Coverage california health insurance – Navigating California’s health insurance landscape can be complex, but understanding your options is essential for securing the care you need. This guide explores the diverse range of health insurance plans available in California, from eligibility requirements to enrollment processes and key coverage components.

We’ll delve into the intricacies of cost and affordability, providing insights into financial assistance programs and strategies for finding the best plan for your individual needs.

California’s health insurance market is dynamic, with a variety of plans and providers to choose from. Whether you’re an individual, a family, or part of a larger group, this guide will equip you with the knowledge necessary to make informed decisions about your health insurance coverage.

Understanding California Health Insurance Coverage

Navigating the California health insurance landscape can seem complex, but understanding the different types of plans available can empower you to make informed decisions about your coverage.

Types of Health Insurance Plans in California

California offers a variety of health insurance plans, each with its own unique features and benefits. Understanding the key differences between these plans can help you choose the one that best suits your individual needs and budget.

- Health Maintenance Organizations (HMOs): HMOs typically offer lower monthly premiums but require you to choose a primary care physician (PCP) within their network. You’ll need a referral from your PCP to see specialists, and coverage is generally limited to services provided by in-network providers.

- Preferred Provider Organizations (PPOs): PPOs offer more flexibility than HMOs, allowing you to see specialists without a referral and access out-of-network providers, though at a higher cost. PPOs generally have higher monthly premiums than HMOs.

- Point-of-Service (POS) Plans: POS plans combine features of HMOs and PPOs. They typically require you to choose a PCP within their network, but allow you to see out-of-network providers at a higher cost.

- Exclusive Provider Organizations (EPOs): EPOs are similar to HMOs, but typically have a broader network of providers. You must see in-network providers, and out-of-network services are not covered.

- High Deductible Health Plans (HDHPs): HDHPs offer lower monthly premiums but have a higher deductible than other plans. These plans are often paired with a Health Savings Account (HSA), which allows you to save pre-tax dollars for healthcare expenses.

Key Features and Benefits of Health Insurance Plans

Each type of health insurance plan in California offers unique features and benefits, which can impact your overall healthcare experience and costs.

- Coverage for Essential Health Benefits: All health insurance plans in California are required to cover essential health benefits, including preventive care, hospitalization, maternity care, and prescription drugs.

- Network of Providers: Each health insurance plan has a network of doctors, hospitals, and other healthcare providers that they contract with. You’ll generally receive lower costs when you use in-network providers.

- Deductibles and Co-pays: Most health insurance plans have deductibles and co-pays, which are the amounts you pay out-of-pocket before your insurance coverage kicks in.

- Prescription Drug Coverage: Most health insurance plans include prescription drug coverage, but the specific drugs covered and the cost-sharing requirements vary by plan.

- Mental Health and Substance Use Disorder Coverage: All health insurance plans in California must provide mental health and substance use disorder coverage, including therapy, medication, and inpatient care.

Major Health Insurance Providers in California

California’s health insurance market is diverse, with numerous major providers offering a range of plans to meet different needs. Some of the prominent health insurance providers in California include:

- Anthem Blue Cross: A large national insurer with a wide network of providers in California.

- Blue Shield of California: A not-for-profit health insurance company with a strong presence in the state.

- Kaiser Permanente: An integrated healthcare system that offers health insurance and healthcare services.

- UnitedHealthcare: A national insurer with a significant presence in California’s health insurance market.

- Health Net: A California-based health insurance company that offers a range of plans, including HMOs, PPOs, and POS plans.

Eligibility and Enrollment: Coverage California Health Insurance

In California, eligibility for health insurance plans depends on factors like your income, household size, and age. Understanding the eligibility criteria and enrollment process is crucial to securing affordable and comprehensive health coverage.

Eligibility Criteria

Eligibility for health insurance plans in California is determined by various factors, including income, household size, and age. The eligibility criteria vary depending on the specific health insurance plan you are applying for. Here’s a breakdown of eligibility criteria for different types of plans:

- Covered California: Covered California offers subsidized health insurance plans to individuals and families with incomes below certain thresholds. The eligibility requirements for Covered California plans are based on the federal poverty level (FPL). For instance, in 2023, a family of four with an annual income below $107,000 might qualify for subsidized plans through Covered California.

