Independent health plans offer a unique path to navigating the healthcare system, providing individuals with a variety of options beyond traditional insurance models. These plans, often offered by private insurance companies, allow you to choose your doctors and hospitals within a specific network, offering flexibility and potentially lower costs.

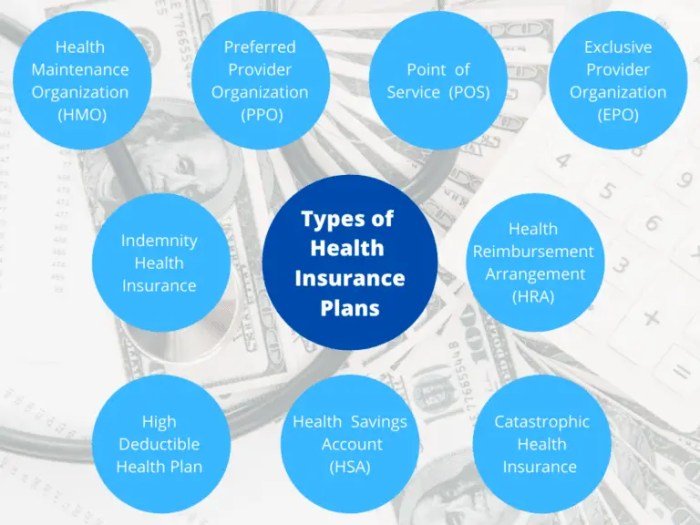

Independent health plans come in different flavors, such as HMOs, PPOs, and POS plans, each with its own set of features and benefits. Understanding the nuances of each plan is crucial for making an informed decision that aligns with your individual needs and budget.

Introduction to Independent Health Plans

Independent health plans, also known as non-group health plans, are a type of health insurance that is offered directly to individuals and families, rather than through an employer or other group. They are a popular option for people who are self-employed, retired, or who are not eligible for employer-sponsored health insurance.Independent health plans offer a wide range of coverage options, including plans that are similar to employer-sponsored plans and plans that are more tailored to individual needs.

They can be purchased directly from the insurance company or through a health insurance broker.

History and Evolution of Independent Health Plans

The history of independent health plans in the United States can be traced back to the early 20th century, when the first health insurance plans were offered to individuals and families. These plans were often sold by fraternal organizations and other groups.The development of independent health plans was significantly influenced by the passage of the Affordable Care Act (ACA) in 2010.

The ACA created the Health Insurance Marketplace, a platform where individuals and families can shop for and compare health insurance plans, including independent health plans. The ACA also established subsidies to help people afford health insurance, making independent health plans more accessible to a wider range of individuals.

Independent health plans offer a variety of options for individuals and families seeking coverage outside of traditional employer-sponsored plans. To help you make an informed decision, you can explore resources like mochi health reviews , which provide insights into different plans and their strengths and weaknesses.

By carefully evaluating your needs and comparing plans, you can find an independent health plan that best meets your healthcare requirements.

Key Characteristics of Independent Health Plans

Independent health plans are typically characterized by the following features:

- Offered directly to individuals and families: Independent health plans are not offered through an employer or other group. Individuals and families purchase these plans directly from the insurance company or through a health insurance broker.

- Wide range of coverage options: Independent health plans offer a variety of coverage options, including plans that are similar to employer-sponsored plans and plans that are more tailored to individual needs. This allows individuals to choose a plan that best meets their needs and budget.

Independent health plans offer a range of options for individuals seeking comprehensive coverage, and staying active is often a key component of overall well-being. For those in Ames, Iowa, Ames Racket and Fitness provides a fantastic resource for staying in shape.

Whether you’re looking for a gym, a tennis court, or a variety of fitness classes, they offer a welcoming and supportive environment to help you achieve your health goals, which can be especially important when navigating the complexities of independent health plans.

- May be subject to federal and state regulations: Independent health plans are subject to federal and state regulations, which vary depending on the state. These regulations are designed to ensure that health insurance plans are affordable and accessible to all individuals.

- May offer lower premiums than employer-sponsored plans: Independent health plans may offer lower premiums than employer-sponsored plans, particularly for individuals who are healthy and have a low risk of using healthcare services.

- May offer more flexibility in coverage options: Independent health plans may offer more flexibility in coverage options than employer-sponsored plans. This allows individuals to customize their coverage to meet their specific needs.

Types of Independent Health Plans

Independent health plans offer a variety of options to meet different needs and budgets. Understanding the different types of plans available can help you make an informed decision about the best plan for you.

Independent health plans offer a range of options for individuals and families, often providing more flexibility than traditional insurance plans. If you’re looking for a comprehensive healthcare provider in the area, consider the university of oregon health center , which offers a wide array of services and is known for its commitment to quality care.

When comparing independent health plans, it’s essential to factor in your individual needs and budget to find the best fit for your health and well-being.

Health Maintenance Organizations (HMOs)

HMOs are known for their lower premiums and emphasis on preventive care. They typically have a network of doctors and hospitals you must use, and you’ll need a referral from your primary care physician to see a specialist.

