Health Plan United, a household name in the world of healthcare, stands as a beacon of comprehensive coverage and personalized support. This guide delves into the intricacies of UnitedHealthcare, unveiling the history, mission, and wide array of plans they offer.

From understanding the different types of plans, like HMOs and PPOs, to navigating the costs, benefits, and provider networks, this exploration aims to equip you with the knowledge to make informed decisions about your healthcare needs.

Understanding UnitedHealthcare

UnitedHealthcare, a leading health insurance provider in the United States, has a rich history and a commitment to providing comprehensive health coverage to individuals and families. The company’s journey reflects its evolution from a regional insurer to a national powerhouse, driven by its mission to help people live healthier lives.

UnitedHealthcare’s History and Evolution

UnitedHealthcare’s origins can be traced back to 1974, when it was founded as a subsidiary of UnitedHealth Group. The company initially focused on providing health insurance to employees of large corporations in the Midwest. Over the years, UnitedHealthcare expanded its reach geographically and broadened its product offerings, entering new markets and developing innovative health plans.

Key milestones in its evolution include:

- 1984:UnitedHealthcare entered the individual health insurance market, offering plans to individuals and families.

- 1990s:The company expanded into the Medicare and Medicaid markets, providing health coverage to seniors and low-income individuals.

- 2000s:UnitedHealthcare made significant investments in technology and data analytics, leveraging these capabilities to improve care coordination and cost efficiency.

- 2010s:The company continued to grow its presence in the Affordable Care Act (ACA) marketplaces, offering a wide range of health plans to individuals and families.

UnitedHealthcare’s Mission, Values, and Core Business Principles

UnitedHealthcare’s mission is to help people live healthier lives. This mission is underpinned by a set of core values that guide the company’s operations and decision-making:

- Integrity:UnitedHealthcare operates with honesty, transparency, and ethical conduct.

- Customer Focus:The company prioritizes the needs and well-being of its customers.

- Innovation:UnitedHealthcare embraces new ideas and technologies to enhance its services and improve health outcomes.

- Teamwork:The company fosters a collaborative and supportive work environment.

- Accountability:UnitedHealthcare takes responsibility for its actions and strives for excellence in all aspects of its business.

UnitedHealthcare’s Market Presence, Health plan united

UnitedHealthcare is one of the largest health insurers in the United States, with a broad geographical reach and a diverse customer base. The company offers a wide range of health plans, including:

- Employer-sponsored health insurance:UnitedHealthcare provides health insurance to employees of large and small businesses across the country.

- Individual health insurance:The company offers health plans to individuals and families through the ACA marketplaces and directly.

- Medicare Advantage:UnitedHealthcare provides Medicare Advantage plans, which offer additional benefits beyond traditional Medicare.

- Medicaid:The company administers Medicaid programs in several states, providing health coverage to low-income individuals and families.

UnitedHealthcare’s market presence is further enhanced by its extensive network of healthcare providers, which includes hospitals, doctors, and other healthcare professionals. This network provides customers with access to a wide range of healthcare services, ensuring that they can receive the care they need when they need it.

Types of Health Plans Offered

UnitedHealthcare offers a variety of health plans to meet the diverse needs of its members. The company’s plans are categorized based on coverage types, each with its unique features, benefits, and limitations.

Health Maintenance Organization (HMO)

HMO plans provide comprehensive healthcare services through a network of providers. Members typically choose a primary care physician (PCP) who acts as their gatekeeper to access specialists and other healthcare services.

- Key Features:HMO plans emphasize preventive care and focus on managing healthcare costs through a network of providers.

- Benefits:HMO plans generally have lower premiums than other plans, and they often provide comprehensive coverage with a focus on preventive care. They also have lower out-of-pocket costs than other plans.

- Limitations:HMO plans require members to use in-network providers, and they may have restrictions on accessing specialists and other healthcare services without a referral from their PCP.

Examples of HMO Plans:

- UnitedHealthcare Choice HMO:This plan offers a wide network of providers and comprehensive coverage. It has a lower premium than other plans but requires members to use in-network providers.

- UnitedHealthcare Community Plan HMO:This plan is designed for individuals and families who are looking for affordable healthcare coverage. It offers a network of providers and comprehensive coverage with a focus on preventive care.

