Tennessee health care insurance is a complex landscape, shaped by a unique blend of national policies, state-specific programs, and evolving healthcare needs. This guide delves into the intricacies of navigating Tennessee’s healthcare insurance system, providing insights into the current state of affairs, available options, and future trends.

From understanding the impact of the Affordable Care Act (ACA) to exploring the challenges of rising healthcare costs and access to quality care, this exploration aims to equip individuals and families with the knowledge necessary to make informed decisions about their healthcare coverage.

Tennessee Healthcare Insurance Landscape

Tennessee’s healthcare insurance landscape is dynamic, shaped by a confluence of factors including demographics, healthcare needs, and the presence of various insurance providers. This section delves into the key aspects of this landscape, highlighting the trends, challenges, and key players.

Demographics and Healthcare Needs

Tennessee’s population is diverse, with a significant proportion of residents facing health challenges. The state has a higher percentage of individuals with chronic conditions compared to the national average, leading to increased healthcare utilization and costs.

- Age Distribution:Tennessee has a slightly older population compared to the national average. The state has a higher percentage of residents aged 65 and older, which translates to higher healthcare needs and expenses.

- Rural Population:A significant portion of Tennessee’s population resides in rural areas, which often experience limited access to healthcare services and specialists. This disparity can lead to higher healthcare costs and poorer health outcomes.

- Health Status:Tennessee faces challenges related to chronic diseases like diabetes, obesity, and heart disease. These conditions contribute to increased healthcare utilization and expenses.

Major Healthcare Insurance Providers in Tennessee

Tennessee’s healthcare insurance market is characterized by the presence of several major players, each offering a range of plans to cater to diverse needs.

- BlueCross BlueShield of Tennessee:As the largest health insurer in the state, BlueCross BlueShield of Tennessee offers a wide range of plans, including individual, family, and employer-sponsored coverage. The company also plays a significant role in managing the state’s Medicaid program.

- UnitedHealthcare:UnitedHealthcare is another prominent provider in Tennessee, offering individual, family, and employer-sponsored plans. The company also operates in the Medicare Advantage market.

- Cigna:Cigna is a national insurer with a significant presence in Tennessee, providing a variety of health insurance plans, including individual, family, and employer-sponsored coverage.

- Humana:Humana is a major player in the Medicare Advantage market, offering a range of plans specifically designed for seniors.

Types of Health Insurance Plans in Tennessee

Tennessee residents have access to various health insurance plan types, each with its own features, coverage, and costs.

- Individual Health Insurance:This type of plan is purchased by individuals or families directly from an insurer. It provides coverage for medical expenses, including doctor visits, hospital stays, and prescription drugs. Premiums are typically based on factors like age, health status, and location.

- Employer-Sponsored Health Insurance:Many employers in Tennessee offer health insurance plans to their employees. These plans often provide comprehensive coverage and may include features like employer contributions to premiums. The specific benefits and costs of employer-sponsored plans vary depending on the employer.

- Medicare:This federal health insurance program is available to individuals aged 65 and older, as well as certain individuals with disabilities. Medicare offers different parts, including Part A (hospital insurance), Part B (medical insurance), and Part D (prescription drug coverage).

- Medicaid:This joint federal and state program provides health insurance to low-income individuals and families. Medicaid eligibility requirements vary by state. Tennessee’s Medicaid program, known as TennCare, provides coverage for a range of medical services.

Comparing Health Insurance Plans in Tennessee

Choosing the right health insurance plan is crucial for individuals and families in Tennessee. Factors to consider include coverage, costs, and personal needs.

- Coverage:Different plans offer varying levels of coverage for medical services. Some plans may have lower deductibles or copayments, while others may have broader networks of healthcare providers.

- Costs:The cost of health insurance plans can vary significantly depending on factors like age, health status, and plan type. Premiums, deductibles, and copayments are key cost considerations.

- Personal Needs:Individuals and families should consider their specific healthcare needs when choosing a plan. For example, individuals with chronic conditions may require a plan with comprehensive coverage for their specific needs.

