Can you use health savings account for dental – Can you use a health savings account for dental? This question often arises for individuals seeking to manage their healthcare expenses effectively. Health Savings Accounts (HSAs) offer tax advantages and potential savings for healthcare costs, but their applicability to dental care can be confusing.

This article delves into the intricacies of HSAs and their use for dental expenses, exploring the coverage, limitations, and advantages of this popular healthcare savings tool.

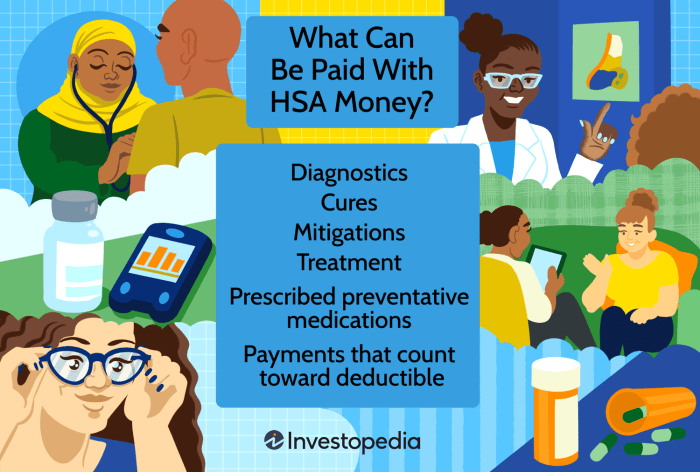

HSAs are tax-advantaged accounts designed to help individuals save for qualified healthcare expenses. To be eligible for an HSA, you must be enrolled in a High Deductible Health Plan (HDHP). These plans have lower monthly premiums but require you to pay a higher deductible before insurance coverage kicks in.

HSAs offer flexibility in managing your healthcare spending, allowing you to pay for eligible expenses directly from the account or receive reimbursement for out-of-pocket expenses.

What is a Health Savings Account (HSA)?: Can You Use Health Savings Account For Dental

A Health Savings Account (HSA) is a tax-advantaged savings account that allows individuals to set aside money to pay for qualified healthcare expenses. The money in an HSA is not taxed when it’s contributed, grows tax-deferred, and is tax-free when used for eligible medical expenses.

HSA Eligibility Requirements

To be eligible to open an HSA, you must be enrolled in a High Deductible Health Plan (HDHP). HDHPs are health insurance plans with high deductibles, meaning you pay a higher out-of-pocket amount before your insurance starts covering your healthcare costs.

- You must be covered by a high-deductible health plan (HDHP).

- You cannot be enrolled in any other health coverage, such as Medicare or Medicaid.

- You cannot be claimed as a dependent on someone else’s tax return.

Differences Between HSAs and FSAs

HSAs and Flexible Spending Accounts (FSAs) are both tax-advantaged accounts that can be used to pay for qualified healthcare expenses. However, there are some key differences between the two:

- Ownership: HSAs are owned by the individual and can be carried over from year to year. FSAs are owned by the employer and any unused funds at the end of the year are forfeited.

- Eligibility: To be eligible for an HSA, you must be enrolled in an HDHP. FSAs are available to anyone with a health insurance plan.

- Contribution Limits: The contribution limits for HSAs are higher than for FSAs.

- Investment Options: HSAs allow you to invest your contributions, while FSAs typically do not.

Dental Expenses and HSA Coverage

While HSAs offer flexibility for healthcare expenses, their coverage of dental expenses can be a bit more nuanced. Let’s delve into how HSAs work in conjunction with dental care.

Dental Expenses Covered by HSAs

Generally, HSAs cover dental expenses that are considered “medically necessary.” This means that the procedures must be deemed essential for treating a medical condition or preventing further health issues. These can include:

- Extractions:Removing a tooth due to decay, infection, or injury.

- Root Canals:Repairing a damaged tooth’s pulp to prevent infection.

- Dental Implants:Replacing missing teeth with artificial roots and crowns.

- Periodontitis Treatment:Addressing gum disease to prevent bone loss.

It’s important to note that preventive dental care, such as routine cleanings and checkups, may not always be covered by HSAs. This is because they are considered preventative measures rather than treatments for medical conditions.

