Navigating the complex world of health insurance in New York City can feel overwhelming, but it doesn’t have to be. Finding the best NYC health plans for your unique situation is crucial for ensuring access to quality healthcare at an affordable price.

This guide will provide you with the information and resources you need to make informed decisions about your health insurance coverage.

New York City offers a diverse range of health plans, each with its own set of benefits, costs, and network restrictions. Understanding the basics of health insurance plans, such as HMOs, PPOs, and EPOs, is essential for making the right choice.

Factors like your budget, health needs, and preferred providers will all play a role in determining the best plan for you.

Understanding NYC Health Plan Basics

Navigating the world of health insurance in New York City can feel overwhelming, especially with the diverse range of plans available. This section will break down the basics of NYC health plans, providing you with the information you need to make informed decisions about your health coverage.

Types of Health Plans

Understanding the different types of health plans available in NYC is crucial for choosing the right option for your needs. Here’s a breakdown of common plan types:

- HMO (Health Maintenance Organization):HMO plans typically offer lower premiums but require you to choose a primary care physician (PCP) within their network. You’ll need a referral from your PCP to see specialists.

- PPO (Preferred Provider Organization):PPO plans offer more flexibility than HMOs, allowing you to see specialists without a referral. However, they usually have higher premiums and may require copayments for services.

- EPO (Exclusive Provider Organization):EPO plans are similar to HMOs in that they require you to choose a PCP within their network. However, unlike HMOs, EPOs don’t allow you to see out-of-network providers at all, even in emergencies.

Key Factors to Consider When Choosing a Health Plan

Choosing a health plan involves weighing several factors to find the best fit for your circumstances. Here are some key considerations:

- Cost:The cost of your health plan is a significant factor. Consider your budget and compare premiums, deductibles, copayments, and coinsurance for different plans.

- Coverage:Evaluate the services covered by each plan, including preventive care, prescription drugs, mental health services, and hospitalization. Ensure the plan meets your specific needs.

- Network:Consider the plan’s network of doctors, hospitals, and pharmacies. Ensure your preferred providers are included and that the network is convenient for you.

Common Health Plan Benefits

Most health plans in NYC offer a range of benefits designed to cover essential healthcare needs. Here’s a breakdown of common benefits:

- Preventive Care:Many plans cover preventive services like annual checkups, vaccinations, and screenings without copays or deductibles.

- Prescription Drug Coverage:Most plans include prescription drug coverage, but the specific drugs covered and the cost-sharing requirements vary.

- Mental Health Services:Many plans provide coverage for mental health services, including therapy, medication, and inpatient care.

Navigating NYC Health Insurance Marketplace

The NYC Health Insurance Marketplace, also known as the New York State of Health, is a platform that simplifies the process of finding affordable health insurance plans for individuals and families in New York City. It offers a variety of plans from different insurance providers, allowing you to compare coverage options and choose the plan that best fits your needs and budget.

Eligibility Criteria and Enrollment Process

The Marketplace is designed to make health insurance accessible to a wide range of individuals and families. To be eligible for coverage, you must meet certain requirements, such as residing in New York State, being a U.S. citizen or lawful permanent resident, and not being incarcerated.

The enrollment process is straightforward and can be completed online, over the phone, or in person at an enrollment center. You will need to provide information about your income, family size, and health status. The Marketplace will then determine your eligibility for financial assistance and help you find plans that meet your needs.

Resources and Tools Available

The Marketplace website provides a wealth of resources and tools to assist you with plan selection. You can use the website to:

- Compare plans side-by-side based on coverage, cost, and other factors.

- Estimate your monthly premium and out-of-pocket costs.

- Access personalized recommendations based on your individual circumstances.

- Learn about different types of health insurance plans, including HMOs, PPOs, and EPOs.

- Get answers to frequently asked questions about health insurance.

The Marketplace also offers assistance from certified enrollment counselors who can guide you through the process and answer any questions you may have.