Affordable Care Act (ACA) in Tennessee

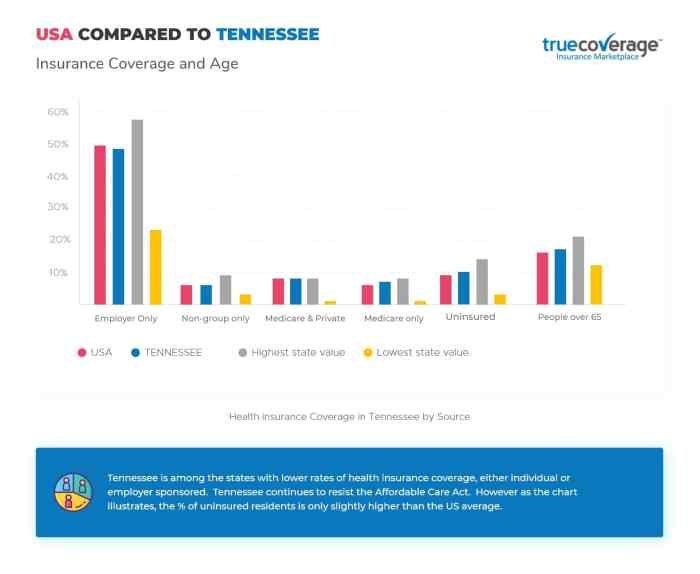

The Affordable Care Act (ACA), also known as Obamacare, has significantly impacted healthcare access and affordability in Tennessee. The ACA has expanded health insurance coverage to millions of Americans, including Tennesseans, through various provisions, such as the creation of health insurance marketplaces and the expansion of Medicaid eligibility.

Impact of the ACA on Healthcare Access and Affordability in Tennessee

The ACA has made a considerable difference in healthcare access and affordability for Tennesseans. Before the ACA, many individuals and families in Tennessee lacked health insurance coverage, leading to limited access to healthcare services and financial burdens when medical expenses arose.

The ACA has helped address these challenges by expanding insurance coverage and providing financial assistance to eligible individuals and families.

Operation of the ACA Marketplace in Tennessee

The ACA marketplace, also known as the Health Insurance Marketplace, provides a platform for individuals and families to compare and purchase health insurance plans. The marketplace offers a variety of plans from different insurance companies, allowing consumers to choose the plan that best meets their needs and budget.

Tennessee residents can access the ACA marketplace through the federal website, Healthcare.gov, or through state-based marketplaces in other states.

Available Plans in the ACA Marketplace

The ACA marketplace offers four levels of coverage: Bronze, Silver, Gold, and Platinum. Each level has different cost-sharing arrangements, with Bronze plans having the lowest monthly premiums but higher out-of-pocket costs and Platinum plans having the highest monthly premiums but lower out-of-pocket costs.

Consumers can also choose from plans with different deductibles and copayments, depending on their individual needs and preferences.

Enrollment and Coverage Rates in Tennessee Under the ACA

Since the ACA’s implementation, enrollment rates in Tennessee have increased significantly. According to the U.S. Department of Health and Human Services, over 700,000 Tennesseans have enrolled in health insurance plans through the ACA marketplace. The ACA has also contributed to a significant decrease in the uninsured rate in Tennessee.

State-Specific Programs and Initiatives Related to the ACA in Tennessee

Tennessee has implemented several state-specific programs and initiatives related to the ACA, including:

- The Tennessee Health Insurance Marketplace: Tennessee operates its own state-based marketplace, which offers a variety of health insurance plans from different insurance companies.

- The Tennessee Health Coverage Program (THCP): The THCP provides financial assistance to eligible Tennesseans to help them afford health insurance premiums.

- The Tennessee Department of Health’s (TDH) Health Insurance Navigator Program: The TDH offers free assistance to Tennesseans who are looking to enroll in health insurance plans through the ACA marketplace.

Healthcare Costs in Tennessee

Healthcare costs in Tennessee, like in many other states, have been steadily rising over the years. This trend has a significant impact on individuals, families, and the state’s overall economy. Understanding the factors contributing to these rising costs is crucial for developing effective solutions to address the issue.

Factors Contributing to Rising Healthcare Costs in Tennessee

Several factors contribute to the increasing healthcare costs in Tennessee. These include:

- Rising costs of medical services and technologies:Advancements in medical technology and treatments often come with higher costs. The use of sophisticated diagnostic equipment, complex surgical procedures, and innovative medications all contribute to increased healthcare spending.

- Aging population:Tennessee, like many other states, is experiencing an aging population. Older individuals generally require more healthcare services, leading to higher healthcare expenditures.

- Chronic diseases:The prevalence of chronic diseases, such as diabetes, heart disease, and obesity, is rising in Tennessee. These conditions often require ongoing medical care, contributing to higher healthcare costs.

