Health savings account Amazon, a powerful combination, allows you to manage your healthcare finances with ease. By tapping into Amazon’s vast resources, you can explore a range of HSA-compatible products and services, streamlining your healthcare spending and maximizing your savings.

This guide delves into the benefits of using Amazon for your HSA, exploring how it can simplify your healthcare journey and help you make the most of your healthcare dollars. We’ll cover everything from opening an account and funding it to tracking expenses and withdrawing funds, all while highlighting the unique advantages Amazon offers.

What is a Health Savings Account (HSA)?

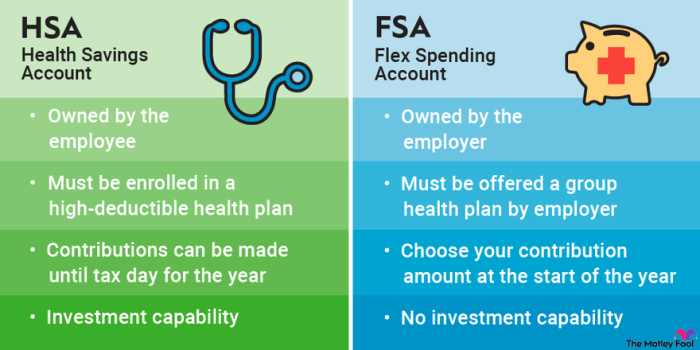

A Health Savings Account (HSA) is a tax-advantaged savings account that you can use to pay for qualified healthcare expenses. It’s a valuable tool for individuals who are enrolled in a high-deductible health plan (HDHP). HSAs offer a triple tax advantage, making them a popular choice for many people.

Eligibility Requirements for Opening an HSA

To be eligible to open an HSA, you must be enrolled in a high-deductible health plan (HDHP) and meet the following criteria:

- You must not be covered by any other health insurance plan, such as Medicare or another health savings account.

- You must not be claimed as a dependent on someone else’s tax return.

Tax Advantages of Using an HSA, Health savings account amazon

One of the most significant benefits of using an HSA is its tax advantages. Here’s how it works:

Contributions are tax-deductible

You can deduct your HSA contributions from your taxable income, which reduces your tax liability.

Earnings grow tax-free

The interest and other earnings on your HSA balance grow tax-free.

Withdrawals for qualified medical expenses are tax-free

When you use your HSA funds to pay for eligible medical expenses, the withdrawals are tax-free.

Potential Benefits of Using an HSA for Healthcare Expenses

HSAs offer a variety of potential benefits for individuals who are looking to save for healthcare expenses.

If you’re looking to maximize your health savings account (HSA) benefits, consider exploring fitness options. You might find that a gym membership, like the one offered at onelife fitness perimeter , can be a worthwhile investment. With an HSA, you can use pre-tax dollars to pay for eligible fitness expenses, potentially saving you money in the long run.

Cost savings

HSAs can help you save money on healthcare expenses by reducing your out-of-pocket costs.

Flexibility

You can use your HSA funds to pay for a wide range of eligible medical expenses, including doctor’s visits, prescription drugs, and dental care.

Control

A Health Savings Account (HSA) can be a valuable tool for managing healthcare costs, especially if you’re looking for ways to save money on medical expenses. If you’re interested in exploring career opportunities in the healthcare field, consider looking into beaumont health careers.

Many healthcare employers offer HSAs as part of their benefits packages, so you can potentially maximize your savings while pursuing a fulfilling career in healthcare.

You have complete control over your HSA funds and can choose how to invest them.

Portability

You can take your HSA with you if you change jobs or health insurance plans.

Amazon’s Role in HSAs

Amazon is not just an online retailer, it’s also becoming a player in the healthcare space, including Health Savings Accounts (HSAs). They offer a range of products and services that can help you manage your HSA effectively.

