What is an exclusive provider organization health plan? An EPO health plan is a type of managed care plan that offers coverage for healthcare services provided by a specific network of doctors and hospitals. Unlike other health plans like HMOs and PPOs, EPOs typically do not cover out-of-network care, except in emergency situations.

This means that you are generally limited to seeing providers within the EPO network. EPOs often have lower premiums and deductibles compared to other plans, making them a potentially attractive option for cost-conscious individuals and families.

EPOs have become increasingly popular in recent years due to their affordability and emphasis on managed care. However, it is important to carefully consider the limitations of an EPO plan before making a decision. Understanding the network, the potential for out-of-network costs, and the specific coverage details are crucial for ensuring that an EPO plan meets your individual healthcare needs.

What is an Exclusive Provider Organization (EPO) Health Plan?

An EPO health plan is a type of health insurance that limits your coverage to a specific network of doctors, hospitals, and other healthcare providers. This means you’ll only be able to receive care from providers within the EPO network.

If you go outside of the network, you’ll be responsible for the full cost of your care.

EPOs Compared to Other Health Plans

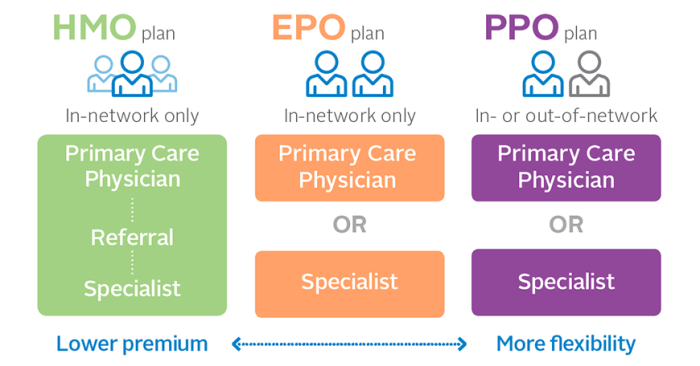

EPOs share some similarities with HMOs and PPOs, but they also have distinct features.

- EPOs are similar to HMOs in that they require you to choose a primary care physician (PCP) who will act as your main point of contact for healthcare. You’ll typically need a referral from your PCP to see specialists.

However, EPOs are different from HMOs in that they don’t require you to get a referral for out-of-network care.

- EPOs are similar to PPOs in that they offer out-of-network coverage, but unlike PPOs, EPOs do not cover any costs for out-of-network care. This means you’ll be responsible for the full cost of any care you receive from a provider outside of the EPO network.

Examples of EPOs in the Healthcare Market

EPOs are becoming increasingly popular, and many large insurance companies offer EPO plans. Some well-known examples include:

- Anthem Blue Cross and Blue Shield

- UnitedHealthcare

- Cigna

- Aetna

Benefits of EPO Health Plans

EPO health plans offer a range of benefits for individuals and families, often appealing to those seeking a balance between cost-effectiveness and comprehensive coverage. These plans provide a streamlined healthcare experience with a strong emphasis on network utilization.

Cost Savings with EPOs

EPOs often present lower monthly premiums compared to other health plans, like PPOs or HMOs. This cost-effectiveness stems from the plan’s restricted network, encouraging members to seek care within the designated provider group. By limiting access to out-of-network providers, EPOs generally negotiate lower rates with their network healthcare providers, which translates to reduced costs for plan members.

Accessibility and Convenience

EPOs offer a convenient and accessible healthcare experience by concentrating care within a defined network of providers. This structure simplifies the process of finding qualified healthcare professionals, as members can rely on the plan’s network directory for a comprehensive list of participating doctors, hospitals, and specialists.

The streamlined approach often results in reduced administrative complexities and faster access to care, particularly for routine checkups and preventive services.

An Exclusive Provider Organization (EPO) health plan restricts you to a specific network of doctors and hospitals. This means you’ll have lower costs for in-network care but face higher out-of-pocket expenses if you choose to go outside the network. For instance, if you’re looking for a way to stay active and healthy, you might consider getting a day pass at Lifetime Fitness – but make sure it’s within your EPO’s network to avoid unexpected bills.

Ultimately, an EPO can be a good option if you value cost-effectiveness and are comfortable with the network’s limitations.

Limitations of EPO Health Plans

While EPOs offer advantages in terms of lower premiums and potentially lower out-of-pocket costs, it’s crucial to understand their limitations before making a decision. EPOs are not the best fit for everyone, and their limitations can significantly impact your healthcare experience.

An Exclusive Provider Organization (EPO) health plan restricts you to using doctors and hospitals within their network. This can be a good option if you want predictable costs and access to a wide range of healthcare professionals. But, if you’re like many people, you might prefer the convenience of “couch beauty” couch beauty , where you can receive beauty treatments at home.

EPOs can offer lower premiums, but you’ll need to carefully consider if the trade-off of limited provider choice is worth it for you.

Restrictions on Out-of-Network Care, What is an exclusive provider organization health plan

EPOs are known for their strict network limitations. They typically do not cover any out-of-network care, even in emergencies. This means that if you need to see a doctor or receive medical treatment outside the EPO’s network, you will be responsible for the entire cost.