- Medi-Cal: Medi-Cal is California’s version of Medicaid, providing health insurance to low-income individuals and families. Eligibility for Medi-Cal is based on income and household size, and it typically covers individuals with incomes below a certain percentage of the FPL. For example, in 2023, a single individual with an annual income below $18,720 might qualify for Medi-Cal.

- Employer-Sponsored Plans: If you are employed, your employer may offer health insurance plans. Eligibility for employer-sponsored plans is usually based on employment status and may vary depending on the employer’s policies. These plans may have different eligibility criteria based on factors like job tenure, full-time or part-time employment, and participation in specific programs.

- Individual Plans: Individuals who are not eligible for Covered California or Medi-Cal can purchase individual health insurance plans. Eligibility for individual plans is generally based on factors like age, health status, and income. These plans are typically more expensive than subsidized plans but offer flexibility and wider coverage options.

Coverage for California health insurance can be a complex topic, especially when considering specialized medical needs. For example, if you require ice therapy for an injury, you might want to explore facilities like the northwell health ice center. While this center is located in New York, understanding the cost and availability of such services can help you navigate your California health insurance coverage more effectively.

Enrollment Process

The enrollment process for health insurance plans in California involves several steps, including determining your eligibility, selecting a plan, and completing the application.

- Determine Eligibility: The first step is to determine your eligibility for various health insurance plans. You can do this by visiting the Covered California website or contacting the Covered California hotline. You will need to provide information about your income, household size, and age.

You can also use the Covered California online eligibility tool to quickly check your eligibility.

- Choose a Plan: Once you determine your eligibility, you can choose a health insurance plan that meets your needs and budget. Covered California offers a variety of plans from different insurance companies, with varying coverage levels and costs. You can use the Covered California website or the hotline to compare plans and find the best option for you.

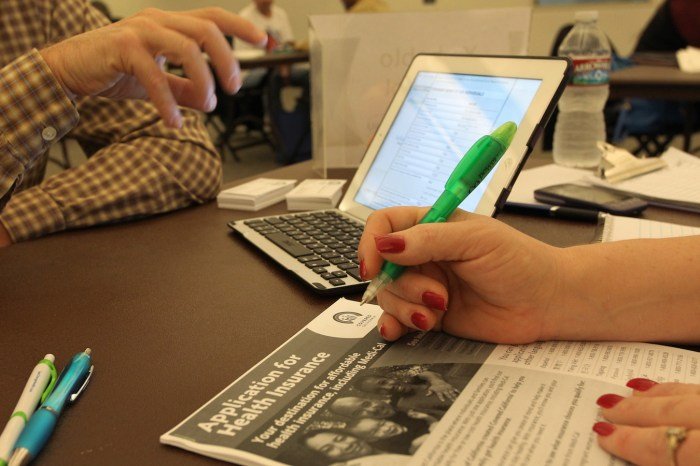

- Complete the Application: After selecting a plan, you will need to complete an application and provide required documentation. The application process typically involves providing personal information, income details, and proof of identity. You can submit your application online, by phone, or through a Covered California enrollment assister.

- Enrollment Deadlines: There are specific enrollment periods for health insurance plans in California. The open enrollment period for Covered California plans runs from November 1st to January 15th each year. If you experience a qualifying life event, such as losing your job or getting married, you may be eligible for a special enrollment period outside of the open enrollment period.

It’s important to note that enrollment deadlines may vary depending on the specific plan you are applying for.

Covered California’s Role in Enrollment

Covered California plays a vital role in facilitating the enrollment process for health insurance plans in California.

- Providing Information and Assistance: Covered California offers resources and support to help individuals understand their eligibility and enrollment options. They have a dedicated website, hotline, and network of enrollment assisters who can provide guidance and answer questions.

- Comparing Plans and Costs: Covered California allows individuals to compare different health insurance plans from various insurance companies, making it easier to find the best option based on their needs and budget. The website provides a comprehensive plan comparison tool that helps individuals understand coverage levels, costs, and other key features.

- Enrolling in Plans: Covered California facilitates the enrollment process by providing a secure online platform and hotline for individuals to submit applications and enroll in plans. They also offer assistance with completing applications and providing required documentation.

