Cheapest health insurance PA is a common search term for residents looking for affordable healthcare options. Pennsylvania offers a diverse health insurance market with various plans and providers, making it essential to understand the factors that influence costs and how to navigate the options available.

From individual plans to family coverage and employer-sponsored options, the state’s health insurance landscape is complex. This guide explores the different types of plans available, key factors affecting costs, and resources to help you find the most affordable health insurance in Pennsylvania.

Understanding Pennsylvania’s Health Insurance Market

Pennsylvania’s health insurance market is diverse, offering various plan options to meet the needs of its residents. Understanding the different types of plans available, the factors that influence costs, and the state’s healthcare landscape is crucial for making informed decisions about your health insurance coverage.

Types of Health Insurance Plans in Pennsylvania, Cheapest health insurance pa

Pennsylvania residents have access to a wide range of health insurance plans, including:

- Individual Health Insurance Plans:These plans are purchased by individuals or families directly from insurance companies, providing coverage outside of employer-sponsored plans.

- Employer-Sponsored Health Insurance Plans:Offered by employers, these plans provide coverage to employees and their dependents, typically with a range of options and cost-sharing arrangements.

- Medicare:A federal health insurance program for individuals aged 65 and older, as well as people with certain disabilities.

- Medicaid:A joint federal and state program providing health coverage to low-income individuals and families, pregnant women, children, and people with disabilities.

- Children’s Health Insurance Program (CHIP):A state-administered program offering health coverage to children in families with incomes too high to qualify for Medicaid.

Factors Influencing Health Insurance Costs in Pennsylvania

Several factors contribute to the cost of health insurance in Pennsylvania, including:

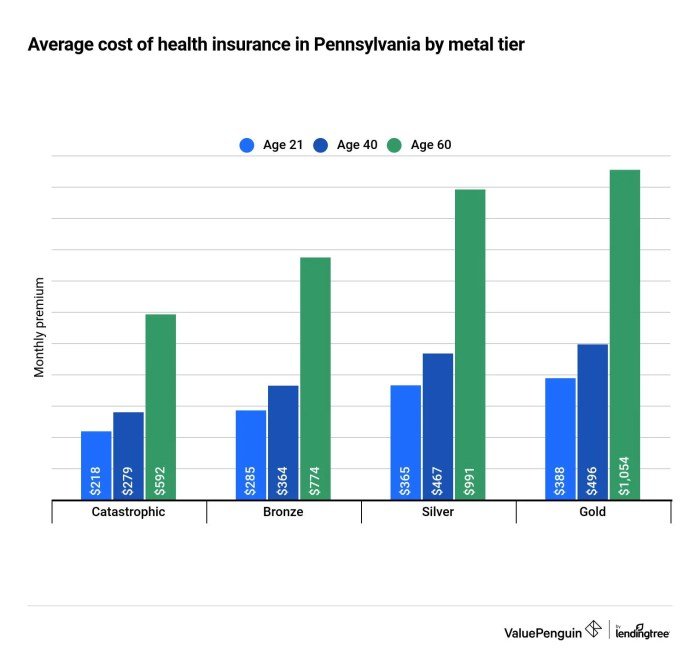

- Age:Older individuals generally pay higher premiums due to their increased risk of health issues.

- Location:Premiums can vary based on the geographic location within Pennsylvania, reflecting differences in healthcare costs and utilization patterns.

- Health Status:Individuals with pre-existing health conditions may face higher premiums as they are considered higher risk.

- Plan Type:Different types of health insurance plans, such as HMOs, PPOs, and POS plans, have varying cost structures and coverage levels, influencing premiums.

- Tobacco Use:Smokers typically pay higher premiums than non-smokers due to the increased health risks associated with smoking.

Pennsylvania’s Healthcare Landscape and Its Impact on Insurance Costs

Pennsylvania’s healthcare landscape is influenced by various factors, including the state’s demographics, health status, and healthcare infrastructure. These factors contribute to the overall cost of healthcare and, consequently, insurance premiums.

Pennsylvania’s healthcare costs are generally higher than the national average, partly due to the state’s aging population and high prevalence of chronic diseases.

The state’s healthcare system is also characterized by a mix of private and public providers, contributing to variations in pricing and service delivery. The availability of specialized medical facilities and services can also impact insurance costs, as higher-level care often comes with higher associated costs.

