American health care reit – American healthcare REITs offer a unique investment opportunity in a sector that is both essential and constantly evolving. These real estate investment trusts specialize in owning and operating healthcare properties, such as hospitals, nursing homes, and medical offices, providing investors with exposure to a growing and resilient industry.

The healthcare sector is driven by several factors, including an aging population, rising healthcare costs, and increasing demand for specialized medical services. Healthcare REITs benefit from these trends, as they provide essential infrastructure for healthcare providers and benefit from long-term leases and stable rental income.

This makes them an attractive option for investors seeking both income and growth potential.

Introduction to American Healthcare REITs

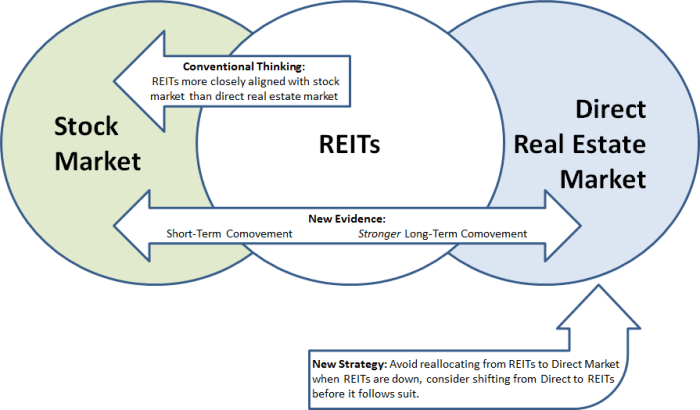

Real Estate Investment Trusts (REITs) are companies that own and operate income-producing real estate. They are a popular investment vehicle for individual investors and institutions, as they offer a way to invest in real estate without having to purchase and manage properties directly.

In the healthcare sector, REITs focus on owning and leasing properties that are essential to providing healthcare services.Healthcare REITs have experienced significant growth in recent years, driven by several factors, including the aging population, rising healthcare costs, and increasing demand for specialized healthcare facilities.

The American healthcare REIT market is currently valued at over \$100 billion, with several large and well-established players operating in the sector.

Types of Healthcare Properties

Healthcare REITs invest in a variety of properties that are essential to providing healthcare services. These properties can be categorized into several key types:

- Hospitals: Hospitals are the largest and most complex healthcare facilities, providing a wide range of medical services. Healthcare REITs invest in both acute care hospitals and specialized hospitals, such as children’s hospitals, cancer centers, and rehabilitation hospitals.

- Nursing Homes: Nursing homes provide long-term care for elderly and disabled individuals. The demand for nursing home services is expected to grow significantly in the coming years as the population ages.

- Medical Offices: Medical offices are used by physicians, dentists, and other healthcare professionals to provide outpatient services. The demand for medical office space is driven by the increasing number of medical practices and the growing use of outpatient care.

- Assisted Living Facilities: Assisted living facilities provide housing and support services for individuals who need help with daily living activities. The demand for assisted living services is growing rapidly, as more people are living longer and need assistance with daily tasks.

- Senior Housing Communities: Senior housing communities provide a range of housing options for older adults, including independent living, assisted living, and skilled nursing care. These communities offer a variety of amenities and services designed to meet the needs of seniors.

Investment Opportunities and Challenges: American Health Care Reit

Investing in American healthcare REITs presents both potential benefits and risks, making it essential to understand the factors that influence their performance. This section explores the opportunities and challenges associated with this asset class, providing insights into the potential returns and risks involved.

Potential Benefits of Investing in Healthcare REITs

Healthcare REITs offer attractive investment opportunities due to their unique characteristics. Their focus on essential healthcare facilities provides a stable and consistent income stream, making them less susceptible to economic downturns.

The American healthcare REIT sector is experiencing a period of growth, with investors seeking stable returns from properties like hospitals and medical offices. While this sector focuses on healthcare facilities, it’s interesting to note the connection to fitness centers like chelsea piers fitness schermerhorn street brooklyn ny , as they cater to the growing demand for preventative health and wellness.

This trend underscores the evolving landscape of healthcare, with a focus on proactive health management and lifestyle choices.

- High Dividend Yields:Healthcare REITs often pay out a significant portion of their earnings as dividends, providing investors with a steady stream of income. The dividend yields for healthcare REITs are generally higher than those of other REIT sectors, making them attractive for income-seeking investors.

- Long-Term Growth Prospects:The aging population and rising healthcare costs create a growing demand for healthcare facilities. This demand is expected to drive long-term growth in the healthcare REIT sector, making it a promising investment opportunity for long-term investors.

