Can you use health savings account for dental – Can you use a health savings account for dental? The answer is often yes, but it depends on the specific circumstances. Health Savings Accounts (HSAs) are a powerful tool for saving money on healthcare expenses, including dental care. They offer tax advantages and flexibility, making them an attractive option for individuals seeking to manage their healthcare costs effectively.

This guide will explore the ins and outs of using HSAs for dental expenses, outlining eligibility requirements, types of covered procedures, and other key considerations. We’ll also compare HSAs to Flexible Spending Accounts (FSAs) to help you determine which option best suits your needs.

Understanding Health Savings Accounts (HSAs)

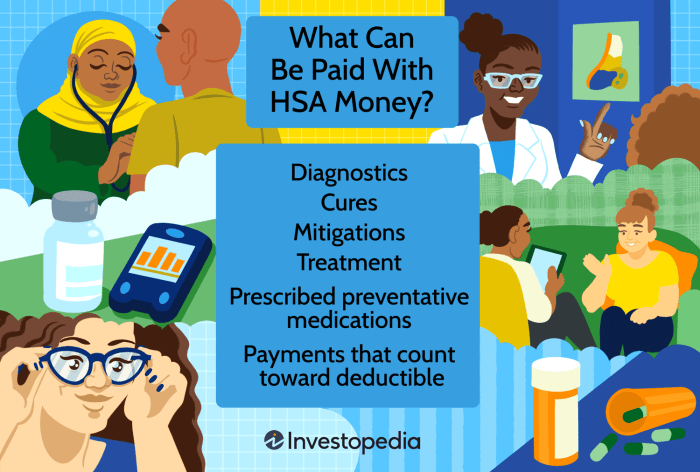

Health Savings Accounts (HSAs) are tax-advantaged savings accounts designed specifically for healthcare expenses. They offer a unique combination of tax benefits and flexibility, making them a valuable tool for individuals and families seeking to manage their healthcare costs effectively.

Purpose and Benefits of HSAs

HSAs are designed to encourage individuals to take a more active role in their healthcare by promoting responsible spending and saving for future medical needs. Here are some key benefits of HSAs:

- Triple Tax Advantage:HSA contributions are tax-deductible, earnings grow tax-free, and withdrawals for qualified medical expenses are tax-free. This triple tax advantage makes HSAs a powerful tool for saving money on healthcare costs.

- Account Portability:Unlike Flexible Spending Accounts (FSAs), HSA funds remain yours even if you change jobs or health insurance plans. You can carry your HSA account with you, ensuring that your savings are protected and accessible.

- Investment Options:Some HSA providers offer investment options, allowing you to grow your savings over time. This potential for investment growth can make HSAs even more attractive for long-term healthcare planning.

- High Deductible Health Plans (HDHPs):HSAs are linked to High Deductible Health Plans (HDHPs), which typically have lower monthly premiums but higher deductibles. This can result in significant savings on healthcare costs, especially for individuals who are generally healthy and don’t require frequent medical care.

Eligibility Requirements for HSAs

To be eligible for an HSA, you must meet the following criteria:

- Be enrolled in a High Deductible Health Plan (HDHP):The specific deductible requirements for an HDHP vary from year to year, but you must have a health insurance plan with a minimum deductible amount set by the IRS.

- Not be covered by another health plan:You cannot be covered by another health insurance plan, such as Medicare, Medicaid, or a health plan provided by your employer if it’s not an HDHP.

- Not be claimed as a dependent on someone else’s tax return:If you are claimed as a dependent on someone else’s tax return, you are not eligible for an HSA.

Tax Advantages of HSAs

HSAs offer significant tax advantages, making them a highly attractive option for individuals seeking to save for healthcare expenses. Here’s a breakdown of the tax benefits:

- Tax-Deductible Contributions:Contributions to your HSA are tax-deductible, meaning you can reduce your taxable income by the amount you contribute. This can result in immediate tax savings.

- Tax-Free Earnings:The earnings on your HSA funds grow tax-free, allowing your savings to accumulate faster. This is a significant advantage compared to traditional savings accounts, where interest earnings are typically taxed.

- Tax-Free Withdrawals for Qualified Medical Expenses:When you use your HSA funds to pay for qualified medical expenses, the withdrawals are tax-free. This means you don’t have to pay any taxes on the money you withdraw for these expenses.

Dental Expenses and HSA Eligibility

You might be wondering if you can use your Health Savings Account (HSA) to cover dental expenses. The good news is, in many cases, you can! HSAs are designed to help you pay for qualified medical expenses, and dental care often falls under this category.

