Indiana Marketplace health insurance offers a lifeline to affordable and comprehensive health coverage for Hoosiers. This government-facilitated marketplace, established under the Affordable Care Act, connects individuals and families with a wide range of health insurance plans from reputable providers. The Indiana Marketplace aims to make healthcare accessible and affordable for everyone, regardless of their income or health status.

Navigating the world of health insurance can be daunting, but the Indiana Marketplace simplifies the process by providing a platform to compare plans, estimate costs, and access financial assistance. The marketplace offers a variety of plan options, including HMO, PPO, and POS, each with its unique features and cost structure.

Understanding these options and factors like deductibles, copayments, and out-of-pocket maximums is crucial for making informed decisions about your health insurance.

Understanding the Indiana Marketplace

The Indiana Marketplace, officially known as the Indiana Health Insurance Marketplace, is a platform that allows Hoosiers to compare and purchase health insurance plans that meet their individual needs and budgets. It serves as a central hub for accessing health insurance options, simplifying the process for individuals and families.

The Affordable Care Act’s Role in the Indiana Marketplace, Indiana marketplace health insurance

The Affordable Care Act (ACA), also known as Obamacare, significantly impacted the development and function of the Indiana Marketplace. The ACA aimed to expand health insurance coverage to millions of Americans and introduced several key provisions that shaped the Indiana Marketplace, including:

- Expansion of Medicaid Eligibility:The ACA expanded Medicaid eligibility, allowing more low-income individuals and families to access affordable health insurance through the Indiana Marketplace.

- Creation of Health Insurance Marketplaces:The ACA mandated the creation of state-based health insurance marketplaces, like the Indiana Marketplace, to offer a standardized platform for comparing and purchasing health insurance plans.

- Premium Tax Credits and Cost-Sharing Reductions:The ACA established premium tax credits and cost-sharing reductions to help individuals and families afford health insurance premiums and out-of-pocket expenses.

- Essential Health Benefits:The ACA requires all health insurance plans offered through the Indiana Marketplace to cover essential health benefits, such as preventive care, hospitalization, and prescription drugs.

Types of Health Insurance Plans Available

The Indiana Marketplace offers a variety of health insurance plans, categorized into four metal tiers:

- Bronze:Bronze plans have the lowest monthly premiums but typically have higher deductibles and out-of-pocket costs.

- Silver:Silver plans offer a balance between monthly premiums and out-of-pocket costs.

- Gold:Gold plans have higher monthly premiums but lower deductibles and out-of-pocket costs.

- Platinum:Platinum plans have the highest monthly premiums but the lowest deductibles and out-of-pocket costs.

Eligibility Criteria for Enrollment

To be eligible for enrollment in the Indiana Marketplace, individuals must meet specific criteria, including:

- Residency:Individuals must be residents of Indiana.

- Citizenship or Legal Residency:Individuals must be U.S. citizens or legal residents.

- Income:Individuals must meet certain income requirements to qualify for premium tax credits and cost-sharing reductions.

- Not Enrolled in Other Coverage:Individuals cannot be enrolled in other health insurance plans, such as employer-sponsored coverage or Medicare.

Navigating the Health Insurance Options

Choosing the right health insurance plan can be a complex process. The Indiana Marketplace offers a variety of plans, each with unique features and costs. Understanding these options is crucial for making an informed decision.

Individual vs. Family Health Insurance

The Indiana Marketplace offers both individual and family health insurance plans. Individual plans cover one person, while family plans cover multiple people, typically including a spouse and children. The primary difference lies in the coverage and cost. Family plans generally cost more than individual plans due to the larger number of people covered.

However, family plans can offer significant cost savings compared to purchasing separate individual plans for each family member.

Types of Health Insurance Plans

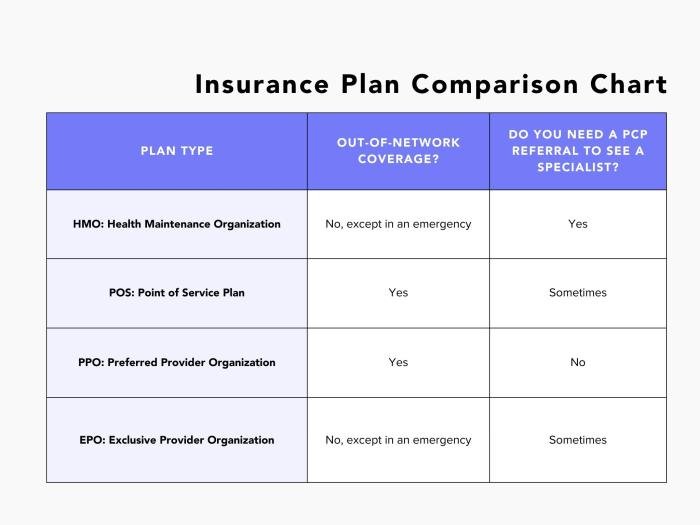

The Indiana Marketplace offers various health insurance plan types, each with its own structure and coverage. Here’s a breakdown of the key features of common plan types:

- Health Maintenance Organization (HMO):HMO plans typically have lower monthly premiums but require you to choose a primary care physician (PCP) within the network. You need a referral from your PCP to see specialists or access other services. HMO plans often have lower out-of-pocket costs for in-network care.