Amazon HSA Bank

Amazon partnered with HSA Bank to offer an HSA account that’s directly integrated with Amazon’s platform. This integration makes it easier for you to manage your HSA funds and spend them on eligible healthcare expenses. Here’s a closer look at the features and benefits of Amazon HSA Bank:

- Easy Access and Management:You can easily manage your HSA account through the Amazon website or mobile app, making it convenient to track your balance, make deposits, and pay for eligible medical expenses.

- Amazon Prime Benefits:Amazon Prime members get access to exclusive discounts and benefits, including potential savings on eligible healthcare expenses through their HSA.

- Amazon Pay Integration:You can use your HSA funds to make purchases on Amazon using Amazon Pay, making it easy to pay for eligible medical expenses directly from your account.

Amazon HSA-Compatible Products and Services

Amazon offers various products and services that are compatible with HSAs, making it easier for you to manage your healthcare expenses.

- Amazon Pharmacy:You can use your HSA funds to buy prescription drugs through Amazon Pharmacy. They offer competitive prices and convenient delivery options, making it a cost-effective way to manage your medication costs.

- Amazon Care:Amazon Care offers virtual and in-person healthcare services, including telehealth consultations, primary care, and urgent care. You can use your HSA funds to pay for these services, offering convenient and potentially cost-effective healthcare options.

- Amazon Health & Wellness Store:You can purchase various health and wellness products using your HSA funds, including over-the-counter medications, first aid supplies, and other eligible items.

Pros and Cons of Using Amazon for HSA Management

Here’s a table comparing the pros and cons of using Amazon for your HSA management:

| Pros | Cons |

|---|---|

| Easy access and management through the Amazon website and mobile app | Limited investment options compared to other HSA providers |

| Amazon Prime benefits and discounts | Potentially higher fees than other HSA providers |

| Integration with Amazon Pay for convenient purchases | May not be the best option for those seeking a wide range of investment choices |

Using Amazon for HSA Management: Health Savings Account Amazon

Amazon offers a convenient and user-friendly platform for managing your Health Savings Account (HSA). You can open an HSA account, fund it, track expenses, and withdraw funds all within the Amazon ecosystem.

Opening an HSA Account through Amazon

Opening an HSA account through Amazon is a straightforward process. You can choose from a range of HSA providers partnered with Amazon, each offering different features and fees.

- Visit the Amazon HSA page and select “Open an HSA.”

- Choose your preferred HSA provider from the list of available options.

- Provide the required personal and financial information, including your Social Security number and bank account details.

- Review the terms and conditions of the HSA account and agree to them.

- Submit your application and wait for approval, which typically takes a few business days.

Funding an HSA Account using Amazon

You can easily fund your HSA account using Amazon. This allows you to take advantage of your HSA contributions before tax deductions.

- Log in to your Amazon HSA account.

- Select “Fund your HSA” or a similar option.

- Enter the amount you wish to contribute.

- Choose your preferred funding method, such as bank transfer or debit card.

- Confirm the transaction and complete the funding process.

Tracking HSA Expenses using Amazon

Amazon provides a comprehensive platform for tracking your HSA expenses. This ensures that you can easily manage your HSA funds and maximize their benefits.

- Access your Amazon HSA account online or through the mobile app.

- Review your transaction history to see all your HSA expenses.

- Filter your expenses by date, category, or amount.

- Download or print your transaction history for your records.

Withdrawing Funds from an HSA using Amazon

Withdrawing funds from your HSA account is easy and straightforward using Amazon.

- Log in to your Amazon HSA account.

- Select “Withdraw funds” or a similar option.

- Enter the amount you wish to withdraw.

- Choose your preferred withdrawal method, such as direct deposit or check.

- Confirm the withdrawal request and wait for the funds to be deposited into your account.

Amazon’s HSA Benefits

Amazon’s Health Savings Account (HSA) services offer a convenient and integrated way to manage your healthcare finances. With Amazon’s extensive reach and user-friendly interface, it aims to simplify the HSA experience for individuals and families.

