Aflac insurance health offers supplemental insurance that can help cover medical expenses not covered by traditional health insurance. Aflac is known for its unique approach to health insurance, focusing on providing cash benefits directly to policyholders to help them manage out-of-pocket costs associated with unexpected health events.

Aflac has a long history of providing insurance products, dating back to 1955. The company has built a reputation for its strong financial stability and customer-centric approach. Aflac’s health insurance plans are designed to provide financial peace of mind by offering coverage for a wide range of medical expenses, including hospitalization, surgery, critical illness, and disability.

Aflac Insurance Overview

Aflac insurance is a supplemental health insurance provider that offers a range of policies designed to help individuals pay for out-of-pocket medical expenses not covered by traditional health insurance. Aflac primarily focuses on providing coverage for unexpected medical events, such as hospitalization, surgery, and critical illnesses.Aflac’s unique selling proposition lies in its focus on providing affordable and accessible supplemental insurance, often with a focus on providing cash benefits directly to policyholders.

This approach allows individuals to use the funds for a variety of medical expenses, including deductibles, copayments, and other out-of-pocket costs, offering financial flexibility and peace of mind.

Aflac’s History and Evolution

Aflac’s origins can be traced back to 1955 when it was founded as American Family Life Assurance Company of Columbus (Aflac) in Columbus, Georgia. The company initially focused on offering life insurance policies to individuals. Over time, Aflac expanded its product offerings to include supplemental health insurance, disability insurance, and other financial products.

Aflac’s growth and success have been attributed to its innovative approach to marketing and its strong focus on customer service. The company has become known for its memorable advertising campaigns, often featuring the iconic Aflac duck, which has helped to build brand recognition and increase consumer awareness.

Aflac Health Insurance Products

Aflac offers a variety of supplemental health insurance products designed to help individuals cover out-of-pocket expenses associated with medical bills. These plans are meant to provide financial protection and peace of mind in the event of unexpected medical costs.

Aflac’s Health Insurance Plans

Aflac’s health insurance plans can be broadly categorized into several types, each designed to address specific needs and financial situations. These plans are generally supplemental, meaning they work in conjunction with existing health insurance plans to provide additional coverage.

| Plan Name | Coverage Details | Eligibility Criteria | Premiums |

|---|---|---|---|

| Hospital Indemnity Insurance | Provides a daily cash benefit for each day spent in a hospital, regardless of the reason for hospitalization. | Typically available to individuals with existing health insurance. | Varies based on coverage amount, age, and health status. |

| Critical Illness Insurance | Offers a lump-sum payment upon diagnosis of a specific critical illness, such as cancer, heart attack, or stroke. | Generally available to individuals under a certain age, typically up to 65. | Premiums depend on coverage amount, age, and health status. |

| Accident Insurance | Provides coverage for medical expenses incurred due to accidental injuries. | Available to individuals of various ages and health conditions. | Premiums vary based on coverage amount and the level of risk. |

| Cancer Insurance | Offers financial assistance for medical expenses associated with cancer treatment. | Typically available to individuals under a certain age, with varying eligibility criteria. | Premiums are determined by coverage amount, age, and health status. |

Comparison of Aflac Health Insurance Plans

Aflac’s health insurance plans cater to different needs and risk profiles.

Hospital Indemnity Insuranceis ideal for individuals concerned about covering the high costs associated with hospital stays. This plan provides a consistent cash benefit, regardless of the reason for hospitalization, offering financial support for daily living expenses or medical bills.

Critical Illness Insuranceis suitable for individuals who want financial protection in case of a serious medical event. The lump-sum payment can help cover medical expenses, lost wages, or other financial burdens associated with a critical illness.

Accident Insuranceprovides peace of mind for individuals who are at risk of accidental injuries, such as those engaged in physically demanding jobs or hobbies. The coverage helps pay for medical expenses, lost wages, or other related costs.

Cancer Insuranceis specifically designed for individuals who want to protect themselves from the financial strain of a cancer diagnosis. The coverage can help cover medical expenses, treatment costs, and other associated expenses.

