Best nyc health plans – Navigating the world of NYC health insurance can be overwhelming, but finding the best plan for your needs doesn’t have to be a headache. From understanding the different types of plans to comparing coverage and costs, this guide will help you make informed decisions and find the perfect fit for you, your family, or your small business.

Whether you’re a young adult looking for affordable coverage, a family seeking comprehensive care, or a small business owner trying to find the best value, we’ll explore the top-rated plans in NYC, highlighting their benefits, drawbacks, and key features. We’ll also provide valuable resources to help you compare plans, understand eligibility requirements, and enroll in the right plan for your unique situation.

Understanding NYC Health Insurance Landscape

Navigating the NYC health insurance landscape can feel overwhelming, with a wide array of plans and providers to choose from. This guide aims to simplify the process, offering insights into different plan types, crucial factors to consider, and prominent health insurance providers in the city.

Choosing the best NYC health plan can feel overwhelming, especially when considering the wide range of options available. For those seeking a comprehensive and reliable plan, resolute health stands out as a reputable provider. With a focus on preventative care and personalized services, they offer plans designed to meet the diverse needs of New Yorkers.

Types of Health Insurance Plans in NYC

Understanding the different types of health insurance plans available in NYC is crucial for making an informed decision. Here’s a breakdown of the most common plan types:

- HMO (Health Maintenance Organization):HMO plans typically offer lower premiums in exchange for a more limited network of doctors and hospitals. You’ll need to choose a primary care physician (PCP) within the network who will refer you to specialists.

- PPO (Preferred Provider Organization):PPO plans offer greater flexibility, allowing you to see doctors and hospitals both in and out of the network. However, out-of-network care often comes with higher costs.

- EPO (Exclusive Provider Organization):EPO plans resemble HMOs in that they require you to choose a PCP and receive referrals within the network. However, they differ in that out-of-network care is generally not covered.

- POS (Point-of-Service):POS plans offer a blend of HMO and PPO features. They require you to choose a PCP, but you can also see out-of-network providers with a higher copay or coinsurance.

Key Factors to Consider When Choosing a Health Plan

When selecting a health plan, consider the following factors:

- Coverage:This includes the types of medical services covered, such as preventive care, prescription drugs, mental health services, and hospitalization.

- Cost:Consider the monthly premium, deductible, copayments, and coinsurance.

- Network:Ensure that your preferred doctors and hospitals are in the plan’s network.

Major Health Insurance Providers in NYC

Several major health insurance providers operate in NYC, each offering a range of plans and services. Some of the most prominent include:

- EmblemHealth:A non-profit health insurer offering a variety of plans, including HMO, PPO, and EPO options.

- Empire BlueCross BlueShield:A well-established provider offering a comprehensive range of plans, including individual and family coverage.

- UnitedHealthcare:A national health insurer with a significant presence in NYC, offering a variety of plans with varying levels of coverage.

Best NYC Health Plans for Individuals

Navigating the world of NYC health insurance can feel overwhelming, especially when you’re choosing a plan for yourself. With so many options available, it’s crucial to find a plan that fits your individual needs and budget. This section will guide you through the top-rated individual health plans in NYC, comparing and contrasting their features, benefits, and drawbacks.

Top-Rated Individual Health Plans in NYC

Understanding the strengths and weaknesses of different health plans is essential for making an informed decision. We’ll examine the top-rated individual health plans based on affordability, coverage, and customer satisfaction.

Choosing the best NYC health plan can be a bit of a maze, especially with so many options available. If you’re looking for a plan that prioritizes cardiovascular health, you might want to check out cardi health. They offer a variety of plans designed to support heart health, which is a crucial aspect of overall well-being in the city that never sleeps.

Ultimately, the best NYC health plan for you will depend on your individual needs and preferences.

- Empire BlueCross BlueShield: Known for its extensive network and comprehensive coverage, Empire BlueCross BlueShield offers a wide range of individual health plans, including HMO, PPO, and EPO options. Empire’s plans are generally considered to be affordable, especially for those who qualify for subsidies through the Affordable Care Act (ACA).

