Federal health open season sets the stage for an annual opportunity to review and potentially change your health insurance plan. During this period, federal employees and their dependents have the chance to explore a range of health plans and coverage options, ensuring their healthcare needs are met.

This guide provides a comprehensive overview of the open season, helping you navigate the process and make informed decisions about your health insurance.

Open season is a time for reflection and strategic planning. It’s an opportunity to assess your current health plan, consider any changes in your family’s needs, and explore new options that may better align with your budget and medical requirements.

Whether you’re a seasoned federal employee or a new enrollee, understanding the open season process is essential for making informed choices that benefit your health and well-being.

Federal Health Open Season Overview

Federal Health Open Season is an annual opportunity for Federal employees, retirees, and their families to review and make changes to their health insurance plans. It’s a time to assess your current coverage and choose the plan that best fits your needs and budget for the coming year.

Federal Health Open Season is a great time to review your health insurance options. If you live in the Battle Creek area, you might want to consider Grace Health as a potential provider. They offer a range of plans and services, and you may be able to find a plan that fits your needs and budget during Open Season.

Don’t forget to compare options and make the best choice for you and your family.

Key Dates for Open Season, Federal health open season

The Open Season period is a specific timeframe during which you can make changes to your health insurance plan. It’s crucial to note these dates, as they are set by the Office of Personnel Management (OPM).

- Open Season Start Date:[Insert Open Season Start Date]

- Open Season End Date:[Insert Open Season End Date]

Eligible Federal Employees and Dependents

Federal employees and their dependents have the opportunity to enroll in a health plan during Open Season. To understand your eligibility, it’s essential to know the categories of employees and dependents who can participate in the program.

Federal Employees Eligible to Enroll

Federal employees eligible to enroll in a health plan during Open Season are those who are:

- Full-time employees of the Federal Government

- Part-time employees of the Federal Government who work at least 20 hours per week

- Employees of the U.S. Postal Service

- Employees of the District of Columbia

- Members of the uniformed services

Dependent Enrollment Options

Dependents of eligible Federal employees can also enroll in a health plan during Open Season. The enrollment options for dependents include:

- Spouse:The spouse of an eligible Federal employee is eligible to enroll in a health plan.

- Children:Children of eligible Federal employees are also eligible to enroll. Children can be enrolled as dependents until they reach the age of 26, regardless of their student status or dependency status.

Eligibility Requirements and Restrictions

There are certain eligibility requirements and restrictions that apply to Federal employees and dependents who wish to enroll in a health plan during Open Season. These include:

- Proof of Eligibility:Employees and dependents must provide proof of their eligibility to enroll. This typically includes documentation such as a birth certificate, marriage certificate, or court order.

- Coverage Period:Coverage for Federal employees and dependents generally begins on the first day of the month following the Open Season period.

- Waiting Period:There may be a waiting period for new employees before they can enroll in a health plan.

- Open Enrollment Period:The Open Enrollment period is a specific time frame during which eligible Federal employees and dependents can make changes to their health plan selections.

Available Health Plans and Coverage Options: Federal Health Open Season

This section will provide a comprehensive overview of the health plans available to federal employees and their families during the Federal Health Open Season. We will delve into the various options, including their key features, premium costs, benefits, and network coverage.

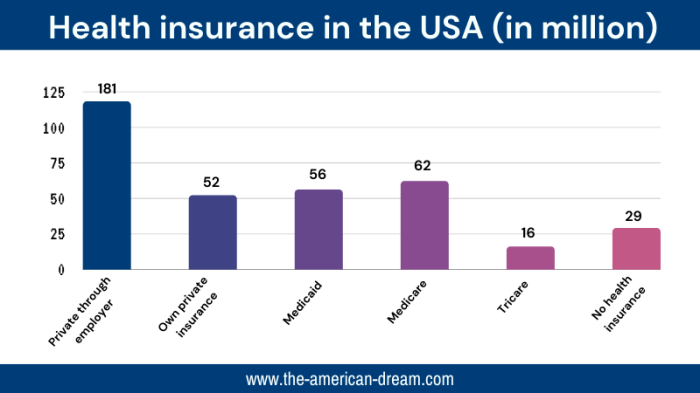

Health Plan Options

The Federal Employees Health Benefits (FEHB) Program offers a wide array of health plans to choose from. These plans are categorized into two main types:

- Self-Plus One:This plan covers the employee and one other person, such as a spouse or domestic partner.

- Family:This plan covers the employee and their dependents, including a spouse and children.

