Cheapest health insurance PA can seem like a daunting quest, but it’s achievable with the right knowledge and resources. Pennsylvania offers a diverse landscape of health insurance options, ranging from traditional HMOs and PPOs to newer plans like EPOs and POS.

The cost of your health insurance will depend on factors like your age, location, health status, and the level of coverage you choose. Understanding the Affordable Care Act (ACA) and its impact on Pennsylvania’s health insurance market is crucial to navigating this complex landscape.

This guide will walk you through the different types of health insurance plans available in Pennsylvania, explain how to find affordable options, and help you understand the trade-offs involved in choosing the cheapest plan. We’ll also explore resources for managing your health insurance costs and maximizing savings.

Understanding Pennsylvania’s Health Insurance Landscape

Navigating the world of health insurance in Pennsylvania can be a complex endeavor. Understanding the different types of plans available, the factors influencing costs, and the impact of the Affordable Care Act (ACA) is crucial for making informed decisions.

Types of Health Insurance Plans in Pennsylvania

Pennsylvania offers a range of health insurance plans, each with its own features and benefits. Understanding these different plan types is essential for selecting the right coverage for your needs.

- Health Maintenance Organization (HMO):HMOs typically have lower premiums but require you to choose a primary care physician (PCP) within their network. You’ll need a referral from your PCP to see specialists.

- Preferred Provider Organization (PPO):PPOs offer more flexibility than HMOs. You can see any doctor or specialist within the network without a referral, although you’ll generally pay lower costs if you stay within the network.

- Exclusive Provider Organization (EPO):EPOs are similar to HMOs in that you must choose a PCP within their network. However, unlike HMOs, EPOs don’t cover out-of-network care except for emergencies.

- Point-of-Service (POS):POS plans offer a combination of HMO and PPO features. You can choose a PCP within the network, but you also have the option to see out-of-network providers for an additional cost.

Factors Influencing Health Insurance Costs in Pennsylvania

Several factors influence the cost of health insurance in Pennsylvania. Understanding these factors can help you estimate your potential premiums and make informed choices.

- Age:Younger individuals typically pay lower premiums than older individuals, as they tend to be healthier and require less medical care.

- Location:Health insurance costs can vary based on your geographic location. Areas with higher healthcare costs generally have higher premiums.

- Health Status:Individuals with pre-existing conditions may face higher premiums. The ACA prohibits insurers from denying coverage based on pre-existing conditions, but it can still affect your cost.

- Coverage Level:The level of coverage you choose, such as bronze, silver, gold, or platinum, also affects your premium. Higher coverage levels generally have higher premiums but offer greater protection against high medical expenses.

- Tobacco Use:Smokers typically pay higher premiums than non-smokers, reflecting the higher risk of health issues associated with smoking.

The Affordable Care Act (ACA) and its Impact on Health Insurance Options in Pennsylvania

The Affordable Care Act (ACA), also known as Obamacare, has significantly impacted health insurance options in Pennsylvania. The ACA has expanded access to health insurance, created marketplaces for individuals to compare plans, and established minimum essential coverage requirements.

The ACA has also prohibited insurers from denying coverage based on pre-existing conditions and from charging higher premiums based on gender.

