Health insurers in Massachusetts play a vital role in providing access to healthcare for its residents. The state boasts a unique healthcare system, shaped by significant reforms over the years, making it a model for other states. The Massachusetts Health Connector, a state-run marketplace, simplifies the process of finding and enrolling in health insurance plans.

From traditional HMOs to more flexible PPOs, a wide array of plans cater to diverse needs and budgets. Understanding the factors that influence health insurance costs, including age, health status, and location, is crucial when choosing a plan.

Overview of Health Insurance in Massachusetts

Massachusetts stands out as a pioneer in health insurance reform, with a unique approach that emphasizes universal coverage and affordability. The state’s journey towards a comprehensive healthcare system has been marked by significant milestones, resulting in a model that has influenced national healthcare policy.

History of Health Insurance Reforms in Massachusetts

The state’s health insurance landscape has undergone a series of transformations over the years, driven by a commitment to ensuring access to affordable healthcare for all residents.

Health insurers in Massachusetts often cover a wide range of services, including preventative care and even some aesthetic treatments. If you’re looking for a reliable and reputable place to enhance your appearance, you might want to consider total skin and beauty birmingham.

Of course, it’s always best to check with your specific insurer to confirm coverage for any particular service before scheduling an appointment.

- Early 2000s:The state began addressing rising healthcare costs and coverage gaps by implementing a series of reforms, including the creation of the Commonwealth Care program in 2006. This program provided subsidized health insurance to low- and middle-income individuals and families who were previously uninsured.

- 2006:The passage of the landmark “Massachusetts Health Care Reform Act” marked a turning point. This legislation mandated that all residents have health insurance, with subsidies available to those who could not afford it. It also established the Massachusetts Health Connector, a state-based marketplace that facilitates access to health insurance plans.

- 2010:The Affordable Care Act (ACA) was enacted at the federal level, drawing inspiration from the Massachusetts reforms. The ACA’s provisions on individual mandates, subsidies, and insurance market regulations mirrored many of the elements of the Massachusetts law.

The Role of the Massachusetts Health Connector

The Massachusetts Health Connector serves as a central hub for residents to access health insurance plans, navigate the enrollment process, and receive support.

- Marketplace for Health Insurance Plans:The Connector offers a variety of health insurance plans from different insurers, allowing individuals and families to compare options and choose the plan that best meets their needs and budget.

- Enrollment Assistance:The Connector provides assistance to individuals and families throughout the enrollment process, helping them understand their options, apply for coverage, and resolve any issues that may arise.

- Financial Assistance:The Connector administers subsidies and tax credits to eligible individuals and families, making health insurance more affordable.

Types of Health Insurance Plans Available

Massachusetts offers a variety of health insurance plans to meet the needs of its residents. Understanding the different types of plans available is crucial for making an informed decision about your health coverage.

Health Maintenance Organizations (HMOs)

HMOs are known for their cost-effectiveness and focus on preventative care. They typically have lower premiums than other plan types.

- Network Restrictions:HMOs operate within a specific network of healthcare providers, meaning you must choose a primary care physician (PCP) within the network. You will need a referral from your PCP to see specialists.

- Lower Premiums:HMOs generally have lower monthly premiums than other plan types. This is because they manage healthcare costs by encouraging preventative care and limiting out-of-network access.

- Emphasis on Preventative Care:HMOs often emphasize preventative care services, such as routine checkups and screenings, as they help prevent more expensive medical issues later.

Preferred Provider Organizations (PPOs)

PPOs offer greater flexibility than HMOs, allowing you to see healthcare providers both in and out of their network. However, this flexibility comes with higher premiums.

- Wider Network Access:PPOs offer access to a broader network of healthcare providers, including specialists, without requiring referrals. You can choose to see a provider outside the network, but you will pay higher out-of-pocket costs.

- Higher Premiums:PPOs generally have higher monthly premiums than HMOs due to their wider network access and out-of-network coverage options.