Benefits of HMOs:

- Lower premiums compared to other plans.

- Emphasis on preventive care, often with no co-pays for wellness visits.

- May offer lower out-of-pocket costs for covered services.

Drawbacks of HMOs:

- Limited choice of doctors and hospitals within the network.

- Need for referrals from your primary care physician to see specialists.

- May have higher co-pays for out-of-network services.

Preferred Provider Organizations (PPOs)

PPOs offer more flexibility than HMOs, allowing you to see doctors and hospitals outside the network, although you’ll pay higher costs for out-of-network services.

Benefits of PPOs:

- More flexibility in choosing doctors and hospitals.

- No need for referrals to see specialists.

- Coverage for out-of-network services, though at a higher cost.

Drawbacks of PPOs:

- Higher premiums compared to HMOs.

- Higher co-pays and deductibles for out-of-network services.

Point-of-Service (POS) Plans

POS plans combine features of HMOs and PPOs. They typically have a network of doctors and hospitals, but you can also see out-of-network providers for a higher cost.

Benefits of POS plans:

- Flexibility to see both in-network and out-of-network providers.

- Lower premiums compared to PPOs.

Drawbacks of POS plans:

- Higher co-pays for out-of-network services.

- May require referrals for specialists, even within the network.

Examples of Independent Health Plans

Major insurance providers like Anthem, Blue Cross Blue Shield, and UnitedHealthcare offer a variety of independent health plans, including HMOs, PPOs, and POS plans. The specific plans and their features may vary depending on your location and the provider.

Advantages and Disadvantages of Independent Health Plans

Independent health plans offer an alternative to traditional health insurance, often appealing to individuals and families seeking greater control over their healthcare choices. However, it’s crucial to weigh the potential benefits against the drawbacks before making a decision.

Advantages of Independent Health Plans

Independent health plans can provide several advantages, making them a suitable option for some individuals and families.

- Cost Savings:Independent health plans may offer lower premiums compared to traditional health insurance plans. This is often attributed to their smaller administrative costs and more streamlined operations.

- Flexibility:Independent health plans often provide greater flexibility in choosing healthcare providers and services. This allows individuals to select doctors and specialists who best suit their needs and preferences.

- Choice of Providers:Independent health plans typically have broader provider networks compared to traditional plans, offering a wider range of healthcare options.

Disadvantages of Independent Health Plans

While independent health plans offer potential benefits, they also come with certain drawbacks that should be considered.

- Limited Network Coverage:Independent health plans may have smaller provider networks than traditional plans. This could limit access to specific specialists or healthcare facilities, particularly in rural areas.

- Higher Deductibles:Independent health plans often have higher deductibles than traditional plans, meaning you’ll need to pay more out-of-pocket before your insurance coverage kicks in.

- Potential for Higher Out-of-Pocket Costs:Despite lower premiums, independent health plans may result in higher out-of-pocket costs due to factors like higher deductibles, copayments, and coinsurance.

Comparison of Independent Health Plans with Other Options

Feature Independent Health Plan Traditional Health Insurance Health Savings Account (HSA) Premiums Potentially lower Generally higher Typically lower Deductibles Often higher Generally lower Higher Provider Network May be smaller Typically larger Wide range of options Flexibility Greater choice of providers Limited choice High level of control Out-of-Pocket Costs Potentially higher Generally lower Potentially lower with pre-tax contributions Choosing the Right Independent Health Plan

Finding the perfect independent health plan can feel like navigating a maze, but it doesn’t have to be overwhelming. By taking a methodical approach and considering your unique needs, you can select a plan that provides the coverage you need at a price you can afford.

Factors to Consider When Choosing an Independent Health Plan

- Coverage:Different plans offer varying levels of coverage for different medical services. Consider your health history, current needs, and potential future medical needs. For example, if you have pre-existing conditions, you’ll want to choose a plan that provides comprehensive coverage for those conditions.

- Provider Network:Ensure your preferred doctors and hospitals are included in the plan’s network. If you have a specific specialist you need to see, verify they are in-network before enrolling.

- Premiums:This is the monthly cost you pay for your health insurance. Compare premiums across different plans to find one that fits your budget. Keep in mind that lower premiums may come with higher deductibles or co-pays.

- Deductibles:This is the amount you pay out-of-pocket before your insurance coverage kicks in. Higher deductibles typically mean lower premiums. Choose a deductible that aligns with your financial capacity to pay for healthcare costs upfront.

- Co-pays:These are fixed amounts you pay for specific medical services, like doctor visits or prescriptions. Consider the frequency of your healthcare needs and choose a plan with co-pays that are manageable for you.

- Out-of-Pocket Maximum:This is the maximum amount you’ll pay for healthcare costs in a year. Once you reach this limit, your insurance covers the rest of your medical expenses.

Essential Questions to Ask Potential Insurance Providers

Before enrolling in an independent health plan, it’s crucial to gather all the necessary information. Here are some essential questions to ask potential insurance providers:

- What is the plan’s coverage for essential health benefits?