Preferred Provider Organization (PPO)

PPO plans offer a wider network of providers than HMO plans and allow members to see out-of-network providers for a higher cost.

- Key Features:PPO plans offer more flexibility than HMO plans, but they generally have higher premiums.

- Benefits:PPO plans allow members to see out-of-network providers, and they generally have fewer restrictions on accessing specialists and other healthcare services.

- Limitations:PPO plans generally have higher premiums than HMO plans, and they may have higher out-of-pocket costs.

Examples of PPO Plans:

- UnitedHealthcare Choice Plus PPO:This plan offers a wide network of providers and allows members to see out-of-network providers for a higher cost. It has a higher premium than the HMO plan but offers more flexibility.

- UnitedHealthcare Premier PPO:This plan offers a wider network of providers than the Choice Plus PPO and allows members to see out-of-network providers for a higher cost. It has the highest premium of the three plans but offers the most flexibility.

Exclusive Provider Organization (EPO)

EPO plans are similar to HMO plans in that they require members to use in-network providers. However, EPO plans do not allow members to see out-of-network providers, even in an emergency.

- Key Features:EPO plans are a hybrid of HMO and PPO plans, offering lower premiums than PPO plans but less flexibility than HMO plans.

- Benefits:EPO plans generally have lower premiums than PPO plans and offer comprehensive coverage.

- Limitations:EPO plans require members to use in-network providers and do not allow members to see out-of-network providers, even in an emergency.

Examples of EPO Plans:

- UnitedHealthcare EPO:This plan offers a network of providers and comprehensive coverage at a lower premium than the PPO plans. However, it does not allow members to see out-of-network providers.

Point of Service (POS)

POS plans combine features of HMO and PPO plans. They require members to choose a PCP but allow them to see out-of-network providers for a higher cost.

- Key Features:POS plans offer a balance of flexibility and affordability.

- Benefits:POS plans offer a wider network of providers than HMO plans and allow members to see out-of-network providers for a higher cost.

- Limitations:POS plans generally have higher premiums than HMO plans and may have higher out-of-pocket costs.

Examples of POS Plans:

Health Plan United, a prominent healthcare provider, emphasizes accessibility and affordability. They draw inspiration from initiatives like the Clinton Health Access Initiative , which has significantly impacted global health access. Health Plan United’s commitment to these values ensures that their services are inclusive and beneficial to a wide range of individuals.

- UnitedHealthcare Choice POS:This plan offers a network of providers and allows members to see out-of-network providers for a higher cost. It has a higher premium than the HMO plan but offers more flexibility.

Benefits and Coverage

UnitedHealthcare offers a wide range of health plans, each with its own unique set of benefits and coverage. Understanding these benefits and coverage options is crucial for choosing the plan that best suits your individual needs and budget.

Common Health Benefits

Common health benefits included in UnitedHealthcare plans typically cover essential medical services, including:

- Preventive care:Routine checkups, screenings, and immunizations are often covered at 100% with no co-pay or deductible. These preventive services can help detect health issues early, leading to better outcomes and lower healthcare costs in the long run.

- Hospitalization:This covers inpatient care, surgery, and other medical services received in a hospital setting. The extent of coverage can vary depending on the specific plan, with some plans offering more comprehensive coverage than others.

- Physician services:This includes office visits, consultations, and other services provided by doctors. The plan may have a co-pay or coinsurance for these services.

- Prescription drugs:Most UnitedHealthcare plans include prescription drug coverage, though the specific drugs covered and the co-pay or coinsurance can vary. You can find out which drugs are covered by checking the formulary, a list of covered medications available on the plan’s website or through your provider.

- Mental health and substance use disorder services:UnitedHealthcare plans typically cover mental health and substance use disorder services, including therapy, counseling, and medication. The coverage can vary depending on the plan, so it’s important to review the plan details to understand the specifics.

Optional Benefits

In addition to the core benefits, UnitedHealthcare offers optional benefits that can be added to plans, allowing you to customize your coverage and protect yourself from unexpected medical expenses. Some common optional benefits include:

- Critical illness insurance:This provides a lump-sum payment if you are diagnosed with a critical illness, such as cancer, heart attack, or stroke. The payment can help cover medical expenses, lost income, or other financial burdens associated with the illness.

- Accident insurance:This provides coverage for accidental injuries, including medical expenses, lost income, and other expenses related to the accident. It can be especially helpful for individuals who engage in high-risk activities or occupations.