- Administrative costs:The administrative complexity of the healthcare system, including insurance claims processing, billing, and paperwork, adds to the overall cost of healthcare.

- Prescription drug costs:The prices of prescription drugs have been rising rapidly, contributing significantly to healthcare spending. This is particularly concerning for individuals with chronic conditions who require ongoing medication.

Healthcare Spending per Capita in Tennessee

Tennessee’s healthcare spending per capita is higher than the national average. According to the Centers for Medicare and Medicaid Services (CMS), Tennessee’s healthcare spending per capita was $10,495 in 2020, compared to the national average of $11,072. This indicates that Tennesseans spend a significant amount on healthcare compared to the rest of the country.

Tennessee’s healthcare insurance market is diverse, offering a range of plans to fit different needs and budgets. When considering your options, it’s essential to evaluate your individual health requirements and lifestyle choices. For example, if you’re looking for a nutritional supplement, it’s worth exploring whether Ensure is a good fit for you.

Is Ensure good for health ? This article explores the benefits and potential drawbacks of Ensure, which could help you make an informed decision. Ultimately, finding the right healthcare insurance plan and making informed choices about your health and nutrition is crucial for your overall well-being in Tennessee.

Impact of Healthcare Costs on Individuals and Families in Tennessee

Rising healthcare costs have a significant impact on individuals and families in Tennessee.

- Financial burden:High healthcare costs can lead to financial strain, forcing individuals and families to make difficult choices between healthcare and other essential needs.

- Uninsured and underinsured:Many Tennesseans struggle to afford health insurance, resulting in a significant number of uninsured and underinsured individuals. This lack of coverage can lead to delayed or forgone care, ultimately leading to more expensive health issues in the long run.

- Debt:High healthcare costs can lead to medical debt, which can have a significant impact on credit scores and overall financial well-being.

Potential Solutions to Address Healthcare Cost Concerns in Tennessee

Several potential solutions can help address the rising healthcare costs in Tennessee:

- Promote preventive care:Encouraging preventive care measures, such as screenings and vaccinations, can help identify health issues early and prevent more expensive treatments later.

- Increase transparency and price negotiation:Increasing transparency in healthcare pricing and encouraging price negotiation between providers and insurers can help reduce costs.

- Promote healthy lifestyles:Public health initiatives aimed at promoting healthy lifestyles, such as encouraging physical activity and healthy eating habits, can help reduce the incidence of chronic diseases and lower healthcare costs in the long run.

- Address social determinants of health:Addressing social determinants of health, such as poverty, access to education, and safe housing, can improve overall health outcomes and reduce healthcare costs.

- Improve access to affordable healthcare:Expanding access to affordable healthcare through programs like Medicaid and the Affordable Care Act can help ensure that more Tennesseans have access to necessary care.

Access to Healthcare in Tennessee

Tennessee faces challenges in providing equitable access to healthcare, particularly in rural areas. This section explores the availability and accessibility of healthcare services in Tennessee, highlighting potential barriers and initiatives aimed at improving access.

Tennessee’s healthcare insurance landscape is complex, offering a range of options to suit individual needs. While navigating these options, it’s important to remember that self-care is equally crucial. For those seeking a relaxing and rejuvenating experience, consider visiting vinita’s beauty & threading studio , where you can pamper yourself with professional beauty services.

Returning to the topic of healthcare insurance, remember that a comprehensive plan can help you manage unexpected medical expenses, providing peace of mind and allowing you to prioritize your overall well-being.

Availability and Accessibility of Healthcare Services in Tennessee

Tennessee’s healthcare landscape is marked by disparities in access, with rural areas facing significant challenges.

- Limited Provider Availability:Rural areas often experience a shortage of healthcare providers, including physicians, nurses, and specialists. This shortage can lead to longer wait times for appointments, limited access to specialized care, and difficulties in finding providers who accept certain insurance plans.

- Distance and Transportation:Rural residents may face significant travel distances to access healthcare facilities. Limited public transportation options and the cost of personal transportation can further hinder access to care.

- Lack of Healthcare Infrastructure:Rural areas may lack adequate healthcare infrastructure, such as hospitals, clinics, and pharmacies. This can limit the availability of essential healthcare services and make it difficult for residents to access necessary care.