Aflac Health Insurance Benefits

Aflac health insurance plans offer a range of benefits designed to provide financial support during unexpected medical events, helping you focus on your recovery rather than worrying about mounting medical expenses. These benefits are designed to complement your existing health insurance, offering an additional layer of protection.

Coverage for Specific Medical Expenses

Aflac health insurance plans offer coverage for various medical expenses, providing financial assistance when you need it most. This includes:

- Hospitalization:Aflac offers daily cash benefits for each day you’re hospitalized, helping cover expenses not covered by your primary health insurance, such as meals, parking, or other incidentals.

- Surgery:Aflac provides a lump-sum payment upon successful completion of a covered surgery, helping with post-surgical expenses or recovery needs.

- Critical Illness:Aflac offers a lump-sum benefit if you’re diagnosed with a covered critical illness, such as cancer, heart attack, or stroke. This benefit can help cover treatment costs, lost income, or other expenses associated with managing your condition.

- Disability:Aflac offers income replacement benefits if you become disabled due to an illness or injury, helping you maintain your financial stability during a challenging time.

Claim Process and Procedures

Filing a claim with Aflac is generally straightforward. Here’s a typical process:

- Contact Aflac:Once you’ve incurred a covered medical expense, contact Aflac through their website, phone, or mobile app. You’ll need to provide details about your claim, including your policy number and the medical expense incurred.

- Submit Required Documentation:Aflac will request supporting documentation, such as medical bills, treatment records, or a doctor’s note. This documentation helps verify your claim and ensure you meet the coverage criteria.

- Claim Review and Processing:Aflac reviews your claim and supporting documentation. Once approved, they’ll process your claim and issue payment directly to you or your healthcare provider, depending on the specific benefit.

Aflac Health Insurance Costs and Premiums

Aflac health insurance premiums, like those of other insurance providers, are determined by several factors. Understanding these factors can help you estimate the cost of Aflac coverage and make informed decisions about your insurance needs.

Factors Influencing Aflac Health Insurance Premiums

Aflac considers various factors when calculating your premiums. These factors are crucial in determining the level of risk associated with insuring you, which directly impacts your premium cost.

Aflac insurance offers supplemental health insurance that can help cover expenses not covered by traditional health insurance plans. Many employers offer Aflac insurance as a benefit to their employees, and this can be particularly beneficial for employees who work for large healthcare systems like Franciscan Health.

Franciscan Health employees may find that Aflac insurance can help them manage unexpected medical costs and provide peace of mind.

- Age:Generally, older individuals tend to have higher healthcare costs, leading to higher premiums. As you age, your risk of health issues increases, making you a higher risk for insurance companies.

- Health Status:Individuals with pre-existing conditions or a history of health issues may face higher premiums. This is because they are considered a higher risk of needing healthcare services, making them more expensive to insure.

- Coverage Level:The level of coverage you choose significantly impacts your premium. Higher coverage levels, offering greater benefits and protection, usually come with higher premiums. Conversely, lower coverage levels with fewer benefits will generally result in lower premiums.

- Location:Your geographic location can also influence your premiums. Areas with higher healthcare costs may have higher premiums due to the increased likelihood of needing healthcare services.

- Tobacco Use:Smokers typically face higher premiums than non-smokers. This is due to the increased risk of health issues associated with smoking, leading to higher healthcare costs for insurance companies.

Examples of Aflac Health Insurance Premiums

Aflac offers a range of plans with varying coverage levels, resulting in different premium costs. The specific premium you pay will depend on your individual circumstances, including the factors discussed above. Here are some examples of Aflac health insurance premiums, considering different coverage options:

- Basic Plan:A basic Aflac health insurance plan with limited coverage might have a monthly premium of around $20-$30 for a healthy individual in their 30s.

- Comprehensive Plan:A comprehensive plan with extensive coverage, including critical illness benefits, might have a monthly premium of $50-$70 for the same individual.

It’s essential to note that these are just examples, and your actual premium will vary based on your specific situation. You can get a personalized quote from Aflac by providing your details, including age, health status, and desired coverage level.