Dental Expenses Covered by HSAs

Dental expenses covered by HSAs are those considered medically necessary. This means they’re intended to prevent, diagnose, or treat a medical condition, rather than purely cosmetic procedures.

- Preventive Care:This includes routine cleanings, fluoride treatments, and dental X-rays, all crucial for maintaining oral health.

- Restorative Care:This covers procedures like fillings, crowns, bridges, and root canals, addressing damage or decay.

- Extractions:Removing teeth due to decay, infection, or other medical reasons is covered.

- Dentures and Partials:These are often covered if medically necessary due to missing teeth or other dental conditions.

- Oral Surgery:Procedures like wisdom tooth removal, bone grafts, and gum surgery are typically eligible for HSA funds.

Examples of Dental Procedures Covered by HSAs

Here are some specific examples of common dental procedures that you can pay for using HSA funds:

- Fillings:Repairing cavities to prevent further damage and infection.

- Root Canals:Treating infected or damaged tooth pulp, saving the tooth.

- Crowns:Covering a damaged tooth to restore its function and appearance.

- Dentures:Replacing missing teeth for improved chewing, speech, and appearance.

- Wisdom Tooth Removal:Extracting impacted wisdom teeth to prevent crowding or other issues.

Limitations and Restrictions

While HSAs offer a valuable tool for managing dental expenses, there are some limitations to keep in mind:

- Cosmetic Procedures:Procedures solely for aesthetic reasons, like teeth whitening or veneers, are generally not covered by HSAs.

- Pre-Existing Conditions:If you have a pre-existing dental condition, your HSA may have limitations on coverage. It’s crucial to review your HSA plan details.

- HSA Plan Rules:Each HSA plan has its own specific rules and restrictions. Be sure to consult your plan documents for detailed information on covered dental expenses.

Using an HSA for Dental Care: Can You Use Health Savings Account For Dental

Using a Health Savings Account (HSA) for dental care is a smart way to save money on dental expenses. HSAs are tax-advantaged accounts that allow you to pay for qualified medical expenses, including dental care, with pre-tax dollars. This means that you can save money on taxes and potentially reduce your overall healthcare costs.

Using an HSA Card for Dental Payments, Can you use health savings account for dental

HSAs typically come with a debit card that can be used to pay for qualified medical expenses, including dental care. You can use your HSA card to pay for dental services directly at the dentist’s office. This eliminates the need to pay out of pocket and then submit a claim for reimbursement.

Maximizing HSA Contributions for Dental Expenses

To maximize the benefits of your HSA for dental expenses, you should contribute the maximum amount allowed each year. The maximum contribution amount is adjusted annually and is based on your health insurance plan. If you anticipate having significant dental expenses, you may want to consider making additional contributions to your HSA to ensure you have enough funds available.

Tracking HSA Spending for Dental Care

It is important to keep track of your HSA spending for dental care to ensure that you are not exceeding the annual contribution limit and to track your overall healthcare expenses. You can track your HSA spending online through your HSA provider’s website or mobile app.

You can also keep track of your spending by maintaining a spreadsheet or using a personal finance tracking app.

While you can’t use a Health Savings Account (HSA) for routine dental care, there are exceptions. If you need dental work due to an accident or injury, or if your dentist recommends a procedure to treat a condition that affects your overall health, you may be able to use your HSA funds.

For example, if you need to visit Allegiance Health Hospital for a dental procedure related to a serious medical condition, you might be able to utilize your HSA. It’s always best to check with your insurance provider and the specific dental office to determine your HSA eligibility for specific procedures.

HSA vs. Flexible Spending Accounts (FSAs) for Dental

Both Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) offer tax advantages for healthcare expenses, including dental care. However, they have distinct features and benefits, making it crucial to understand their differences to determine the best option for your individual needs.

HSA vs. FSA for Dental: Key Differences

Understanding the key differences between HSAs and FSAs is essential to make an informed decision about which account best suits your dental care needs.

| Feature | HSA | FSA |

|---|---|---|

| Eligibility | Must be enrolled in a high-deductible health plan (HDHP) | Available with any health insurance plan |

| Contribution Limit | Set by the IRS annually (higher than FSA limits) | Set by the employer annually |

| Rollover | Unused funds roll over to the next year | Unused funds typically forfeit at the end of the year |

| Ownership | Account belongs to you, even if you change jobs | Account belongs to your employer, may be forfeited if you leave |

| Investment Options | Allows for investment growth | No investment options, funds typically held in a bank account |

| Tax Benefits | Contributions are tax-deductible, withdrawals for qualified medical expenses are tax-free | Contributions are tax-deductible, withdrawals for qualified medical expenses are tax-free |

Advantages of HSAs for Dental Expenses

* Higher Contribution Limits:HSAs typically have higher contribution limits than FSAs, allowing you to save more for dental expenses.