- Defensive Characteristics:Healthcare is considered a non-cyclical industry, meaning that demand for healthcare services remains relatively stable even during economic downturns. This stability makes healthcare REITs a defensive investment option, providing investors with a degree of protection against market volatility.

Risks Associated with Investing in Healthcare REITs

While healthcare REITs offer potential benefits, they also carry certain risks that investors should be aware of. These risks can affect the value of their investments and the income they receive.

- Regulatory Changes:Healthcare is a heavily regulated industry, and changes in regulations can significantly impact the operations of healthcare facilities. New regulations, such as changes in Medicare or Medicaid reimbursement rates, could negatively affect the profitability of healthcare REITs.

- Occupancy Rates:The profitability of healthcare REITs is directly linked to the occupancy rates of their facilities. If occupancy rates decline due to factors such as competition or changes in healthcare demand, it could lead to lower rental income and reduced profitability for the REIT.

- Competition:The healthcare industry is becoming increasingly competitive, with new players entering the market and existing players expanding their services. This competition can put pressure on healthcare REITs to keep their rental rates competitive, which could affect their profitability.

Performance Comparison, American health care reit

Healthcare REITs have historically outperformed other REIT sectors and the broader stock market in terms of total returns. This strong performance can be attributed to the stable and growing demand for healthcare facilities.

“Over the past decade, the healthcare REIT sector has generated an average annual return of approximately 10%, outperforming both the broader REIT sector and the S&P 500 index.”

However, it is important to note that past performance is not necessarily indicative of future results. The performance of healthcare REITs can be influenced by a variety of factors, including economic conditions, interest rates, and regulatory changes.

Key Players and Market Trends

The healthcare REIT market is a dynamic landscape populated by several key players who shape the industry’s trajectory. These companies play a crucial role in providing real estate solutions for healthcare providers, driving innovation, and shaping the future of the industry.

Major Healthcare REIT Companies

- Welltower Inc. (WELL):Welltower is the largest healthcare REIT in the world, with a portfolio primarily focused on senior housing, post-acute care, and outpatient medical facilities. The company has a strong presence across the United States and internationally, with a diverse portfolio of properties.

Welltower’s investment strategy emphasizes long-term partnerships with leading healthcare operators and a focus on high-quality, strategically located assets.

- Ventas, Inc. (VTR):Ventas is another leading healthcare REIT, with a diversified portfolio that includes senior housing, medical office buildings, skilled nursing facilities, and hospitals. The company is known for its strong relationships with healthcare providers and its focus on developing innovative real estate solutions.

Ventas’s investment strategy emphasizes long-term value creation and a commitment to sustainable growth.

- Healthpeak Properties, Inc. (PEAK):Healthpeak Properties is a leading healthcare REIT specializing in medical office buildings, senior housing, and life science properties. The company has a strong focus on developing and acquiring high-quality properties in strategic locations. Healthpeak’s investment strategy emphasizes a disciplined approach to asset management and a commitment to innovation.

- Medical Properties Trust (MPW):Medical Properties Trust is a healthcare REIT primarily focused on acute care hospitals and related healthcare facilities. The company has a significant portfolio of properties in the United States and internationally, with a strong emphasis on growth and diversification.

Medical Properties Trust’s investment strategy emphasizes long-term value creation and a commitment to responsible investing.

- HCP, Inc. (HCP):HCP is a healthcare REIT with a diversified portfolio that includes senior housing, skilled nursing facilities, and medical office buildings. The company has a strong focus on providing real estate solutions for a wide range of healthcare providers. HCP’s investment strategy emphasizes a disciplined approach to asset management and a commitment to sustainability.

Market Trends in Healthcare REITs

- Mergers and Acquisitions:The healthcare REIT sector has witnessed significant consolidation in recent years, with several major mergers and acquisitions. These transactions have allowed companies to expand their portfolios, diversify their investments, and achieve economies of scale. For example, in 2021, Welltower acquired a portfolio of senior housing communities from Brookdale Senior Living, expanding its presence in the senior housing market.

- New Property Development:Healthcare REITs are actively involved in developing new properties, particularly in high-growth areas such as senior housing and medical office buildings. This development activity is driven by the increasing demand for healthcare services and the aging population. For instance, Ventas has been actively developing new medical office buildings in urban areas, capitalizing on the growing demand for outpatient services.

- Impact of Technology:Technology is playing an increasingly important role in the healthcare industry, and this trend is also impacting the healthcare REIT sector. REITs are investing in technology to improve operational efficiency, enhance tenant relationships, and create new revenue streams. For example, Welltower has invested in digital platforms to streamline communication with tenants and provide them with access to real-time information about their properties.