How to Choose an EPO Health Plan

Choosing the right EPO health plan can be a challenging task, but it’s essential to ensure you get the coverage you need at a price you can afford. Here’s a step-by-step guide to help you make an informed decision.

Factors to Consider When Evaluating EPO Options

It’s important to compare and contrast different EPO plans based on key factors to find the best fit for your individual needs and circumstances.

| Factor | Description |

|---|---|

| Network Size and Provider Availability | Check the plan’s provider network to ensure that your preferred doctors and hospitals are included. Consider the plan’s network size, geographic coverage, and specialty availability. |

| Cost-Sharing | Compare the plan’s deductibles, copayments, coinsurance, and out-of-pocket maximums. Consider your expected healthcare needs and how these cost-sharing elements will impact your overall expenses. |

| Prescription Drug Coverage | Review the plan’s formulary, which lists the medications covered and their associated costs. Ensure your required medications are included and that the cost is manageable for you. |

| Preventive Care Coverage | Check if the plan covers preventive services like screenings and vaccinations without any cost-sharing. This can help you stay healthy and prevent future health issues. |

| Customer Service and Claims Processing | Research the plan’s customer service reputation and ease of claims processing. Look for plans with excellent customer service and efficient claims handling processes. |

Questions to Ask Potential EPO Providers

When you’re evaluating different EPO plans, it’s essential to ask the provider specific questions to gather the information you need to make a well-informed decision.

- What is the plan’s network size and geographic coverage?

- Are my preferred doctors and hospitals included in the network?

- What are the plan’s deductibles, copayments, coinsurance, and out-of-pocket maximums?

- What is the plan’s formulary and how are medications covered?

- Does the plan cover preventive care services without cost-sharing?

- What are the plan’s customer service options and how are claims processed?

- What are the plan’s appeal processes and how are grievances handled?

EPOs and Healthcare Trends

Exclusive Provider Organizations (EPOs) are playing an increasingly important role in the evolving healthcare landscape, particularly as healthcare costs continue to rise. This section will explore the impact of rising healthcare costs on EPO plan popularity and provide insights into the future of EPOs and their potential for innovation.

The Impact of Rising Healthcare Costs

Rising healthcare costs are a major concern for both individuals and employers. EPOs have become more popular in recent years due to their potential for cost savings. They typically have lower premiums than other types of health plans, such as Preferred Provider Organizations (PPOs), because they limit coverage to a specific network of providers.

This can help employers control healthcare costs and make health insurance more affordable for employees.

An Exclusive Provider Organization (EPO) health plan offers coverage within a specific network of doctors and hospitals. You might find yourself considering an EPO if you frequently use the gym, for example, like the LA Fitness Secaucus , and want to ensure your health plan covers the services you need in your area.

EPOs generally offer lower premiums than other plans, but the trade-off is limited out-of-network coverage.

“The average annual premium for employer-sponsored health insurance has increased by over 100% in the past 20 years.”

Kaiser Family Foundation

- Lower Premiums:EPOs typically have lower premiums than other types of health plans, which can be attractive to employers and employees.

- Network Restrictions:By limiting coverage to a specific network of providers, EPOs can negotiate lower rates with providers, leading to lower premiums for members.

- Cost-Sharing:EPOs often have lower deductibles and copayments than PPOs, which can make healthcare more affordable for members.

The Future of EPOs

EPOs are expected to continue to be a popular choice for health insurance in the future, as healthcare costs continue to rise. However, there are several challenges that EPOs will need to address in order to remain competitive. One challenge is the need to provide access to a wide range of providers, particularly in rural areas.

Another challenge is the need to adapt to the changing healthcare landscape, such as the increasing use of telehealth and other digital health technologies.

“The number of EPO plans offered by employers is expected to continue to grow in the coming years.”

The National Committee for Quality Assurance (NCQA)

- Expansion of Networks:EPOs will need to expand their networks to include a wider range of providers, particularly in rural areas.

- Integration of Digital Health Technologies:EPOs will need to integrate digital health technologies, such as telehealth and mobile health apps, to provide more convenient and affordable care.

- Focus on Value-Based Care:EPOs will need to shift their focus to value-based care, which emphasizes quality of care over quantity of services.

Last Point: What Is An Exclusive Provider Organization Health Plan

In conclusion, EPO health plans can be a valuable option for individuals seeking affordable healthcare coverage within a managed care network. However, it’s essential to carefully evaluate the limitations of EPOs, particularly regarding out-of-network care, before making a decision.

By understanding the pros and cons of EPOs and comparing them to other health plan options, you can make an informed choice that aligns with your healthcare needs and budget.

Detailed FAQs

What are the advantages of an EPO health plan?

EPOs often have lower premiums and deductibles compared to other plans, making them more affordable. They also offer a managed care approach that can help control healthcare costs.

Can I use an EPO plan for out-of-network care?

EPOs typically do not cover out-of-network care, except in emergency situations. You will generally need to stay within the EPO network to receive coverage.

How do I find an EPO provider in my area?

You can use online tools or contact health insurance companies to find EPO providers in your area. It’s essential to ensure that your preferred doctors and hospitals are part of the network.