Barriers to Accessing Healthcare in Tennessee

Several factors contribute to barriers in accessing healthcare in Tennessee, including:

- Cost:The cost of healthcare is a major barrier for many Tennesseans, particularly those with low incomes or who are uninsured. High deductibles, co-pays, and out-of-pocket expenses can make it challenging for individuals to afford necessary care.

- Insurance Coverage:Access to affordable health insurance is crucial for accessing healthcare. Individuals who are uninsured or have limited insurance coverage may face financial difficulties when seeking medical care.

- Lack of Awareness:Some Tennesseans may not be aware of available healthcare resources or programs that can help them access care. This lack of awareness can prevent individuals from seeking necessary medical attention.

Initiatives and Programs Aimed at Improving Healthcare Access in Tennessee

The state of Tennessee has implemented various initiatives and programs to address healthcare access challenges:

- Tennessee Health Insurance Marketplace:The Affordable Care Act (ACA) established the Tennessee Health Insurance Marketplace, where individuals and families can compare and purchase health insurance plans. This program aims to expand access to affordable coverage and reduce the number of uninsured Tennesseans.

- Tennessee Medicaid Expansion:In 2019, Tennessee expanded its Medicaid program to cover more low-income adults. This expansion has significantly increased access to healthcare for individuals who previously lacked coverage.

- Rural Health Clinics:Tennessee has a network of rural health clinics that provide primary care services to underserved populations. These clinics offer affordable and accessible care in rural areas, addressing the shortage of healthcare providers.

- Telehealth Programs:Telehealth programs are expanding access to healthcare in rural areas by allowing patients to consult with healthcare providers remotely. This technology reduces the need for travel and allows individuals in remote locations to access specialized care.

Role of Telehealth in Expanding Healthcare Access in Tennessee

Telehealth plays a crucial role in expanding healthcare access in Tennessee, particularly in rural areas. By leveraging technology, telehealth services can bridge geographic gaps and improve access to care for underserved populations.

- Increased Access to Specialists:Telehealth allows patients in rural areas to consult with specialists who may not be physically located in their communities. This expands access to specialized care without the need for lengthy travel.

- Reduced Travel Time and Costs:Telehealth appointments can significantly reduce travel time and costs associated with seeking healthcare. This is particularly beneficial for individuals with limited transportation options or who live in remote areas.

- Improved Continuity of Care:Telehealth allows patients to maintain continuity of care with their providers, even if they move to a different location or have difficulty traveling. This helps ensure consistent medical management and reduces the risk of health complications.

Healthcare Quality in Tennessee

Tennessee’s healthcare system is a complex web of providers, facilities, and programs, making it crucial to evaluate the quality of care delivered. Assessing healthcare quality in Tennessee involves analyzing various metrics and indicators, understanding the initiatives aimed at improvement, and examining the performance of hospitals and providers.

This analysis provides a comprehensive picture of the healthcare landscape in Tennessee, highlighting areas of strength and areas requiring attention.

Healthcare Quality Metrics and Indicators

Tennessee’s healthcare quality is measured using a range of metrics and indicators. These metrics provide valuable insights into the effectiveness, efficiency, and safety of healthcare services. Here are some key metrics:

- Hospital Readmission Rates:This metric measures the rate at which patients are readmitted to a hospital within a specific timeframe after being discharged. Lower readmission rates indicate better quality care and improved patient outcomes.

- Mortality Rates:Mortality rates measure the number of deaths occurring within a specific period in a given population. These rates are used to assess the effectiveness of healthcare services and identify areas where improvements are needed.

- Patient Safety Indicators (PSIs):PSIs are a set of measures designed to identify potentially preventable hospital-acquired conditions. They help healthcare providers track and improve patient safety practices.

- Healthcare-Associated Infections (HAIs):HAIs are infections acquired during a hospital stay or other healthcare setting. Tracking and reducing HAI rates are crucial for ensuring patient safety.

Initiatives and Programs for Quality Improvement

The Tennessee Department of Health (TDH) and other organizations are actively involved in initiatives and programs aimed at improving healthcare quality in the state. These initiatives focus on various aspects of healthcare delivery, including:

- Quality Improvement Collaborative (QIC):The QIC is a program that brings together healthcare providers to share best practices and collaborate on improving patient care.

- Tennessee Health Information Network (THIN):THIN is a statewide health information exchange that facilitates the secure sharing of patient health information among providers. This helps improve care coordination and patient safety.

- Patient-Centered Medical Home (PCMH) Program:The PCMH program promotes primary care practices that are focused on patient needs and provide comprehensive, coordinated care.

