Health plan cigna – Cigna Health Plan stands as a major player in the health insurance landscape, offering a range of plans designed to cater to individuals, families, and employers. With a commitment to providing comprehensive coverage and accessible healthcare, Cigna has become a trusted name in the industry.

But navigating the world of health insurance can be overwhelming, especially when faced with a multitude of plans and options. This guide aims to shed light on Cigna Health Plan, exploring its features, benefits, costs, and customer service aspects.

Whether you’re seeking individual coverage, a family plan, or employer-sponsored insurance, Cigna offers a variety of options to suit your needs. From comprehensive medical coverage to prescription drug benefits and wellness programs, Cigna strives to provide a holistic approach to healthcare.

Understanding the intricacies of Cigna’s offerings, however, requires a deeper dive into its coverage details, cost considerations, and network access. This guide serves as your roadmap to navigating the complexities of Cigna Health Plan, empowering you to make informed decisions about your health insurance.

Cigna Health Plan Overview

Cigna is a well-known health insurance company that plays a significant role in the health insurance industry, offering a wide range of health plans to individuals, families, and employers. Cigna provides coverage for various healthcare needs, including medical, dental, vision, and pharmacy benefits.

Types of Cigna Health Plans

Cigna offers a diverse range of health plans to cater to different needs and budgets. Here’s a breakdown of the primary plan types:

- Individual and Family Plans:These plans are designed for individuals and families who want to purchase health insurance directly from Cigna. They offer a range of coverage options and flexibility to choose plans that best suit their specific requirements and healthcare needs.

- Employer-Sponsored Plans:Many employers partner with Cigna to provide health insurance benefits to their employees. These plans typically offer a wider range of coverage options and may include additional features, such as employer contributions towards premiums and access to wellness programs.

Key Features and Benefits of Cigna Health Plans

Cigna health plans are known for their comprehensive coverage and a variety of benefits designed to enhance the overall healthcare experience. Some key features include:

- Wide Network of Providers:Cigna has a vast network of healthcare providers, including doctors, hospitals, and specialists, across the country. This ensures that policyholders have access to quality care within their network.

- Prescription Drug Coverage:Cigna health plans typically include prescription drug coverage, allowing policyholders to access essential medications at affordable prices. They offer formularies that list covered medications and their corresponding costs.

- Preventive Care Services:Cigna emphasizes preventive care and offers coverage for routine screenings and immunizations to help individuals maintain their health and prevent potential health issues.

- Wellness Programs:Many Cigna plans include wellness programs that encourage healthy habits and provide resources for managing health conditions. These programs may offer incentives for healthy behaviors, such as discounts on gym memberships or fitness trackers.

- Telehealth Services:Cigna offers telehealth services, allowing policyholders to consult with doctors remotely through video conferencing or phone calls. This provides convenient access to healthcare, especially for those who may have limited time or mobility.

- Customer Support:Cigna provides dedicated customer support channels, including phone lines, online resources, and mobile apps, to assist policyholders with their health insurance needs. Their customer service representatives are available to answer questions, provide guidance, and resolve any issues that may arise.

Cigna’s Strengths and Unique Offerings

Cigna stands out in the health insurance industry with its focus on:

- Innovation:Cigna is continuously innovating and developing new technologies and services to enhance the healthcare experience. They invest in digital tools, data analytics, and personalized care solutions to improve patient outcomes and streamline healthcare processes.

- Personalized Care:Cigna emphasizes personalized care and aims to tailor its plans and services to meet the individual needs of its members. They utilize data and insights to identify specific health risks and provide targeted interventions and support.

- Focus on Value:Cigna prioritizes providing value to its members by offering competitive premiums, comprehensive coverage, and access to high-quality healthcare. They strive to make healthcare more affordable and accessible for all.

Cigna Health Plan Coverage and Benefits

Cigna offers a variety of health insurance plans to meet the needs of individuals and families. These plans provide comprehensive coverage for a wide range of medical services, including hospitalization, outpatient care, and prescription drugs.

Cigna offers a variety of health plans to suit different needs and budgets. It’s interesting to note that even royalty like Kate Middleton, known for her healthy lifestyle, likely has a comprehensive health plan. You can learn more about her approach to health and fitness here , which might inspire you to make healthier choices.

Ultimately, choosing the right health plan for you is essential for peace of mind and financial stability.

Coverage Limits, Deductibles, and Copayments

The specific coverage limits, deductibles, and copayments associated with Cigna health plans vary depending on the chosen plan and the individual’s needs. Cigna offers different plan types, such as HMO, PPO, and POS, each with its own set of benefits and cost-sharing arrangements.