However, their deductibles can be high, and out-of-network coverage is limited.

- UnitedHealthcare: UnitedHealthcare is another major player in the NYC health insurance market, offering a diverse selection of individual health plans. Their plans are known for their wide provider networks and competitive pricing. UnitedHealthcare’s plans also offer various options for managing costs, such as telehealth services and prescription drug discounts.

Navigating the best NYC health plans can be a real challenge, but once you’ve got that sorted, you can focus on the finer things, like a flawless manicure. If you’re looking for a long-lasting, chip-resistant nail glue, check out beauty secrets drip & clog proof nail glue – it’s a game-changer for nail art enthusiasts.

With your health plan and nails in tip-top shape, you’ll be ready to take on the city with confidence.

However, some customers have reported issues with customer service.

- Oxford Health Plans: Oxford Health Plans stands out for its focus on providing quality care at an affordable price. They offer a variety of individual health plans, including HMO, POS, and PPO options. Oxford is particularly known for its strong provider network in the NYC area.

However, their plans may have higher deductibles compared to some other options.

- Healthfirst: Healthfirst is a non-profit health plan that provides comprehensive coverage to individuals and families in NYC. Their plans are known for their affordability and focus on preventive care. Healthfirst offers a variety of individual health plans, including HMO, EPO, and PPO options.

However, their provider network may be smaller compared to some other plans.

Comparing Individual Health Plans

Choosing the best health plan depends on your individual needs and priorities. To make an informed decision, consider factors like:

- Affordability: Compare monthly premiums, deductibles, copayments, and out-of-pocket maximums.

- Coverage: Assess the plan’s coverage for essential health benefits, such as preventive care, prescription drugs, and hospitalization.

- Provider Network: Ensure your preferred doctors and hospitals are included in the plan’s network.

- Customer Satisfaction: Research customer reviews and ratings to gauge the plan’s overall quality and customer service.

Best Individual Health Plans by Category

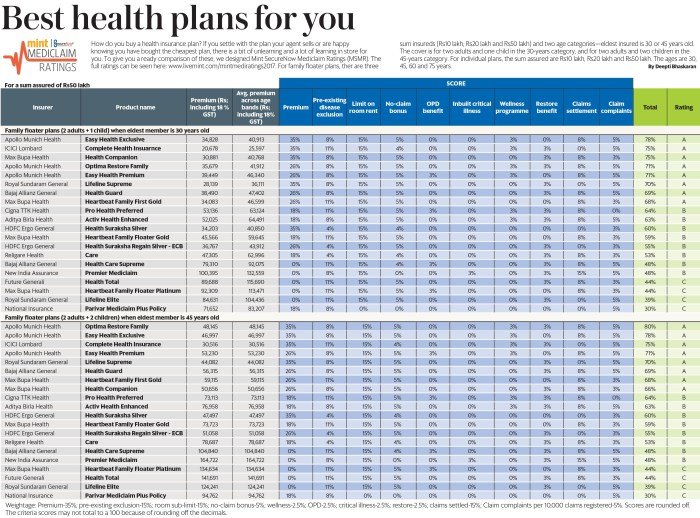

Here’s a table summarizing the best individual health plans in NYC by category:

| Category | Plan | Key Features |

|---|---|---|

| Best for Families | Empire BlueCross BlueShield | Extensive network, comprehensive coverage, affordable options. |

| Best for Young Adults | UnitedHealthcare | Wide provider network, competitive pricing, telehealth options. |

| Best for Seniors | Oxford Health Plans | Focus on quality care, affordable pricing, strong provider network. |

Best NYC Health Plans for Families

Navigating the NYC health insurance landscape can be daunting, especially when you’re looking for a plan that covers your family’s needs. With so many options available, it’s essential to consider factors like pediatric coverage, maternity care, and prescription drug benefits to find the best fit for your family.

Types of Family Health Plans

Families in NYC have several options when it comes to health insurance. Here’s a breakdown of the most common types:

- Employer-Sponsored Plans:If your employer offers health insurance, you can often enroll your family in their plan. These plans typically offer comprehensive coverage at competitive rates.