Impact of Healthcare Reform and Demographic Shifts

Healthcare reform and demographic shifts are having a significant impact on the healthcare REIT industry. The Affordable Care Act (ACA) has led to an increase in the number of insured individuals, which has boosted demand for healthcare services and created opportunities for REITs to invest in new properties.

The aging population is also driving demand for senior housing and other healthcare facilities, creating growth opportunities for REITs.

Financial Performance and Valuation

Healthcare REITs, like all REITs, are required to distribute at least 90% of their taxable income to shareholders in the form of dividends. This focus on dividend payouts is a key characteristic of healthcare REITs, making them attractive to income-oriented investors.

However, understanding the financial performance and valuation of healthcare REITs is crucial for investors to make informed decisions.

Financial Performance Metrics

Healthcare REITs are typically evaluated based on key financial performance metrics, such as revenue, earnings, and dividend payouts. These metrics provide insights into the REIT’s profitability, growth potential, and ability to sustain dividend payments.

- Revenue:Healthcare REITs generate revenue primarily from rental income from their properties. Revenue growth is influenced by factors such as occupancy rates, rental rates, and the acquisition of new properties.

- Earnings:Earnings per share (EPS) represent the company’s profitability. Higher EPS indicates strong earnings and a potential for higher dividend payouts.

- Dividend Payouts:Dividend payouts are a key consideration for investors seeking income. Healthcare REITs generally have a high dividend yield compared to other REIT sectors.

Valuation Methods

Various valuation methods are used to assess the value of healthcare REITs. These methods help investors compare the intrinsic value of the REIT to its current market price.

- Price-to-Earnings (P/E) Ratio:This ratio compares the REIT’s stock price to its earnings per share. A higher P/E ratio suggests that investors are willing to pay more for each dollar of earnings, which can indicate growth potential or market confidence in the REIT.

- Dividend Yield:This ratio measures the annual dividend payout as a percentage of the REIT’s stock price. A higher dividend yield indicates a higher return on investment for investors seeking income.

- Net Asset Value (NAV):This metric represents the value of the REIT’s assets minus its liabilities. It provides an estimate of the REIT’s intrinsic value based on its underlying assets.

Valuation Compared to Other Sectors

The valuation of healthcare REITs is often compared to other REIT sectors and the broader stock market.

- Comparison to Other REIT Sectors:Healthcare REITs generally have higher valuations than other REIT sectors, such as retail or office REITs, due to their stable and predictable cash flows. The healthcare industry is less cyclical than other industries, making healthcare REITs more resilient to economic downturns.

- Comparison to the Broader Stock Market:Healthcare REITs tend to have lower valuations than the broader stock market. This is because REITs are generally considered less risky than stocks, but they also offer lower growth potential.

Regulatory Landscape and Legal Considerations

The healthcare REIT industry in the United States is subject to a complex and evolving regulatory landscape. These regulations aim to ensure transparency, protect investors, and promote a stable healthcare system.

American healthcare REITs are a fascinating investment opportunity, offering a unique blend of stability and growth potential. However, while these REITs are focused on the tangible aspects of healthcare, it’s worth remembering that beauty, in its many forms, is also a vital component of well-being.

As the saying goes, “Beauty is not in the face; beauty is a light in the heart,” quotes about beauty woman remind us that true beauty emanates from within. This concept resonates deeply with the healthcare industry, as it emphasizes the importance of holistic care and emotional well-being alongside physical health.

Ultimately, both healthcare REITs and the pursuit of beauty contribute to a more fulfilling and balanced life.

Healthcare Legislation and its Impact

Healthcare legislation has a significant impact on the operations and profitability of healthcare REITs. The Affordable Care Act (ACA) has been particularly influential, expanding health insurance coverage and increasing demand for healthcare services. This has led to growth in the healthcare REIT sector, as investors seek to capitalize on the increasing need for healthcare facilities.

However, healthcare legislation can also introduce challenges for healthcare REITs. For example, changes to reimbursement rates or regulations on healthcare providers can impact the financial performance of healthcare REITs.

Legal Considerations for Investors

Investors in healthcare REITs need to be aware of several legal considerations, including tax implications and disclosure requirements.

Tax Implications

Healthcare REITs are subject to specific tax regulations. The Internal Revenue Service (IRS) defines REITs as companies that invest in real estate, meet certain requirements, and distribute at least 90% of their taxable income to shareholders. This structure allows investors to receive dividends from REITs that are taxed at a lower rate than ordinary income.

However, it is crucial for investors to understand the tax implications of investing in healthcare REITs, as these can vary depending on the specific REIT and the investor’s individual circumstances.

