Health Savings Account PNC offers a unique way to manage your healthcare costs and save for the future. This comprehensive guide delves into the benefits, features, and functionalities of this powerful financial tool, providing insights into how it can contribute to your overall financial wellness.

HSAs are tax-advantaged accounts that allow individuals to save money for healthcare expenses. PNC’s HSA offerings provide a secure and convenient platform to manage your healthcare savings, offering a range of features, investment options, and user-friendly tools to make the process seamless.

What is a Health Savings Account (HSA)?

A Health Savings Account (HSA) is a tax-advantaged savings account that can be used to pay for qualified healthcare expenses. It’s designed to help individuals save money on healthcare costs while also reducing their tax burden.HSAs offer numerous benefits, making them a valuable tool for managing healthcare expenses.

Here’s a breakdown of how they work and who qualifies:

Eligibility

To be eligible for an HSA, you must be enrolled in a high-deductible health plan (HDHP). An HDHP is a health insurance plan with a higher deductible than traditional health plans, but lower premiums. The deductible for an HDHP is typically $1,500 for an individual and $3,000 for a family, though these amounts can vary each year.

How HSAs Work

HSAs work similarly to traditional savings accounts, but with significant tax advantages. You can contribute pre-tax dollars to your HSA, and the money grows tax-free. When you withdraw money from your HSA to pay for qualified medical expenses, the withdrawals are also tax-free.

This means you save money on taxes both when you contribute and when you withdraw.

A Health Savings Account (HSA) with PNC can be a great way to save for healthcare expenses, but it’s important to remember that it’s not just about finances. Taking care of your overall well-being is crucial, and that includes mental health.

Perhaps a little inspiration from the Miss France beauty pageant might help! They emphasize confidence and self-acceptance, which are essential for a healthy mindset. With a PNC HSA, you can invest in your physical and mental health, ensuring you have the resources to thrive.

Tax Advantages of HSAs

HSAs offer significant tax advantages, making them a popular choice for individuals seeking to manage their healthcare costs:* Tax-deductible contributions:Contributions to your HSA are tax-deductible, meaning you can reduce your taxable income by the amount you contribute.

Tax-free growth

The money in your HSA grows tax-free, allowing your savings to accumulate faster.

Tax-free withdrawals for qualified medical expenses

When you withdraw money from your HSA to pay for qualified medical expenses, the withdrawals are tax-free.

Examples of Qualified Medical Expenses

Qualified medical expenses include:* Doctor’s visits

- Prescription drugs

- Hospital stays

- Dental and vision care

- Over-the-counter medications (with a prescription)

HSA Ownership

You own your HSA, even if you change jobs or health plans. This means you can keep your HSA and continue to contribute to it even if you leave your current employer.

HSA Contributions

The maximum contribution limit for an HSA varies each year. For 2023, the maximum contribution limit is $3,850 for individuals and $7,750 for families. If you are 55 or older, you can make an additional “catch-up” contribution of $1,000.

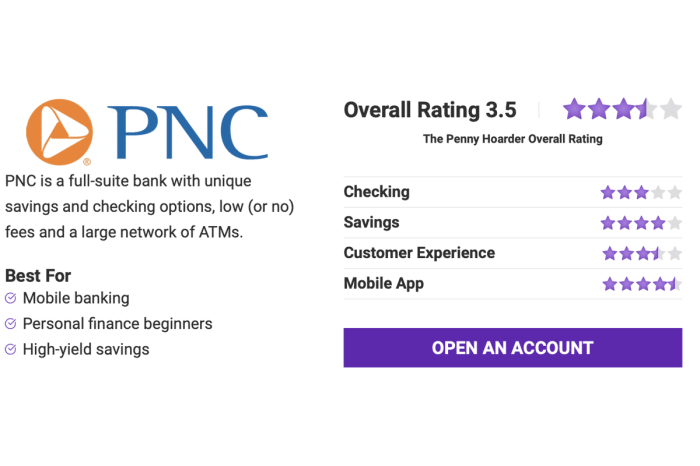

PNC Health Savings Accounts

PNC offers a variety of Health Savings Account (HSA) options to help you save for your healthcare expenses. PNC’s HSA offerings provide a range of features and benefits, including investment options, convenient account management tools, and competitive fees.