- Offering Financial Assistance: Covered California offers financial assistance to individuals and families who qualify for subsidized health insurance plans. The subsidies help reduce the cost of premiums and make health insurance more affordable. The amount of financial assistance available depends on income and household size.

Understanding California health insurance coverage is crucial for ensuring your well-being. It’s important to remember that maintaining a healthy lifestyle is equally important. Incorporating regular exercise can significantly improve your overall health, and a fitness recumbent bike can be a great way to achieve this.

With a recumbent bike, you can enjoy a comfortable and low-impact workout, which is particularly beneficial for those with joint issues. By taking proactive steps towards your health, you can maximize the benefits of your California health insurance coverage.

Key Coverage Components

California health insurance plans are designed to provide comprehensive coverage for essential health needs. Understanding the key components of these plans is crucial for making informed decisions about your healthcare. This section will delve into the essential health benefits covered, explore the coverage limits and deductibles associated with different plans, and discuss prescription drug coverage and mental health benefits.

Essential Health Benefits, Coverage california health insurance

The Affordable Care Act mandates that all health insurance plans offered in California must cover a set of essential health benefits. These benefits are designed to ensure that individuals have access to a broad range of healthcare services, including:

- Ambulatory patient services: These include routine checkups, vaccinations, and other services provided in a doctor’s office or clinic.

- Emergency services: This covers treatment for unexpected illnesses or injuries, regardless of whether the individual has a pre-existing condition.

- Hospitalization: This includes coverage for inpatient care, such as surgeries, procedures, and overnight stays.

- Maternity and newborn care: This covers prenatal care, labor and delivery, and postpartum care for both the mother and newborn.

- Mental health and substance use disorder services: This includes coverage for treatment of mental health conditions and substance use disorders, such as therapy, counseling, and medication.

- Prescription drugs: This covers the cost of prescription medications, although there may be co-pays or deductibles.

- Rehabilitative services and devices: This includes coverage for services and devices that help individuals recover from injuries or illnesses, such as physical therapy and prosthetics.

- Laboratory services: This covers the cost of lab tests, such as blood work and urine analysis.

- Preventive and wellness services: This includes coverage for screenings, vaccinations, and other services designed to prevent illness and promote health.

Coverage Limits and Deductibles

Coverage limits and deductibles vary depending on the specific plan you choose. Understanding these terms is crucial for determining the overall cost of your healthcare.

- Deductible: This is the amount you must pay out-of-pocket before your health insurance plan begins to cover your healthcare expenses. For example, if your deductible is $1,000, you would need to pay the first $1,000 of your healthcare expenses yourself before your insurance kicks in.

- Co-pay: This is a fixed amount you pay for specific healthcare services, such as doctor’s visits or prescription drugs.

- Co-insurance: This is a percentage of your healthcare expenses that you are responsible for paying after you have met your deductible. For example, if your co-insurance is 20%, you would be responsible for paying 20% of your healthcare expenses after your deductible is met.

- Out-of-pocket maximum: This is the maximum amount you will have to pay out-of-pocket for healthcare expenses in a given year. Once you reach this limit, your insurance will cover 100% of your healthcare costs for the rest of the year.

Prescription Drug Coverage

Prescription drug coverage is an essential component of California health insurance plans. The specifics of prescription drug coverage can vary based on the plan you choose, but here are some key aspects:

- Formulary: This is a list of prescription drugs covered by your insurance plan. Not all drugs are covered, and there may be different tiers of coverage based on the cost of the drug.

- Prior authorization: Some plans require prior authorization for certain prescription drugs, meaning you need to get approval from your insurance company before filling the prescription.

- Co-pay: You will typically pay a co-pay for each prescription drug you fill, even if you have met your deductible.

Mental Health Benefits

Mental health benefits are an important part of comprehensive healthcare coverage. California health insurance plans are required to cover a wide range of mental health services, including:

- Therapy: This includes individual, group, and family therapy.

- Counseling: This includes services for substance abuse, domestic violence, and other issues.

- Medication: This includes coverage for prescription medications to treat mental health conditions.

- Inpatient care: This includes coverage for hospitalization for mental health conditions.