Finding Affordable Health Insurance Options

Navigating the world of health insurance can feel overwhelming, especially when you’re looking for the most affordable option. Pennsylvania offers a variety of plans, each with its own set of benefits and costs. This section will guide you through finding the right health insurance plan for your needs and budget.

Reputable Health Insurance Providers in Pennsylvania

Pennsylvania is home to a diverse range of health insurance providers. These providers offer a range of plans, from individual coverage to family plans and employer-sponsored options. Here are some of the most reputable providers in the state:

- Individual and Family Plans:

- Aetna

- Anthem

- Highmark Blue Cross Blue Shield

- Independence Blue Cross

- UnitedHealthcare

- Employer-Sponsored Plans:

- Aetna

- Anthem

- Cigna

- Highmark Blue Cross Blue Shield

- UnitedHealthcare

Comparing Health Insurance Plans

Choosing the right health insurance plan involves carefully comparing various options. Consider factors such as:

- Monthly Premiums:This is the amount you pay each month for your insurance coverage. Premiums vary based on factors like age, location, and the type of plan you choose.

- Deductibles:This is the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles typically mean lower monthly premiums.

- Co-pays and Co-insurance:These are the amounts you pay for specific services or treatments. Co-pays are fixed amounts, while co-insurance is a percentage of the cost.

- Network:This is the list of doctors, hospitals, and other healthcare providers that are covered by your insurance plan. Make sure the network includes providers you need and trust.

- Benefits:Each plan offers a specific set of benefits, such as coverage for preventive care, prescription drugs, and hospitalization. Choose a plan that aligns with your healthcare needs.

Using Online Comparison Tools

To simplify the comparison process, use online health insurance comparison tools. These tools allow you to enter your information and preferences, then present you with a list of plans that meet your criteria. Some popular comparison tools include:

- Healthcare.gov

- eHealth

- HealthMarkets

Seeking Expert Advice

Don’t hesitate to seek guidance from a licensed insurance agent or broker. They can provide personalized recommendations and help you understand the nuances of different plans.

Factors Influencing Health Insurance Costs

Several factors influence the cost of health insurance in Pennsylvania. Understanding these factors can help you make informed decisions:

- Age:Generally, older individuals pay higher premiums due to a higher risk of healthcare expenses.

- Location:Health insurance costs can vary based on the cost of living and healthcare expenses in different regions of Pennsylvania.

- Health Status:Individuals with pre-existing health conditions may face higher premiums.

- Plan Type:Different plan types (e.g., Bronze, Silver, Gold) have varying levels of coverage and cost.

- Tobacco Use:Smokers often pay higher premiums compared to non-smokers.

Financial Assistance Options

If you’re struggling to afford health insurance, explore financial assistance programs. The Affordable Care Act (ACA) offers subsidies to eligible individuals and families. You can also inquire about state-specific programs and community resources.

Understanding Coverage for Essential Health Benefits

The Affordable Care Act mandates that all health insurance plans cover essential health benefits, including:

- Ambulatory patient services (outpatient care)

- Emergency services

- Hospitalization

- Maternity and newborn care

- Mental health and substance use disorder services

- Prescription drugs

- Rehabilitative services and devices

- Preventive and wellness services

Open Enrollment Period

Pennsylvania has an open enrollment period for health insurance, typically running from November 1st to January 15th. During this period, you can enroll in a new plan or make changes to your existing coverage.

Finding the cheapest health insurance in Pennsylvania can be a bit of a challenge, but it’s worth the effort to secure affordable coverage. While you’re searching for the best plan, why not take a break and check out a black beauty shop near me for a little pampering?

Once you’ve found a great health insurance plan, you can focus on staying healthy and looking your best.

Navigating Government Assistance Programs: Cheapest Health Insurance Pa

Pennsylvania residents seeking affordable health insurance have access to various government assistance programs, designed to help individuals and families manage healthcare costs. One of the most significant resources is the state-based health insurance marketplace, known as Pennie.

Pennie Eligibility and Benefits

Pennie is a platform where individuals can compare and enroll in health insurance plans, with the added benefit of potential financial assistance. To be eligible for Pennie, you must be a Pennsylvania resident, a U.S. citizen or legal resident, and not be incarcerated.