PNC HSA Features and Benefits

PNC’s HSA offerings are designed to help you save for your healthcare expenses and maximize your savings potential. Some key features and benefits include:

- Tax-advantaged savings:Contributions to an HSA are tax-deductible, and withdrawals for qualified medical expenses are tax-free. This can help you save money on your taxes and reduce your overall healthcare costs.

- Investment options:PNC offers a variety of investment options for your HSA, allowing you to grow your savings over time. You can choose from a range of mutual funds, ETFs, and other investments that align with your risk tolerance and financial goals.

- Convenient account management:PNC provides easy-to-use online and mobile banking tools for managing your HSA. You can track your balance, make contributions, withdraw funds, and review your transaction history, all from the convenience of your computer or smartphone.

- Competitive fees:PNC’s HSA fees are competitive with other financial institutions, helping you maximize your savings potential.

Comparing PNC HSA Options

PNC offers a range of HSA options to meet the needs of different individuals and families. You can choose from a variety of account types, including:

- Individual HSA:This is the most common type of HSA, designed for individuals with a high-deductible health plan (HDHP).

- Family HSA:This type of HSA is designed for families with an HDHP, allowing you to cover the healthcare expenses of multiple family members.

- Spousal HSA:This option is available for individuals with an HDHP who are married to someone who is not covered by an HDHP.

When comparing PNC’s HSA options to those offered by other financial institutions, consider factors such as:

- Fees:Compare the annual fees, monthly maintenance fees, and transaction fees charged by different institutions.

- Investment options:Evaluate the range of investment options available, including mutual funds, ETFs, and other investments.

- Account management tools:Consider the ease of use of online and mobile banking tools, as well as the availability of features such as account alerts and mobile check deposits.

- Customer service:Research the customer service reputation of different institutions and consider factors such as response times and the availability of live support.

PNC HSA Platform and User Interface

PNC’s HSA platform is designed to be user-friendly and accessible. You can manage your HSA account online through PNC’s website or mobile app. The platform offers a range of features, including:

- Account overview:View your current balance, transaction history, and account activity.

- Contribution management:Make contributions to your HSA and set up automatic contributions.

- Withdrawal management:Withdraw funds for qualified medical expenses and track your withdrawals.

- Investment management:View your investment portfolio, adjust your asset allocation, and make trades.

- Customer support:Access online help resources and contact PNC’s customer support team.

The PNC HSA platform is designed to be intuitive and easy to navigate, with clear menus and straightforward instructions. You can find information about your account, make transactions, and manage your investments with ease.

A PNC Health Savings Account (HSA) can be a valuable tool for managing healthcare costs. Understanding how your health information is managed is crucial, especially when dealing with sensitive medical data. If you’re interested in learning more about the importance of health information management, check out this article: why health information management.

This knowledge can help you make informed decisions about your HSA and overall healthcare.

Using a PNC HSA

Opening a PNC HSA is a straightforward process that can be done online, by phone, or in person at a PNC branch. You’ll need to provide some basic information, such as your Social Security number and date of birth. You’ll also need to choose a contribution amount and a beneficiary for your account.

Once you’ve opened your account, you can fund it with contributions from your paycheck, bank account, or other sources. You can also make contributions to your HSA after tax season.

Using an HSA to Pay for Eligible Medical Expenses

You can use your HSA to pay for eligible medical expenses, such as doctor’s visits, prescriptions, and hospital stays. To use your HSA to pay for medical expenses, you can either:

- Use your HSA debit card:This is the most convenient way to pay for medical expenses. Simply swipe your debit card at the point of sale, and the funds will be deducted from your HSA account.

- Submit a claim for reimbursement:If you pay for medical expenses out of pocket, you can submit a claim to PNC for reimbursement from your HSA. You’ll need to provide documentation of your expenses, such as receipts or invoices.

Accessing HSA Funds

There are a few different ways to access your HSA funds:

- Use your HSA debit card:This is the most convenient way to access your funds. You can use your debit card to make purchases at eligible merchants, withdraw cash from ATMs, or pay for medical expenses.

- Withdraw funds:You can withdraw funds from your HSA for non-medical expenses, but you’ll have to pay taxes and a penalty on the withdrawn funds. However, if you are over 65, you can withdraw funds for any reason without penalty.

- Transfer funds:You can transfer funds from your HSA to another account, such as a checking or savings account. This is a good option if you need to access funds for non-medical expenses and want to avoid the taxes and penalties associated with withdrawals.

HSA Contributions and Limits

The amount you can contribute to your HSA each year is limited. These limits are set by the IRS and can change annually. Understanding these limits is crucial for maximizing your tax benefits and saving for future healthcare expenses.