Cost and Affordability

The cost of health insurance in California can vary significantly depending on several factors, including your age, location, health status, and the type of plan you choose. Understanding these factors and the available financial assistance programs can help you find affordable health insurance options.

Factors Influencing Premiums

Several factors determine the cost of your health insurance premiums in California. These factors are used by insurance companies to assess the risk of covering you and set premiums accordingly.

- Age:Generally, older individuals tend to have higher premiums as they are more likely to require healthcare services.

- Location:Premiums can vary based on your location due to differences in healthcare costs and utilization rates.

- Health Status:Individuals with pre-existing conditions may face higher premiums, as they are considered higher risk.

- Tobacco Use:Smokers typically have higher premiums compared to non-smokers, as smoking increases the risk of health issues.

- Plan Type:The type of plan you choose, such as a Bronze, Silver, Gold, or Platinum plan, influences your premiums. Plans with higher coverage and benefits usually come with higher premiums.

Financial Assistance Programs

California offers various financial assistance programs to help individuals and families afford health insurance. These programs are designed to reduce the cost of premiums and make health insurance more accessible.

- Subsidies:These are government payments that help reduce your monthly premium costs. The amount of subsidy you qualify for depends on your income and family size. You can apply for subsidies through Covered California, the state’s health insurance marketplace.

- Tax Credits:The federal government offers tax credits to help individuals and families afford health insurance. These credits are available to those who purchase health insurance through the Marketplace and meet certain income requirements. The tax credits can be claimed on your federal income tax return, reducing your tax liability.

Strategies for Finding Affordable Options

Several strategies can help you find affordable health insurance options in California:

- Shop Around:Compare quotes from different insurance companies and plans to find the most affordable option that meets your needs. You can use Covered California’s website to compare plans and prices.

- Consider a High-Deductible Plan:High-deductible health plans (HDHPs) generally have lower premiums but require you to pay a higher deductible before your insurance coverage kicks in. This option can be cost-effective if you are generally healthy and do not anticipate needing frequent healthcare services.

- Take Advantage of Financial Assistance:Explore the subsidies and tax credits available through Covered California and the federal government. These programs can significantly reduce your premium costs.

- Negotiate with Your Employer:If you have employer-sponsored health insurance, discuss with your employer the possibility of negotiating lower premiums or exploring other affordable plan options.

- Look for Discounts:Some insurance companies offer discounts for healthy habits, such as non-smoking or participation in wellness programs.

Navigating the System

Navigating California’s health insurance system can be a daunting task, but with a little understanding and effort, you can find a plan that meets your needs and budget. This section will guide you through the process of comparing plans, filing claims, and managing healthcare costs.

Comparing and Choosing Plans

When comparing plans, it’s crucial to consider your individual needs and priorities. The California Department of Insurance offers a comprehensive online tool, Covered California, which allows you to compare plans side-by-side based on factors such as cost, coverage, and provider network.

Navigating the complexities of California health insurance can be overwhelming, but remember, taking care of your health is paramount. A healthy lifestyle can often be a key factor in managing costs. Consider incorporating beauty practices into your routine, like those offered by canas beauty , to enhance your overall well-being.

Remember, a healthy body and a healthy mind go hand in hand, and a comprehensive health insurance plan can provide the peace of mind you need to prioritize both.

- Cost:Consider your monthly premium, deductible, and co-pays. You can use Covered California’s cost calculator to estimate your monthly premium based on your income and household size.

- Coverage:Review the plan’s benefits, including what services are covered, and any limitations or exclusions. Ensure the plan covers the services you need, such as preventive care, hospitalization, and prescription drugs.

- Provider Network:Verify that your preferred doctors and hospitals are included in the plan’s network. Out-of-network services can be significantly more expensive.

- Customer Service:Read reviews and ratings of different insurance companies to get an idea of their customer service reputation. You can also contact the companies directly to ask questions about their plans and policies.

Filing Claims and Resolving Disputes

Once you have chosen a plan, you’ll need to understand the process for filing claims and resolving disputes with your insurance provider.

- Filing Claims:When you receive medical care, you will need to file a claim with your insurance provider. You can typically do this online, by mail, or by phone. Make sure to keep all receipts and medical records for your records.

- Resolving Disputes:If you have a dispute with your insurance provider, you can file a complaint with the California Department of Insurance. The department will investigate your complaint and attempt to resolve it between you and the insurance company.