- Who are the participating doctors and hospitals in the plan’s network?

- What are the monthly premiums, deductibles, co-pays, and out-of-pocket maximums?

- Are there any pre-existing condition exclusions?

- What is the plan’s process for filing claims and appeals?

- What customer service resources are available?

The Role of Independent Health Plans in the Healthcare System

Independent health plans play a significant role in the American healthcare system, impacting the market dynamics, providing access to affordable care, and navigating a complex regulatory landscape. They offer a diverse range of health insurance options, competing with traditional insurers and influencing healthcare delivery models.

Impact on the Healthcare Market and Competition, Independent health plans

Independent health plans contribute to a more competitive healthcare market by offering alternative insurance options to traditional insurers. Their presence fosters innovation and encourages existing players to improve their offerings and pricing strategies. The increased competition can lead to:

- Lower premiums and out-of-pocket costs for consumers.

- Wider selection of health insurance plans with varying benefits and coverage.

- Enhanced plan designs tailored to specific needs and demographics.

This competition drives efficiency and forces insurers to focus on providing value to their customers.

Providing Access to Affordable Healthcare

Independent health plans often cater to specific populations or geographic regions, offering plans that may be more affordable than traditional options. They can be particularly valuable for:

- Individuals and families with limited income or specific health needs.

- Small businesses seeking cost-effective insurance solutions for their employees.

By providing access to affordable healthcare, independent health plans contribute to improving health outcomes and reducing financial burdens for individuals and families.

The Regulatory Landscape Surrounding Independent Health Plans

Independent health plans operate within a complex regulatory framework designed to protect consumers and ensure market stability. The regulatory landscape includes:

- State-level insurance regulations that govern plan offerings, pricing, and consumer protections.

- Federal regulations, such as the Affordable Care Act (ACA), which establish minimum coverage requirements and standardize health insurance markets.

- Oversight by state insurance departments to monitor compliance and address consumer complaints.

These regulations can influence the availability and affordability of independent health plans, as well as the benefits and coverage they offer.

Future Trends in Independent Health Plans

The healthcare landscape is constantly evolving, driven by technological advancements, shifting demographics, and evolving policy landscapes. Independent health plans, with their agility and focus on innovation, are well-positioned to navigate these changes and play a significant role in shaping the future of healthcare.

The Impact of Telehealth and Personalized Medicine

Telehealth, the delivery of healthcare services remotely using technology, has witnessed rapid adoption, particularly during the COVID-19 pandemic. This trend is expected to continue, with independent health plans playing a crucial role in facilitating telehealth integration. They can partner with telehealth providers, develop virtual care programs, and leverage technology to enhance patient engagement and improve access to care.

Independent health plans can leverage telehealth to offer more affordable and accessible care options, particularly for rural populations and those with limited mobility.

Personalized medicine, tailoring healthcare to individual patients based on their genetic makeup, lifestyle, and environmental factors, is another transformative trend. Independent health plans can embrace personalized medicine by offering genetic testing, developing targeted treatment plans, and partnering with providers specializing in personalized care.

Independent health plans can utilize personalized medicine to optimize treatment outcomes, reduce unnecessary healthcare costs, and improve patient satisfaction.

Adapting to a Changing Healthcare Landscape

Independent health plans can thrive in the future healthcare landscape by embracing the following strategies:

- Focusing on Value-Based Care:Independent health plans can shift their focus from volume-based care to value-based care, emphasizing quality outcomes and cost-effectiveness. This can involve developing programs that incentivize providers to deliver high-quality care at lower costs.

- Leveraging Data Analytics:Independent health plans can leverage data analytics to gain insights into patient needs, identify trends, and improve care delivery. This includes using data to personalize care plans, optimize resource allocation, and prevent unnecessary hospitalizations.

- Partnering with Technology Companies:Independent health plans can collaborate with technology companies to develop innovative healthcare solutions. This can involve integrating artificial intelligence (AI) for disease prediction, using wearables for remote patient monitoring, and developing mobile apps for patient engagement.

Ending Remarks

Navigating the world of independent health plans requires careful consideration of factors like network coverage, premiums, and deductibles. By understanding the advantages and disadvantages, and by asking the right questions, you can empower yourself to choose a plan that provides the right level of coverage and financial protection for you and your family.

FAQ Compilation: Independent Health Plans

What are the benefits of choosing an independent health plan?

Independent health plans can offer benefits such as cost savings, flexibility in choosing providers, and potentially wider network coverage compared to traditional insurance plans.

What are the potential drawbacks of independent health plans?

Potential drawbacks include limited network coverage, higher deductibles, and potentially higher out-of-pocket costs.

How can I find an independent health plan that meets my needs?

You can compare plans online, contact insurance providers directly, or consult with a health insurance broker to find the best plan for your individual needs and budget.

Are independent health plans regulated by the government?

Yes, independent health plans are subject to state and federal regulations that ensure they meet certain standards and provide consumer protections.