- Tennessee Health Services and Review Agency (HSR):HSR is a state agency responsible for regulating healthcare facilities and providers, ensuring compliance with quality standards.

Performance of Tennessee Hospitals and Providers

Tennessee hospitals and healthcare providers are regularly evaluated on their performance on various quality measures. These evaluations provide valuable information about the quality of care provided in the state.

- Hospital Compare:Hospital Compare is a website run by the Centers for Medicare & Medicaid Services (CMS) that provides information on the performance of hospitals on various quality measures.

- Leapfrog Group:The Leapfrog Group is a national organization that rates hospitals on their safety and quality of care.

- National Committee for Quality Assurance (NCQA):NCQA is a private, non-profit organization that accredits healthcare organizations and provides ratings on their quality of care.

Patient Satisfaction with Healthcare Services, Tennessee health care insurance

Patient satisfaction is a crucial aspect of healthcare quality. Satisfied patients are more likely to follow treatment plans, engage in preventive care, and have positive health outcomes.

- Hospital Consumer Assessment of Healthcare Providers and Systems (HCAHPS):HCAHPS is a standardized survey that measures patient satisfaction with hospital care.

- Physician Finders:Many organizations, including the TDH and CMS, provide physician finders that allow patients to search for healthcare providers and view patient satisfaction ratings.

Health Insurance Options for Specific Groups in Tennessee

Tennessee offers a variety of healthcare insurance options tailored to meet the unique needs of different population groups. This section will explore the programs and resources available to seniors, children, and low-income individuals in Tennessee, highlighting the diverse insurance options and their impact on access to affordable healthcare.

Seniors

Seniors in Tennessee have access to several healthcare insurance programs designed to address their specific needs. Medicare, a federal program, provides health insurance to individuals aged 65 and older, as well as younger individuals with certain disabilities. Medicare offers different parts, each providing specific coverage:

- Medicare Part A:Covers hospital stays, skilled nursing facilities, hospice care, and some home health services.

- Medicare Part B:Covers doctor’s visits, outpatient care, preventive services, and some durable medical equipment.

- Medicare Part C (Medicare Advantage):Offered by private insurance companies, it combines Part A, Part B, and often Part D (prescription drug coverage) into a single plan.

- Medicare Part D:Covers prescription drugs.

In addition to Medicare, Tennessee offers a state-funded program called TennCare, which provides health insurance to low-income seniors who do not qualify for Medicare. TennCare offers comprehensive coverage, including hospital care, doctor’s visits, prescription drugs, and mental health services.

Children

Children in Tennessee have access to various healthcare insurance programs designed to ensure they receive the necessary medical care. The Children’s Health Insurance Program (CHIP), a federal-state partnership, provides health insurance to children from families who earn too much to qualify for Medicaid but cannot afford private insurance.

CHIP offers comprehensive coverage, including doctor’s visits, hospital stays, immunizations, and preventive care.TennCare, the state-funded program, also provides health insurance to children from low-income families. TennCare offers comprehensive coverage, including hospital care, doctor’s visits, prescription drugs, and mental health services.

Tennessee health care insurance options can vary widely, and finding the right plan for your needs can be a challenge. Staying active and healthy is a great way to manage your overall well-being, and you can find a great gym to help you do just that at Crunch Fitness Paramus.

Of course, it’s important to consider all aspects of your health, including preventative care and regular checkups, when making decisions about your Tennessee health insurance.

Low-Income Individuals

Low-income individuals in Tennessee have access to several healthcare insurance programs designed to help them afford healthcare. Medicaid, a federal-state partnership, provides health insurance to low-income individuals and families, including pregnant women, children, and people with disabilities. Medicaid offers comprehensive coverage, including hospital care, doctor’s visits, prescription drugs, and mental health services.TennCare, the state-funded program, also provides health insurance to low-income individuals who do not qualify for Medicaid.

TennCare offers comprehensive coverage, including hospital care, doctor’s visits, prescription drugs, and mental health services.

Resources for Accessing Affordable Healthcare

Tennessee offers several resources to help individuals access affordable healthcare, including:

- Tennessee Health Insurance Marketplace:A website where individuals can compare and enroll in health insurance plans offered through the Affordable Care Act (ACA).

- Tennessee Department of Health:Provides information and resources on healthcare programs and services available in Tennessee.

- Local Health Departments:Offer a range of services, including immunizations, screenings, and health education programs.