Annual Contribution Limits

The annual contribution limit for HSAs is based on your coverage status. If you have a high-deductible health plan (HDHP), you can contribute to an HSA. The IRS sets the annual contribution limit, which is adjusted for inflation. Here’s a breakdown of the contribution limits for 2023:

- Single Coverage:$3,850

- Family Coverage:$7,750

If you’re 55 or older, you can contribute an additional “catch-up” amount. This amount is added to the regular contribution limit:

- Catch-up Contribution:$1,000

Example:If you’re 60 years old and have family coverage, your maximum contribution limit for 2023 would be $8,750 ($7,750 + $1,000).

Tax Benefits of HSA Contributions

HSA contributions are tax-deductible, meaning you can reduce your taxable income by the amount you contribute. This can result in significant tax savings.

Potential Tax Deductions and Credits

In addition to the tax deduction for contributions, you may be eligible for other tax benefits related to your HSA.

- Tax-Free Withdrawals for Qualified Medical Expenses:You can withdraw money from your HSA tax-free to pay for qualified medical expenses. This includes expenses like doctor’s visits, prescription drugs, and dental care.

- Tax-Free Rollover:You can roll over your HSA to another HSA if you change employers or health plans.

Example:If you contribute $3,850 to your HSA in 2023 and your tax bracket is 22%, you would save $847 in federal income tax ($3,850 x 0.22).

HSA Investment Options

Investing your HSA funds can help your money grow over time, potentially leading to a larger nest egg for future healthcare expenses. PNC offers a variety of investment options within your HSA, allowing you to tailor your portfolio to your individual needs and risk tolerance.

Investment Options

PNC offers a range of investment options for your HSA, allowing you to diversify your portfolio and potentially achieve higher returns. These options typically include:

- Mutual Funds:These funds pool money from multiple investors to purchase a basket of stocks, bonds, or other assets. Mutual funds offer diversification and professional management, making them a popular choice for investors seeking to spread their risk.

- Exchange-Traded Funds (ETFs):Similar to mutual funds, ETFs are baskets of securities traded on stock exchanges.

ETFs generally have lower fees than mutual funds and offer greater flexibility for investors.

- Individual Stocks:If you’re comfortable with higher risk, you can invest in individual stocks. This allows you to choose specific companies you believe will perform well, but it also carries the risk of losing money if your investments don’t meet your expectations.

- Bonds:Bonds are debt securities that pay a fixed interest rate over a set period. Bonds generally offer lower returns than stocks but are considered less risky.

Investing Your HSA Funds

To invest your HSA funds, you’ll need to open an investment account with PNC. You can choose from a variety of investment options and allocate your funds according to your investment goals and risk tolerance.

- Self-Directed Investing:This option allows you to make your own investment decisions. You can choose from a wide range of investment options, including mutual funds, ETFs, individual stocks, and bonds. This option provides the most control but requires a higher level of knowledge and understanding of the market.

- Guided Investing:PNC offers guided investing options that provide support and guidance for your investment decisions. These options may include robo-advisors, which use algorithms to create and manage your portfolio based on your risk tolerance and investment goals. This option provides a balance between control and support, making it suitable for investors with moderate knowledge and experience.

- Target-Date Funds:These funds automatically adjust their asset allocation based on your retirement date. As you approach retirement, the fund becomes more conservative, shifting its focus from growth to preserving capital. This option is a simple and convenient choice for investors who want to set it and forget it.

Risks and Rewards of Investing

Investing your HSA funds comes with both risks and rewards. While investing can potentially lead to higher returns, it also carries the risk of losing money.

Risk:The value of your investments can fluctuate, and you may lose money if your investments decline in value.

Reward:The potential for higher returns over time, which can help your HSA grow faster and provide more funds for future healthcare expenses.

Comparing HSA Investment Options

The performance of different HSA investment options can vary significantly, depending on factors such as market conditions, asset allocation, and investment fees.

- Mutual Funds:Mutual funds can offer diversification and professional management, but they may have higher fees than other options.

- ETFs:ETFs generally have lower fees than mutual funds and offer greater flexibility, but they may not provide the same level of diversification.

- Individual Stocks:Individual stocks offer the potential for high returns, but they also carry the highest risk.

- Bonds:Bonds generally offer lower returns than stocks but are considered less risky.

