Aetna health insurance phone number is your direct line to a comprehensive suite of healthcare services. Aetna, a leading health insurance provider, offers a wide range of plans and services to individuals, families, and businesses. From finding the right plan to managing your health, Aetna’s customer support team is ready to assist you.

Navigating the world of health insurance can be daunting, but understanding how to contact Aetna for specific needs is crucial. This guide provides an overview of Aetna’s phone numbers, customer service channels, and other resources available to help you manage your health insurance plan effectively.

Aetna Health Insurance Overview

Aetna is a leading health insurance provider in the United States, offering a wide range of plans and services to individuals, families, and businesses. With a rich history and a commitment to customer satisfaction, Aetna has established itself as a trusted name in the healthcare industry.Aetna’s mission is to help people live healthier lives.

This commitment is reflected in their comprehensive range of health insurance products and services, designed to meet the diverse needs of their customers.

If you’re looking for Aetna health insurance phone number, you might also want to consider your overall wellness. Aetna often has programs that encourage healthy living, and that might include finding a fitness center near me with childcare.

Finding a gym with childcare can make it easier to stick to your fitness goals, which could lead to lower healthcare costs in the long run, and that’s something Aetna would likely appreciate!

Aetna’s History and Mission

Aetna was founded in 1853 as the Aetna Life Insurance Company in Hartford, Connecticut. The company initially focused on life insurance, but it soon expanded into other areas of insurance, including health insurance. Aetna has a long history of innovation and leadership in the health insurance industry.

Aetna’s mission is to help people live healthier lives. This commitment is reflected in their comprehensive range of health insurance products and services, designed to meet the diverse needs of their customers. Aetna strives to provide access to quality healthcare, promote preventive care, and support individuals in managing their health.

Aetna’s Services and Coverage Options

Aetna offers a wide range of health insurance plans, including:

- Individual and family health insurance

- Employer-sponsored health insurance

- Medicare plans

- Medicaid plans

- Dental and vision insurance

- Life insurance

- Disability insurance

Aetna’s health insurance plans provide coverage for a wide range of medical expenses, including:

- Doctor visits

- Hospital stays

- Prescription drugs

- Mental health services

- Preventive care

Aetna also offers a variety of value-added services, such as:

- Health and wellness programs

- Disease management programs

- Care coordination services

- Customer support

Aetna’s Target Market and Customer Base

Aetna targets a wide range of customers, including individuals, families, and businesses of all sizes. Aetna’s customer base is diverse, reflecting the diverse needs of the American population. Aetna’s health insurance plans are available in all 50 states, and the company serves millions of customers nationwide.Aetna’s target market includes individuals and families looking for affordable and comprehensive health insurance coverage.

The company also targets businesses seeking to provide their employees with competitive health insurance benefits. Aetna’s Medicare and Medicaid plans are designed to meet the specific needs of seniors and low-income individuals, respectively.

Finding Aetna’s Phone Number

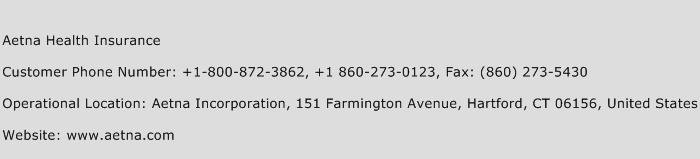

Aetna offers a variety of phone numbers for different purposes. Knowing the right number to call can save you time and ensure you reach the appropriate department.

Locating the Correct Phone Number

Aetna provides different phone numbers for various needs, including customer service, claims, and provider directory. You can find the specific phone number you need by:

- Visiting the Aetna website:The Aetna website has a dedicated section with a list of phone numbers for various departments. You can search by topic or browse through the list to find the number you need.