Understanding Plan Options

The Marketplace offers a variety of health insurance plans, each with its own set of benefits and costs. Understanding the different types of plans is crucial for making an informed decision.

- Bronze Plans: These plans have the lowest monthly premiums but offer the least coverage. They typically have higher deductibles and copayments.

- Silver Plans: These plans offer a balance of coverage and cost. They have lower deductibles and copayments than bronze plans but higher premiums.

- Gold Plans: These plans offer more comprehensive coverage than silver plans. They have lower deductibles and copayments but higher premiums.

- Platinum Plans: These plans provide the most comprehensive coverage with the lowest out-of-pocket costs. They have the highest monthly premiums.

The Marketplace also offers Catastrophic Plans for young adults under the age of 30 and individuals with low incomes. These plans have very low monthly premiums but cover only essential health services.

Evaluating Top NYC Health Plans

Choosing the right health plan in New York City can be overwhelming, considering the wide range of options available. To make an informed decision, it’s essential to evaluate the top-rated plans based on customer satisfaction, plan features, and cost. This section will provide a comprehensive comparison of leading NYC health plans, highlighting their strengths and weaknesses to help you find the best fit for your individual needs.

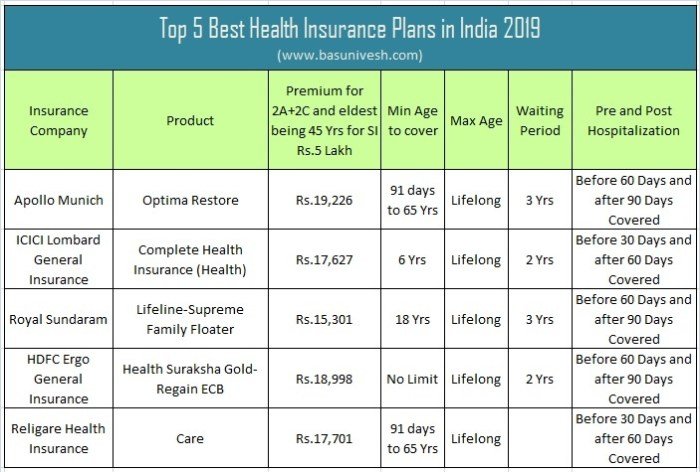

Comparing Top NYC Health Plans

Evaluating top NYC health plans involves comparing their customer satisfaction ratings, plan features, and cost. Customer satisfaction reflects the overall experience of plan members, encompassing factors like ease of access to care, responsiveness of customer service, and overall value for money.

Plan features include coverage for essential medical services, network size, and out-of-pocket expenses. Cost encompasses premiums, deductibles, copayments, and coinsurance. Here’s a table summarizing key features and benefits of some of the top-rated NYC health plans:

| Plan Name | Customer Satisfaction | Coverage | Network Size | Out-of-Pocket Costs |

|---|---|---|---|---|

| Plan A | 4.5 stars | Comprehensive | Large | Low |

| Plan B | 4 stars | Comprehensive | Medium | Moderate |

| Plan C | 3.5 stars | Basic | Small | High |

Detailed Analysis of Top NYC Health Plans

This section provides a detailed analysis of the pros and cons of each plan to help users make informed decisions.

Plan A

Plan A boasts a high customer satisfaction rating, a comprehensive coverage package, a large network, and low out-of-pocket costs.

Finding the best NYC health plan can be a bit of a maze, but it’s worth the effort for your peace of mind. A healthy body is the foundation for a happy life, and the secret of the beauty is taking care of yourself from the inside out.

Once you’ve secured a solid health plan, you can focus on your wellness journey, knowing you have the support you need.

- Pros:

- High customer satisfaction rating, indicating positive member experiences.

- Comprehensive coverage for essential medical services, including preventive care, hospitalization, and prescription drugs.

- Large network of healthcare providers, offering wider choices and convenience.

