Health insurance licensure is a critical step for individuals seeking a career in the insurance industry. It ensures that professionals possess the necessary knowledge and skills to provide competent and ethical advice to clients.

This comprehensive guide will explore the intricacies of obtaining and maintaining a health insurance license, covering essential aspects such as licensing requirements, examination procedures, ethical considerations, and career pathways. Whether you are a seasoned professional or a newcomer to the field, this information will equip you with the tools to navigate the licensing process successfully.

Understanding Health Insurance Licensure

Obtaining a health insurance license is a crucial step for individuals seeking to work in the insurance industry. It ensures that professionals possess the necessary knowledge and skills to advise clients effectively on health insurance plans and options.

Types of Health Insurance Licenses

The specific types of health insurance licenses available vary depending on the state or jurisdiction. However, common categories include:

- Life and Health Insurance License:This is a broad license that allows individuals to sell various types of insurance, including health, life, and disability insurance.

- Property and Casualty Insurance License:This license focuses on property and casualty insurance, such as auto, homeowners, and business insurance.

- Accident and Health Insurance License:This license is specifically for selling accident and health insurance, including medical, dental, and vision insurance.

- Health Insurance Agent License:This license is for individuals who primarily sell health insurance plans, such as individual health insurance, group health insurance, and Medicare supplements.

Requirements for Obtaining a Health Insurance License

To qualify for a health insurance license, individuals must typically meet specific requirements, including:

- Age Requirements:Most states require applicants to be at least 18 years old.

- Residency Requirements:Applicants must typically reside in the state where they are seeking licensure.

- Criminal Background Check:A criminal background check is usually required to ensure that applicants have no history of fraudulent or illegal activities.

- Education and Training:Applicants must complete a pre-licensing education course that covers the fundamentals of health insurance.

- Examination:After completing the pre-licensing course, applicants must pass a state-administered examination to demonstrate their understanding of health insurance principles and regulations.

- Continuing Education:Once licensed, insurance professionals must complete continuing education courses to maintain their licenses and stay updated on industry changes and regulations.

The Licensing Process

Obtaining a health insurance license is a crucial step for individuals seeking to work in the insurance industry. This process ensures that professionals possess the necessary knowledge and understanding to provide competent and ethical services to clients. The licensing process typically involves several steps, including application, examination, and background check.

Application Process, Health insurance lic

The application process for a health insurance license typically begins with submitting an application form to the relevant state insurance department. This application usually requires personal information, such as name, address, and social security number, as well as professional details, including education, work history, and any previous licenses held.

The application may also require the applicant to disclose any criminal convictions or disciplinary actions taken against them in the past.

Examination Process

The licensing exam is designed to assess an applicant’s knowledge and understanding of health insurance principles, regulations, and practices. The exam format varies depending on the state, but it usually consists of multiple-choice questions covering topics such as:

- Insurance fundamentals

- Health insurance plans and coverage

- Underwriting and risk assessment

- Sales and marketing practices

- Ethics and compliance

- State and federal regulations

The exam is typically administered by a third-party testing organization, and the passing score varies by state.

Obtaining a health insurance license can be a challenging yet rewarding process. It’s important to research and understand the specific requirements in your state. While navigating this journey, you might also find inspiration in exploring the world of beauty, such as the payal beauty brand, which offers a range of skincare and wellness products.

Ultimately, prioritizing your health and well-being is essential, and having a health insurance license can provide you with the tools and knowledge to help others achieve their own health goals.

Preparing for the Licensing Exam

Preparing for the licensing exam is essential for success. Here are some resources and tips for effective preparation:

- Study materials:Utilize official study guides, textbooks, and practice exams provided by the licensing body or reputable third-party providers. These resources will help you understand the exam content and format.

- Review courses:Consider enrolling in review courses offered by insurance organizations or educational institutions. These courses provide comprehensive instruction and guidance from experienced instructors.

- Practice exams:Take advantage of practice exams to assess your knowledge and identify areas for improvement. Practice exams help you familiarize yourself with the exam format and time management strategies.