- Telemedicine:This allows you to consult with a doctor virtually, through phone or video call, for non-emergency medical conditions. It can be a convenient and cost-effective option for routine checkups, medication refills, or minor health concerns.

Exclusions and Limitations

While UnitedHealthcare plans offer comprehensive coverage, there are certain exclusions and limitations that apply. It’s crucial to understand these limitations to make informed decisions about your health insurance coverage. Some common exclusions and limitations include:

- Pre-existing conditions:Some plans may have restrictions on coverage for pre-existing conditions, meaning conditions you had before enrolling in the plan. However, under the Affordable Care Act, most health insurance plans are prohibited from denying coverage or charging higher premiums based on pre-existing conditions.

- Coverage restrictions:Some plans may have limitations on the types of services or treatments covered, or they may require pre-authorization for certain procedures or medications. It’s important to review the plan documents to understand the specific coverage restrictions.

- Out-of-network coverage:While most UnitedHealthcare plans offer coverage for in-network providers, they may have limited coverage for out-of-network providers. This means you may have to pay higher out-of-pocket costs for services received from out-of-network providers.

Cost and Pricing

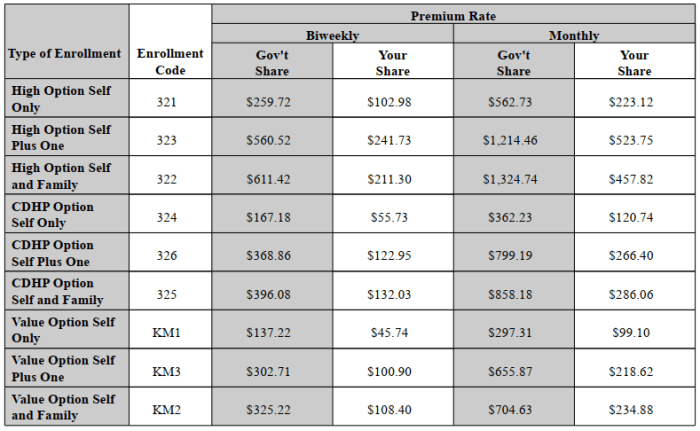

The cost of a UnitedHealthcare plan is influenced by several factors, including your age, location, coverage level, and health status. The company uses this information to calculate your premium, which is the monthly amount you pay for your health insurance.

Factors Influencing Cost

- Age:Younger individuals generally pay lower premiums than older individuals, as they are statistically less likely to require expensive medical care.

- Location:Premiums can vary depending on your location, as healthcare costs can differ significantly across regions. For example, plans in urban areas with high healthcare costs may be more expensive than plans in rural areas.

- Coverage Level:Higher coverage levels, such as plans with lower deductibles and copayments, typically have higher premiums. This is because you are paying for greater protection against medical expenses.

- Health Status:Individuals with pre-existing health conditions may pay higher premiums than those without, as they are more likely to need medical care.

Comparing Plan Prices

- Plan Types:UnitedHealthcare offers a variety of plans, including HMOs, PPOs, and POS plans. Each plan type has different cost structures, so it’s important to compare prices and benefits across different plan options.

- Cost-Saving Options:UnitedHealthcare may offer discounts for certain groups, such as seniors, employees, or individuals with certain health conditions. They also may offer discounts for paying premiums annually rather than monthly.

- Open Enrollment:During open enrollment periods, you can typically switch plans or enroll in a new plan without having to wait for a qualifying event. This allows you to compare prices and find the best plan for your needs.

Deductibles, Copayments, and Coinsurance

- Deductibles:The deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. For example, if your deductible is $1,000, you would pay the first $1,000 of your medical expenses before your insurance starts paying.

- Copayments:Copayments are fixed amounts you pay for specific services, such as doctor’s visits or prescriptions. For example, you might pay a copayment of $20 for each doctor’s visit.

- Coinsurance:Coinsurance is a percentage of the cost of a medical service that you pay after you’ve met your deductible. For example, you might pay 20% of the cost of a hospital stay after you’ve met your deductible.

Network and Provider Access

UnitedHealthcare’s network is extensive, encompassing a wide range of healthcare providers across the country. This means you have a broad selection of doctors, hospitals, and other healthcare professionals to choose from when seeking medical care. The size and scope of this network are crucial factors in determining the quality and accessibility of your healthcare services.