The program provides subsidies and tax credits to eligible individuals and families, making health insurance more affordable.

Financial Assistance through Pennie

Pennie offers various types of financial assistance to help individuals and families afford health insurance.

Subsidies

Subsidies are direct payments from the government that reduce the monthly premium cost of your health insurance plan. The amount of subsidy you receive depends on your income, household size, and the cost of the plan you choose.

Tax Credits

Tax credits are reductions in your federal income tax liability. They can be claimed on your federal tax return and can help offset the cost of your health insurance premiums. The amount of tax credit you receive depends on your income and the cost of your health insurance plan.

Applying for Government Assistance Programs

To apply for government assistance programs, such as Pennie, you can visit the Pennie website or contact the Pennie customer service hotline.

Pennie Website

The Pennie website provides comprehensive information about the program, including eligibility requirements, financial assistance options, and enrollment procedures. You can also apply for coverage online through the website.

Pennie Customer Service

Pennie’s customer service hotline provides personalized support and guidance throughout the application process. You can call the hotline to ask questions, get assistance with the application, or report any issues.

Factors Affecting Health Insurance Costs

The cost of health insurance in Pennsylvania, like in other states, is influenced by several factors. Understanding these factors can help you make informed decisions when choosing a plan that fits your budget and needs.

Age

Your age is a significant factor determining your health insurance premiums. Generally, younger individuals tend to have lower premiums than older individuals. This is because younger people are statistically less likely to require expensive medical care.

Health Status

Your health status plays a crucial role in determining your health insurance premiums. Individuals with pre-existing conditions, such as diabetes or heart disease, may face higher premiums. This is because insurance companies anticipate higher healthcare costs associated with managing these conditions.

Location

The location where you live can also influence your health insurance costs. In areas with a higher cost of living or a greater concentration of healthcare providers, premiums may be higher.

Family Size

The size of your family also affects your health insurance premiums. Larger families typically have higher premiums than smaller families, as they are likely to require more healthcare services.

Deductibles, Copayments, and Coinsurance

Deductibles, copayments, and coinsurance are important components of health insurance plans that influence your overall healthcare costs.

A deductibleis the amount you pay out-of-pocket before your insurance coverage kicks in.

A copaymentis a fixed amount you pay for certain medical services, such as doctor’s visits or prescriptions.

Finding the cheapest health insurance in Pennsylvania can be a challenge, but it’s essential for your well-being. If you’re looking for ways to stay active and healthy, you might want to check out onelife fitness skyline , a popular gym with a range of fitness classes and equipment.

Maintaining a healthy lifestyle can contribute to your overall health, which can also help you manage your health insurance costs in the long run.

Coinsuranceis a percentage of the cost of healthcare services that you are responsible for paying after meeting your deductible.

Finding the cheapest health insurance in Pennsylvania can be a challenge, but it’s important to have coverage. If you’re looking for a job with a focus on health and wellness, consider checking out beauty clinic receptionist jobs. These positions often offer benefits packages that include health insurance, so you can find a job that fits your needs and your budget.

Once you have a good plan in place, you can focus on staying healthy and enjoying all that Pennsylvania has to offer.

For example, if you have a $1,000 deductible and a 20% coinsurance rate, you would pay the first $1,000 of your healthcare costs yourself. After that, you would pay 20% of the remaining costs, with your insurance company covering the other 80%.

Health Insurance Tiers

Health insurance plans are often categorized into tiers based on their coverage and costs.

Bronze planshave the lowest premiums but the highest out-of-pocket costs.

Silver plansoffer a balance between premiums and out-of-pocket costs.

Gold planshave higher premiums but lower out-of-pocket costs.

Platinum planshave the highest premiums but the lowest out-of-pocket costs.

The tier you choose will depend on your individual circumstances and your tolerance for risk. If you are generally healthy and expect to have low healthcare costs, a bronze plan may be suitable. If you have a pre-existing condition or expect to use healthcare services frequently, a gold or platinum plan may be a better choice.

Essential Considerations for Choosing a Plan

Choosing the right health insurance plan can feel overwhelming, but it’s crucial for ensuring you have the coverage you need when you need it. Consider these factors to make an informed decision.

Understanding Coverage Details

It’s essential to understand the details of your potential plan’s coverage, beyond just the monthly premium. Look for information about the following:

- Network Providers:Check if your preferred doctors and hospitals are in the plan’s network. Out-of-network care can be significantly more expensive.