- Time management:Allocate sufficient time for studying and practice. Create a study schedule that allows for consistent review and practice sessions.

- Seek support:Don’t hesitate to seek support from experienced professionals or mentors in the insurance industry. They can provide valuable insights and guidance throughout your preparation.

Maintaining a Health Insurance License

Maintaining a valid health insurance license is crucial for agents to continue practicing. This involves fulfilling continuing education requirements and renewing the license periodically.

Continuing Education Requirements

Continuing education ensures that licensed agents stay up-to-date with industry changes and regulations. Most states mandate a specific number of continuing education hours for license renewal. These requirements vary by state and can be found on the state insurance department website.

- Continuing Education Hours:States typically require agents to complete a certain number of continuing education hours within a specific timeframe, usually within a two-year period. The number of required hours can range from 24 to 40 hours, depending on the state.

Navigating the world of health insurance lic can be a complex process, especially when considering mental health needs. It’s crucial to understand how mental health benefits are incorporated into your policy. For a deeper dive into the importance of mental health awareness, check out this resource on mental health awa.

By understanding the nuances of both health insurance lic and mental health awareness, you can make informed decisions about your health and wellbeing.

- Approved Courses:Agents can earn continuing education credits by completing approved courses. These courses may cover topics like:

- Ethics and compliance

- Changes in health insurance regulations

- New products and services

- Medicare and Medicaid updates

- Course Providers:Continuing education courses are offered by various providers, including insurance companies, industry associations, and educational institutions. Agents should ensure that the courses they take are approved by their state insurance department.

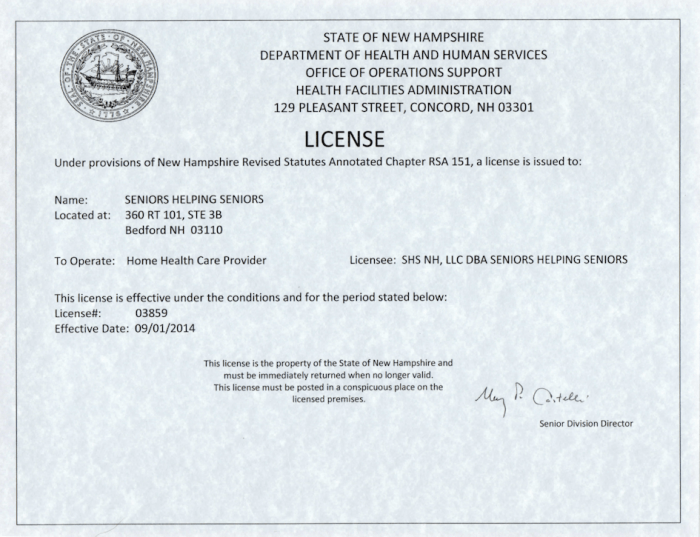

License Renewal Process

Renewal procedures vary by state, but generally involve the following steps:

- Complete Continuing Education:Agents must meet the continuing education requirements for their state.

- Submit Renewal Application:Agents need to complete and submit a renewal application to the state insurance department. This application typically includes personal information, license number, and continuing education completion details.

- Pay Renewal Fee:A renewal fee is usually required for license renewal. The fee amount varies by state.

- License Renewal:Upon successful completion of the renewal process, the state insurance department will issue a new license.

Consequences of Non-Compliance

Failing to meet continuing education requirements or renew a license on time can result in penalties, including:

- License Suspension or Revocation:A state insurance department may suspend or revoke a license if an agent fails to comply with continuing education requirements or license renewal deadlines.

- Fines:States may impose fines on agents who fail to renew their licenses or meet continuing education requirements.

- Legal Action:In some cases, non-compliance with licensing regulations could lead to legal action, such as lawsuits or investigations.

Ethical Considerations in Health Insurance Sales

Selling health insurance is a crucial responsibility that requires navigating ethical considerations to ensure fair and transparent practices. Licensed agents must prioritize the best interests of their clients, providing accurate information and guiding them towards the most suitable coverage options.