Navigating Affordable Health Insurance Options

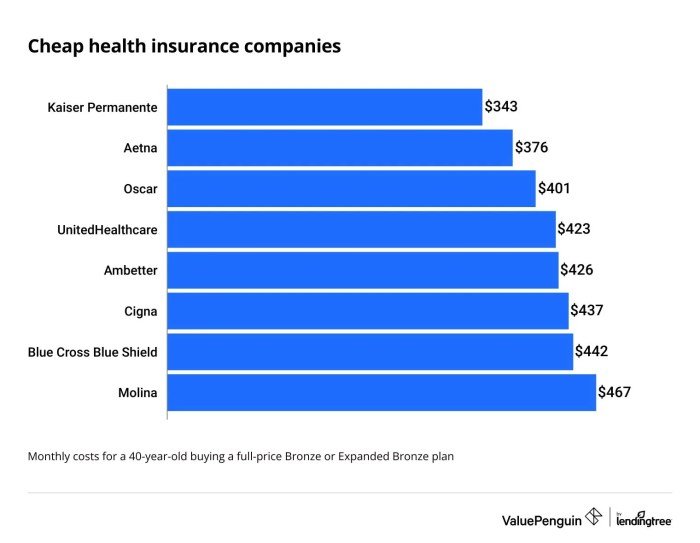

Finding the right health insurance plan can feel overwhelming, especially when you’re looking for affordability. Pennsylvania offers various options through the Pennsylvania Health Insurance Marketplace (PHIX), each with its own costs and benefits. This section will guide you through the process of navigating these options to find the plan that best suits your needs and budget.

Comparing Health Insurance Plan Costs

Understanding the cost variations among different health insurance plans is crucial for making informed decisions. Here’s a breakdown of key factors influencing plan costs:

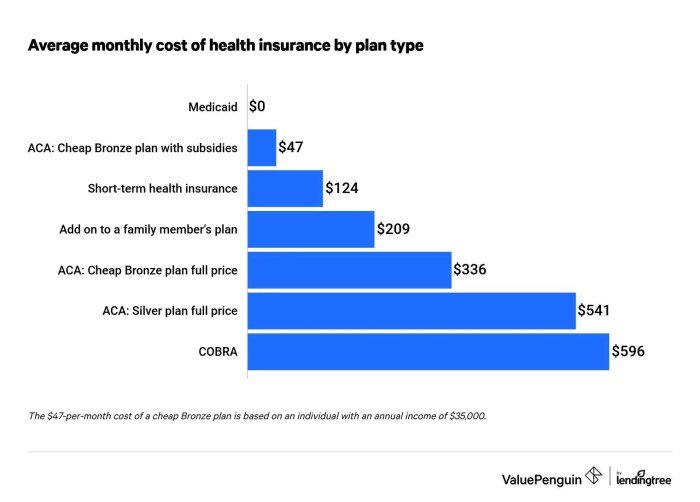

- Plan Type:Pennsylvania offers four main types of health insurance plans: Bronze, Silver, Gold, and Platinum. Bronze plans have the lowest monthly premiums but typically have higher out-of-pocket costs, while Platinum plans have the highest premiums but lower out-of-pocket costs.

- Deductible:The deductible is the amount you pay out-of-pocket before your insurance starts covering medical expenses. Higher deductibles usually mean lower monthly premiums.

- Co-pays and Co-insurance:These are the costs you share with your insurance company for medical services. Plans with higher co-pays and co-insurance generally have lower premiums.

- Network:Your health insurance plan’s network determines which doctors, hospitals, and other healthcare providers are covered. Narrower networks typically have lower premiums.

Resources for Finding Affordable Health Insurance Plans

Several resources can assist you in finding affordable health insurance plans in Pennsylvania:

- Pennsylvania Health Insurance Marketplace (PHIX):The PHIX website (www.healthcare.gov) is your primary source for comparing plans, calculating costs, and enrolling in coverage. You can use the website’s tools to filter plans based on your budget, needs, and location.

- Health Insurance Navigators:Navigators are trained professionals who can provide free, impartial assistance with the enrollment process. They can help you understand your options, compare plans, and complete your application. You can find a navigator near you by visiting the PHIX website.

Finding the cheapest health insurance in Pennsylvania can be a challenge, but it’s crucial for protecting your financial well-being. One option to consider is turquoise health , which offers a variety of plans with competitive premiums. However, remember to compare quotes from multiple insurers to ensure you’re getting the best deal for your individual needs and budget.

- Pennsylvania Department of Human Services (DHS):DHS offers various programs and resources for Pennsylvanians seeking affordable health insurance. You can contact DHS at 1-800-692-7462 for information and assistance.

- Your Employer:If you are employed, your employer may offer health insurance plans through a group plan. These plans often have lower premiums than individual plans.