- Deductibles: The amount you pay out-of-pocket before your health insurance plan begins to cover costs. Deductibles can vary significantly depending on the plan. For example, a high-deductible plan may have a deductible of $5,000, while a lower-deductible plan might have a deductible of $1,000.

- Copayments: A fixed amount you pay for specific medical services, such as doctor’s visits, prescriptions, or hospital stays. Copayments are typically a lower amount than deductibles.

- Coverage Limits: The maximum amount your health insurance plan will cover for certain services or conditions. For example, there may be a limit on the number of days you can stay in the hospital or the amount of money your plan will cover for mental health services.

Filing Claims and Accessing Benefits

Cigna offers a variety of ways to file claims and access benefits, including:

- Online: You can file claims and access benefits online through Cigna’s website.

- Mobile App: The Cigna mobile app allows you to manage your health insurance plan, file claims, and access benefits from your smartphone or tablet.

- Phone: You can contact Cigna by phone to file claims and access benefits.

- Mail: You can also file claims and access benefits by mail.

Cigna Health Plan Cost and Affordability

The cost of a Cigna health plan can vary depending on several factors, including your age, location, and the level of coverage you choose. Understanding these factors can help you make an informed decision about the plan that best suits your needs and budget.

Factors Influencing Cigna Plan Costs, Health plan cigna

The cost of a Cigna health plan is determined by various factors, including:

- Age:Generally, older individuals tend to have higher healthcare costs due to a greater likelihood of requiring medical care. Cigna, like most insurers, adjusts premiums based on age to reflect this.

- Location:The cost of healthcare services can vary significantly by location. Cigna plans in areas with higher healthcare costs will typically have higher premiums. For example, plans in major metropolitan areas might be more expensive than plans in rural areas.

- Coverage Level:Cigna offers various plans with different levels of coverage. Plans with more comprehensive coverage, such as those with lower deductibles and copayments, will usually be more expensive than plans with less coverage.

Comparing Cigna Plan Costs with Other Insurers

Cigna’s plan costs are competitive within the health insurance market. It’s essential to compare quotes from different insurers to find the best value for your needs. Factors like plan coverage, network size, and customer service can also influence your decision.

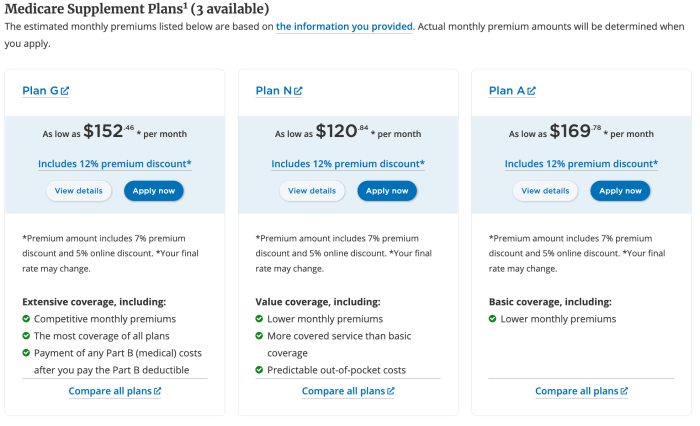

Financial Assistance Programs and Subsidies

Cigna offers various financial assistance programs and subsidies to help make its plans more affordable. These programs can be accessed through:

- The Affordable Care Act (ACA):Cigna participates in the ACA marketplace, offering plans that qualify for subsidies based on income level. These subsidies can significantly reduce your monthly premiums.

- Cigna’s Own Programs:Cigna offers programs such as premium assistance and copay assistance to help individuals with specific financial needs. Contact Cigna directly to learn more about these programs and eligibility criteria.

Cigna Health Plan Network and Provider Access: Health Plan Cigna

Cigna’s extensive network of healthcare providers is a key component of its health plan offerings. It gives members access to a wide range of doctors, hospitals, and pharmacies across the country. This extensive network ensures that members can find quality care close to home, while also potentially saving money on healthcare costs.

Finding In-Network Providers

Finding in-network providers is crucial for maximizing the benefits of a Cigna health plan. Cigna offers several resources to help members locate in-network providers:

- Cigna’s website:The Cigna website features a comprehensive provider directory that allows members to search for doctors, hospitals, and pharmacies by location, specialty, and other criteria.

- Cigna’s mobile app:The Cigna mobile app offers a convenient way to find in-network providers on the go. Members can search for providers, view provider profiles, and even schedule appointments directly through the app.

- Cigna’s customer service:Members can contact Cigna’s customer service team for assistance in finding in-network providers. Cigna representatives can help members locate providers based on their specific needs and preferences.