Ethical Responsibilities of Licensed Health Insurance Agents

Licensed health insurance agents have a significant ethical obligation to act with integrity and professionalism. Their primary responsibility is to prioritize the needs and interests of their clients, ensuring they receive accurate and unbiased information. This includes:

- Honesty and Transparency:Agents must be truthful and transparent in their communications, providing clients with all relevant information about policies, including potential limitations and exclusions. This ensures clients can make informed decisions based on accurate data.

- Confidentiality:Agents must maintain the confidentiality of their clients’ personal and financial information. This is crucial for building trust and protecting sensitive data.

- Competence:Agents should have a thorough understanding of the health insurance market, different types of plans, and relevant regulations. This ensures they can effectively advise clients on the most suitable coverage options.

- Fairness and Objectivity:Agents must act fairly and objectively when recommending policies. They should not prioritize personal gain or commissions over the client’s best interests.

- Compliance with Regulations:Agents must adhere to all applicable state and federal regulations regarding health insurance sales and marketing practices.

Legal and Regulatory Framework

The health insurance industry is subject to a complex web of federal and state laws and regulations designed to protect consumers and ensure fair market practices. Understanding these legal and regulatory frameworks is crucial for health insurance agents, as they are directly responsible for adhering to these rules in their sales activities.

Federal Laws

Federal laws provide the foundation for the regulation of health insurance.

- The Health Insurance Portability and Accountability Act (HIPAA)protects the privacy and security of patient health information (PHI). It establishes standards for the use, disclosure, and safeguarding of PHI by health insurance companies and their agents.

- The Patient Protection and Affordable Care Act (ACA), commonly known as Obamacare, has significantly reshaped the health insurance landscape. It mandated the expansion of health insurance coverage, established health insurance marketplaces, and introduced regulations like the individual mandate and essential health benefits.

- The Employee Retirement Income Security Act (ERISA)regulates employer-sponsored health insurance plans. It sets standards for the administration and disclosure of plan information, including benefit levels and claim procedures.

- The Fair Credit Reporting Act (FCRA)governs the use of consumer credit information in insurance underwriting. It protects consumers’ rights to access and dispute their credit reports.

State Laws

State laws play a significant role in regulating the specific aspects of health insurance sales within their jurisdictions.

- State insurance departments are responsible for licensing and regulating health insurance agents, brokers, and companies. They set standards for licensing exams, continuing education requirements, and ethical conduct.

- States have their own laws regarding insurance policy provisions, such as coverage for pre-existing conditions, waiting periods, and benefit limits.

- State laws may also address specific insurance products, like long-term care insurance or Medicare supplement plans.

Regulatory Bodies

Several regulatory bodies play a role in overseeing the health insurance industry:

- The National Association of Insurance Commissioners (NAIC)is a non-governmental organization that develops model laws and regulations for state insurance departments to consider adopting.

- The Centers for Medicare & Medicaid Services (CMS)administers the Medicare and Medicaid programs and sets regulations for participating health insurance companies.

- The Federal Trade Commission (FTC)enforces consumer protection laws, including those related to insurance advertising and marketing.

Implications of Legal and Regulatory Changes

Changes in legal and regulatory frameworks can significantly impact health insurance agents:

- Agents must stay informed about new laws and regulations and adjust their sales practices accordingly. This includes updating their knowledge about eligibility requirements, benefit options, and consumer protections.

- Regulatory changes can impact the products and services agents offer, requiring them to adapt their sales strategies. For example, the ACA’s introduction of essential health benefits mandated that all plans include specific coverage, influencing product design and sales approaches.

- Compliance with new regulations is crucial to avoid penalties and maintain their licenses. Agents must understand their obligations and ensure they are adhering to the latest requirements.

Career Paths in Health Insurance

A health insurance license opens doors to a variety of rewarding career paths within the dynamic and essential health insurance industry. Whether you prefer client-facing roles or behind-the-scenes operations, a license equips you with the knowledge and skills to thrive in this field.