HSA Rollover and Withdrawal Rules

Your HSA is a valuable tool for managing your healthcare expenses. Understanding the rules for rolling over and withdrawing funds is crucial to maximizing its benefits.

HSA Rollovers, Health savings account pnc

When you switch health insurance plans or change employers, you may need to transfer your HSA funds to a new account. The good news is that you can generally roll over your HSA funds without any tax penalties.

- Direct Rollover:The simplest way to transfer funds is through a direct rollover. This involves transferring your HSA funds directly from your old HSA provider to your new HSA provider. You will need to contact both providers to initiate this process.

Direct rollovers are generally tax-free and penalty-free.

- Indirect Rollover:You can also withdraw funds from your old HSA and then deposit them into a new HSA within 60 days. This is known as an indirect rollover. While the initial withdrawal is considered taxable, the subsequent deposit into a new HSA will be tax-free.

It’s important to note that you’ll still need to report the initial withdrawal on your tax return.

HSA Withdrawals for Non-Medical Expenses

While HSA funds are primarily intended for qualified medical expenses, you can withdraw funds for non-medical purposes. However, this comes with tax implications.

- Taxable Income:Withdrawals for non-medical expenses are considered taxable income. This means you’ll need to report them on your tax return and pay income tax on the amount withdrawn.

- Additional Penalty:In addition to taxes, you’ll also be subject to a 20% penalty for early withdrawal. This penalty applies to withdrawals before age 65, unless the funds are used for certain qualified expenses, such as long-term care or end-of-life expenses.

Avoiding HSA Penalties

To avoid penalties, ensure your HSA withdrawals are for qualified medical expenses. Here are some strategies:

- Keep Detailed Records:Maintain accurate records of all your medical expenses. This includes receipts, insurance statements, and other relevant documentation. These records will help you justify your withdrawals for tax purposes.

- Consult with a Tax Professional:If you have questions about HSA withdrawals or are unsure whether an expense qualifies, consult with a tax professional. They can provide guidance and ensure you’re compliant with IRS regulations.

Advantages and Disadvantages of HSAs: Health Savings Account Pnc

Health Savings Accounts (HSAs) offer a tax-advantaged way to save for healthcare expenses, but like any financial tool, they have their own set of advantages and disadvantages. It’s important to weigh these carefully to determine if an HSA is the right choice for you.

Comparing HSAs to Other Healthcare Savings Options

HSAs are often compared to Flexible Spending Accounts (FSAs) and Health Reimbursement Arrangements (HRAs). While all three offer tax advantages for healthcare expenses, they have key differences that can affect your choice.

- HSAs offer tax-free growth and withdrawals, making them more advantageous than FSAs and HRAs, which are subject to taxation on earnings.

- HSAs are portable, meaning you can take them with you if you change jobs or retire. This is unlike FSAs and HRAs, which are typically tied to your employer.

- HSAs have no “use-it-or-lose-it” rule, allowing you to carry over funds year after year. This contrasts with FSAs, where unused funds are often forfeited at the end of the year.

Potential Drawbacks of HSAs

While HSAs offer numerous advantages, there are some potential drawbacks to consider:

- Limited Access to Funds:Funds in an HSA can only be used for qualified medical expenses. While this limitation provides tax advantages, it restricts your access to the money for other purposes.

- Potential Tax Penalties:Using HSA funds for non-qualified medical expenses will result in taxes and a 20% penalty. This can be a significant drawback if you need to access your funds for non-medical reasons.

- High Deductible Health Plans:HSAs are typically paired with high-deductible health plans (HDHPs), which may require you to pay a larger upfront cost for healthcare services.

Situations Where an HSA May Not Be Ideal

An HSA may not be the best option for everyone. Here are some situations where an HSA might not be the most suitable:

- High Healthcare Expenses:If you have significant healthcare expenses, an HSA might not be sufficient to cover your costs.

- Limited Savings Capacity:If you are unable to contribute significantly to an HSA, the tax advantages might not outweigh the potential drawbacks.

- Uncertainty About Future Healthcare Needs:If you are unsure about your future healthcare needs, an HSA might not be the best option, as you may not be able to fully utilize the tax advantages.

HSA vs. Flexible Spending Accounts (FSAs)

Both Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) are tax-advantaged accounts designed to help you pay for eligible healthcare expenses. However, they differ in key aspects, including eligibility, contribution limits, and tax implications. Understanding these differences can help you determine which account is right for you.