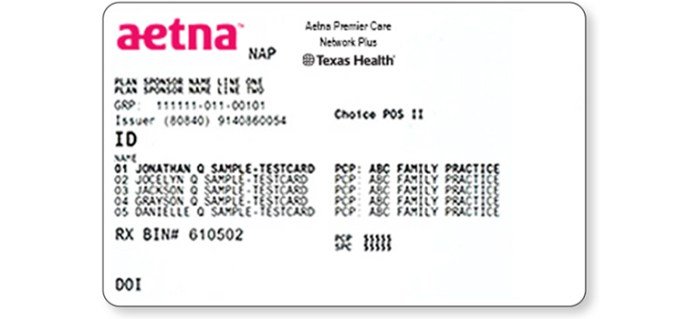

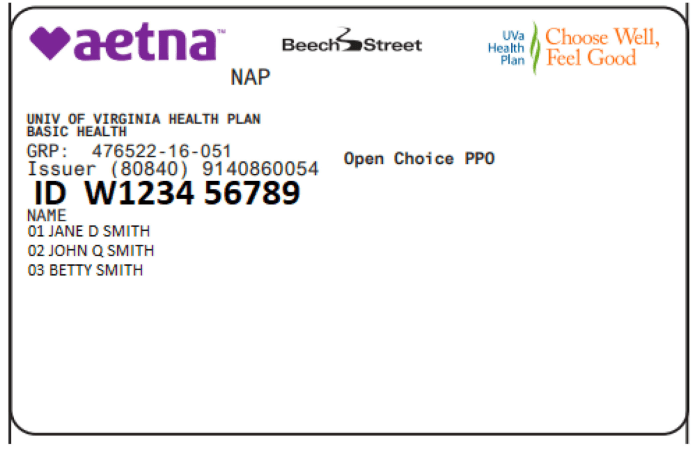

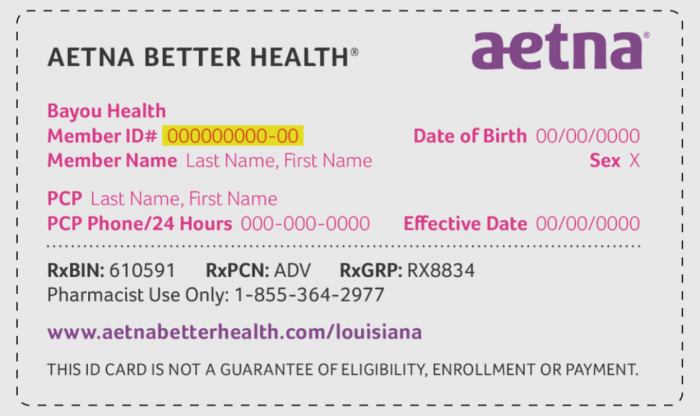

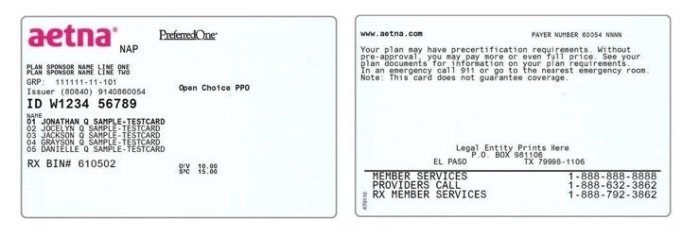

- Checking your Aetna member ID card:Your member ID card may contain a phone number for customer service or other important contacts.

- Using the Aetna mobile app:The Aetna mobile app offers access to a variety of resources, including phone numbers for different departments.

- Contacting your Aetna representative:If you have an Aetna representative, you can contact them directly for assistance finding the right phone number.

Aetna Phone Numbers

| Purpose | Phone Number | Hours of Operation | Additional Notes |

|---|---|---|---|

| Customer Service | 1-800-238-6222 | Monday

Friday, 8 00 AM 8 00 PM ET |

For general inquiries, plan information, and other support. |

| Claims | 1-800-238-6222 | Monday

Friday, 8 00 AM 8 00 PM ET |

To report claims, check claim status, or inquire about claim processing. |

| Provider Directory | 1-800-238-6222 | Monday

Friday, 8 00 AM 8 00 PM ET |

To find in-network providers, specialists, or facilities. |

| Behavioral Health | 1-800-238-6222 | Monday

Friday, 8 00 AM 8 00 PM ET |

For mental health and substance abuse services. |

Customer Service and Support

Aetna offers a variety of customer service channels to assist members with their health insurance needs. These channels provide access to information, assistance with claims, and support with various other inquiries.

Customer Service Channels

Aetna provides multiple ways for members to connect with their customer service team:

- Phone:Aetna’s customer service phone number is available 24/7 for urgent matters and during regular business hours for other inquiries. Members can expect to wait an average of 5-10 minutes during peak hours, but wait times can vary depending on the day and time of call.