How Aflac Premiums Are Calculated

Aflac uses a complex algorithm to calculate your premiums. This algorithm considers various factors, including your age, health status, coverage level, location, and other relevant information.

Aflac’s premium calculation formula is based on actuarial science, which uses statistical data to assess risk and determine premiums.

Aflac insurance offers supplemental health coverage, which can be particularly helpful for those seeking additional protection beyond their primary insurance. To manage your health care needs effectively, you might find the IU Health Teams Portal a valuable resource. It provides a centralized platform for accessing important health information and connecting with your healthcare providers, allowing you to better understand and manage your overall health and well-being, which is essential when considering supplemental insurance options like Aflac.

The formula takes into account the probability of you needing healthcare services and the estimated cost of those services. It then adjusts the premium based on your individual risk profile, ensuring that you pay a premium that reflects your likelihood of needing coverage.

Aflac insurance health can be a valuable resource for individuals and families seeking supplemental coverage for unexpected medical expenses. One key aspect of maintaining good health is understanding the diverse range of health needs, which can be explored in detail at health in color.

By addressing individual health concerns and promoting overall wellness, Aflac insurance health can help individuals navigate the complexities of healthcare and achieve their health goals.

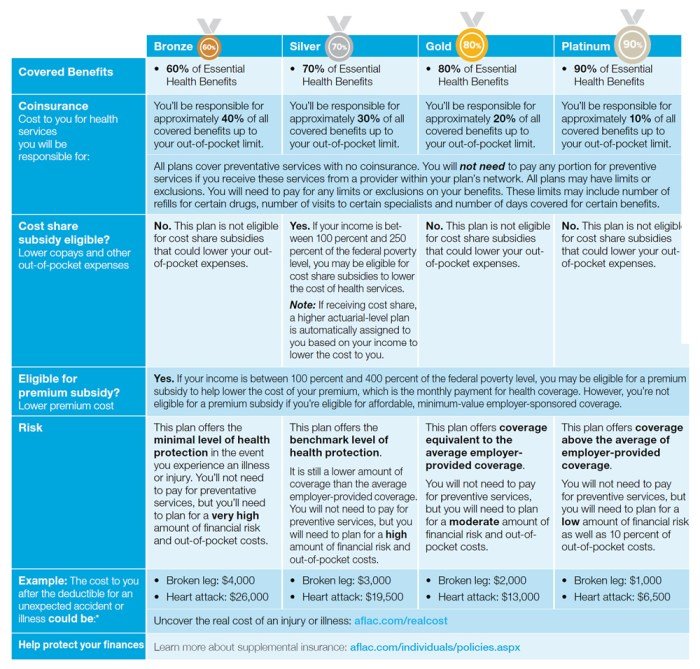

Aflac Health Insurance vs. Traditional Health Insurance

Choosing the right health insurance plan is crucial for safeguarding your financial well-being in the face of unexpected medical expenses. While traditional health insurance is a familiar option, Aflac offers a distinct approach that focuses on supplementing your existing coverage.

Understanding the key differences between these two types of insurance can help you make an informed decision that aligns with your individual needs and financial situation.

Comparison of Aflac and Traditional Health Insurance

Aflac and traditional health insurance differ significantly in terms of their coverage, costs, and accessibility. Here’s a detailed comparison:

| Feature | Aflac | Traditional Health Insurance |

|---|---|---|

| Coverage | Provides supplemental coverage for specific medical expenses, such as hospital stays, surgery, and critical illnesses. | Offers comprehensive coverage for a wide range of medical expenses, including preventive care, hospitalization, and prescription drugs. |

| Premiums | Typically lower than traditional health insurance premiums, as they cover a more limited range of expenses. | Premiums are generally higher due to the comprehensive nature of the coverage. |

| Benefits | Provides cash benefits directly to the policyholder, allowing for flexibility in using the funds. | Covers medical expenses directly, typically through a network of providers. |

| Accessibility | Generally more accessible, as it often doesn’t require a medical exam or pre-existing condition screening. | May require a medical exam and can be more difficult to obtain for individuals with pre-existing conditions. |

| Limitations | Limited coverage for certain medical expenses and may not cover all medical costs. | May have high deductibles and co-pays, which can lead to significant out-of-pocket expenses. |

Advantages and Disadvantages of Aflac Health Insurance

Advantages

- Lower premiums compared to traditional health insurance.