Disclosure Requirements

Healthcare REITs are required to comply with strict disclosure requirements under the Securities and Exchange Commission (SEC). These regulations ensure that investors have access to accurate and timely information about the REIT’s financial performance, management, and operations. Investors should carefully review the REIT’s prospectus and other SEC filings before making an investment decision.

Environmental, Social, and Governance (ESG) Factors

ESG factors are becoming increasingly important for investors, and healthcare REITs are no exception. These factors can impact the long-term sustainability and profitability of these companies, making it crucial for investors to consider them.

Sustainability Practices

Sustainable practices are essential for healthcare REITs, as they operate facilities that consume significant amounts of energy and resources. Investors are increasingly seeking companies with strong environmental performance, which includes reducing carbon emissions, conserving water, and minimizing waste.

- Energy efficiency:Healthcare REITs can improve their environmental performance by implementing energy-efficient technologies in their facilities, such as LED lighting, high-efficiency HVAC systems, and solar panels.

- Water conservation:Water conservation measures, such as low-flow fixtures, rainwater harvesting, and water-efficient landscaping, can significantly reduce water consumption.

- Waste reduction and recycling:Healthcare REITs can implement waste reduction programs and recycling initiatives to minimize their environmental footprint.

Future Outlook and Investment Strategies

The American healthcare REIT market is poised for continued growth, driven by a confluence of demographic trends, technological advancements, and evolving policy landscapes. Understanding these factors is crucial for investors seeking to capitalize on the opportunities within this sector.

Investment Strategies for Healthcare REITs

Investors interested in healthcare REITs have several strategies at their disposal, each with its own set of considerations and potential returns.

- Diversification: A well-diversified portfolio across different healthcare REIT subsectors, such as hospitals, senior housing, or medical office buildings, can mitigate risk and enhance returns. This strategy spreads investment across various segments, reducing exposure to any single sector’s vulnerabilities.

- Sector-Specific Focus: Investors may choose to focus on specific healthcare REIT sectors based on their individual investment goals and market outlook. For instance, an investor expecting strong growth in the aging population might favor senior housing REITs. Conversely, those anticipating technological advancements in healthcare might consider medical office REITs.

American healthcare REITs are increasingly investing in fitness centers, recognizing the growing demand for wellness services. One example is the recent acquisition of California Family Fitness , a popular chain in California. This strategic move demonstrates the potential for REITs to capitalize on the evolving healthcare landscape, where fitness and preventative care are becoming increasingly important.

- Long-Term Investing: Healthcare REITs are generally considered long-term investments. Their stability and consistent cash flows make them suitable for investors seeking steady income streams and potential capital appreciation over time. However, it’s important to remember that market fluctuations and economic cycles can impact REIT performance.

Importance of Due Diligence

Before investing in any healthcare REIT, conducting thorough research and due diligence is paramount.

- Financial Performance: Analyze the REIT’s financial statements, including revenue, expenses, debt levels, and profitability. Examine key metrics like occupancy rates, lease terms, and operating margins to assess the REIT’s financial health and future prospects.

- Management Team: Evaluate the experience and expertise of the REIT’s management team. A strong and experienced management team is crucial for driving growth, managing risks, and maximizing shareholder value. Research the company’s track record and its approach to capital allocation and investment strategies.

- Property Portfolio: Assess the quality and location of the REIT’s property portfolio. Consider factors like tenant quality, lease terms, and market demand for healthcare facilities. A well-maintained and strategically located portfolio can enhance a REIT’s long-term value.

- Regulatory Landscape: Understand the regulatory environment in which the REIT operates. Regulatory changes, such as healthcare reform or zoning laws, can significantly impact a REIT’s profitability and investment returns. Stay informed about relevant legislation and its potential implications.

Last Word

Investing in American healthcare REITs presents a compelling opportunity for investors seeking exposure to a vital sector with strong long-term growth prospects. While the industry faces challenges, such as regulatory changes and competition, the overall demand for healthcare services remains robust.

By carefully considering the risks and rewards, investors can potentially benefit from the growth of this sector and achieve their financial goals.

Common Queries

What are the main types of healthcare properties owned by REITs?

Healthcare REITs typically invest in a variety of properties, including hospitals, nursing homes, assisted living facilities, medical office buildings, and senior housing communities.

How do healthcare REITs generate income?

Healthcare REITs primarily generate income through rental payments from healthcare providers who lease their properties. They also may generate income from property sales and other sources.

What are the risks associated with investing in healthcare REITs?

Risks include changes in healthcare regulations, competition from other healthcare providers, occupancy rates, and the overall health of the economy.

How do I invest in healthcare REITs?

You can invest in healthcare REITs by purchasing shares of publicly traded REIT companies through a brokerage account. It is important to conduct thorough research and consult with a financial advisor before making any investment decisions.