- Greater Flexibility:PPOs provide greater flexibility in choosing healthcare providers, as you don’t need referrals to see specialists and can access out-of-network care if needed.

Point-of-Service (POS) Plans

POS plans combine elements of both HMOs and PPOs, offering a balance between cost-effectiveness and flexibility.

- Hybrid Approach:POS plans function similarly to HMOs but allow you to access out-of-network care for an additional cost. You typically need a referral from your PCP to see specialists within the network.

- Moderate Premiums:POS plans usually have moderate premiums compared to HMOs and PPOs, reflecting their hybrid approach.

- Limited Out-of-Network Coverage:While POS plans allow out-of-network care, they typically have higher out-of-pocket costs for such services compared to PPOs.

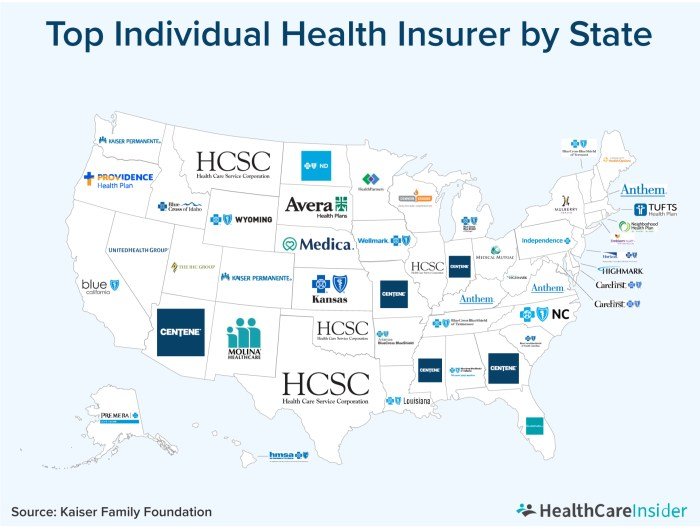

Major Health Insurance Companies in Massachusetts

Several major health insurance companies operate in Massachusetts, including:

- Blue Cross Blue Shield of Massachusetts:One of the largest insurers in the state, offering a wide range of plans.

- Harvard Pilgrim Health Care:Known for its focus on quality care and innovative programs.

- Tufts Health Plan:Offers a diverse range of plans, including HMOs, PPOs, and POS options.

- Fallon Health:A not-for-profit insurer focused on providing affordable and accessible care.

- Health New England:Offers plans through the Massachusetts Health Connector, providing affordable options for individuals and families.

Factors Affecting Health Insurance Costs

In Massachusetts, like most other states, health insurance premiums are influenced by various factors. Understanding these factors can help individuals make informed decisions about their health insurance coverage and find affordable options.

Age

Age is a significant factor in determining health insurance premiums. Generally, older individuals tend to have higher healthcare costs due to increased likelihood of chronic conditions and higher healthcare utilization. This is reflected in premium calculations, where older individuals often pay higher premiums than younger individuals.

Health insurers in Massachusetts play a crucial role in providing access to quality healthcare, and they often work in collaboration with various organizations to improve patient outcomes. One such organization is the national institute of health .gov , which conducts groundbreaking research and provides valuable insights into various health conditions.

This collaboration between insurers and the NIH can lead to better informed policies and improved healthcare delivery for individuals in Massachusetts.

Health Status

Health status plays a crucial role in premium calculations. Individuals with pre-existing conditions, such as diabetes or heart disease, may face higher premiums than those in good health. This is because they are more likely to require expensive medical care.

However, the Affordable Care Act (ACA) prohibits health insurers from denying coverage or charging higher premiums based solely on pre-existing conditions.

Location

The cost of living, including healthcare costs, varies significantly across different regions of Massachusetts. Health insurance premiums may be higher in areas with a higher concentration of specialists or advanced medical facilities. For example, premiums in Boston may be higher than in rural areas due to the higher cost of healthcare services in the city.

