overall well-being, you’ll be better equipped to manage your health and your finances, including your insurance deductible.

A health insurance deductible works similarly.

Types of Health Insurance Deductibles

Deductibles are an important part of your health insurance policy, as they determine how much you’ll pay out of pocket before your insurance starts covering your medical expenses. Understanding different types of deductibles can help you choose a plan that best suits your needs and budget.

- Individual Deductible: This is the most common type of deductible. It applies to the individual policyholder and is the amount they need to pay before their insurance kicks in for covered medical expenses.

- Family Deductible: This type of deductible applies to the entire family covered under the policy. Once the family deductible is met, the insurance will cover the rest of the medical expenses for all family members. However, it’s important to note that some plans might have a separate deductible for each family member, which can make it more confusing to track.

An insurance deductible is the amount you pay out-of-pocket before your health insurance kicks in. This can be a significant expense, especially if you have a major medical event. Staying healthy can help minimize these costs, and a program like am fam fitness can be a great way to get started.

By focusing on fitness and wellness, you can potentially lower your risk of health issues and reduce your overall healthcare expenses, ultimately making your insurance deductible less of a burden.

- Per-Incident Deductible: This deductible applies to each separate medical event or incident. For example, if you have a per-incident deductible of $500, you’ll need to pay $500 for each doctor’s visit, hospital stay, or other medical service, even if you’re receiving treatment for the same condition.

Importance of Deductibles

Deductibles play a crucial role in the healthcare insurance system, influencing both the cost of insurance and the financial responsibility of individuals when seeking medical care. Deductibles are essentially a predetermined amount of money you must pay out-of-pocket before your health insurance plan starts covering your medical expenses.

Understanding how deductibles work and their implications is essential for making informed decisions about your health insurance coverage.

Impact of Deductibles on Healthcare Costs

Deductibles directly affect healthcare costs by influencing how much individuals pay for medical services.

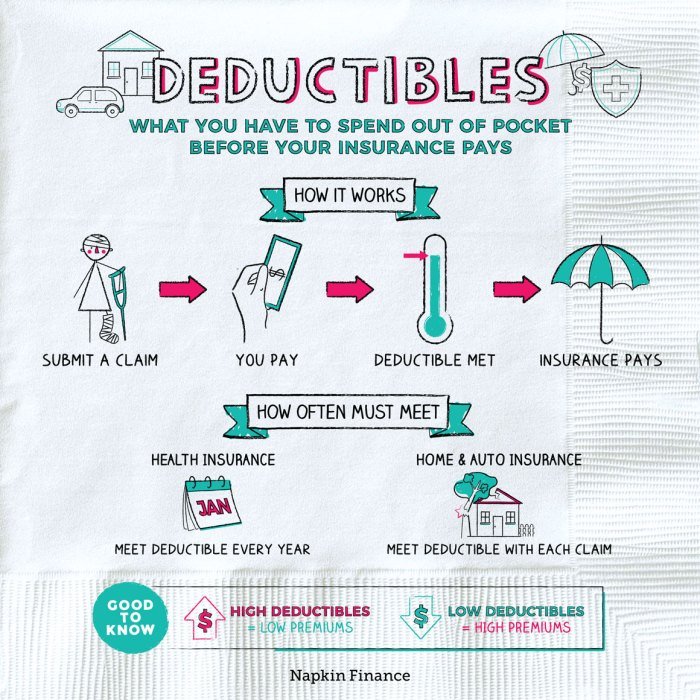

- Lower deductibles: Generally lead to higher monthly premiums but result in lower out-of-pocket expenses for routine medical care. This can be advantageous for individuals who anticipate frequent medical visits or expect high medical expenses.

- Higher deductibles: Usually translate to lower monthly premiums but result in higher out-of-pocket expenses when medical care is needed. This option can be more cost-effective for individuals who are generally healthy and expect fewer medical visits.

Deductibles act as a mechanism to share the risk of healthcare costs between individuals and insurance companies. By paying a deductible, individuals take on a portion of the financial burden, which can lead to lower premiums for everyone.

Influence of Deductibles on Premiums

The relationship between deductibles and premiums is inverse.

- Higher deductibles: Often lead to lower premiums because the insurance company is assuming less risk. Individuals with higher deductibles are responsible for a larger portion of their healthcare costs, reducing the financial burden on the insurance company.

- Lower deductibles: Generally result in higher premiums because the insurance company is assuming more risk. Individuals with lower deductibles have lower out-of-pocket expenses, meaning the insurance company will be responsible for a larger portion of the healthcare costs.

The specific relationship between deductibles and premiums varies depending on the insurance plan and the individual’s circumstances.

An insurance deductible for health is the amount you pay out-of-pocket before your insurance coverage kicks in. It’s often a fixed amount, and it’s a good idea to understand the difference between a deductible and a co-pay, which is a smaller amount paid for each service.