Finding In-Network Providers

Locating in-network providers is a straightforward process. You can utilize UnitedHealthcare’s online tools or mobile app to search for providers based on your location, specialty, and other preferences. This user-friendly platform allows you to easily identify healthcare professionals within your geographical area who are part of your health plan’s network.

Health Plan United understands that a healthy lifestyle goes beyond just medical coverage. They encourage members to prioritize their well-being, and that includes incorporating regular fitness into their routines. This can range from simple daily walks to joining a gym, and Health Plan United offers resources and support to help members achieve their fitness goals.

Customer Service and Support

UnitedHealthcare prioritizes providing comprehensive and accessible customer service to its members. They offer a variety of channels to connect with their support team, ensuring assistance is readily available when needed.

Contact Channels

UnitedHealthcare offers multiple ways for members to reach their customer service team:

- Phone:A dedicated phone number is available for members to speak directly with a customer service representative. This option is ideal for immediate assistance and personalized support.

- Email:Members can submit inquiries or concerns through email, allowing for detailed explanations and attachments if necessary. This option is suitable for non-urgent matters or for providing detailed information.

- Online Portal:The UnitedHealthcare website provides a secure online portal where members can access their account information, view claims, manage benefits, and submit messages to customer service. This option offers convenience and 24/7 access.

Response Times and Resolution Processes

UnitedHealthcare strives to provide prompt and efficient service.

- Phone:Call wait times vary depending on the time of day and volume of calls, but representatives are typically available to assist within a reasonable timeframe.

- Email:Response times for emails typically range from 24 to 48 hours, although complex inquiries or complaints may take longer.

- Online Portal:Messages submitted through the online portal are generally responded to within a few business days.

Navigating Health Insurance Plans and Accessing Healthcare Services

UnitedHealthcare offers a range of resources and support to help members navigate their health insurance plans and access healthcare services:

- Member Handbook:A comprehensive handbook is provided to each member, outlining plan details, benefits, coverage, and important procedures.

- Website Resources:The UnitedHealthcare website features a wealth of information, including plan summaries, FAQs, and helpful guides on navigating the healthcare system.

- Health Education Materials:UnitedHealthcare provides educational materials on various health topics, promoting healthy lifestyle choices and disease prevention.

- Provider Directory:A comprehensive provider directory is available online and through customer service, allowing members to search for in-network doctors, hospitals, and other healthcare professionals.

- Care Coordination Services:UnitedHealthcare offers care coordination services to help members manage chronic conditions and navigate complex healthcare needs.

Health Management and Wellness Programs

UnitedHealthcare recognizes that proactive health management is crucial for improving individual well-being and reducing healthcare costs. The company offers a comprehensive suite of health management programs designed to empower members to take control of their health and live healthier lives.

These programs focus on various aspects of health, including disease prevention, wellness initiatives, and chronic condition management. By promoting healthy habits, early detection, and effective management of chronic conditions, UnitedHealthcare aims to improve health outcomes, reduce healthcare utilization, and ultimately lower costs.

Disease Prevention Programs

UnitedHealthcare’s disease prevention programs focus on identifying and mitigating health risks before they develop into serious conditions. These programs leverage a range of strategies, including:

- Health Screenings:UnitedHealthcare encourages members to undergo regular health screenings, such as blood pressure checks, cholesterol tests, and cancer screenings, to detect potential health issues early on. Early detection often allows for timely interventions and treatment, improving outcomes and reducing the risk of complications.

- Immunizations:UnitedHealthcare promotes vaccinations to protect members from preventable diseases. They provide access to a wide range of immunizations, including flu shots, pneumonia vaccines, and tetanus boosters, ensuring members are protected against common and potentially serious illnesses.

- Health Education and Counseling:UnitedHealthcare offers educational resources and counseling services to help members understand health risks and make informed decisions about their health. They provide information on topics such as nutrition, exercise, smoking cessation, and stress management, empowering members to adopt healthy habits and reduce their risk of developing chronic conditions.

Wellness Initiatives

UnitedHealthcare’s wellness initiatives encourage members to adopt healthy lifestyles and behaviors that contribute to overall well-being. These programs include:

- Fitness Programs:UnitedHealthcare partners with fitness centers and gyms to offer members discounted memberships or access to fitness classes. These programs provide opportunities for regular physical activity, promoting cardiovascular health, weight management, and improved overall fitness.