Government Subsidies and Cost-Sharing Programs

The Massachusetts Health Connector offers financial assistance to eligible individuals and families to make health insurance more affordable. These subsidies are based on income and family size, and they can significantly reduce the cost of premiums. Additionally, the Connector offers cost-sharing programs, such as the Essential Plan, which provide additional financial assistance to help cover out-of-pocket expenses.

Finding Affordable Health Insurance Options, Health insurers in massachusetts

Several strategies can help individuals find affordable health insurance options in Massachusetts:

- Shop around:Compare premiums and coverage from different health insurers to find the best value for your needs.

- Consider a higher deductible plan:High-deductible plans typically have lower monthly premiums but require you to pay more out-of-pocket before insurance coverage kicks in. This can be a good option for healthy individuals who are confident they can afford the deductible.

- Take advantage of government subsidies:If you qualify, apply for subsidies through the Massachusetts Health Connector to reduce your monthly premiums.

- Consider a Health Savings Account (HSA):HSAs allow you to save pre-tax dollars to pay for medical expenses. These accounts can help reduce your overall healthcare costs.

- Negotiate with your employer:If you have employer-sponsored health insurance, negotiate with your employer to see if they can offer more affordable options or contribute more to your premiums.

Accessing and Enrolling in Health Insurance

In Massachusetts, you can access and enroll in health insurance through the Massachusetts Health Connector, a state-run marketplace that offers a variety of plans from different insurance companies.

Enrollment Periods and Deadlines

The Massachusetts Health Connector offers several enrollment periods throughout the year. You can enroll in a health insurance plan during the annual open enrollment period, which typically runs from November 1st to January 15th. You can also enroll during a special enrollment period if you experience a qualifying life event, such as getting married, having a baby, or losing your job.

- Open Enrollment Period:This period typically runs from November 1st to January 15th, during which you can enroll in a health insurance plan regardless of your circumstances.

- Special Enrollment Period:This period allows you to enroll in a health insurance plan outside of the open enrollment period if you experience a qualifying life event. These events include getting married, having a baby, losing your job, or moving to a new county.

Choosing the Right Health Insurance Plan

Choosing the right health insurance plan can be challenging, but it’s essential to consider your individual needs and circumstances. It’s important to compare different plans and consider factors such as the monthly premium, deductible, copayments, and network of providers.

- Premium:The monthly cost you pay for your health insurance plan.

- Deductible:The amount you must pay out-of-pocket for healthcare services before your insurance plan starts covering the costs.

- Copayments:Fixed amounts you pay for specific healthcare services, such as doctor visits or prescription drugs.

- Network of Providers:The doctors, hospitals, and other healthcare providers that are covered by your insurance plan.

Key Considerations for Choosing a Health Insurer

Choosing the right health insurance plan is crucial for your financial well-being and access to healthcare. With numerous options available in Massachusetts, it’s essential to carefully consider your individual needs and preferences when making a decision.

Factors to Consider When Choosing a Health Insurer

It’s essential to evaluate different factors to determine the best health insurance plan for you. Here are some key aspects to consider:

| Factor | Explanation |

|---|---|

| Network of doctors and hospitals | Ensure your preferred doctors and hospitals are included in the insurer’s network. Out-of-network care can lead to higher costs. |

| Prescription drug coverage | Check the formulary (list of covered medications) and co-pays for your necessary prescriptions. |

| Customer service and claims processing | Read reviews and inquire about the insurer’s reputation for customer service and timely claims processing. |

| Cost and value for money | Compare premiums, deductibles, co-pays, and out-of-pocket maximums to find the most cost-effective plan that meets your healthcare needs. |

Comparison of Health Insurers in Massachusetts

Comparing the strengths and weaknesses of different health insurers can help you make an informed decision.