Eligibility

- HSAsare available to individuals enrolled in a high-deductible health plan (HDHP). These plans typically have higher deductibles than traditional health plans, but they often have lower premiums.

- FSAsare available to employees of companies that offer them. Eligibility for FSAs is typically determined by your employer’s plan rules.

Contribution Limits

- HSAshave annual contribution limits that vary depending on your coverage status (single or family). These limits are set by the IRS and are adjusted each year.

- FSAsalso have annual contribution limits, which are set by your employer. These limits may vary from employer to employer.

Tax Implications

- HSAsoffer triple tax advantages: contributions are pre-tax, earnings grow tax-deferred, and withdrawals for qualified medical expenses are tax-free.

- FSAsoffer pre-tax contributions, meaning you pay less in taxes now. However, any unused funds at the end of the year are typically forfeited.

Situations Where an HSA Might Be a Better Choice

- If you are healthy and expect to have relatively low healthcare expenses, an HSA can be a good choice. You can contribute pre-tax dollars to the account and let the money grow tax-deferred, potentially using it for future healthcare expenses or other qualified expenses after you turn 65.

- If you are comfortable with a higher deductible and are confident in your ability to pay for unexpected healthcare costs, an HSA can help you save money on healthcare premiums.

- If you want a more flexible account with potential for long-term savings, an HSA might be a better option than an FSA.

Situations Where an FSA Might Be a Better Choice

- If you expect to have significant healthcare expenses in the near future, an FSA can help you cover those expenses immediately.

- If you prefer a lower deductible, an FSA may be a better choice.

- If you are concerned about losing money in an HSA if you don’t use it, an FSA may be a better option because unused funds are typically forfeited at the end of the year.

HSA Resources and Support

Navigating the world of HSAs can be confusing, but there are plenty of resources available to help you make the most of your account. PNC provides various support options to ensure you understand your HSA and its benefits.

A Health Savings Account (HSA) with PNC can be a great way to save for healthcare expenses, especially if you have a high-deductible health plan. One of the key things to remember is that HSAs allow you to invest your money, which can help it grow over time.

For example, you might consider investing in a product like cardi health , a heart-healthy supplement, which can help you stay healthy and reduce your future healthcare costs. By taking a proactive approach to your health and using your HSA wisely, you can potentially lower your out-of-pocket expenses and save for your future healthcare needs.

PNC HSA Website

PNC’s website is your one-stop shop for all things HSA-related. Here, you can find detailed information on:

- Account features and benefits

- Contribution limits and eligibility requirements

- Investment options and performance

- Withdrawal rules and tax implications

- Frequently asked questions and answers

You can also access your account online, manage your funds, and make transactions.

Additional Resources

Beyond PNC’s website, there are other valuable resources available to help you learn more about HSAs:

- Internal Revenue Service (IRS):The IRS website provides comprehensive information on HSAs, including tax rules and regulations.

- Health Savings Account (HSA) Association:This non-profit organization advocates for HSA consumers and provides educational resources.

- Consumer Financial Protection Bureau (CFPB):The CFPB offers guidance on consumer financial products and services, including HSAs.

Customer Support

PNC offers various customer support options to assist you with your HSA:

- Phone Support:You can reach PNC’s customer service team by phone for assistance with account inquiries, transactions, or any other questions.

- Online Chat:PNC provides live chat support on its website for quick and convenient assistance.

- Email Support:You can also contact PNC through email for non-urgent inquiries.

Ending Remarks

By understanding the nuances of Health Savings Account PNC, you can make informed decisions about your healthcare savings strategy. From contributing to your HSA to accessing funds for eligible expenses, this guide empowers you to navigate the world of HSAs with confidence, maximizing your financial well-being and securing a brighter future.

Question Bank

What are the eligibility requirements for a PNC HSA?

You must be enrolled in a high-deductible health plan (HDHP) and not be covered by another health plan to be eligible for a PNC HSA.

Can I use my PNC HSA for non-medical expenses?

While you can withdraw funds for non-medical expenses, you will be subject to taxes and a 20% penalty. It’s generally recommended to use HSA funds solely for eligible medical expenses.

What are the advantages of investing my HSA funds?

Investing your HSA funds can potentially grow your savings over time, helping you build a larger healthcare nest egg. However, keep in mind that investments carry inherent risks.

How can I contact PNC for HSA support?

You can reach PNC’s customer support through their website, phone number, or by visiting a local branch. They are available to answer your questions and provide assistance with your HSA account.