- Healthy Eating Programs:UnitedHealthcare offers programs and resources to help members make healthier food choices. They provide nutrition counseling, access to online resources with healthy recipes and meal planning tools, and incentives for participating in healthy eating challenges. These programs aim to promote balanced diets and reduce the risk of chronic conditions associated with poor nutrition.

- Stress Management Programs:UnitedHealthcare recognizes the impact of stress on overall health. They offer stress management programs, including mindfulness techniques, relaxation exercises, and access to mental health professionals. These programs help members manage stress levels, improve mental well-being, and reduce the risk of stress-related health problems.

Health Plan United offers a variety of health insurance plans, but it’s important to remember that staying active is crucial for overall well-being. If you’re looking for ways to incorporate fitness into your routine, you might consider checking out health clubs near me with pool to find a facility that fits your needs.

Health Plan United encourages healthy habits, and joining a health club can be a great way to achieve your fitness goals.

Chronic Condition Management Programs

UnitedHealthcare provides comprehensive programs to support members with chronic conditions, such as diabetes, heart disease, and asthma. These programs aim to help members manage their conditions effectively, prevent complications, and improve their quality of life. Key features of these programs include:

- Medication Management:UnitedHealthcare helps members manage their medications by providing access to pharmacists, medication adherence programs, and tools for tracking medication refills. This ensures members receive the appropriate medications and take them as prescribed, improving treatment effectiveness and reducing the risk of adverse events.

- Disease Education and Self-Management:UnitedHealthcare offers educational resources and support to help members understand their chronic conditions and manage them effectively. They provide information on self-management strategies, including healthy lifestyle modifications, medication adherence, and early detection of complications.

- Telehealth Services:UnitedHealthcare offers telehealth services to provide convenient and accessible care for members with chronic conditions. Telehealth consultations allow members to connect with healthcare professionals remotely, reducing the need for in-person visits and improving access to care, especially for those living in remote areas or with limited mobility.

Technology and Digital Tools

UnitedHealthcare offers a range of digital tools and technologies designed to enhance the healthcare experience for its members. These tools provide convenient access to healthcare information, streamline administrative tasks, and promote proactive health management.

Mobile Apps

Mobile apps provide a convenient and accessible way for members to manage their health and insurance.

- UnitedHealthcare’s mobile app allows members to view their health plan details, check their coverage, and find in-network providers.

- Members can also use the app to schedule appointments, request prescription refills, and access their medical records.

- Some apps even offer features like health tracking, wellness challenges, and personalized health insights.

Online Portals

UnitedHealthcare’s online portal serves as a central hub for managing health insurance and accessing healthcare information.

- Members can log in to view their coverage details, download important documents, and pay their premiums.

- The portal also allows members to track their claims, find providers, and access health education materials.

- Some portals offer features like online chat with customer service representatives or virtual visits with healthcare providers.

Telehealth Services

Telehealth services allow members to consult with healthcare providers remotely, using video conferencing or phone calls.

- Telehealth can be a convenient and cost-effective option for routine checkups, follow-up appointments, and managing chronic conditions.

- UnitedHealthcare offers telehealth services through its own network of providers, as well as through third-party platforms.

- The availability and scope of telehealth services may vary depending on the member’s health plan and location.

Impact of Technology on Healthcare

Technology is transforming the healthcare industry, creating opportunities for greater efficiency, personalized care, and improved patient outcomes.

- Digital tools can empower patients to take a more active role in managing their health, accessing information, and making informed decisions.

- Technology can also facilitate better communication and coordination between patients, providers, and insurers.

- The use of data analytics and artificial intelligence can help identify trends, predict health risks, and develop personalized interventions.

Regulatory Compliance and Oversight

UnitedHealthcare, as a major player in the health insurance industry, operates within a complex regulatory framework designed to ensure consumer protection, fair market practices, and the overall integrity of the healthcare system. This regulatory landscape involves federal and state agencies, with each level playing a critical role in shaping the industry’s operations.

Federal Oversight Agencies

The federal government plays a significant role in overseeing the health insurance industry, with agencies like the Centers for Medicare & Medicaid Services (CMS) and the Department of Health and Human Services (HHS) setting the foundation for national health insurance regulations.