- Preferred Provider Organization (PPO):PPO plans offer more flexibility than HMOs. You can choose to see any doctor or specialist, in-network or out-of-network, without a referral. PPO plans typically have higher monthly premiums but lower out-of-pocket costs for in-network care. Out-of-network services are usually covered at a lower rate.

The Indiana Marketplace Health Insurance program provides a way for individuals and families to find affordable health insurance plans. If you’re looking for more information about options in California, you can check out resources on cover ca health insurance.

Both the Indiana Marketplace and California’s health insurance programs offer a variety of plans and subsidies to help people get the coverage they need.

- Point of Service (POS):POS plans combine elements of HMO and PPO plans. You choose a PCP within the network, but you can also see specialists or access services out-of-network. POS plans typically have lower premiums than PPO plans but higher out-of-pocket costs than HMO plans.

Understanding Key Factors

When choosing a health insurance plan, it’s crucial to consider the following factors:

- Deductible:The deductible is the amount you pay out-of-pocket before your insurance starts covering your medical expenses. A higher deductible generally means lower monthly premiums, but you’ll have to pay more before your insurance kicks in.

- Copayments:Copayments are fixed amounts you pay for specific medical services, such as doctor visits or prescriptions. Copayments can vary depending on the plan and the service.

- Out-of-Pocket Maximum:The out-of-pocket maximum is the maximum amount you’ll have to pay for covered medical expenses in a year. Once you reach this limit, your insurance will cover 100% of your eligible expenses.

Comparing Health Insurance Plans

The following table compares different health insurance plans available in the Indiana Marketplace, highlighting key features:

| Plan Type | Monthly Premium | Deductible | Copayments | Out-of-Pocket Maximum | Network Restrictions |

|---|---|---|---|---|---|

| HMO | Lower | Lower | Lower | Lower | Yes, requires PCP referral |

| PPO | Higher | Higher | Higher | Higher | No, but higher out-of-network costs |

| POS | Moderate | Moderate | Moderate | Moderate | PCP referral preferred, but not required |

Finding Affordable Coverage

Finding affordable health insurance in Indiana can be a challenge, but the Indiana Marketplace offers resources and tools to help you find a plan that fits your budget. You may be eligible for financial assistance, including tax credits and subsidies, which can significantly lower your monthly premiums.

Financial Assistance and Subsidies

The Indiana Marketplace offers financial assistance to help individuals and families afford health insurance. This assistance comes in the form of tax credits and subsidies, which can reduce your monthly premium costs. To qualify for financial assistance, you must meet certain income requirements.

The amount of financial assistance you receive depends on your income and family size.

- The Indiana Marketplace website has a calculator that can help you estimate your eligibility for financial assistance.

- You can also contact a certified application counselor for help with the application process.

Applying for Financial Assistance

The application process for financial assistance is relatively straightforward. You can apply online, by phone, or through a certified application counselor.

- To apply online, you will need to create an account on the Indiana Marketplace website.

- You will need to provide information about your income, family size, and other relevant factors.

- Once you submit your application, it will be reviewed and you will receive a determination of your eligibility for financial assistance.

Resources and Tools for Calculating Estimated Costs

The Indiana Marketplace provides several resources and tools to help you estimate your health insurance costs and find affordable plans.

Navigating the Indiana Marketplace for health insurance can feel overwhelming, but it’s essential to find the right plan that fits your needs and budget. While the process may not seem like it, it’s all about finding the right fit for your well-being, much like exploring all the beauty in the world and discovering what resonates with you.

Once you find the right health insurance plan, you can feel secure and confident knowing you have the coverage you need.

- The website has a plan comparison tool that allows you to compare different plans and their costs.

- You can also use the website’s cost estimator to get an estimate of your monthly premiums and out-of-pocket costs.

- The Indiana Marketplace offers a free service called “Shop & Compare,” which allows you to compare plans from different insurance companies.

Finding Affordable Health Insurance in Indiana

Here is a step-by-step guide to finding affordable health insurance in Indiana:

- Determine your eligibility for financial assistance:Visit the Indiana Marketplace website and use the calculator to estimate your eligibility.

- Create an account on the Indiana Marketplace website:You will need an account to apply for financial assistance and shop for plans.

- Gather your income and family size information:This information is needed to complete the application process.

- Apply for financial assistance:Complete the application online, by phone, or through a certified application counselor.

Indiana Marketplace health insurance offers a variety of plans to fit your needs and budget. If you’re looking for comprehensive coverage, you might consider checking out the ucd health and wellness center for their wellness programs and services. These programs can help you stay healthy and manage chronic conditions, potentially reducing your healthcare costs in the long run.

Remember to explore your options carefully to find the best plan for you.

- Use the plan comparison tool and cost estimator:Compare plans and estimate your costs to find a plan that fits your budget.

- Enroll in a plan:Once you have found a plan that meets your needs, you can enroll through the Indiana Marketplace website.