It is important to note that eligibility for certain plans may vary based on your specific circumstances, so it’s crucial to review the plan details carefully.

Federal Health Open Season is a great time to review your health insurance options. If you’re in the Encinitas area, consider checking out Sage Health Encinitas for a personalized consultation. They can help you understand your coverage choices and find the best plan for your needs during this annual enrollment period.

FEHB Plans

The FEHB Program offers a diverse range of health plans from different insurance companies, each with unique features and coverage options. These plans can be broadly classified into four main categories:

- Standard Option:These plans typically have a lower premium but higher out-of-pocket costs. They offer a wide network of healthcare providers and hospitals.

- High Deductible Health Plan (HDHP):These plans have lower premiums but require a higher deductible before coverage kicks in. They are often paired with a Health Savings Account (HSA), allowing you to save pre-tax dollars for healthcare expenses.

- Federal Employees Dental and Vision Insurance Program (FEDVIP):This program offers dental and vision coverage separately from your FEHB plan. You can choose from various dental and vision plans, each with different premiums and benefits.

- Medicare:Federal employees who are eligible for Medicare can enroll in a Medicare plan through FEHB. Medicare Part B premiums are deducted from your paycheck, while Medicare Part A premiums are paid directly to the Medicare program.

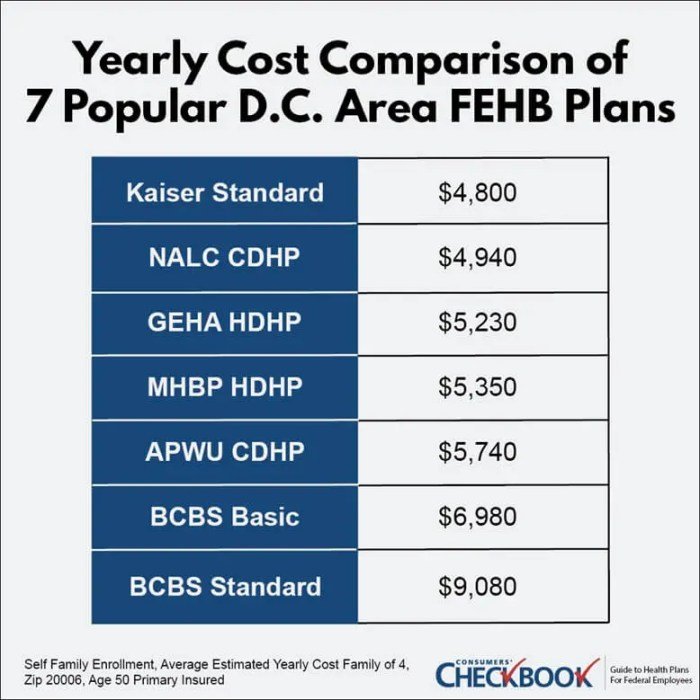

Plan Comparison

The following table provides a general comparison of the different health plan options available under FEHB, highlighting their key features, premiums, benefits, and network coverage. Remember, specific details may vary based on the individual plan chosen and your location.

Federal Health Open Season is a great time to review your health insurance options. If you’re looking for quality care in the Pittsburgh area, consider Allegheny Health Network, which includes facilities like allegheny health network wexford hospital. This hospital offers a range of services, so you can find the right plan to meet your needs during this year’s open season.

| Plan Type | Key Features | Premiums | Benefits | Network Coverage |

|---|---|---|---|---|

| Standard Option | Lower premiums, higher out-of-pocket costs, wide network | Vary depending on plan and location | Comprehensive coverage for medical services | Wide network of healthcare providers and hospitals |

| High Deductible Health Plan (HDHP) | Lower premiums, higher deductible, HSA-eligible | Vary depending on plan and location | Limited coverage until deductible is met | Wide network of healthcare providers and hospitals |

| FEDVIP | Separate dental and vision coverage | Vary depending on plan and location | Dental and vision services | Wide network of dental and vision providers |

| Medicare | Medicare Part A and Part B coverage | Part B premiums deducted from paycheck, Part A premiums paid directly to Medicare | Comprehensive coverage for eligible medical services | Wide network of healthcare providers and hospitals |

Coverage Options

Each FEHB plan offers various coverage options, including deductibles, copayments, and out-of-pocket maximums. These options can significantly impact your overall healthcare costs, so it’s crucial to understand their implications:

- Deductible:The amount you pay out-of-pocket before your health insurance coverage kicks in.

- Copayment:A fixed amount you pay for certain medical services, such as doctor’s visits or prescriptions.