Understanding Subsidies and Tax Credits

For eligible Pennsylvanians, subsidies and tax credits can significantly reduce the cost of health insurance.

- Subsidies:Subsidies are government-provided financial assistance that lowers your monthly premium. The amount of the subsidy depends on your income and family size.

- Tax Credits:Tax credits are reductions in your federal income tax liability. You may be eligible for a tax credit if you purchase health insurance through the PHIX and meet certain income requirements.

Remember:The availability and amount of subsidies and tax credits may vary depending on your income, family size, and other factors. It’s important to contact the PHIX or a navigator to determine your eligibility and understand the potential benefits.

Exploring Specific Health Insurance Options for Different Groups

Pennsylvania’s health insurance landscape offers a variety of options, each tailored to the unique needs of different demographics. Understanding these options is crucial for finding the most affordable and comprehensive coverage. This section explores specific health insurance plans designed for families, individuals, and seniors, highlighting plans that cater to specific health conditions or lifestyles.

Health Insurance for Families

Families have unique health insurance needs, often requiring coverage for multiple individuals with varying health conditions. The Affordable Care Act (ACA) offers various subsidies and tax credits to help families afford health insurance.

- ACA Marketplace Plans:These plans offer comprehensive coverage for families, including preventive care, prescription drugs, and mental health services. They are subsidized based on income, making them accessible to families with varying financial situations.

- Employer-Sponsored Plans:Many employers offer group health insurance plans to their employees, which often include family coverage. These plans may offer lower premiums and more comprehensive benefits compared to individual plans.

- Children’s Health Insurance Program (CHIP):CHIP provides affordable health insurance to children from families with limited incomes. This program is available to children under 19 years old and can cover essential medical services, including preventive care, immunizations, and dental care.

Health Insurance for Individuals

Individuals seeking health insurance have diverse needs and preferences. They need to consider their budget, health status, and lifestyle when choosing a plan.

- Individual Health Insurance Plans:These plans are purchased directly from insurance companies and are available to individuals who are not covered by employer-sponsored plans or government programs. They offer various coverage options, from basic plans to comprehensive plans, and may be subsidized based on income.

- Short-Term Health Insurance:This type of insurance is designed for temporary coverage, typically lasting for a few months. It is often less expensive than traditional health insurance but may have limited coverage and higher out-of-pocket costs.

- Catastrophic Health Insurance:This plan is available to individuals under 30 years old or those with limited incomes. It covers catastrophic medical expenses but has high deductibles and limited coverage for preventive care and other services.

Health Insurance for Seniors

Seniors have unique health insurance needs, often requiring coverage for chronic conditions and long-term care.

- Medicare:This government-funded health insurance program is available to individuals aged 65 and older. It offers different parts, including hospital insurance (Part A), medical insurance (Part B), and prescription drug coverage (Part D). Medicare Advantage plans offer additional benefits and coverage through private insurance companies.

- Medigap:These supplemental insurance plans help cover out-of-pocket costs associated with Medicare, such as deductibles, copayments, and coinsurance. They are available to individuals enrolled in Medicare Part A and Part B.

- Long-Term Care Insurance:This type of insurance helps cover the costs of long-term care services, such as assisted living, nursing home care, and home health care. It can be a valuable option for seniors who want to protect their assets and ensure they have access to the care they need.

Finding the cheapest health insurance in Pennsylvania can be a challenge, but it’s important to remember that affordable coverage doesn’t always mean sacrificing quality. A strong understanding of public health principles can help you make informed decisions about your health insurance options.

If you’re interested in deepening your knowledge of public health, consider pursuing an online master degree in public health. This can equip you with the skills and knowledge to navigate the complexities of the healthcare system and make the best choices for your individual needs.

Health Insurance for Specific Health Conditions

Individuals with pre-existing conditions or specific health needs may require specialized health insurance plans.