- Prescription Drug Coverage:Ensure the plan covers the medications you need. Consider the formulary (list of covered drugs) and any prior authorization requirements.

- Mental Health Benefits:Mental health services are essential. Check the plan’s coverage for therapy, medication, and inpatient care.

Comparing Plans Based on Individual Needs

Every individual has unique health needs and financial circumstances. Therefore, comparing plans based on these factors is essential. Consider:

- Your Health History:If you have pre-existing conditions, look for plans with comprehensive coverage for those conditions.

- Your Budget:Balance your monthly premium with the plan’s coverage and out-of-pocket costs.

- Your Lifestyle:If you travel frequently, consider a plan with extensive out-of-state coverage.

Resources for Additional Information

Finding the right health insurance plan in Pennsylvania can be a challenging process, especially with the variety of options and programs available. To make informed decisions and navigate the complexities of the market, it’s essential to have access to reliable resources and guidance.

This section will provide you with links to official websites, contact information for consumer advocacy organizations, and a list of helpful resources to assist you in your search for affordable and comprehensive health insurance.

Official Websites

Official websites are valuable sources for up-to-date information, guidelines, and program details. These platforms provide direct access to state and federal resources, ensuring you have accurate and current information.

- Pennsylvania Department of Insurance:The Pennsylvania Department of Insurance (DOI) is the primary regulatory body overseeing health insurance in the state. Their website offers a wealth of information, including consumer guides, insurance company directories, and complaint filing procedures. Visit the website at: [https://www.insurance.pa.gov/](https://www.insurance.pa.gov/)

- Pennie:Pennie is the official health insurance marketplace for Pennsylvania. It provides a platform to compare plans, enroll in coverage, and access financial assistance programs. Visit the website at: [https://www.pennie.com/](https://www.pennie.com/)

Consumer Advocacy Organizations

Consumer advocacy organizations play a crucial role in supporting individuals seeking health insurance. These organizations offer guidance, resources, and support to ensure consumers understand their rights and options.

- Pennsylvania Health Access Network (PHAN):PHAN is a non-profit organization dedicated to advocating for affordable and accessible healthcare for all Pennsylvanians. They provide information, resources, and assistance to individuals navigating the health insurance system. You can contact them at: [https://www.phan.org/](https://www.phan.org/)

- The Center for Medicare Advocacy:This national organization focuses on advocating for Medicare beneficiaries and providing information on Medicare coverage and rights. They offer resources and support to individuals seeking assistance with Medicare-related issues. You can contact them at: [https://www.medicareadvocacy.org/](https://www.medicareadvocacy.org/)

Helpful Resources

Navigating the health insurance market can be overwhelming. These resources can provide valuable information and support to help you understand your options and make informed decisions.

- HealthCare.gov:This website provides comprehensive information about the Affordable Care Act (ACA), including eligibility requirements, plan options, and financial assistance programs. Visit the website at: [https://www.healthcare.gov/](https://www.healthcare.gov/)

- National Association of Insurance Commissioners (NAIC):The NAIC is a non-profit organization representing state insurance regulators. Their website offers consumer guides, resources, and information on various insurance topics, including health insurance. Visit the website at: [https://www.naic.org/](https://www.naic.org/)

- Your local health insurance broker:Health insurance brokers can provide personalized guidance and assistance in finding the right plan for your needs. They are familiar with the local market and can help you navigate the complexities of choosing coverage.

Final Summary

Finding the cheapest health insurance in Pennsylvania requires a thorough understanding of your needs, available options, and the resources available to help you. By considering factors like age, health status, location, and family size, and utilizing government assistance programs, you can navigate the health insurance market effectively and find a plan that fits your budget and provides adequate coverage.

FAQ Corner

What are the different types of health insurance plans available in Pennsylvania?

Pennsylvania offers a range of plans, including HMOs, PPOs, EPOs, and POS plans, each with varying levels of coverage and cost.

How can I find a health insurance provider in Pennsylvania?

You can explore reputable providers through the Pennsylvania Department of Insurance website, Pennie, or by contacting consumer advocacy organizations.

What is Pennie, and how does it work?

Pennie is Pennsylvania’s state-based health insurance marketplace where you can compare plans and apply for financial assistance.