- Out-of-Pocket Maximum:The maximum amount you’ll pay for covered healthcare expenses in a year, after which your health insurance will cover 100% of the costs.

Enrollment and Plan Changes

Open Season is your chance to review your health insurance options and make changes to your coverage for the upcoming year. This is an important opportunity to ensure you have the right plan to meet your health needs and budget.

Enrollment Process

The enrollment process is straightforward and can be completed online, by phone, or through the mail. Here’s a step-by-step guide to help you navigate the process:

- Review your current plan:Start by carefully reviewing your current health plan. Consider your healthcare needs, budget, and any changes in your family or health status since last year.

- Explore available plans:Visit the Federal Employees Health Benefits (FEHB) website or your agency’s benefits website to explore the range of plans available.

- Compare plans:Compare plans based on factors like premiums, deductibles, copayments, and coverage for specific services. You can use the FEHB website’s Plan Finder tool to compare plans side-by-side.

- Choose your plan:Once you’ve chosen a plan, you can enroll or make changes to your existing coverage.

- Complete the enrollment form:You can complete the enrollment form online, by phone, or through the mail.

- Submit your enrollment form:Make sure to submit your enrollment form by the Open Season deadline to ensure your changes take effect.

Plan Changes

Making changes to your health plan during Open Season can impact your coverage and costs. Here’s what you need to know:

- Switching plans:Switching to a different health plan will affect your coverage and costs.

- Adding or dropping dependents:Adding or dropping dependents from your plan will also impact your coverage and costs.

- Open Season deadline:It’s crucial to submit your enrollment changes by the Open Season deadline to avoid disruptions in your coverage.

Enrollment Resources

For assistance navigating the enrollment process, you can access various resources:

- FEHB website:The FEHB website provides comprehensive information about enrollment, plans, and coverage options.

- Your agency’s benefits office:Your agency’s benefits office can answer questions and provide personalized guidance on enrollment.

- Health insurance brokers:Licensed health insurance brokers can assist you in comparing plans and making informed decisions.

Resources and Support for Decision-Making

Making the right health plan choice during Open Season can be crucial for your well-being and finances. The good news is that you have access to various resources and support to help you make an informed decision. This section will Artikel the key resources available to you and guide you through the process of comparing plans and making the best choice for your needs.

Official Websites and Resources

The official websites and resources provide comprehensive information about Open Season, including eligibility, plan options, and enrollment procedures.

- Federal Employees Health Benefits Program (FEHB) website:The FEHB website is your primary source for information about Open Season. It provides detailed information about all available health plans, their coverage options, costs, and enrollment procedures. You can also use the website to compare plans side-by-side, find plan brochures, and access FAQs.

- Office of Personnel Management (OPM) website:The OPM website offers general information about Open Season, including eligibility criteria, enrollment deadlines, and important dates. You can also find resources on how to choose a health plan and how to make changes to your existing coverage.

- Your agency’s benefits website:Your agency’s benefits website may provide additional information about Open Season, including local resources and support services. Check your agency’s website for specific information relevant to your workplace.

Key Resources and Contact Information

| Resource | Website | Phone Number |

|---|---|---|

| Federal Employees Health Benefits Program (FEHB) | https://www.opm.gov/healthcare/plan-information/index.aspx | (202) 606-0800 |

| Office of Personnel Management (OPM) | https://www.opm.gov/ | (202) 606-0800 |

| Your agency’s benefits office | [Your agency’s website] | [Your agency’s benefits office phone number] |

Tools and Resources for Comparing Plans

To make an informed decision, you need to compare different plans and their coverage options. Several tools and resources can help you with this process.

- FEHB Plan Finder:The FEHB Plan Finder tool allows you to compare plans side-by-side based on your needs and preferences. You can filter plans by location, coverage options, and cost, making it easier to find the best fit for you.

- FEHB Plan Brochures:Each health plan offers a detailed brochure that Artikels its coverage options, costs, and benefits. Review these brochures carefully to understand the specific details of each plan.

- Health Plan Comparison Websites:Several websites, such as eHealth, allow you to compare health plans from different insurance providers. These websites can be helpful in understanding the broader health insurance market and comparing options outside of the FEHB program.

- Health Insurance Navigators:Health insurance navigators are trained professionals who can provide personalized guidance on choosing a health plan. They can help you understand your options, compare plans, and make the best decision for your needs.