- Plans with Mental Health Coverage:Many health insurance plans now include comprehensive mental health coverage, including therapy, medication, and inpatient care. It is important to compare plans and ensure they offer adequate mental health benefits.

- Plans for Individuals with Pre-existing Conditions:The ACA prohibits insurance companies from denying coverage or charging higher premiums based on pre-existing conditions. Individuals with pre-existing conditions can access affordable and comprehensive health insurance through the ACA Marketplace.

- Plans for Specific Health Conditions:Some insurance companies offer plans tailored to individuals with specific health conditions, such as diabetes, heart disease, or cancer. These plans may provide specialized coverage and support services.

Comparing Health Insurance Plans

When choosing a health insurance plan, it is essential to compare different options based on coverage levels, premiums, deductibles, and other key features.

| Feature | ACA Marketplace Plans | Employer-Sponsored Plans | Individual Health Insurance Plans | Short-Term Health Insurance | Catastrophic Health Insurance | Medicare | Medigap | Long-Term Care Insurance |

|---|---|---|---|---|---|---|---|---|

| Coverage Levels | Comprehensive, including preventive care, prescription drugs, and mental health services | Varies depending on employer, often comprehensive | Varies from basic to comprehensive | Limited coverage, typically for emergencies and hospitalizations | High deductible, limited coverage for preventive care and other services | Hospital insurance (Part A), medical insurance (Part B), and prescription drug coverage (Part D) | Supplemental coverage for Medicare out-of-pocket costs | Coverage for long-term care services, such as assisted living, nursing home care, and home health care |

| Premiums | Subsidized based on income | Varies depending on employer | Varies depending on plan and coverage | Typically lower than traditional health insurance | Low premiums but high deductibles | Varies depending on plan and coverage | Varies depending on plan and coverage | Varies depending on coverage and policy terms |

| Deductibles | Varies depending on plan | Varies depending on employer | Varies depending on plan | High deductibles | Very high deductibles | Varies depending on plan and coverage | None | Varies depending on coverage and policy terms |

| Copayments and Coinsurance | Varies depending on plan | Varies depending on employer | Varies depending on plan | Varies depending on plan | Varies depending on plan | Varies depending on plan and coverage | Varies depending on plan and coverage | Varies depending on coverage and policy terms |

| Network | Varies depending on plan | Varies depending on employer | Varies depending on plan | Varies depending on plan | Varies depending on plan | Varies depending on plan and coverage | Varies depending on plan and coverage | Varies depending on coverage and policy terms |

Understanding the Implications of Choosing the Cheapest Plan

It’s tempting to go for the cheapest health insurance plan, especially when you’re on a tight budget. However, choosing the cheapest plan without careful consideration can lead to unexpected financial burdens and inadequate coverage when you need it most.

Trade-offs Associated with Choosing the Cheapest Plan

The most affordable health insurance plans often come with lower coverage levels and higher out-of-pocket costs. This means you might have to pay more for medical services, even if you have insurance.

Factors to Consider When Evaluating Health Insurance Options

Before choosing a health insurance plan, it’s crucial to consider your individual health needs and financial circumstances.

- Your Health History:If you have pre-existing conditions or a history of frequent medical visits, you’ll likely need a plan with more comprehensive coverage.

- Your Expected Healthcare Needs:If you expect to require regular medical care or have a family with young children, a plan with lower out-of-pocket costs might be more beneficial.

- Your Budget:Consider your monthly budget and how much you can comfortably afford to pay for health insurance premiums and out-of-pocket expenses.

- Your Preferred Network:Ensure that your preferred doctors and hospitals are included in the plan’s network.

- Your Coverage Levels:Compare the coverage levels of different plans to understand the benefits and limitations of each option.

- Your Out-of-Pocket Costs:Analyze the deductible, co-pays, and coinsurance amounts for each plan to estimate your potential out-of-pocket expenses.

Additional Considerations for Affordable Health Insurance

Finding the cheapest health insurance plan is only the first step in securing affordable coverage. It’s equally crucial to understand the nuances of applying, managing costs, and navigating the complexities of health insurance policies. This section will delve into additional considerations that can significantly impact your overall experience with health insurance in Pennsylvania.