Accessing Care Through the Cigna Network

Once a member has identified an in-network provider, accessing care is typically straightforward:

- Scheduling appointments:Members can schedule appointments directly with the provider or through Cigna’s website or mobile app.

- Receiving care:At the time of service, members should present their Cigna ID card to the provider. This ensures that the provider can verify the member’s coverage and bill Cigna directly for the services provided.

- Filling prescriptions:Members can fill prescriptions at in-network pharmacies. Cigna’s website and mobile app can help members locate nearby pharmacies.

Out-of-Network Provider Implications

While using in-network providers is generally recommended, there may be situations where a member needs to see an out-of-network provider. It’s important to understand the implications of using out-of-network providers:

- Higher costs:Members may have to pay a higher copay or coinsurance for services provided by out-of-network providers. They may also be responsible for paying a portion of the provider’s charges that exceed the allowed amount under the plan.

- Prior authorization:In many cases, members may need to obtain prior authorization from Cigna before receiving care from an out-of-network provider. This process involves submitting a request to Cigna for approval to receive specific services from the provider.

- Limited coverage:Out-of-network providers may not be covered under certain plan benefits. Members should check their plan documents or contact Cigna to confirm coverage for out-of-network services.

Cigna Health Plan Customer Service and Support

Cigna recognizes that excellent customer service is essential for a positive healthcare experience. They offer a variety of channels and resources to support their plan members, ensuring their needs are met efficiently and effectively.

Customer Service Channels

Cigna provides multiple avenues for plan members to access customer service:

- Phone:Cigna offers a dedicated customer service phone line, available 24/7 for urgent needs and general inquiries. They also have specialized lines for specific departments, such as claims or provider relations.

- Online Portal:The Cigna website features a secure online portal where members can manage their accounts, view claims, access health information, and send messages to customer service representatives. This platform provides a convenient and accessible way to manage health plan needs anytime, anywhere.

- Mobile App:The Cigna mobile app offers similar features to the online portal, allowing members to access their health plan information and communicate with customer service directly from their smartphones. The app also provides additional features like health trackers and wellness tools.

Cigna health plans offer a variety of options to suit your needs, from individual plans to family coverage. If you’re looking for a way to manage your health and wellness, you might be interested in checking out my health one , a platform that provides resources and tools to help you stay on top of your health.

Cigna often partners with platforms like this to offer additional support to their members.

Customer Service Policies

Cigna is committed to providing prompt and helpful service. Their customer service representatives are trained to handle a wide range of inquiries and assist members in resolving issues efficiently.

- Response Times:Cigna aims to respond to phone calls and online messages within a reasonable timeframe, depending on the complexity of the issue. They strive to resolve urgent matters promptly, such as claims processing or provider access issues.

- Resolution Procedures:Cigna has established procedures for addressing customer concerns and resolving disputes. Members can escalate issues to higher levels of customer service if their initial concerns are not addressed satisfactorily.

Resources and Support

Beyond customer service, Cigna offers a variety of resources and support programs to help members manage their health and well-being.

- Health Education Materials:Cigna provides access to a wealth of health education materials, including articles, videos, and interactive tools, covering various health topics. These resources empower members to make informed decisions about their health and engage actively in their care.

- Wellness Programs:Cigna offers a range of wellness programs designed to promote healthy lifestyles and prevent chronic conditions. These programs include fitness challenges, nutrition guidance, and stress management tools. Cigna’s wellness programs aim to improve overall health outcomes and reduce healthcare costs.

Cigna Health Plan Enrollment and Administration

Joining Cigna and managing your health plan is straightforward. The enrollment process is designed to be easy, and Cigna provides tools to help you navigate the administrative aspects of your plan.

Cigna health plans offer comprehensive coverage for a variety of medical needs, including mental health services. If you’re seeking specialized care, Cigna may cover your stay in a mental health ward , depending on your specific plan and the nature of your treatment.

It’s important to contact your Cigna representative to understand your coverage and the specific benefits you can expect.

Eligibility Requirements and Application Procedures

Cigna health plans are available to individuals, families, and groups, including employers. Eligibility requirements vary based on the specific plan and your individual circumstances. To enroll in a Cigna health plan, you typically need to:

- Meet the plan’s eligibility criteria, such as age, residency, and employment status.

- Complete an application, which may be done online, by phone, or through a Cigna representative.

- Provide necessary documentation, such as proof of identity and income.

- Choose the plan that best suits your needs and budget.

Managing Your Cigna Plan

Once you’re enrolled, Cigna provides resources to manage your plan effectively.