- Email:Members can also contact Aetna via email for non-urgent inquiries. Response times typically range from 1-3 business days, depending on the complexity of the request.

- Online Chat:Aetna offers a live chat option on their website for quick and convenient assistance with simple questions. Chat representatives are available during business hours and can usually respond within a few minutes.

Common Customer Service Issues and Resolutions

Aetna’s customer service team handles a wide range of inquiries, including:

- Claims:Members may contact customer service to inquire about the status of a claim, appeal a denied claim, or report a lost or stolen insurance card. Aetna’s customer service representatives can assist with claim-related issues, providing guidance and information on the claim process.

- Benefits:Members can contact customer service to clarify their coverage benefits, understand their out-of-pocket costs, or find out if a specific service is covered under their plan. Customer service representatives can explain the details of the member’s plan and answer questions about their coverage.

- Plan Changes:Members may need to make changes to their plan, such as adding or removing dependents, changing their address, or updating their payment information. Customer service representatives can help members make these changes and ensure their information is up-to-date.

- Provider Network:Members may need assistance finding a provider in their network, verifying provider credentials, or understanding their coverage for out-of-network care. Aetna’s customer service team can provide information on the provider network and help members locate in-network providers.

Claims Processing and Payment

Filing a claim with Aetna is a straightforward process designed to make it easy for you to receive the benefits you’re entitled to. Understanding the process and the factors that determine your payment amount can help you navigate the system smoothly.

Finding the Aetna health insurance phone number can be a bit of a hassle, but it’s important to have it on hand for any questions or concerns. If you’re looking for information on heart health, consider checking out cardi health for helpful resources and tips.

Once you have your Aetna phone number, you can easily connect with a representative to discuss your coverage or any other inquiries you might have.

Submitting a Claim

Submitting a claim with Aetna can be done through a variety of methods, including online, by mail, or through a mobile app. The specific steps may vary depending on the type of claim and your plan. Here are the general steps involved:

- Gather necessary information: This includes your member ID, the date of service, the provider’s name and contact information, and any supporting documentation, such as medical bills or receipts.

- Complete the claim form: You can find the appropriate form on the Aetna website or through your member portal. Make sure to fill out all required fields accurately and legibly.

- Submit the claim: You can submit your claim online, by mail, or through the Aetna mobile app. If submitting by mail, be sure to send it to the address listed on your claim form.

Claims Processing and Payment Determination

Once you submit a claim, Aetna will review it to determine if it’s covered under your plan and to calculate the payment amount. The following factors are considered:

- Your plan benefits: Aetna will review your plan’s coverage details to determine if the service you received is covered and what percentage of the cost will be paid. This may include copayments, coinsurance, and deductibles.

- Medical necessity: Aetna will assess whether the service you received was medically necessary. This may involve reviewing your medical records and consulting with medical professionals.

- Provider billing: Aetna will verify that the provider has billed for the service appropriately and that the charges are consistent with their usual and customary rates.

Tips for a Smooth Claims Experience

Following these tips can help ensure a smooth and timely claims experience:

- Submit your claim promptly: Submitting your claim within the required timeframe (usually 30 days) will help prevent delays.

- Review your Explanation of Benefits (EOB): Carefully review the EOB you receive after your claim is processed. It details the services covered, the amount paid, and any remaining balance. If you have any questions, contact Aetna’s customer service.

- Keep track of your claim: Use the Aetna website or mobile app to track the status of your claim. This will help you stay informed and identify any potential issues.

- Keep records: Keep copies of all claim forms, medical bills, and other related documents. This will help you if you need to appeal a claim decision or address any discrepancies.

Member Resources and Information: Aetna Health Insurance Phone Number

Aetna provides a comprehensive suite of online resources for members to access their health insurance plans, benefits, and essential information. These resources are designed to empower members to manage their health and insurance effectively.

If you’re looking for the Aetna health insurance phone number, you might also be interested in exploring career opportunities within the healthcare industry. Ascension Health, a leading Catholic healthcare system, offers a wide range of positions across the country. You can learn more about careers at Ascension Health and potentially find a fulfilling career path that aligns with your skills and interests.

Once you’ve explored those options, you can then easily locate the Aetna health insurance phone number online or through their website.