When you’re considering your health insurance options, it’s also a good idea to think about the overall value of your health and well-being. There are many ways to describe the beauty of good health, such as synonyms for beauty like radiance, vibrancy, and vitality.

Ultimately, a healthy lifestyle can lead to a more fulfilling and enjoyable life, and understanding your insurance plan is a key part of that.

Benefits and Drawbacks of Deductible Levels

The choice of a high or low deductible depends on individual circumstances and risk tolerance.

- High deductibles:

- Benefit: Lower monthly premiums, making health insurance more affordable for budget-conscious individuals.

- Drawback: Higher out-of-pocket expenses for medical care, which can be a significant financial burden if unexpected medical needs arise.

- Low deductibles:

- Benefit: Lower out-of-pocket expenses for medical care, providing greater peace of mind for individuals who anticipate frequent medical visits or expect high medical expenses.

- Drawback: Higher monthly premiums, which can make health insurance less affordable for individuals with limited budgets.

It’s important to carefully consider your individual needs and financial situation when choosing a deductible level.

Deductibles and Out-of-Pocket Expenses: What Is An Insurance Deductible Health

Your deductible is the amount you pay out-of-pocket before your health insurance plan starts covering your healthcare costs. It’s a significant part of your overall out-of-pocket expenses, which include all the costs you pay for healthcare that aren’t covered by your insurance.

Deductibles and Out-of-Pocket Expenses

Deductibles directly contribute to your out-of-pocket expenses. Here’s how it works:

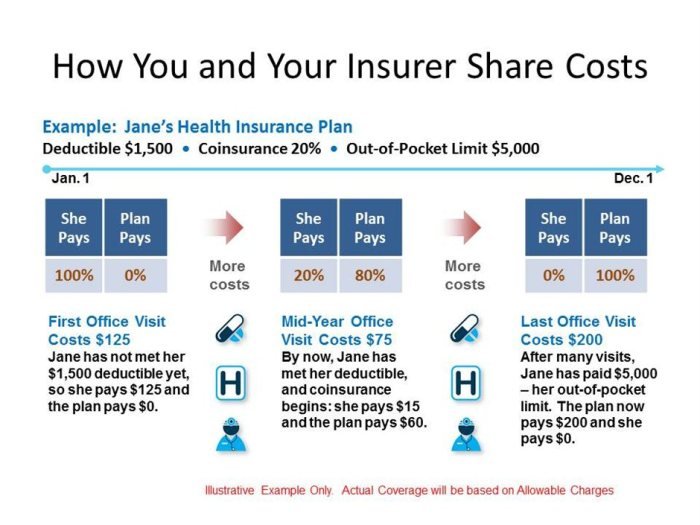

Your deductible is the amount you pay before your insurance starts paying.

For example, if you have a $1,000 deductible and you receive $2,000 worth of medical care, you’ll pay the first $1,000 yourself. After you’ve met your deductible, your insurance will start covering the remaining costs, usually according to your co-pay or co-insurance percentage.

Deductibles, Co-pays, and Co-insurance

Deductibles, co-pays, and co-insurance are all different components of your health insurance plan that determine how much you pay for healthcare.

- Deductible: The amount you pay before your insurance starts covering costs.

- Co-pay: A fixed amount you pay for each medical service, like a doctor’s visit or prescription.

- Co-insurance: A percentage of the cost of medical services that you pay after you’ve met your deductible.

Impact of Different Deductible Levels

The amount of your deductible can significantly impact your out-of-pocket expenses. Here’s a table illustrating the potential financial impact of various deductible levels:

| Deductible | Total Medical Costs | Out-of-Pocket Costs |

|---|---|---|

| $500 | $1,000 | $500 |

| $1,000 | $1,000 | $1,000 |

| $2,000 | $1,000 | $0 (since costs are below deductible) |

| $500 | $2,000 | $1,500 |

| $1,000 | $2,000 | $1,000 |

| $2,000 | $2,000 | $2,000 |

As you can see, a higher deductible can result in lower monthly premiums but potentially higher out-of-pocket expenses if you need a lot of medical care. Conversely, a lower deductible might mean higher monthly premiums but lower out-of-pocket expenses if you need medical care frequently.

Deductibles and Health Savings Accounts (HSAs)

Health Savings Accounts (HSAs) are tax-advantaged savings accounts specifically designed for healthcare expenses. These accounts can be paired with high-deductible health plans (HDHPs), offering a unique way to manage healthcare costs.

Relationship Between Deductibles and HSAs

HSAs are specifically designed to be used in conjunction with high-deductible health plans (HDHPs). These plans typically have higher deductibles than traditional health plans, meaning you pay more out-of-pocket before your insurance coverage kicks in. However, HDHPs often come with lower premiums, making them an attractive option for individuals who are generally healthy and expect to incur fewer healthcare expenses.