Finding the cheapest health insurance in Pennsylvania can be a challenge, especially if you’re looking for a plan that meets your specific needs. But while you’re searching for affordable coverage, take a break and check out the Miss France beauty pageant for some inspiring glamour.

Once you’ve had a dose of glitz and grace, you can get back to the task of securing your health insurance, knowing you’re making a smart decision for your well-being.

Applying for Health Insurance through PHIX

The Pennsylvania Health Insurance Exchange (PHIX) serves as a central platform for individuals and families to shop for and enroll in health insurance plans. Applying for health insurance through PHIX is a straightforward process, typically involving the following steps:

- Create an Account:Visit the PHIX website and create an account. This will allow you to save your progress and return to the application later.

- Provide Personal Information:Fill out the application with your personal information, including your name, address, date of birth, Social Security number, and income details.

- Determine Eligibility:The PHIX system will assess your eligibility for financial assistance based on your income and family size. You may be eligible for subsidies or tax credits that can significantly reduce your monthly premiums.

- Select a Plan:Based on your needs and budget, browse through the available health insurance plans and select the one that best suits you. You can compare plans based on factors such as premium costs, deductibles, co-pays, and coverage benefits.

- Enroll in Coverage:Once you’ve chosen a plan, complete the enrollment process. You’ll typically have a specific open enrollment period each year to make changes to your coverage.

Managing Health Insurance Costs, Cheapest health insurance pa

While finding the cheapest plan is essential, there are additional strategies to help you manage your health insurance costs and maximize savings.

- Utilize Preventive Care Services:Many health insurance plans cover preventive care services, such as annual checkups, screenings, and vaccinations, at no additional cost. These services can help detect health issues early and prevent more costly treatments later.

- Negotiate Medical Bills:If you receive a medical bill that seems high, don’t hesitate to negotiate with the provider or billing department. Many hospitals and healthcare providers are willing to work with patients to reduce outstanding balances.

- Consider a Health Savings Account (HSA):HSAs are tax-advantaged savings accounts specifically designed for healthcare expenses. If you have a high-deductible health plan, an HSA can be a valuable tool for saving money on healthcare costs.

Common Health Insurance Terms

Understanding the terminology used in health insurance policies is crucial for making informed decisions about your coverage. Here are some common terms and their definitions:

| Term | Definition |

|---|---|

| Premium | The monthly payment you make for your health insurance coverage. |

| Deductible | The amount you must pay out-of-pocket before your insurance coverage kicks in. |

| Co-pay | A fixed amount you pay for a specific healthcare service, such as a doctor’s visit or prescription. |

| Co-insurance | The percentage of the cost of a healthcare service that you are responsible for paying after your deductible has been met. |

| Out-of-pocket maximum | The maximum amount you will have to pay for healthcare expenses in a given year. Once you reach this limit, your insurance will cover 100% of your costs. |

Closing Summary: Cheapest Health Insurance Pa

Finding the cheapest health insurance in Pennsylvania requires careful consideration of your individual needs and financial situation. While the cheapest plan might seem appealing, it’s important to assess coverage levels and potential out-of-pocket costs. By understanding the nuances of health insurance and utilizing the resources available, you can find a plan that provides the coverage you need at a price that fits your budget.

FAQ Insights

What are the different types of health insurance plans available in Pennsylvania?

Pennsylvania offers a variety of health insurance plans, including HMOs, PPOs, EPOs, and POS. Each plan has its own structure for coverage and costs.

How do I find affordable health insurance plans in Pennsylvania?

You can use the Pennsylvania Health Insurance Marketplace (PHIX) to compare plans and find subsidies or tax credits to reduce costs. You can also consult with an insurance broker or agent for personalized assistance.

What are some tips for managing health insurance costs?

Utilize preventive care services, negotiate medical bills, and consider a health savings account (HSA) to save money on healthcare expenses.