Premium Payments

Cigna offers various payment options for your monthly premiums, including:

- Automatic bank deductions

- Online payments through your Cigna account

- Mail-in checks or money orders

Plan Changes

You may need to make changes to your plan throughout the year. Cigna provides options for:

- Adding or removing dependents

- Changing your coverage level

- Updating your contact information

Accessing Plan Information and Managing Benefits

Cigna offers convenient ways to access your plan information and manage your benefits:

- Cigna website:You can log into your Cigna account to view your plan details, track claims, and access online tools.

- Cigna mobile app:The Cigna mobile app allows you to manage your plan on the go, including finding providers, checking claim status, and accessing virtual care.

- Customer service:Cigna offers phone and email support for any questions or assistance you may need.

Cigna Health Plan Reviews and Customer Feedback

Cigna, a prominent health insurance provider, receives a wide range of customer feedback, reflecting diverse experiences and opinions. Understanding these reviews is crucial for prospective customers seeking insights into the quality of Cigna’s services and plan offerings.

Customer Reviews and Testimonials

Customer reviews provide valuable insights into the strengths and weaknesses of Cigna health plans. Platforms like Healthgrades, Trustpilot, and the Better Business Bureau (BBB) offer a wealth of customer testimonials, highlighting both positive and negative experiences.

- Positive reviews often praise Cigna’s comprehensive coverage, extensive provider networks, and responsive customer service. Customers appreciate the ease of access to healthcare professionals and the overall support provided by Cigna representatives.

- Conversely, negative reviews may express concerns about high premiums, complex plan structures, or challenges with claim processing. Some customers may encounter difficulties navigating the plan’s features or accessing specific healthcare services.

Strengths and Weaknesses of Cigna Plans

Analyzing customer feedback reveals key strengths and weaknesses of Cigna health plans:

- Strengths:

- Extensive provider networks: Cigna offers a wide range of healthcare providers, ensuring access to specialists and primary care physicians across various regions.

- Comprehensive coverage: Cigna plans typically cover a broad spectrum of medical services, including preventive care, hospitalization, and prescription drugs.

- Digital tools and resources: Cigna provides user-friendly online platforms and mobile apps for managing health benefits, accessing claims information, and finding providers.

- Customer service support: Cigna offers dedicated customer service channels, including phone lines, online chat, and email, for resolving inquiries and addressing concerns.

- Weaknesses:

- Premium costs: Cigna plans can sometimes have higher premiums compared to other insurers, particularly for certain coverage levels or geographic locations.

- Plan complexity: Some customers find Cigna’s plan structures intricate and challenging to understand, leading to confusion and potential difficulties in navigating benefits.

- Claim processing issues: Occasionally, customers may encounter delays or difficulties in processing claims, particularly for complex medical procedures or out-of-network services.

- Limited provider choice in certain areas: While Cigna boasts a large provider network, availability may vary depending on location, potentially limiting options for some individuals.

Overall Satisfaction Levels

Overall, customer satisfaction levels with Cigna health plans are generally positive. However, it’s essential to acknowledge that experiences can vary significantly based on individual needs, plan selection, and geographic location.

- Customer satisfaction ratings on platforms like Healthgrades and Trustpilot often reflect a positive sentiment towards Cigna, with many customers praising the company’s coverage, provider access, and customer service.

- However, it’s crucial to consider the full range of reviews, including both positive and negative feedback, to gain a comprehensive understanding of customer experiences.

- Prospective customers should carefully research Cigna’s plans, compare them with other insurers, and consider their individual healthcare needs and budget before making a decision.

Cigna Health Plan Alternatives and Comparison

Choosing the right health insurance plan is crucial, and comparing Cigna with other leading providers can help you make an informed decision. This section will examine key differences in coverage, cost, and customer service across various providers, guiding you towards the most suitable plan based on your individual needs and preferences.

Coverage Comparison

Different health insurance providers offer varying levels of coverage, impacting the types of medical services and treatments included in your plan. It’s essential to understand the specific benefits and limitations of each provider to determine if they align with your healthcare requirements.

- Cigna: Cigna offers a wide range of health insurance plans, including HMO, PPO, and POS options. They provide comprehensive coverage for essential medical services, such as doctor visits, hospital stays, and prescription drugs. However, specific coverage details can vary depending on the chosen plan and state of residence.

- UnitedHealthcare: As the largest health insurer in the US, UnitedHealthcare offers diverse plan options with varying coverage levels. They generally provide broad coverage for essential medical services, but specific details can differ based on plan type and location.