- Provides cash benefits, offering flexibility in using the funds.

- Generally more accessible, with fewer restrictions on eligibility.

- Can supplement existing health insurance coverage, providing additional financial protection.

Disadvantages

- Limited coverage for certain medical expenses, such as routine checkups and preventive care.

- May not cover all medical costs, leaving the policyholder responsible for the remaining expenses.

- May not be suitable for individuals with high healthcare needs.

Advantages and Disadvantages of Traditional Health Insurance

Advantages

- Provides comprehensive coverage for a wide range of medical expenses.

- Covers medical expenses directly, reducing out-of-pocket costs.

- May offer access to a wider network of providers.

Disadvantages

- Higher premiums compared to Aflac.

- May require a medical exam and can be more difficult to obtain for individuals with pre-existing conditions.

- May have high deductibles and co-pays, leading to significant out-of-pocket expenses.

Aflac Health Insurance Customer Reviews and Testimonials

Customer reviews and testimonials provide valuable insights into the experiences of individuals who have used Aflac health insurance. These firsthand accounts offer a diverse perspective on the company’s services, coverage, and claim handling processes.

Analysis of Customer Feedback

Analyzing customer reviews and testimonials helps to identify common themes and concerns. Positive feedback often focuses on the ease of claim filing, the promptness of payments, and the overall customer service experience. Conversely, negative feedback may highlight issues with coverage limitations, high premiums, or delays in claim processing.

Customer Reviews and Testimonials Table

Here’s a table summarizing customer experiences with Aflac health insurance, based on online reviews and testimonials:

| Customer Rating | Coverage Satisfaction | Claim Handling Experience | Comments |

|---|---|---|---|

| 4.5 stars | Very satisfied | Smooth and efficient | “I’ve been with Aflac for years, and I’ve always been happy with their coverage. The claims process is straightforward, and they always pay out quickly.”

|

| 3 stars | Mixed | Some delays | “The coverage is decent, but I’ve had some issues with claims processing. It took a while to get my claim approved, and I had to call several times to follow up.”

|

| 2 stars | Not satisfied | Difficult and frustrating | “I had a major medical expense, and Aflac denied my claim. The customer service was terrible, and I felt like I was getting the runaround.”

|

Aflac Health Insurance Industry Landscape

The health insurance industry is a dynamic and competitive landscape, characterized by a diverse range of players offering a wide array of products and services. Understanding the competitive landscape is crucial for evaluating Aflac’s position and its ability to navigate industry trends and challenges.

Key Players and Offerings

The health insurance industry is dominated by a handful of large, established players, including:

- UnitedHealth Group

- Anthem

- Cigna

- Humana

- Aetna

These companies offer a wide range of health insurance products, including individual and group health plans, Medicare and Medicaid plans, and specialty insurance products. They compete based on factors such as premium pricing, network size, benefits coverage, and customer service.

Aflac’s Market Position

Aflac occupies a unique niche in the health insurance market, focusing primarily on supplemental insurance products. Unlike traditional health insurance providers, Aflac does not offer comprehensive health plans. Instead, it provides coverage for specific medical expenses, such as hospital stays, cancer treatment, and critical illnesses.

This niche positioning has allowed Aflac to establish a strong brand identity and a loyal customer base.

Aflac’s Strengths and Weaknesses

Aflac’s strengths include:

- Strong Brand Recognition:Aflac has built a recognizable brand through its iconic duck mascot and its focus on providing supplemental coverage. This brand recognition has translated into high customer loyalty and a strong reputation.

- Wide Distribution Network:Aflac has a broad distribution network through its independent agents, who work directly with customers to sell and service its products. This network allows Aflac to reach a wide range of potential customers.