Considerations for Choosing a Health Plan

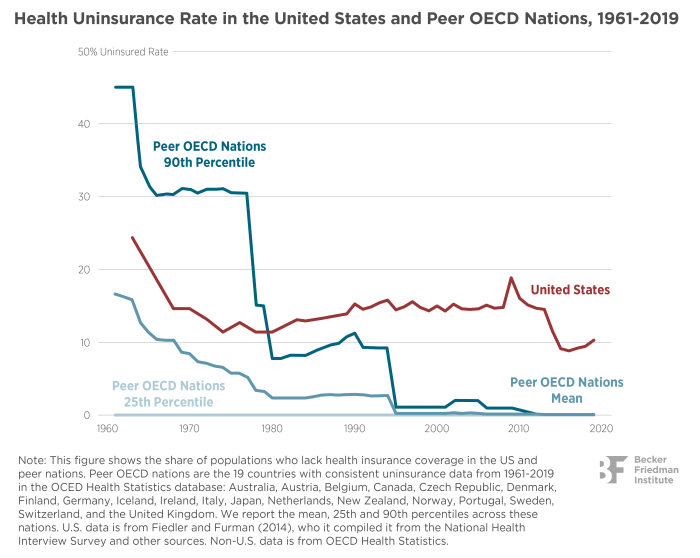

Open season is a time to review your health insurance needs and make sure you have the right coverage for you and your family. Choosing the right health plan can have a significant impact on your healthcare costs and access to care.

Factors to Consider

It’s essential to consider several factors when selecting a health plan. Here are some key aspects to evaluate:

- Medical Needs:Think about your current and anticipated healthcare needs. If you have pre-existing conditions, you’ll want to ensure your chosen plan covers them adequately. If you expect to have routine checkups, preventive care, or specialized treatments, consider plans that offer comprehensive coverage in those areas.

- Budget:Determine your budget for health insurance premiums and out-of-pocket costs. Compare the monthly premiums of different plans and consider the deductible, copayments, and coinsurance amounts. Some plans may have lower premiums but higher out-of-pocket costs, while others might offer higher premiums but lower out-of-pocket expenses.

- Preferred Providers:Check if your preferred doctors, hospitals, and specialists are included in the plan’s network. If you have a specific doctor you want to continue seeing, ensure they are part of the plan’s network.

Evaluating Plan Options

Once you’ve considered your medical needs, budget, and preferred providers, you can start evaluating specific plan options. Here are some tips for making informed decisions:

- Compare Plans Side-by-Side:Use the plan comparison tools provided by the Federal Employees Health Benefits (FEHB) Program. This allows you to see the premiums, deductibles, copayments, and other key features of different plans.

- Review Plan Documents:Carefully read the plan’s brochure and summary of benefits to understand the coverage details. Pay attention to the formulary (list of covered medications), exclusions, and limitations.

- Consider Your Health History:Think about your past medical expenses and healthcare utilization. If you have a history of high healthcare costs, you may want to consider a plan with lower out-of-pocket costs.

- Seek Professional Advice:If you’re unsure about which plan is right for you, consult with a health insurance broker or advisor. They can provide personalized guidance based on your specific needs and circumstances.

Impact of Plan Choices on Healthcare Costs and Access

Your choice of health plan can significantly affect your healthcare costs and access to care. For example:

- Lower Premiums vs. Higher Out-of-Pocket Costs:Some plans may have lower premiums but higher deductibles and copayments. This means you’ll pay less each month but potentially more for healthcare services.

- Limited Network vs. Wider Access:Plans with narrower networks may have lower premiums but limit your choice of doctors and hospitals. Plans with wider networks may have higher premiums but provide greater flexibility.

- Formulary Coverage:The formulary, or list of covered medications, can impact your access to certain drugs. Some plans may cover a wider range of medications than others.

Summary

Navigating the federal health open season can seem daunting, but with careful planning and an understanding of the available resources, it can be a smooth and rewarding experience. By taking the time to explore your options, compare plans, and consider your individual circumstances, you can confidently choose a health plan that provides the best coverage and value for you and your family.

Remember, open season is your chance to take control of your health insurance and ensure you have the right coverage for the year ahead.

FAQ Corner

What are the key dates for the current open season?

The open season dates vary each year. You can find the current dates on the Office of Personnel Management (OPM) website.

Can I enroll in a new health plan if I’m already enrolled in one?

Yes, you can enroll in a new plan, change your coverage, or drop your coverage during open season.

What if I have a pre-existing condition?

Federal health plans are required to cover pre-existing conditions. You cannot be denied coverage or charged higher premiums based on your health status.

Where can I find more information about open season?

The OPM website is the primary resource for information about open season, including plan details, enrollment procedures, and contact information.