- Anthem: Anthem is another major health insurance provider known for its extensive network of healthcare providers. They offer a variety of plans, including HMO, PPO, and EPO options, with varying levels of coverage for medical services.

- Aetna: Aetna provides comprehensive health insurance plans with strong coverage for essential medical services. Their plans often include a wide range of benefits, such as preventive care, mental health services, and prescription drug coverage.

Cost Comparison

Health insurance premiums and out-of-pocket expenses can vary significantly across different providers. It’s essential to consider the overall cost of each plan, including monthly premiums, deductibles, copayments, and coinsurance, to determine affordability.

- Premium Variations: Premium costs for similar plans can differ significantly between providers, influenced by factors such as age, location, and health status. It’s essential to compare premium quotes from multiple providers to find the most affordable option.

- Deductibles and Out-of-Pocket Costs: Deductibles represent the amount you pay out-of-pocket before your insurance coverage kicks in. Copayments and coinsurance are additional expenses you incur for specific medical services. These costs can vary across providers and plans, impacting the overall affordability of the plan.

- Cost-Sharing and Coverage Limits: Some plans have cost-sharing provisions, where you pay a portion of the medical expenses. Others may have coverage limits, restricting the amount of medical expenses covered by the plan. Understanding these details is crucial for evaluating the overall cost of a plan.

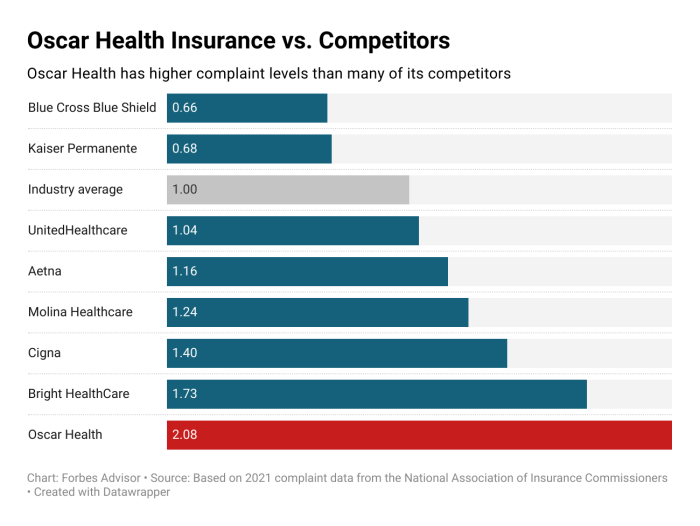

Customer Service Comparison

Customer service is an essential aspect of any health insurance plan, as it directly impacts your experience when navigating healthcare needs. Comparing customer service ratings and reviews can provide valuable insights into the responsiveness, helpfulness, and overall satisfaction of different providers.

- Accessibility and Responsiveness: Evaluate how easy it is to reach customer service representatives and the speed of their responses. Look for providers with multiple communication channels, such as phone, email, and online chat, for convenient access to support.

- Problem Resolution and Support: Consider the provider’s track record in resolving customer complaints and addressing issues effectively. Look for providers with a reputation for fair and timely resolution of claims and other concerns.

- Customer Reviews and Ratings: Research customer reviews and ratings from independent sources to gauge overall customer satisfaction with the provider’s customer service.

Last Point

Cigna Health Plan offers a comprehensive range of plans designed to meet diverse healthcare needs. By understanding the different coverage options, cost factors, and customer service aspects, individuals can make informed decisions about their health insurance. Whether you’re seeking individual coverage, a family plan, or employer-sponsored insurance, Cigna provides a platform for accessing quality healthcare.

Remember, exploring Cigna’s network of providers, understanding coverage limits, and familiarizing yourself with customer service channels are essential steps in making the most of your health insurance plan.

FAQ Overview

What are the eligibility requirements for enrolling in a Cigna health plan?

Eligibility requirements for Cigna health plans vary depending on the specific plan and your individual circumstances. Factors such as age, residency, and employment status may influence your eligibility. It’s best to contact Cigna directly or visit their website for detailed eligibility information.

How can I find a Cigna provider in my area?

Cigna offers various resources to help you find in-network providers. You can use their online provider directory, mobile app, or contact their customer service line for assistance.

What are the options for managing my Cigna health plan online?

Cigna provides a user-friendly online portal and mobile app for managing your health plan. You can access your plan information, view claims, pay premiums, and contact customer support through these platforms.

What are some of the common customer complaints about Cigna health plans?

Customer complaints about Cigna health plans often revolve around issues such as network access, claim processing delays, and customer service responsiveness. However, it’s important to note that these experiences can vary greatly depending on individual circumstances and plan specifics.