- Financial Strength:Aflac is a financially sound company with a strong track record of profitability. This financial strength provides Aflac with the resources to invest in product development, technology, and customer service.

However, Aflac also faces some challenges:

- Limited Product Offerings:Aflac’s focus on supplemental insurance products limits its appeal to customers seeking comprehensive health coverage.

- Competition from Traditional Insurers:Traditional health insurance providers are increasingly offering supplemental insurance products, which puts pressure on Aflac’s market share.

- Regulatory Changes:The healthcare industry is subject to frequent regulatory changes, which can impact Aflac’s product offerings and pricing.

Emerging Trends and Challenges

The health insurance industry is facing several emerging trends and challenges, including:

- Rising Healthcare Costs:Healthcare costs continue to rise, putting pressure on insurers to find ways to control expenses and offer affordable premiums.

- Consumer Demand for Transparency:Consumers are increasingly demanding transparency from insurers regarding pricing, benefits, and customer service.

- Growth of Telehealth:The use of telehealth services is growing rapidly, which is creating new opportunities for insurers to offer innovative products and services.

- Data Analytics and Artificial Intelligence:Insurers are using data analytics and artificial intelligence to improve risk assessment, pricing, and customer service.

These trends and challenges will continue to shape the health insurance industry in the coming years. Aflac will need to adapt its business model and product offerings to remain competitive in this evolving landscape.

Aflac Health Insurance Resources and Contact Information

Finding the right health insurance can be a daunting task, but Aflac provides resources to help you navigate the process and make informed decisions. From their website to dedicated customer support channels, Aflac offers a wealth of information and assistance.

Aflac’s Official Website

Aflac’s official website is a comprehensive resource for information about their health insurance products and services. It provides details about different plans, coverage options, premiums, and frequently asked questions. You can also access online tools like quote calculators and policy management features.

The website also offers a variety of educational materials, including articles, videos, and infographics, to help you understand the complexities of health insurance.

Aflac Policy Documents

Aflac offers various policy documents that provide detailed information about their health insurance plans. These documents Artikel the coverage, benefits, exclusions, and limitations of each plan. It is essential to review these documents carefully before making a decision. You can access these documents through Aflac’s website or by contacting your insurance agent.

Aflac Customer Support Channels

Aflac offers multiple customer support channels to assist you with any questions or concerns you may have. You can reach their customer service team via phone, email, or live chat. Their website also features a comprehensive FAQ section that addresses common inquiries.

Additionally, Aflac provides dedicated support for policyholders, including claims processing and account management assistance.

Contacting Aflac Insurance Agents and Brokers, Aflac insurance health

For personalized consultations and assistance, you can connect with Aflac insurance agents and brokers. These professionals can help you understand your specific needs, explore different coverage options, and choose the plan that best suits your situation. You can find an Aflac agent or broker near you using the online directory available on their website.

Conclusive Thoughts: Aflac Insurance Health

Whether you’re looking for additional coverage for unexpected medical expenses or simply want to explore alternative health insurance options, understanding Aflac insurance health can be valuable. By carefully considering your individual needs and financial situation, you can make an informed decision about whether Aflac’s supplemental insurance is right for you.

Expert Answers

What types of medical expenses does Aflac insurance health cover?

Aflac health insurance plans typically cover a range of medical expenses, including hospitalization, surgery, critical illness, and disability. Specific coverage details vary depending on the chosen plan.

How do I file a claim with Aflac?

Filing a claim with Aflac is generally straightforward. You can usually file a claim online, by phone, or through an Aflac agent. The specific process may vary depending on the type of claim and your chosen plan.

What are the factors that influence Aflac health insurance premiums?

Aflac health insurance premiums are influenced by factors such as your age, health status, coverage level, and location. Younger and healthier individuals typically pay lower premiums than older or less healthy individuals.

Is Aflac insurance health right for me?

Whether Aflac insurance health is right for you depends on your individual needs and financial situation. If you’re looking for additional coverage for unexpected medical expenses and want to manage out-of-pocket costs, Aflac can be a valuable option.