Advantages of Using Amazon for HSA Management

Amazon’s HSA services offer several advantages, making them a compelling option for many users.

- Convenience and Integration:Amazon’s HSA platform is seamlessly integrated with your existing Amazon account, providing a familiar and user-friendly experience. You can manage your HSA funds, track your spending, and access your account information all within the Amazon ecosystem.

- Wide Acceptance:Amazon’s HSA debit card is widely accepted at various healthcare providers and pharmacies, offering flexibility and ease of use for your healthcare expenses.

- Investment Options:Amazon’s HSA platform offers investment options, allowing you to grow your HSA funds over time. You can choose from a variety of investment options based on your risk tolerance and financial goals.

- Mobile App:Amazon’s HSA mobile app allows you to manage your account on the go, track your spending, and access your account information anytime, anywhere.

User Experiences and Reviews of Amazon’s HSA Services

Amazon’s HSA services have garnered mixed reviews from users. While some users appreciate the convenience and integration with Amazon’s ecosystem, others have expressed concerns about limited investment options and customer support.

- Positive Reviews:Many users praise the convenience and ease of use of Amazon’s HSA platform. They appreciate the seamless integration with their existing Amazon accounts and the ability to manage their HSA funds through the familiar Amazon interface. Some users also highlight the wide acceptance of the HSA debit card at various healthcare providers.

- Negative Reviews:Some users have expressed concerns about the limited investment options offered by Amazon’s HSA platform. They find the available investment options to be insufficient for their financial goals and prefer a wider range of choices. Additionally, some users have reported challenges with customer support, finding it difficult to resolve issues or get timely assistance.

A Health Savings Account (HSA) can be a great way to save money on healthcare expenses, especially if you’re enrolled in a high-deductible health plan. You might consider exploring health alliance plans as they often offer HSA-compatible options. When choosing an HSA, make sure to compare features and fees to find the best fit for your needs.

Potential Drawbacks of Using Amazon for HSA Management

While Amazon’s HSA services offer several advantages, there are also some potential drawbacks to consider.

- Limited Investment Options:Compared to some other HSA providers, Amazon’s HSA platform offers a limited range of investment options. This may be a concern for users seeking more diversified or customized investment strategies.

- Customer Support:Some users have reported challenges with customer support, finding it difficult to resolve issues or get timely assistance. This can be a concern for users who require prompt and efficient support.

- Fees:Amazon’s HSA platform may have fees associated with certain services, such as account maintenance or transaction fees. It’s important to review the fee schedule carefully before opening an account.

Comparison of Amazon’s HSA Services with Other Popular HSA Providers

Amazon’s HSA services compete with a wide range of HSA providers, each offering unique features and benefits. When comparing Amazon’s HSA services with other popular providers, it’s important to consider factors such as investment options, fees, customer support, and user experience.

- Investment Options:Some HSA providers offer a wider range of investment options compared to Amazon’s HSA platform. This can be a significant factor for users seeking more diversified or customized investment strategies.

- Fees:Fees can vary significantly between HSA providers. It’s essential to compare the fee schedules of different providers to identify the most cost-effective option.

- Customer Support:The quality of customer support can vary widely between HSA providers. It’s important to consider the availability, responsiveness, and helpfulness of customer support before making a decision.

- User Experience:The user experience can be a significant factor in choosing an HSA provider. Some providers offer more user-friendly platforms and mobile apps compared to others.

Tips for Using an HSA with Amazon

Taking advantage of your Health Savings Account (HSA) with Amazon can be a smart move for managing your healthcare expenses and saving for the future. Amazon’s HSA platform offers a range of features and benefits that can help you maximize your HSA potential.

Maximizing HSA Benefits

You can make the most of your HSA by taking advantage of Amazon’s offerings and implementing smart strategies. Here are some tips:

- Utilize Amazon’s HSA-eligible store:Amazon offers a wide selection of HSA-eligible products, including over-the-counter medications, medical supplies, and even some health and wellness items. By purchasing these items through Amazon, you can use your HSA funds to cover the cost.