| Health Insurer | Strengths | Weaknesses |

|---|---|---|

| [Insurer 1 Name] | [List strengths, e.g., wide network, affordable premiums, good customer service] | [List weaknesses, e.g., limited prescription drug coverage, complex claims process] |

| [Insurer 2 Name] | [List strengths, e.g., comprehensive coverage, strong provider network, easy claims processing] | [List weaknesses, e.g., higher premiums, limited customer service availability] |

| [Insurer 3 Name] | [List strengths, e.g., innovative programs, strong customer support, value for money] | [List weaknesses, e.g., smaller network, limited provider options in certain areas] |

Health Insurance Regulations and Consumer Protections

In Massachusetts, a robust regulatory framework ensures fair and transparent practices in the health insurance market, safeguarding consumers’ rights and interests. The Division of Insurance, a key player in this system, plays a crucial role in overseeing the industry and ensuring compliance with regulations.

The Role of the Massachusetts Division of Insurance

The Division of Insurance, a division of the Massachusetts Office of Consumer Affairs and Business Regulation, is responsible for regulating the health insurance market in the state. This includes overseeing the licensing and operations of health insurers, setting rates, and enforcing consumer protection laws.

The Division also works to educate consumers about their rights and responsibilities under the state’s health insurance laws.

Navigating the world of health insurers in Massachusetts can be complex, especially when trying to find the best coverage for your needs. For those looking for top-notch fitness facilities, a great option is life fitness montvale nj. Staying healthy is a key component of managing your overall well-being, and finding the right health insurer in Massachusetts can help you achieve your fitness goals and maintain a healthy lifestyle.

Key Consumer Protection Laws and Regulations

Massachusetts has implemented several consumer protection laws and regulations to ensure fairness and transparency in the health insurance market. These include:

- The Massachusetts Health Insurance Connector: This agency helps individuals and families find and enroll in affordable health insurance plans. It also provides subsidies to help lower-income individuals and families afford coverage.

- The Massachusetts Group Insurance Commission (GIC): The GIC provides health insurance to state employees, retirees, and their dependents. It also offers a variety of health insurance plans and benefits.

- The Massachusetts Health Insurance Exchange: The Health Insurance Exchange is a marketplace where individuals and families can compare and purchase health insurance plans. It offers a variety of plans from different insurers, and it also provides subsidies to help lower-income individuals and families afford coverage.

- The Massachusetts Health Insurance Marketplace: This marketplace allows individuals and families to compare and purchase health insurance plans from different insurers. It also offers subsidies to help lower-income individuals and families afford coverage.

Filing Complaints or Seeking Assistance

Consumers can file complaints or seek assistance with health insurance issues through the Division of Insurance. The Division offers a variety of resources, including:

- A website with information about health insurance and consumer protection laws.

- A toll-free hotline where consumers can ask questions and file complaints.

- A complaint form that consumers can submit online or by mail.

Emerging Trends in Health Insurance: Health Insurers In Massachusetts

The health insurance landscape in Massachusetts is undergoing a significant transformation, driven by technological advancements, evolving healthcare models, and changing consumer preferences. These trends are reshaping the way individuals access and manage their healthcare, influencing the cost and quality of care.

The Impact of Telehealth and Digital Health Technologies

Telehealth and digital health technologies are revolutionizing the way healthcare is delivered in Massachusetts. These technologies offer convenience, accessibility, and cost-effectiveness, making healthcare more readily available to a wider population.

- Increased Access to Care:Telehealth platforms enable patients to consult with healthcare providers remotely, eliminating geographical barriers and facilitating access to specialized care. For example, patients in rural areas can connect with specialists in major cities without traveling long distances. This is particularly beneficial for individuals with limited mobility or those who live in areas with a shortage of healthcare professionals.

- Improved Patient Engagement:Digital health tools empower patients to actively participate in their healthcare journey. Wearable devices, mobile apps, and online platforms provide patients with real-time data about their health, enabling them to track their progress, manage chronic conditions, and make informed decisions about their care.

This enhanced engagement leads to better health outcomes and reduced healthcare costs.