Understanding Key Considerations

Choosing the right health insurance plan is a crucial decision that can significantly impact your financial well-being and access to healthcare. It’s essential to consider your individual circumstances and needs when selecting a plan that best suits your unique situation.

Coverage Limitations and Exclusions

Understanding the limitations and exclusions of a health insurance plan is crucial for making informed decisions about your coverage. Exclusions refer to specific medical services or conditions that are not covered by the plan. Limitations may include restrictions on coverage amounts, such as annual deductibles or out-of-pocket maximums.

For example, some plans may exclude coverage for pre-existing conditions or specific treatments, while others may have limitations on the number of visits or procedures covered. Carefully reviewing the plan documents and asking clarifying questions can help you avoid unexpected costs and ensure you have adequate coverage for your needs.

Accessing Support and Resources

Navigating the health insurance landscape can feel overwhelming, especially when you’re trying to find the right plan for your individual needs and budget. Fortunately, there are numerous resources and support systems available to help you make informed decisions and access the coverage you deserve.

Available Resources and Support Organizations

Finding the right health insurance plan can be a complex process, and you don’t have to go through it alone. There are several organizations and resources available to provide guidance and support:

- The Indiana Health Insurance Marketplace:The official website for Indiana’s health insurance marketplace offers a wealth of information, tools, and resources. You can compare plans, estimate costs, apply for financial assistance, and access helpful guides and FAQs.

- The Indiana Department of Insurance:This state agency regulates insurance companies and provides consumer protection. You can contact them for assistance with insurance-related issues or to file complaints.

- The Centers for Medicare & Medicaid Services (CMS):The federal agency that oversees Medicare and Medicaid also provides information and resources on the Affordable Care Act and health insurance options. You can find helpful guides, FAQs, and contact information on their website.

- Consumer advocacy groups:Organizations like the National Consumer Law Center and the Center for Medicare Advocacy provide valuable information and support for consumers navigating the health insurance system. They offer resources on plan choices, consumer rights, and advocacy services.

- Local community health centers:These organizations often offer enrollment assistance and guidance on health insurance options to their patients and the local community.

Role of Insurance Brokers and Agents

Insurance brokers and agents play a crucial role in the health insurance selection process. They act as intermediaries between you and insurance companies, helping you find the best plan based on your individual needs and budget.

- Provide personalized guidance:Brokers and agents can assess your specific health needs, budget, and coverage requirements to recommend suitable plans.

- Simplify the process:They can navigate the complexities of the health insurance market and help you understand the different plan options, benefits, and costs.

- Offer support throughout the year:Brokers and agents can assist with enrollment, plan changes, and claims processing throughout the year, ensuring you have access to ongoing support.

Understanding Enrollment Periods and Deadlines

It’s essential to be aware of the enrollment periods and deadlines for health insurance plans. Missing these deadlines could limit your options or result in a gap in coverage.

- Open Enrollment Period:This period typically runs from November 1st to January 15th each year, offering a chance to enroll in or change health insurance plans.

- Special Enrollment Period:You may qualify for a Special Enrollment Period if you experience a qualifying life event, such as losing your job, getting married, or having a baby. This allows you to enroll in or change plans outside of the Open Enrollment Period.

Navigating the Indiana Marketplace Website and Online Resources

The Indiana Marketplace website is a comprehensive resource for finding health insurance information and assistance. Here’s a guide to navigating the website and utilizing its resources:

- Homepage:The homepage provides an overview of the Marketplace, including information on eligibility, plan options, and enrollment assistance.

- Plan Finder Tool:This tool allows you to compare plans based on your needs and budget, including monthly premiums, deductibles, and co-pays.

- Financial Assistance:The Marketplace website provides information on subsidies and tax credits available to help you afford coverage.

- Enrollment Assistance:You can find contact information for certified enrollment assisters who can help you navigate the enrollment process.

- Resources and FAQs:The website offers a wealth of resources, including FAQs, guides, and videos to help you understand the health insurance process.

Closure

Choosing the right Indiana Marketplace health insurance plan requires careful consideration of individual needs and circumstances. With a range of plan options, financial assistance programs, and helpful resources available, Hoosiers can find affordable coverage that meets their specific healthcare requirements.

By understanding the different plan types, eligibility criteria, and financial assistance options, individuals can navigate the Indiana Marketplace effectively and secure peace of mind knowing they have access to quality healthcare.

Popular Questions: Indiana Marketplace Health Insurance

What if I am self-employed? Can I still use the Indiana Marketplace?

Yes, self-employed individuals are eligible to enroll in health insurance plans through the Indiana Marketplace.

Is there a waiting period for coverage after I enroll?

The waiting period for coverage varies depending on the plan you choose, but it is typically around 30 days.

What happens if I lose my job and my employer-sponsored health insurance?

You may be eligible for a Special Enrollment Period (SEP) to enroll in a health insurance plan through the Indiana Marketplace.

Can I change my health insurance plan during the year?

You can change your health insurance plan during the Open Enrollment Period, which runs from November 1st to January 15th each year. You may also be eligible for a Special Enrollment Period if you experience certain life events, such as losing your job or getting married.