Rollover of Unused Funds

Unused HSA funds roll over to the next year, allowing you to accumulate funds for future dental needs.

Investment Options

HSAs allow for investment growth, potentially increasing your savings over time.

Ownership

HSAs belong to you, even if you change jobs, ensuring you retain your savings.

Advantages of FSAs for Dental Expenses

* Availability with Any Health Insurance Plan:FSAs are available with any health insurance plan, unlike HSAs, which require enrollment in an HDHP.

Potential for Employer Contributions

Some employers may contribute to employee FSAs, increasing your savings potential.

Disadvantages of HSAs for Dental Expenses

* High-Deductible Health Plan Requirement:To be eligible for an HSA, you must be enrolled in a high-deductible health plan, which may have higher out-of-pocket costs.

Disadvantages of FSAs for Dental Expenses

* Use-It-or-Lose-It Rule:Unused FSA funds typically forfeit at the end of the year, meaning you may lose money if you don’t use it.

Lower Contribution Limits

While you’re busy planning your dental appointments and figuring out if you can use your health savings account, take a moment to appreciate the beauty of nature. August is the perfect time to enjoy the fragrant blossoms of august beauty gardenias , a reminder that even amidst life’s practicalities, there’s always room for beauty.

And speaking of practicalities, remember to check your HSA guidelines to see if dental expenses are covered – you might be surprised at what you can use it for!

FSAs generally have lower contribution limits than HSAs, potentially limiting your savings.

While you can use a Health Savings Account (HSA) for dental expenses, remember to check your specific plan’s coverage. If you’re looking for a way to stay active while saving money, consider trying out a la fitness three day pass for a short-term fitness boost.

Returning to the topic of HSAs, be sure to consult your insurance provider or HSA administrator to ensure your dental expenses are eligible for reimbursement.

Account Ownership

FSAs belong to your employer, and you may forfeit your funds if you leave your job.

Additional Considerations for Dental and HSAs

While using an HSA for dental care offers flexibility and potential savings, it’s crucial to consider how it interacts with other aspects of your dental health plan.

The Role of Dental Insurance

Dental insurance, while not directly linked to HSAs, can significantly impact how you use your HSA funds for dental care.

- Coverage Limits:Dental insurance often has annual limits on covered procedures. If you exceed those limits, HSA funds can help cover the remaining costs.

- Deductibles and Co-pays:You may have to pay a deductible or co-pay for certain dental services, even with insurance. HSAs can be used to cover these expenses.

- Preventative Care:Many dental insurance plans cover preventive care, such as cleanings and exams, at a lower cost or even for free. You may not need to use HSA funds for these services.

Finding HSA-Friendly Dental Providers

To ensure your HSA funds can be used for dental care, it’s essential to choose providers who accept HSA payments.

- Check Provider Networks:Many dental insurance plans have networks of providers who accept their plans. These providers often also accept HSA payments.

- Contact Providers Directly:Call or email potential dental providers to confirm they accept HSA payments. Ask about their specific procedures for billing and reimbursement.

- Online Directories:Several online directories list dental providers who accept HSA payments. Use these resources to find providers in your area.

Maximizing HSA Use for Dental Care

To make the most of your HSA for dental care, consider these strategies:

- Plan Ahead:Anticipate potential dental expenses, such as routine cleanings or anticipated procedures. This allows you to contribute to your HSA regularly and have funds available when needed.

- Compare Costs:Obtain quotes from multiple providers for procedures. This can help you find the most cost-effective options and maximize your HSA savings.

- Prioritize Coverage:Focus on using your HSA for services not fully covered by your dental insurance. This allows you to maximize the benefits of both your HSA and insurance.

Conclusion

Utilizing an HSA for dental care can be a smart financial strategy, allowing you to save money and control your healthcare costs. By understanding the rules and maximizing your contributions, you can make the most of this valuable benefit.

Whether you’re planning routine checkups or more complex procedures, having an HSA can provide peace of mind and financial security.

Answers to Common Questions

What are the most common dental procedures covered by HSAs?

HSAs typically cover routine dental care like cleanings, fillings, and extractions. They may also cover more complex procedures like root canals and dentures, depending on your specific HSA plan.

Can I use my HSA for cosmetic dental work?

Generally, HSAs do not cover cosmetic dental procedures like teeth whitening or veneers. However, there may be exceptions, so it’s always best to consult with your HSA provider or dentist.

What are the tax benefits of using an HSA for dental?

Contributions to an HSA are tax-deductible, and withdrawals for qualified medical expenses, including dental, are tax-free. This can result in significant savings over time.