- Cost Reduction:Telehealth consultations often cost less than traditional in-person visits, reducing out-of-pocket expenses for patients. Digital health technologies can also streamline administrative processes, leading to cost savings for both patients and insurers. For example, automated appointment scheduling and online claim submissions reduce administrative overhead for healthcare providers and insurers.

The Rise of Value-Based Care Models

Value-based care models are gaining traction in Massachusetts, shifting the focus from volume of services to the value of care delivered. These models incentivize healthcare providers to deliver high-quality care at a lower cost, aligning the interests of patients, providers, and insurers.

- Focus on Quality and Outcomes:Value-based care models emphasize the importance of achieving positive health outcomes for patients. Instead of simply paying for the number of services provided, insurers reimburse providers based on the quality of care delivered and the improvement in patient health.

This encourages providers to prioritize preventative care, manage chronic conditions effectively, and improve patient satisfaction.

- Shared Risk and Rewards:Value-based care models often involve shared risk and rewards between providers and insurers. Providers share in the financial success or failure of their patients’ health outcomes, motivating them to deliver high-quality care and manage costs effectively. For example, if a provider successfully manages a patient’s chronic condition, leading to reduced hospitalizations and emergency room visits, they may receive a bonus payment.

Conversely, if a patient’s health deteriorates under their care, they may face a financial penalty.

- Data-Driven Care:Value-based care models rely heavily on data analytics to track patient health outcomes, identify areas for improvement, and measure the effectiveness of care interventions. This data-driven approach allows providers and insurers to make evidence-based decisions about care delivery and optimize resource allocation.

For example, data analysis can identify patients at high risk for certain conditions, allowing providers to intervene early and prevent costly complications.

Evolving Health Insurance Options for Individuals and Families

The health insurance landscape in Massachusetts is becoming increasingly diverse, offering individuals and families a wider range of options to meet their specific needs and preferences.

- Personalized Health Plans:Insurers are developing personalized health plans that cater to individual health needs and lifestyle preferences. These plans may offer coverage for specific health conditions, provide access to specialized care, or include wellness programs tailored to individual goals. This trend allows individuals to customize their insurance coverage to meet their unique needs and budget.

- Direct-to-Consumer Health Insurance:Direct-to-consumer health insurance models are emerging, allowing individuals to purchase insurance directly from insurers without intermediaries. These models offer greater transparency and flexibility, empowering individuals to choose the coverage that best suits their needs. However, navigating these options can be challenging, requiring individuals to understand their health needs and compare different plans carefully.

- Hybrid Insurance Models:Some insurers are offering hybrid insurance models that combine elements of traditional health insurance with features of health savings accounts (HSAs) or health reimbursement arrangements (HRAs). These models provide individuals with greater control over their healthcare spending, encouraging them to make more informed decisions about their care.

However, these models require individuals to actively manage their healthcare finances, which may not be suitable for everyone.

Conclusive Thoughts

Choosing the right health insurer is a significant decision that impacts your financial well-being and access to healthcare. By carefully considering factors such as network coverage, prescription drug benefits, customer service, and cost, individuals can find a plan that meets their specific requirements.

With the evolving landscape of healthcare, staying informed about emerging trends and technological advancements is essential for making informed decisions about health insurance.

Query Resolution

What are the different types of health insurance plans available in Massachusetts?

Massachusetts offers various health insurance plans, including HMOs (Health Maintenance Organizations), PPOs (Preferred Provider Organizations), and POS (Point of Service) plans. Each plan type has its own unique features and cost structures.

How do I find affordable health insurance in Massachusetts?

The Massachusetts Health Connector offers subsidies and cost-sharing programs to help individuals and families find affordable health insurance. You can also compare plans from different insurers to find the best value for your needs.

What are the key consumer protection laws in Massachusetts?

Massachusetts has strong consumer protection laws in place to safeguard individuals’ rights in the health insurance market. These laws cover areas such as coverage, pricing, and dispute resolution.