- Explore Amazon’s subscription services:Amazon’s subscription services, like Subscribe & Save, can help you save money on frequently purchased items. You can often find HSA-eligible products that qualify for these services, which can help you save on both the cost of the products and the shipping fees.

- Take advantage of Amazon Prime benefits:If you have an Amazon Prime membership, you can enjoy free shipping and other benefits on HSA-eligible purchases. This can help you save money on shipping costs and make it easier to manage your HSA funds.

- Consider Amazon’s HSA investment options:Amazon offers a range of investment options for your HSA funds, allowing you to potentially grow your savings over time. This can be a good option if you have a long-term savings goal, such as retirement.

Using Amazon to Make the Most of HSA Funds

By incorporating Amazon into your HSA strategy, you can leverage its platform to optimize your savings and healthcare spending:

- Track your HSA spending:Amazon’s detailed transaction history can help you keep track of your HSA spending and ensure you’re staying within your budget. This is especially useful if you’re trying to avoid exceeding your annual contribution limit.

- Set up budget alerts:You can set up alerts to notify you when your HSA balance is getting low or when you’ve reached a certain spending threshold. This can help you stay on top of your finances and avoid overspending.

- Use Amazon’s HSA debit card:Amazon’s HSA debit card makes it easy to pay for HSA-eligible expenses at participating retailers. You can use it for both online and in-store purchases, providing flexibility and convenience.

- Compare prices:Amazon’s price comparison tools can help you find the best deals on HSA-eligible products. This can help you save money and maximize your HSA funds.

Managing HSA Investments with Amazon

Amazon offers investment options for your HSA, allowing you to potentially grow your savings over time. Here are some tips for managing these investments:

- Choose investments that align with your risk tolerance:Amazon offers a range of investment options, from low-risk to high-risk. Choose investments that align with your risk tolerance and financial goals.

- Diversify your investments:Diversifying your investments across different asset classes can help reduce your overall risk. Consider investing in a mix of stocks, bonds, and other assets.

- Monitor your investments regularly:It’s important to monitor your investments regularly and make adjustments as needed. This can help you stay on track with your financial goals.

- Consider using a financial advisor:If you’re unsure about how to manage your HSA investments, consider working with a financial advisor. They can help you develop a personalized investment strategy that meets your needs.

Checklist for Using Amazon for Your HSA

Before using Amazon for your HSA, consider these factors:

- Eligibility:Ensure you’re eligible for an HSA and that your HSA provider supports Amazon’s platform.

- Fees:Check for any fees associated with using Amazon for your HSA, such as transaction fees or investment management fees.

- Security:Ensure that Amazon’s platform is secure and that your personal information is protected.

- Customer service:Consider Amazon’s customer service reputation and how they handle HSA-related inquiries.

Closure

As you embark on your journey to manage your health savings account, consider the potential of Amazon. Its user-friendly platform, diverse offerings, and commitment to simplifying healthcare finances can empower you to make informed decisions and maximize your HSA benefits.

Remember, your health is an investment, and with Amazon’s help, you can make the most of it.

Helpful Answers

Is Amazon a bank that offers HSA accounts?

No, Amazon doesn’t directly offer HSA accounts. It collaborates with other HSA providers to offer products and services that enhance HSA management.

Can I use my HSA funds to buy anything on Amazon?

Not everything. You can only use your HSA funds for eligible medical expenses as defined by the IRS. Amazon offers a wide range of HSA-eligible products, but you’ll need to ensure the items you purchase are medically necessary.

What are the fees associated with using Amazon for HSA management?

Fees may vary depending on the specific HSA provider you choose through Amazon. It’s essential to carefully review the terms and conditions of the provider to understand any associated fees.

Are there any limitations to using Amazon for HSA management?

While Amazon offers a convenient platform, it’s important to note that not all HSA providers are available through Amazon. You may need to explore other options if your preferred HSA provider isn’t listed.