- Community Health Centers:Provide affordable healthcare services to individuals and families regardless of their ability to pay.

Future of Healthcare Insurance in Tennessee

The healthcare insurance landscape in Tennessee is constantly evolving, shaped by a confluence of factors, including technological advancements, policy shifts, and changing demographics. Understanding these trends is crucial for stakeholders, from individuals seeking coverage to healthcare providers and insurance companies.

Potential Trends and Challenges

The future of healthcare insurance in Tennessee is likely to be influenced by several key trends and challenges.

- Rising Healthcare Costs:Tennessee, like many other states, faces the challenge of rising healthcare costs. This is driven by factors such as technological advancements, aging populations, and the increasing prevalence of chronic diseases.

- Shifting Demographics:Tennessee’s population is aging, with a growing number of seniors requiring more healthcare services. This demographic shift will place additional strain on the healthcare system and insurance providers.

- Increased Demand for Telehealth:The COVID-19 pandemic accelerated the adoption of telehealth services. This trend is likely to continue, offering greater access to healthcare and potentially reducing costs.

- Growing Importance of Value-Based Care:There is a growing emphasis on value-based care models that focus on quality and outcomes rather than simply the volume of services. This shift will require insurance companies to adapt their reimbursement models.

- Impact of Policy Changes:Changes in federal and state healthcare policy will continue to influence the healthcare insurance landscape. For example, the future of the Affordable Care Act (ACA) remains uncertain.

Emerging Technologies and Innovations

Technological advancements are transforming the healthcare industry, and their impact on healthcare insurance is significant.

- Artificial Intelligence (AI):AI is being used to analyze vast amounts of data, identify trends, and personalize healthcare recommendations. This can lead to more efficient care delivery and lower costs.

- Wearable Technology:Wearable devices can track health metrics, providing valuable insights into individual health status. This data can be used to personalize insurance plans and promote preventive care.

- Blockchain Technology:Blockchain can improve the security and transparency of healthcare data, streamlining processes and reducing fraud.

- Precision Medicine:Advances in genomics and personalized medicine allow for targeted treatments based on individual genetic profiles. This can lead to more effective and efficient healthcare, potentially impacting insurance coverage.

Potential Impact of Policy Changes

Policy changes at both the federal and state levels can significantly impact healthcare insurance in Tennessee.

- ACA Expansion:If the ACA is expanded, it could provide greater access to healthcare insurance for low-income Tennesseans.

- Medicaid Expansion:Expanding Medicaid coverage in Tennessee could increase the number of individuals with health insurance, potentially reducing the number of uninsured.

- State-Level Regulations:State-level regulations on insurance premiums, coverage mandates, and provider networks can significantly influence the healthcare insurance market.

Roadmap for Improving Healthcare Insurance Access and Affordability

Addressing the challenges and leveraging the opportunities in healthcare insurance requires a comprehensive approach.

- Expand Medicaid Coverage:Expanding Medicaid coverage would provide health insurance to a larger portion of the population, particularly low-income Tennesseans.

- Support Affordable Care Act (ACA) Marketplaces:Providing subsidies and other financial assistance to individuals and families seeking coverage through the ACA marketplaces would increase affordability.

- Promote Value-Based Care:Shifting towards value-based care models can incentivize providers to focus on quality and efficiency, potentially reducing healthcare costs.

- Invest in Telehealth Infrastructure:Expanding access to telehealth services can improve healthcare access, particularly in rural areas, and potentially lower costs.

- Address Social Determinants of Health:Addressing factors such as poverty, education, and access to healthy food can improve overall health outcomes and reduce healthcare costs.

End of Discussion

Navigating the Tennessee health care insurance landscape requires a comprehensive understanding of the available options, potential costs, and access to quality care. This guide provides a framework for exploring these complexities, empowering individuals to make informed choices about their health and well-being.

FAQ: Tennessee Health Care Insurance

What are the different types of health insurance plans available in Tennessee?

Tennessee offers a variety of health insurance plans, including individual plans, employer-sponsored plans, and government-sponsored plans like Medicare and Medicaid.

How can I find out if I qualify for financial assistance with my health insurance premiums?

You can use the Health Insurance Marketplace website or contact a certified application counselor to determine your eligibility for subsidies and tax credits.

What are some resources available for seniors who need help with their health insurance?

The Tennessee Department of Health offers resources and assistance for seniors, including information about Medicare and other programs.