Managing Healthcare Costs

Managing healthcare costs is an important aspect of maintaining your health and financial well-being.

- Preventive Care:Take advantage of preventive care services, such as annual checkups and screenings, as they can help prevent more serious health problems in the future. Many plans cover these services at no cost.

- Generic Medications:Ask your doctor about generic medications, which are often less expensive than brand-name drugs.

- Negotiating Costs:Don’t be afraid to negotiate with healthcare providers about their fees. Many providers are willing to work with patients to find affordable payment options.

- Health Savings Account (HSA):If you have a high-deductible health plan, consider opening a Health Savings Account (HSA). You can contribute pre-tax dollars to an HSA and use the funds to pay for qualified medical expenses.

Special Considerations

California’s health insurance landscape has specific provisions and considerations for various groups and situations. Understanding these nuances is crucial for making informed decisions about your health insurance coverage.

Health Insurance Coverage for Specific Groups

The state of California offers special programs and provisions to ensure access to healthcare for vulnerable populations. These include:

- Children:The California Children’s Services (CCS) program provides comprehensive health coverage for children with special health care needs. Eligibility is based on income and medical conditions.

- Seniors:Medicare is the primary health insurance program for individuals aged 65 and older. However, California offers supplemental programs like Medi-Cal, which provides additional financial assistance for healthcare costs.

- Individuals with Pre-existing Conditions:The Affordable Care Act (ACA) prohibits health insurance companies from denying coverage or charging higher premiums based on pre-existing conditions. This ensures access to healthcare for individuals with chronic illnesses or disabilities.

Impact of Changes in Employment Status

Changes in employment status can significantly impact health insurance coverage.

- Job Loss:If you lose your job, you may be eligible for COBRA (Consolidated Omnibus Budget Reconciliation Act) coverage, which allows you to continue your employer-sponsored health insurance for a limited time at your own expense.

- New Job:When starting a new job, you’ll typically have an open enrollment period to choose your health insurance plan. Be sure to compare different options and select the plan that best meets your needs and budget.

- Self-Employment:If you’re self-employed, you have the option to purchase individual health insurance plans through the Covered California marketplace. You may also be eligible for tax credits to help offset the cost of premiums.

Unique Aspects of California’s Health Insurance Landscape

California has implemented several unique programs and initiatives to improve access to affordable healthcare.

- Covered California:This state-based marketplace provides a platform for individuals and families to compare and purchase health insurance plans from different insurance companies.

- Medi-Cal:California’s version of Medicaid, Medi-Cal, offers health insurance coverage to low-income individuals and families. Eligibility is based on income and other factors.

- Health Insurance Exchange:California’s health insurance exchange is designed to streamline the process of shopping for and enrolling in health insurance plans.

Ending Remarks

Understanding California’s health insurance system is crucial for ensuring access to quality healthcare. By familiarizing yourself with the different plan types, eligibility criteria, and cost factors, you can navigate the system confidently and secure the coverage that best meets your needs.

Remember, resources are available to help you along the way, from Covered California to individual insurance agents and financial assistance programs. Take advantage of these resources and prioritize your health and well-being.

FAQ Guide

What are the main types of health insurance plans available in California?

California offers a variety of health insurance plans, including HMOs, PPOs, POS plans, and EPOs. Each plan type has its own unique features and benefits, so it’s important to compare them carefully to find the one that best suits your needs.

How do I know if I’m eligible for financial assistance with my health insurance premiums?

California offers a number of financial assistance programs, including subsidies and tax credits, to help individuals and families afford health insurance. To determine your eligibility, you can visit Covered California’s website or contact a certified enrollment counselor.

What are the essential health benefits covered by California health insurance plans?

California health insurance plans must cover a set of essential health benefits, including preventive care, hospitalization, emergency services, prescription drugs, and mental health services. These benefits are designed to ensure that all Californians have access to essential healthcare services.

How do I file a claim with my health insurance provider?

The process for filing a claim varies depending on your insurance provider. However, most providers offer online claim filing options, as well as the ability to file by phone or mail. It’s important to keep track of your claim number and follow up with your provider if you don’t receive a response within a reasonable timeframe.