- Individual Plans:You can purchase an individual health plan directly from an insurance company, even if you’re not employed. These plans offer flexibility but may be more expensive than employer-sponsored plans.

- Government-Sponsored Plans:The government offers health insurance programs like Medicaid and the Children’s Health Insurance Program (CHIP) for families with low incomes. These programs provide affordable or free coverage.

Top Family Health Plans in NYC

Here’s a comparison of some of the top family health plans in NYC, based on factors like coverage, costs, and benefits:

| Plan | Pediatric Coverage | Maternity Care | Prescription Drug Benefits | Monthly Premium (Estimated) |

|---|---|---|---|---|

| Empire BlueCross BlueShield PPO | Comprehensive coverage | Full maternity care | Formulary coverage | $1,000

|

| UnitedHealthcare Choice Plus | Comprehensive coverage | Full maternity care | Formulary coverage | $800

|

| NYC Health + Hospitals Plan | Comprehensive coverage | Full maternity care | Formulary coverage | $500

|

Best NYC Health Plans for Small Businesses

Navigating the NYC health insurance landscape can be overwhelming for small businesses. With numerous options available, choosing the right plan can significantly impact your company’s finances and employee well-being. This section provides a comprehensive guide to help you understand the various types of health insurance plans available for small businesses in NYC and identify the best options based on your specific needs.

Types of Health Insurance Plans for Small Businesses in NYC

Small businesses in NYC have two primary options for providing health insurance to their employees: group plans and individual plans.

- Group Health Insurance Plans: These plans are offered through an insurance company to a group of individuals, typically employees of a company. They are usually more affordable than individual plans due to economies of scale and often offer more comprehensive coverage.

- Individual Health Insurance Plans: These plans are purchased by individuals directly from an insurance company. They are more flexible and can be tailored to meet individual needs, but they are often more expensive than group plans.

Comparing Group and Individual Plans for Small Businesses

Both group and individual plans have their advantages and disadvantages, and the best option for your small business will depend on several factors, including the size of your company, your budget, and the health needs of your employees.

Group Plans

- Benefits:

- Lower Premiums: Group plans often have lower premiums than individual plans due to the pooling of risk among a larger group of individuals.

- More Comprehensive Coverage: Group plans typically offer more comprehensive coverage than individual plans, including coverage for preventive care, hospitalization, and prescription drugs.

- Simplified Administration: Group plans are typically easier to administer than individual plans, as the insurance company handles most of the administrative tasks.

- Drawbacks:

- Limited Flexibility: Group plans can be less flexible than individual plans, as they may not offer as many coverage options.

- Potential for Higher Deductibles: Group plans may have higher deductibles than individual plans, especially for smaller companies.

- Minimum Participation Requirements: Some group plans require a minimum number of employees to participate.

Individual Plans

- Benefits:

- Greater Flexibility: Individual plans offer more flexibility in terms of coverage options and plan design.

- Tailored Coverage: Individual plans can be tailored to meet the specific needs of each employee.

- Potential for Lower Premiums: In some cases, individual plans may be more affordable than group plans, especially for employees with low healthcare needs.

- Drawbacks:

- Higher Premiums: Individual plans are generally more expensive than group plans.

- Limited Coverage: Individual plans may offer less comprehensive coverage than group plans.

- More Administrative Burden: Individual plans require more administrative work, as employees are responsible for selecting and managing their own plans.

Best NYC Health Plans for Small Businesses

| Plan Name | Type | Key Features | Pricing Options |

|---|---|---|---|

| Empire BlueCross BlueShield | Group | Comprehensive coverage, wide network of providers, competitive pricing | Various plans with different deductibles and copayments |

| Healthfirst | Group | Affordable premiums, robust coverage, strong customer service | Flexible plans with different levels of coverage |

| UnitedHealthcare | Group | Large network of providers, innovative wellness programs, online tools | Wide range of plans to meet different needs |

| Oxford Health Plans | Group | Strong provider network, comprehensive coverage, flexible plan options | Competitive pricing, various plans with different deductibles |

| Aetna | Group | National provider network, extensive coverage, online tools and resources | Flexible plans with different levels of coverage and deductibles |

Resources for Finding the Best NYC Health Plan

Navigating the NYC health insurance landscape can be overwhelming, but there are numerous resources available to help you find the best plan for your individual needs. This section will Artikel the various resources available to help you make an informed decision.