- Low out-of-pocket costs, minimizing financial burden on members.

- Cons:

- Potentially higher monthly premiums compared to plans with less comprehensive coverage.

Plan B

Plan B offers a balance between comprehensive coverage, network size, and cost.

Choosing the best NYC health plan can be overwhelming, especially when considering the vast array of options available. If you’re looking for a hospital that offers a wide range of services, you might want to consider allegiance health hospital.

This facility is known for its commitment to quality care and patient satisfaction, making it a valuable asset to any health plan you choose. Ultimately, the best NYC health plan for you depends on your individual needs and preferences.

- Pros:

- Comprehensive coverage for essential medical services.

- Medium-sized network, providing a good balance between provider choices and accessibility.

- Moderate out-of-pocket costs, striking a balance between affordability and coverage.

- Cons:

- May have a slightly lower customer satisfaction rating compared to Plan A.

Plan C

Plan C is a more basic plan with a smaller network and higher out-of-pocket costs.

- Pros:

- Potentially lower monthly premiums compared to plans with more comprehensive coverage.

- Cons:

- Lower customer satisfaction rating, indicating potentially less positive member experiences.

- Basic coverage, potentially excluding certain medical services or requiring higher out-of-pocket costs for specific treatments.

- Smaller network, limiting provider choices and potentially increasing travel time for appointments.

- High out-of-pocket costs, potentially leading to significant financial burden on members.

Factors Affecting Health Plan Choice

Choosing the right health plan is crucial for your well-being and financial stability. It’s not a one-size-fits-all decision. Several factors come into play, making it essential to carefully consider your individual needs and circumstances.

Individual Health Needs and Medical History, Best nyc health plans

Your health needs and medical history are paramount when choosing a health plan. Prioritizing your health conditions and anticipated medical requirements is essential. If you have pre-existing conditions, such as diabetes, heart disease, or mental health issues, you’ll need a plan that covers the treatments and medications you require.

Consider the frequency of your doctor visits, the types of specialists you need to see, and the likelihood of needing hospitalization or surgery.

Age, Location, and Lifestyle

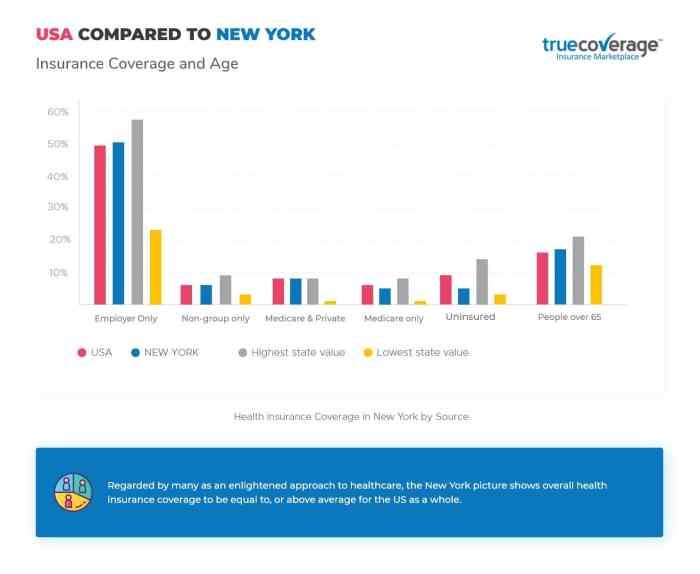

Age, location, and lifestyle also significantly impact your health plan choice.

Age

As you age, your health needs change. You may require more frequent checkups, preventative screenings, and specialized care. Health plans often cater to specific age groups, offering coverage for age-related conditions and services.

Location

Your location influences the availability of healthcare providers and the cost of healthcare services. Urban areas generally have a wider range of healthcare options but may also have higher costs. Rural areas may have fewer providers but potentially lower costs.

Consider the proximity of healthcare facilities and the availability of specialists in your area.