Online Account Access

Aetna offers a secure online portal where members can manage their accounts, view their health insurance plans, and access important information. This portal provides a centralized location for members to access their health insurance details and manage their healthcare needs.

- Account Management: Members can update their personal information, contact details, and beneficiaries. They can also manage their dependents and adjust their coverage options.

- Plan Information: Members can view their plan details, including coverage benefits, deductibles, copayments, and out-of-pocket maximums. They can also access their policy documents and plan summaries.

- Claims Status: Members can track the status of their claims, view claim details, and download claim summaries.

- Benefit Utilization: Members can monitor their benefit usage, including the amount of their deductible met and remaining coverage benefits.

- Communication Tools: Members can send secure messages to Aetna customer service representatives, schedule appointments, and receive notifications regarding their health insurance.

Health and Wellness Tools, Aetna health insurance phone number

Aetna offers a variety of health and wellness tools to help members manage their health and well-being. These tools provide resources and information to support members in making healthy choices and maintaining their health.

- Health Assessment: Members can take online health assessments to evaluate their health risks and identify areas for improvement. These assessments provide personalized recommendations and resources based on their individual needs.

- Health Education: Aetna offers educational resources on various health topics, including chronic disease management, nutrition, exercise, and mental health. These resources provide evidence-based information to support members in making informed health decisions.

- Disease Management Programs: Aetna provides disease management programs for members with chronic conditions, such as diabetes, asthma, and heart disease. These programs offer personalized support, education, and resources to help members manage their conditions effectively.

- Fitness and Nutrition Tools: Members can access fitness and nutrition tracking tools to monitor their activity levels, food intake, and overall health. These tools provide personalized insights and guidance to help members achieve their health goals.

Finding and Managing Healthcare Providers

Aetna provides tools and resources to help members find healthcare providers within their network and manage their healthcare appointments.

- Provider Directory: Members can use Aetna’s online provider directory to search for doctors, hospitals, and other healthcare providers within their network. The directory provides information about provider specialties, locations, and availability.

- Appointment Scheduling: Members can schedule appointments with providers directly through the online portal or by contacting Aetna customer service. They can also manage their appointments, reschedule, or cancel them.

- Second Opinion: Members can request a second opinion from a different provider if they have concerns about a diagnosis or treatment plan. Aetna provides resources and support to facilitate this process.

Member Statements and Policy Documents

Aetna provides members with access to their member statements, policy documents, and other important information online. This ensures members have the necessary information to understand their coverage and manage their health insurance.

- Member Statements: Members can view and download their member statements, which include details of their coverage benefits, claims paid, and outstanding balances.

- Policy Documents: Members can access their policy documents, including the summary of benefits and coverage, plan details, and terms and conditions.

- Other Important Information: Members can access other important information, such as formularies, provider directories, and claim forms, through the online portal.

Comparison with Other Health Insurance Providers

Choosing the right health insurance plan can be a complex process, especially considering the wide range of options available. Aetna is a well-established provider with a strong reputation, but it’s essential to compare its offerings to other major health insurance companies to make an informed decision.

Aetna vs. Other Providers

Aetna’s offerings and features can be compared to other major health insurance providers like Anthem, Cigna, Humana, and UnitedHealthcare. Each provider has its own strengths and weaknesses, and the best choice for you will depend on your individual needs and preferences.

Key Features and Benefits

The following table highlights key features and benefits of different health insurance providers, allowing you to compare their offerings:

| Provider | Key Features | Pros | Cons |

|---|---|---|---|

| Aetna | Wide network, various plan options, strong customer service | Extensive network, diverse plan options, reliable customer support | Potentially higher premiums, limited coverage in some areas |

| Anthem | Wide network, strong focus on preventive care, digital health tools | Large network, emphasis on preventive care, user-friendly digital platforms | Limited plan options in some regions, potential customer service issues |

| Cigna | Global network, strong focus on mental health, personalized health solutions | International coverage, comprehensive mental health benefits, personalized care programs | Higher premiums compared to some competitors, limited plan options in certain areas |

| Humana | Strong focus on Medicare and retirement plans, extensive wellness programs | Specialization in Medicare and retirement plans, robust wellness initiatives | Limited network in some regions, potential customer service delays |

| UnitedHealthcare | Largest health insurance provider, diverse plan options, strong customer service | Extensive network, wide range of plan choices, reliable customer support | Potentially higher premiums, limited coverage in certain areas |

It’s crucial to consider factors like network size, plan options, premiums, and customer service when comparing different providers.