Limitations on Using an HSA for Dental Care

There are a few key limitations to keep in mind when using an HSA for dental expenses:

- Coverage Varies by Plan:The specific dental procedures covered by an HSA can differ depending on your individual plan. It’s crucial to review your plan’s details to understand what’s covered and what’s not.

- Deductible and Co-pays:You may still have a deductible and co-pays to meet for dental services, even if they are considered medically necessary.

- Prior Authorization:Some dental procedures may require prior authorization from your insurance company before they can be covered by your HSA.

It’s always a good idea to contact your HSA administrator or insurance provider to confirm coverage and obtain pre-authorization for any dental procedures you plan to use your HSA for.

Whether you can use your health savings account (HSA) for dental expenses depends on your specific plan and the services provided. The Texas Health and Human Services Commissioner might have resources or guidance on this, but ultimately, it’s best to check with your HSA provider and dental insurance company for definitive answers.

Using an HSA for Dental Care

You can use your HSA funds to pay for qualified dental expenses, offering a tax-advantaged way to manage your oral health. Here’s how to leverage your HSA for dental care:

Paying for Dental Expenses with an HSA

When you need dental care, you can either pay out-of-pocket and then submit a claim for reimbursement from your HSA or use your HSA debit card directly at the dentist’s office.

Submitting Claims for Reimbursement

To receive reimbursement, you will typically need to:

- Obtain a receipt or invoice from your dentist.

- Complete a claim form provided by your HSA administrator.

- Submit the claim form and supporting documentation to your HSA administrator.

The HSA administrator will review your claim and process the reimbursement if the expenses are eligible.

While you can’t use your Health Savings Account (HSA) for routine beauty treatments, you might be able to use it for dental work, especially if it’s considered medically necessary. This could include procedures like extractions or implants that are related to a health condition.

If you’re unsure, it’s always best to check with your HSA provider or a qualified dental professional. In the meantime, you might want to check out some beauty parlour beauty parlour options for those non-medical treatments, just remember to keep your HSA funds for their intended purpose!

Using Your HSA Debit Card

If your HSA administrator offers a debit card, you can use it directly at your dentist’s office to pay for your dental expenses. This eliminates the need to submit claims for reimbursement.

Common Dental Procedures Covered by HSAs, Can you use health savings account for dental

A wide range of dental procedures are eligible for HSA reimbursement, including:

- Cleanings and checkups

- Fillings and crowns

- Extractions

- Root canals

- Dentures and implants

- Orthodontic treatment (braces)

It’s important to note that some dental procedures may not be covered by HSAs, such as cosmetic dentistry. Check with your HSA administrator for a comprehensive list of eligible expenses.

Advantages and Disadvantages of Using an HSA for Dental Care

Using a Health Savings Account (HSA) for dental expenses can be a smart financial move, offering potential tax advantages and savings. However, there are also some limitations and potential drawbacks to consider before relying solely on an HSA for your dental needs.

Tax Advantages and Potential Savings

Using an HSA for dental care can offer significant tax advantages. Contributions to an HSA are tax-deductible, meaning you can reduce your taxable income by the amount you contribute. Additionally, the money you withdraw from your HSA for qualified medical expenses, including dental care, is tax-free.

- Tax-deductible contributions:HSA contributions are tax-deductible, reducing your taxable income and potentially lowering your tax liability.

- Tax-free withdrawals for qualified medical expenses:Withdrawals from an HSA for qualified medical expenses, including dental care, are tax-free, meaning you won’t have to pay taxes on the money you use for dental treatment.

- Potential for savings:By utilizing an HSA for dental expenses, you can potentially save money on taxes and accumulate funds for future dental needs.

Limitations and Potential Drawbacks

While HSAs offer benefits, it’s essential to be aware of their limitations and potential drawbacks:

- Coverage limitations:HSAs are subject to coverage limitations, meaning they may not cover all dental expenses. It’s crucial to check your HSA plan’s coverage details and understand what expenses are eligible for reimbursement.

- Potential penalties for misuse:Using HSA funds for non-qualified medical expenses can result in penalties, including taxes and a 20% penalty on the misused funds.

Whether you can use your health savings account (HSA) for dental depends on your specific plan. Some plans cover dental, while others don’t. It’s important to check your plan details to see if dental expenses are eligible. If you’re looking for a gym to stay fit and healthy, consider checking out 24 hours fitness san ramon.

They offer a variety of classes and equipment to help you achieve your fitness goals. And remember, maintaining good oral health is crucial for overall well-being, so make sure you understand your HSA coverage and seek professional dental care when needed.