These agencies establish rules governing health plan operations, benefits, pricing, and consumer rights.

- Centers for Medicare & Medicaid Services (CMS):CMS is the primary federal agency responsible for administering Medicare, Medicaid, and the Children’s Health Insurance Program (CHIP). It also oversees the implementation of the Affordable Care Act (ACA), which has significantly impacted the health insurance market. CMS sets standards for health plan coverage, affordability, and consumer protections, ensuring that plans meet minimum requirements.

- Department of Health and Human Services (HHS):HHS encompasses various agencies, including the Office of Civil Rights, which enforces civil rights laws related to healthcare, including prohibiting discrimination based on race, color, national origin, sex, age, disability, or religion. HHS also plays a role in overseeing the implementation of the ACA, ensuring that health insurance plans adhere to its provisions.

State Oversight Agencies

States also have a significant role in regulating the health insurance industry. State insurance departments are responsible for licensing and overseeing health insurance companies operating within their jurisdictions. They ensure that plans comply with state-specific regulations, including those related to coverage mandates, rate reviews, and consumer protections.

- State Insurance Departments:State insurance departments have broad authority to regulate health insurance plans, including setting requirements for coverage, pricing, and consumer protections. They also handle consumer complaints and investigate potential violations of state insurance laws.

- State Health Exchanges:In states that have established health insurance marketplaces, or exchanges, state agencies play a role in overseeing these platforms. They ensure that plans offered on the exchanges meet minimum requirements and are available to consumers at affordable rates.

Recent Regulatory Developments

The health insurance landscape is constantly evolving, driven by new legislation, regulations, and technological advancements. Recent regulatory developments have had a significant impact on UnitedHealthcare and its customers, shaping the way health insurance is offered and consumed.

- Affordable Care Act (ACA):The ACA, enacted in 2010, has brought about significant changes to the health insurance industry. It has expanded health insurance coverage to millions of Americans, established minimum coverage requirements for health plans, and created health insurance marketplaces. UnitedHealthcare, like other health insurance companies, has had to adapt its products and services to comply with the ACA’s provisions.

- Medicare Modernization Act (MMA):The MMA, passed in 2003, has introduced changes to Medicare, including the creation of Medicare Part D, which provides prescription drug coverage. This has impacted UnitedHealthcare, as it offers Medicare Advantage plans and Medicare Part D prescription drug plans.

- Telehealth Expansion:The COVID-19 pandemic accelerated the adoption of telehealth services, and many states have enacted legislation to expand telehealth coverage and reimbursement. This has impacted UnitedHealthcare, as it has expanded its telehealth offerings to meet the growing demand for virtual healthcare services.

Industry Trends and Innovations: Health Plan United

The healthcare industry is constantly evolving, driven by technological advancements, changing consumer preferences, and a growing focus on value-based care. UnitedHealthcare recognizes these trends and is actively innovating to meet the evolving needs of its customers.

Value-Based Care

The shift towards value-based care is a major trend in the healthcare industry. This approach focuses on improving patient outcomes and reducing costs by incentivizing providers to deliver high-quality, efficient care. UnitedHealthcare is a leader in value-based care, with a range of programs designed to support this model.

For example, UnitedHealthcare’s Accountable Care Organizations (ACOs) partner with providers to coordinate care and improve patient health. These ACOs are designed to share financial risk and reward, aligning incentives to improve quality and efficiency.

Final Wrap-Up

UnitedHealthcare’s commitment to innovation and customer satisfaction shines through in their robust digital tools, comprehensive wellness programs, and unwavering dedication to regulatory compliance. As the healthcare landscape evolves, UnitedHealthcare remains a trusted partner, providing access to quality care and peace of mind.

Answers to Common Questions

What are the key differences between HMO and PPO plans?

HMOs typically have lower premiums but require you to choose a primary care physician within the network. PPOs offer more flexibility in choosing providers, but premiums are generally higher.

How can I find a doctor in the UnitedHealthcare network?

You can use the UnitedHealthcare website or mobile app to search for providers by specialty, location, and other criteria.

What are the benefits of using UnitedHealthcare’s digital tools?

Digital tools provide convenient access to your health information, appointment scheduling, benefit details, and communication with providers.