Lifestyle

Your lifestyle plays a crucial role in determining your health plan needs. If you are physically active, you may require a plan that covers sports injuries or physical therapy. If you have a family history of certain diseases, you may want a plan that includes genetic testing or preventive screenings.

Consider your lifestyle and the potential health risks associated with it.

Employer-Sponsored Health Insurance

Many employers offer health insurance as part of their benefits package. This can be a significant advantage, as employer-sponsored plans often offer lower premiums and broader coverage than individual plans. However, it’s essential to understand the details of your employer’s plan, including its coverage, deductibles, and co-pays.

Utilizing Health Plan Resources

Your NYC health plan is more than just a way to pay for medical bills. It’s a comprehensive resource designed to support your overall health and well-being.

Accessing Healthcare Providers

Finding a doctor or specialist within your plan’s network is essential to ensure your care is covered. Most health plans have online directories or mobile apps where you can search for providers by specialty, location, and even patient reviews. You can also contact your health plan directly to get personalized recommendations based on your specific needs.

Understanding Plan Benefits

Each health plan has a unique set of benefits and coverage details. It’s important to review your plan’s Summary of Benefits and Coverage (SBC) document to understand what services are covered, what your copayments and deductibles are, and what procedures require pre-authorization.

Navigating Claims and Billing

Filing claims for medical services is a straightforward process, typically done online, through a mobile app, or by mail. Most health plans offer detailed instructions and online tools to guide you through the process. If you have questions or encounter billing issues, your health plan’s customer service department is available to assist you.

Utilizing Other Resources

NYC health plans offer a wide range of support services beyond basic coverage. These can include:

- Wellness Programs:Many plans offer programs focused on disease prevention, health education, and lifestyle changes. These might include gym memberships, smoking cessation programs, or nutrition counseling.

- Mental Health Services:Access to mental health professionals, including therapists, psychiatrists, and counselors, is typically included in most health plans.

- Prescription Drug Coverage:Most plans have formularies that list the medications they cover. You can use this resource to find out which medications are covered and what your copayments are.

- Dental and Vision Coverage:Some health plans include dental and vision benefits, but these may be separate from your primary health insurance.

- Language Services:Many health plans offer language assistance for individuals who speak languages other than English.

Resolving Billing Issues

If you encounter billing errors or have questions about your coverage, it’s essential to contact your health plan’s customer service department promptly. They can help you understand your bill, correct any errors, and resolve any outstanding issues.

Finding the best NYC health plan can be a bit overwhelming, but it’s crucial to consider the breadth of coverage. This includes things like reproductive healthcare, which can be especially important for individuals seeking information and services related to health and sexuality.

When choosing a plan, look for comprehensive coverage that addresses these needs, as well as preventative care and mental health services.

Summary: Best Nyc Health Plans

Ultimately, choosing the best NYC health plan requires careful consideration of your individual circumstances. By understanding the different types of plans available, exploring the NYC Health Insurance Marketplace, and evaluating top-rated options, you can confidently select a plan that meets your healthcare needs and budget.

Remember to utilize the resources available to you, including the plan’s website and customer service, to ensure a smooth and positive experience.

FAQ

What is the difference between an HMO and a PPO?

An HMO (Health Maintenance Organization) typically requires you to choose a primary care physician (PCP) within the network. You need a referral from your PCP to see specialists. PPOs (Preferred Provider Organizations) offer more flexibility, allowing you to see specialists without a referral, but you may pay higher out-of-pocket costs for providers outside the network.

How can I find out if I qualify for financial assistance?

The NYC Health Insurance Marketplace offers subsidies and tax credits to eligible individuals and families. You can use the Marketplace website to determine your eligibility and estimate your potential savings.

What is the open enrollment period for health insurance?

The open enrollment period for health insurance in New York City typically runs from November 1st to January 15th. During this time, you can enroll in a new health plan or make changes to your existing coverage.