Career Paths for Licensed Health Insurance Professionals

A health insurance license is a valuable asset, providing access to diverse career paths within the health insurance industry. Here are some common career paths for licensed professionals:

- Health Insurance Agent/Broker:These professionals act as intermediaries between individuals or businesses and insurance companies. They advise clients on coverage options, explain policy details, and help them choose the most suitable plan.

- Insurance Sales Representative:These individuals focus on selling health insurance products to individuals, families, and businesses. They often work for insurance companies directly and are responsible for generating leads, conducting presentations, and closing sales.

- Health Insurance Underwriter:Underwriters assess risk and determine the eligibility and premium rates for insurance policies. They analyze applications, review medical records, and make decisions on coverage based on individual circumstances.

- Claims Adjuster:Claims adjusters investigate and process insurance claims submitted by policyholders. They determine the validity of claims, assess damages, and authorize payments.

- Health Insurance Specialist/Analyst:These professionals conduct research, analyze data, and provide insights on health insurance trends, market conditions, and regulatory changes. They may work for insurance companies, consulting firms, or government agencies.

- Health Insurance Consultant:Consultants advise businesses and organizations on developing and implementing health insurance plans. They help employers design comprehensive benefits packages, manage risk, and optimize costs.

The Future of Health Insurance Licensure

The health insurance industry is undergoing a period of rapid transformation, driven by technological advancements, evolving consumer expectations, and changing regulatory landscapes. These changes are impacting how health insurance is sold and how licenses are obtained and maintained. This section explores the emerging trends and technologies shaping the future of health insurance licensure.

Impact of Technology on Health Insurance Sales

Technological advancements are reshaping the health insurance landscape, influencing how policies are sold, serviced, and regulated. Here are some of the key technological trends influencing health insurance sales:

- Artificial Intelligence (AI):AI is being used to automate tasks, personalize customer experiences, and improve fraud detection. AI-powered chatbots and virtual assistants are increasingly used to answer customer questions and provide support. AI algorithms can analyze vast amounts of data to identify patterns and predict future trends, which can help insurance companies develop more targeted products and services.

Navigating the world of health insurance can be a bit like deciphering a mystical riddle, but it doesn’t have to be a beastly experience. There are resources available to help you understand your options and find the right coverage for your needs, just like the beauty and beast rose in glass offers a glimpse into a world of enchantment.

With a little research and the right guidance, you can find a policy that fits your budget and provides the protection you need.

- Big Data and Analytics:The availability of large datasets and advanced analytics tools is enabling insurance companies to gain deeper insights into customer behavior, risk factors, and market trends. This information can be used to personalize pricing, develop new products, and improve risk assessment.

- Mobile Apps and Digital Platforms:Mobile apps and digital platforms are making it easier for consumers to compare insurance plans, purchase policies, and manage their coverage online. This shift towards digital channels is creating new opportunities for insurance agents and brokers to reach customers and build relationships.

- Blockchain Technology:Blockchain technology offers the potential to streamline insurance processes, improve security, and reduce fraud. Blockchain can be used to track claims, manage policies, and verify identities. It can also be used to create a decentralized marketplace for insurance products.

Wrap-Up: Health Insurance Lic

Navigating the world of health insurance licensure can be challenging, but with proper preparation and understanding, it can be a rewarding journey. This guide has provided a roadmap to success, highlighting key aspects of the licensing process, ethical considerations, and career opportunities.

Remember, staying informed, adhering to regulations, and upholding ethical standards are crucial for a fulfilling and successful career in the health insurance industry.

FAQs

What are the benefits of obtaining a health insurance license?

A health insurance license opens doors to a rewarding career in the insurance industry, offering competitive salaries, benefits, and opportunities for growth.

How long does it take to get a health insurance license?

The time required to obtain a health insurance license varies depending on factors such as state regulations, study time, and exam preparation. It typically takes several weeks to a few months.

What are some common ethical dilemmas faced by health insurance agents?

Ethical dilemmas in health insurance sales include conflicts of interest, misleading clients, and prioritizing commissions over client needs.

What are the future trends in health insurance licensure?

The future of health insurance licensure is likely to be shaped by technological advancements, changing consumer expectations, and evolving regulatory landscapes.