Government Websites

Government websites offer comprehensive information about health insurance options in NYC, including eligibility requirements, enrollment deadlines, and plan details. These resources are invaluable for understanding your options and making an informed decision.

- NYC Health Insurance Marketplace (NY State of Health):This website is the official marketplace for finding affordable health insurance plans in NYC. It offers a variety of plans, including plans for individuals, families, and small businesses. You can compare plans, estimate costs, and apply online.

- New York State Department of Health:This website provides general information about health insurance in New York State, including information about eligibility, enrollment, and plan benefits.

- Centers for Medicare & Medicaid Services (CMS):This website offers information about Medicare and Medicaid, two federal health insurance programs. It also provides information about the Affordable Care Act (ACA) and its impact on health insurance in NYC.

Insurance Brokers

Insurance brokers are licensed professionals who can help you navigate the complex world of health insurance. They can provide personalized advice and help you find a plan that meets your specific needs and budget.

- Independent Insurance Brokers:These brokers work with a variety of insurance companies, allowing them to offer a wide range of plans to their clients. They can help you compare plans and find the best value for your money.

- Captive Insurance Brokers:These brokers represent a single insurance company, which may limit their options but could offer a more specialized approach.

Online Comparison Tools

Online comparison tools allow you to quickly and easily compare health insurance plans from different insurance companies. These tools can save you time and effort by providing a comprehensive overview of your options.

- eHealth:This website allows you to compare health insurance plans from multiple insurance companies. It provides detailed information about each plan, including premiums, deductibles, and co-pays.

- HealthPocket:This website offers a similar comparison tool to eHealth, with the added feature of allowing you to rate and review different insurance companies.

- Healthcare.gov:This website is the official website for the Affordable Care Act (ACA) and provides information about health insurance options, including eligibility requirements and enrollment deadlines.

Enrolling in a Health Plan

Once you have chosen a health plan, you will need to enroll in it. The enrollment process typically involves the following steps:

- Determine Eligibility:The first step is to determine your eligibility for the health plan you have chosen. This may involve providing documentation to verify your income, age, and other factors.

- Complete an Application:You will need to complete an application form, which will ask for information about your personal details, health history, and employment status.

- Pay Your Premium:Once your application is approved, you will need to pay your first premium payment. The premium amount will vary depending on the plan you choose and your individual circumstances.

- Receive Your ID Card:After you have paid your premium, you will receive your health insurance ID card. This card will provide you with the information you need to access your health insurance benefits.

Flowchart for Choosing and Enrolling in a Health Plan

The following flowchart illustrates the process of choosing and enrolling in a health plan in NYC:

[Image of a flowchart depicting the process of choosing and enrolling in a health plan in NYC]

Final Thoughts

With a little research and careful consideration, you can confidently navigate the NYC health insurance landscape and secure the best plan for your individual needs. Remember to compare plans, consider your budget, and leverage the resources available to you. Don’t hesitate to reach out to a qualified insurance broker for personalized advice and assistance in finding the right coverage for you.

FAQ Corner

What are the different types of health insurance plans available in NYC?

NYC offers a variety of health insurance plans, including HMO, PPO, EPO, and POS. Each plan type has its own coverage structure, network of providers, and cost considerations.

How can I compare health insurance plans in NYC?

You can compare health insurance plans in NYC using online comparison tools, insurance brokers, or government websites. These resources allow you to filter plans based on your specific needs, budget, and coverage preferences.

What is the enrollment process for health insurance plans in NYC?

The enrollment process for health insurance plans in NYC typically involves applying online, providing necessary documentation, and meeting eligibility requirements. Deadlines and specific procedures may vary depending on the plan and provider.

What resources are available to help me find the best NYC health plan?

You can find valuable resources on government websites, insurance broker websites, and online comparison tools. These resources provide information about plan types, coverage details, costs, and enrollment processes.