Using HSAs to Offset Deductible Expenses

HSAs allow you to save pre-tax dollars for healthcare expenses, including deductibles. The funds you contribute to your HSA grow tax-free, and withdrawals for qualified medical expenses are also tax-free. This means you can use HSA funds to pay for deductible expenses, effectively reducing your out-of-pocket costs.

Tips for Maximizing the Benefits of HSAs with Deductibles

- Contribute the maximum amount allowed.The annual contribution limit for HSAs is set by the IRS, and you can contribute up to the maximum amount each year. This will help you build up a substantial balance in your HSA, which can be used to cover future deductible expenses.

- Use your HSA for all qualified medical expenses.HSA funds can be used for a wide range of medical expenses, including deductibles, copayments, coinsurance, and prescription drugs. Make sure to use your HSA funds for all eligible expenses to maximize the tax benefits.

- Keep track of your HSA receipts.When you use your HSA to pay for medical expenses, make sure to keep all receipts and documentation. This will help you track your spending and ensure that you are using your HSA funds correctly.

- Consider investing your HSA funds.HSA funds can be invested in a variety of assets, such as stocks, bonds, and mutual funds. This can help your HSA balance grow over time, providing you with a larger pool of funds to cover future healthcare expenses.

Choosing the Right Deductible

Choosing the right deductible for your health insurance plan is a crucial decision that impacts your monthly premiums and out-of-pocket costs. It involves balancing your financial situation, healthcare needs, and risk tolerance. A higher deductible generally translates to lower monthly premiums, but you’ll pay more out-of-pocket before your insurance kicks in.

Conversely, a lower deductible means higher monthly premiums, but you’ll have lower out-of-pocket costs.

Factors to Consider, What is an insurance deductible health

When selecting a deductible, consider these factors:

- Your Health History and Expected Healthcare Needs:If you anticipate needing frequent medical care, a lower deductible might be preferable. A higher deductible might be more suitable if you are generally healthy and expect fewer medical expenses.

- Your Financial Situation:A higher deductible can save you money on premiums, but ensure you can afford to pay the deductible in case of unexpected medical expenses. Consider your emergency savings, income, and other financial obligations.

- Your Risk Tolerance:Are you comfortable taking on more risk for lower premiums? A higher deductible means more risk, while a lower deductible means less risk. Evaluate your risk tolerance and decide how much risk you’re willing to assume.

- Your Health Insurance Plan Options:Compare different plans with varying deductible options. Consider the overall cost, including premiums, deductibles, and out-of-pocket expenses. Some plans may offer lower deductibles with higher premiums or higher deductibles with lower premiums.

Assessing Your Individual Healthcare Needs

To determine your healthcare needs, consider:

- Your Age and Health:As you age, you may need more healthcare services. Pre-existing conditions can also increase your healthcare needs. Consider your age and health status when evaluating your deductible.

- Your Lifestyle and Habits:Your lifestyle and habits can impact your health. For example, if you engage in risky activities or have unhealthy habits, you may need more medical care. Assess your lifestyle and habits and how they might affect your healthcare needs.

- Your Family History:Family history can provide insights into potential health risks. If you have a family history of certain conditions, you may need more medical care.

Questions to Ask Your Insurance Provider

To gain clarity about your deductible options, ask your insurance provider:

- What are the deductible options for my health insurance plan?

- How much are the premiums for each deductible option?

- What are the out-of-pocket maximums for each deductible option?

- What types of services are covered under the deductible?

- Are there any specific requirements or limitations for meeting the deductible?

Ending Remarks

In conclusion, deductibles are an integral part of health insurance plans. By understanding how they work, you can make informed decisions about your coverage and ensure you’re prepared for potential medical expenses. Remember to consider your individual needs and financial situation when selecting a deductible, and don’t hesitate to reach out to your insurance provider for clarification or guidance.

Armed with knowledge and a clear understanding of deductibles, you can confidently navigate the healthcare system and protect your financial well-being.

General Inquiries

What happens if I don’t meet my deductible?

If you don’t meet your deductible, you’ll be responsible for the full cost of your medical expenses until you reach the deductible amount. This can be a significant financial burden, so it’s important to consider your potential healthcare needs and budget when choosing a deductible.

Can I pay my deductible in installments?

Whether or not you can pay your deductible in installments depends on your insurance provider. Some insurers offer payment plans, while others require a lump sum payment. It’s best to check with your provider directly to understand their payment options.

What happens to my deductible if I change insurance plans?

Your deductible typically resets when you switch to a new insurance plan. This means you’ll have to start paying towards your new deductible from scratch, regardless of how much you’ve already paid towards your previous deductible.

Can I use a credit card to pay my deductible?

Most insurance providers accept credit card payments for deductibles. However, it’s important to check with your provider to confirm their accepted payment methods.