- Limited access to funds:HSA funds are typically restricted to qualified medical expenses, making them less flexible than traditional savings accounts.

Comparing HSA with Other Payment Options

When deciding whether to use an HSA for dental care, it’s helpful to compare it with other payment options:

- Dental insurance:Dental insurance typically offers broader coverage than an HSA, but premiums can be expensive.

- Credit cards:Using a credit card for dental expenses can be convenient, but high-interest rates can accumulate significant debt.

- Personal savings:Using personal savings for dental care provides flexibility but lacks the tax advantages of an HSA.

Resources and Information

Navigating the world of HSAs and dental coverage can be confusing. Luckily, several resources can help you understand your options and make informed decisions.

Finding Reliable Information

To gain a comprehensive understanding of HSAs and their application to dental care, it’s crucial to consult reliable sources.

- The Internal Revenue Service (IRS):The IRS website provides official guidance on HSAs, including eligibility requirements, contribution limits, and allowable expenses. You can find detailed information on the IRS website or by contacting the IRS directly.

- The Department of Health and Human Services (HHS):HHS offers valuable information on health savings accounts, including their purpose, benefits, and regulations. Their website is a valuable resource for understanding the broader context of HSAs within the healthcare system.

- Your HSA Provider:The company that administers your HSA can provide specific information about your account, including contribution limits, allowable expenses, and available resources. They are a primary source for personalized guidance and support.

- Consumer Advocacy Groups:Organizations like the National Consumer League or the Center for Medicare Advocacy offer valuable information on healthcare costs, consumer rights, and strategies for managing healthcare expenses. These groups can provide valuable insights and resources for navigating the complexities of healthcare financing.

Locating HSA-Accepting Dental Providers

Finding a dental provider who accepts HSA payments is essential for utilizing your HSA funds effectively.

- Ask Your HSA Provider:Your HSA administrator may have a directory of providers who accept HSA payments. They can provide a list of dentists in your area who are qualified to receive HSA funds.

- Check Online Directories:Several online directories, such as HSA Bank’s Find a Provider tool or FSAstore’s directory, allow you to search for dental providers who accept HSA payments. These directories can be helpful in identifying dentists who accept HSA payments within your geographic area.

- Contact Dental Providers Directly:You can contact dental offices directly to inquire about their HSA acceptance policies. Many dentists are familiar with HSA payments and will be happy to discuss their payment options.

Maximizing HSA Benefits for Dental Care

By utilizing your HSA strategically, you can maximize its benefits for your dental care needs.

- Contribute Regularly:Consistent contributions to your HSA can help accumulate funds for future dental expenses. Aim to contribute the maximum amount allowed by law, as this can provide significant savings over time.

- Use Your HSA for Preventative Care:Routine dental cleanings and checkups are typically covered by HSAs. By utilizing your HSA for preventative care, you can help prevent more expensive dental issues in the future.

- Keep Detailed Records:Maintain meticulous records of all HSA transactions, including dental expenses. This documentation will be essential for tax purposes and for tracking your HSA balance.

- Seek Second Opinions:For significant dental procedures, consider seeking a second opinion from another qualified dentist. This can help ensure you receive the most appropriate and cost-effective treatment.

Wrap-Up

Understanding the intricacies of using an HSA for dental care can significantly impact your healthcare planning and financial well-being. By leveraging the tax benefits and potential savings associated with HSAs, individuals can make informed decisions about their dental care and maximize the value of this valuable healthcare tool.

Remember to consult with your healthcare provider and HSA administrator to ensure you are utilizing your HSA effectively and complying with all relevant regulations.

Key Questions Answered

Can I use my HSA for routine dental cleanings?

Yes, most HSAs cover routine dental cleanings as they are considered preventive care.

What types of dental procedures are not covered by HSAs?

Some dental procedures, like cosmetic dentistry or dental implants, may not be covered by HSAs. It’s crucial to check with your HSA administrator for specific coverage details.

Are there any limits on how much I can contribute to my HSA?

Yes, there are annual contribution limits for HSAs, which vary based on individual coverage. The IRS sets these limits each year.

What happens to the money in my HSA if I don’t use it?

The money in your HSA remains yours, and it can be used for eligible healthcare expenses at any time, even after you retire. Unused funds roll over year after year.