Tips for Choosing the Right Aetna Plan

Choosing the right Aetna health insurance plan is a crucial decision that can significantly impact your financial well-being and access to healthcare. By carefully considering various factors and comparing plans, you can find a plan that meets your individual needs and budget.

Factors to Consider When Choosing an Aetna Plan

When selecting an Aetna health insurance plan, several factors should be considered to ensure the plan aligns with your individual needs and financial situation.

- Your Medical Needs:Evaluate your current and anticipated healthcare needs, including any pre-existing conditions or potential future requirements. Consider factors like the frequency of doctor visits, prescription drug usage, and potential need for specialized care.

- Budget:Determine your monthly budget for health insurance premiums. Consider your income, other expenses, and financial goals.

- Coverage Options:Explore the different types of coverage offered by Aetna, such as HMO, PPO, and POS plans. Understand the differences in provider networks, co-pays, and deductibles for each plan type.

- Provider Network:Ensure that your preferred doctors and hospitals are included in the plan’s network. This is particularly important if you have a specific healthcare provider you rely on.

- Prescription Drug Coverage:If you take prescription medications, review the plan’s formulary and determine if your medications are covered. Consider the co-pay amounts and any limitations on coverage.

- Out-of-Pocket Costs:Understand the plan’s deductibles, co-pays, and coinsurance amounts. These out-of-pocket costs can significantly impact your overall healthcare expenses.

Comparing Aetna Plans

To effectively compare Aetna plans and find the best fit for your needs, follow these tips:

- Use Aetna’s Online Tools:Aetna offers online tools and resources that allow you to compare plans side-by-side, based on your individual needs and preferences.

- Contact Aetna Directly:Reach out to Aetna’s customer service representatives for personalized guidance and assistance in understanding plan options and benefits.

- Review Plan Documents:Carefully review the plan’s Summary of Benefits and Coverage (SBC) to understand the details of coverage, costs, and limitations.

- Consider Your Long-Term Healthcare Needs:When making your decision, consider your future healthcare needs, such as potential changes in your health status or family planning.

Decision-Making Process for Choosing an Aetna Plan

The following flowchart illustrates a systematic approach to choosing an Aetna plan:

- Assess Your Needs:Identify your current and anticipated healthcare needs, including pre-existing conditions, frequency of doctor visits, and prescription drug usage.

- Determine Your Budget:Set a monthly budget for health insurance premiums, considering your income, other expenses, and financial goals.

- Explore Plan Options:Research different Aetna plan types (HMO, PPO, POS) and understand their features, provider networks, and costs.

- Compare Plans:Use Aetna’s online tools, contact customer service, and review plan documents to compare plans side-by-side.

- Make a Decision:Choose the plan that best meets your needs, budget, and healthcare preferences.

Last Word

Having access to Aetna’s phone numbers and understanding the various customer service channels available empowers you to take control of your healthcare journey. Whether you need to file a claim, ask a question about your coverage, or simply need guidance, Aetna’s dedicated team is there to assist you.

Remember, understanding your health insurance plan and knowing how to reach out for support are key to maximizing your benefits and ensuring peace of mind.

Helpful Answers

How do I find the correct Aetna phone number for my specific needs?

Aetna provides dedicated phone numbers for different purposes. You can find the specific number for customer service, claims, provider directory, and other inquiries on their website or by contacting their general customer service line.

What are the typical wait times for Aetna customer service?

Wait times for Aetna customer service can vary depending on the time of day and the volume of calls. However, they strive to provide timely service and resolution to customer inquiries.

How can I file a claim with Aetna?

Aetna offers various methods for filing claims, including online, by phone, or by mail. You can find detailed instructions on their website or by contacting their claims department.

What are the benefits of using in-network providers?

Using in-network providers generally results in lower out-of-pocket costs for healthcare services. Aetna’s provider network includes a wide range of doctors, hospitals, and other healthcare professionals.

How can I access my Aetna member statements and policy documents online?

Aetna members can access their account information, statements, and policy documents online through their member portal. You can find the link to the portal on their website.