Jobs health insurance is a vital component of the American workplace, offering financial security and peace of mind to employees. It acts as a safety net, protecting individuals and families from the potentially devastating costs of unexpected medical expenses. This comprehensive guide delves into the intricacies of job-based health insurance, exploring its benefits for both employees and employers, examining the challenges it faces, and looking ahead to its future trajectory.

From the different types of plans available to the impact of healthcare reform, this exploration sheds light on the crucial role health insurance plays in ensuring a healthy and productive workforce. By understanding the nuances of this complex system, individuals can make informed decisions about their health coverage and employers can navigate the landscape of providing benefits effectively.

Importance of Health Insurance for Employees

Health insurance is a crucial benefit that employers can offer to their employees, providing financial security and peace of mind in the face of unexpected medical expenses. This financial protection is essential for employees to focus on their well-being and productivity, without the burden of healthcare costs weighing them down.

Financial Security and Protection from Catastrophic Medical Bills

Health insurance acts as a safety net for employees, shielding them from the potentially devastating financial impact of unexpected medical expenses. A serious illness or accident can quickly lead to substantial medical bills, which can be overwhelming for individuals and families.

Health insurance helps mitigate this risk by covering a significant portion of these costs, allowing employees to access necessary medical care without financial strain.

A study by the Kaiser Family Foundation found that the average annual premium for employer-sponsored health insurance in 2022 was $7,739 for single coverage and $22,221 for family coverage.

Employee Well-being and Reduced Stress

Beyond financial security, health insurance plays a vital role in promoting employee well-being. When employees have access to quality healthcare, they are more likely to prioritize their health and seek preventive care. This proactive approach can lead to better overall health and reduced healthcare costs in the long run.

A study published in the Journal of Occupational and Environmental Medicine found that employees with health insurance were more likely to engage in preventive health behaviors, such as getting regular checkups and screenings.

Furthermore, the absence of financial stress related to healthcare costs can significantly improve employee morale and productivity. Employees who are worried about medical bills are less likely to be engaged in their work, leading to decreased productivity and increased absenteeism.

Health insurance helps alleviate this burden, allowing employees to focus on their work and contribute to the success of the organization.

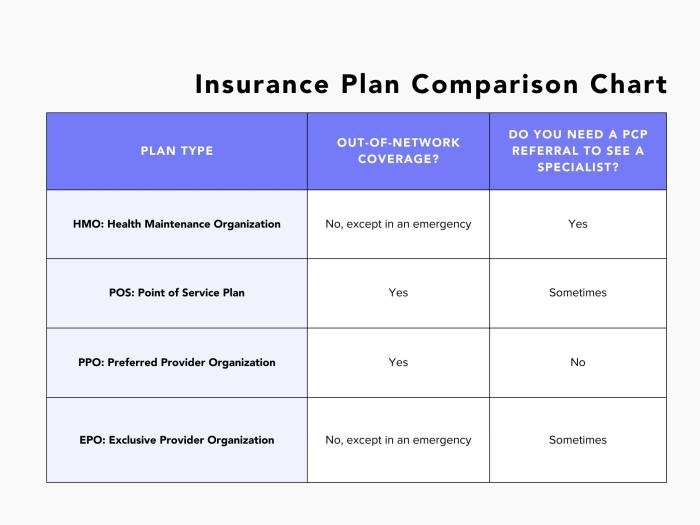

Types of Health Insurance Plans Offered by Employers

Employers often offer a variety of health insurance plans to their employees, each with its own unique features, costs, and coverage options. Choosing the right plan can be a complex decision, as it depends on individual needs, preferences, and financial circumstances.

Understanding the different types of plans available is crucial for making an informed decision.

Health Maintenance Organizations (HMOs)

HMOs are a type of health insurance plan that provides comprehensive medical care through a network of healthcare providers. They typically have lower premiums than other plans, but require you to choose a primary care physician (PCP) within the network.

You must receive referrals from your PCP to see specialists or other healthcare providers within the network.

Jobs health insurance is a critical aspect of employee benefits, especially in healthcare settings. If you’re seeking employment at a reputable medical center in Salisbury, NC, Novant Health Rowan Medical Center Salisbury NC might be a great option. They offer competitive benefits packages, including health insurance plans that cater to diverse needs, making it a desirable place to work for many professionals.

HMOs emphasize preventive care and focus on managing costs through coordinated care.

Preferred Provider Organizations (PPOs)

PPOs offer more flexibility than HMOs, allowing you to see healthcare providers both inside and outside the network. You will generally pay lower costs for services within the network, but you will have to pay more for services outside the network.

PPOs typically have higher premiums than HMOs.

PPOs offer more choice and flexibility but may have higher out-of-pocket costs.

Health Savings Accounts (HSAs), Jobs health insurance

HSAs are tax-advantaged savings accounts that can be used to pay for healthcare expenses. They are typically paired with high-deductible health insurance plans (HDHPs), which have lower premiums but higher deductibles. You can contribute to an HSA pre-tax, and the funds grow tax-free.

HSAs offer flexibility and tax benefits, but require a high deductible.

Table Comparing Health Insurance Plan Features

| Plan Type | Premium Cost | Deductible | Co-pay | Coverage | Network | Other Key Features |

|---|---|---|---|---|---|---|

| HMO | Low | Low | Low | Comprehensive | Limited | Requires PCP referrals, emphasizes preventive care |

| PPO | Moderate | Moderate | Moderate | Comprehensive | Broader | More flexibility, higher out-of-pocket costs for out-of-network services |

| HSA | Low | High | Low | Comprehensive | Broader | Tax-advantaged savings account, paired with high-deductible plans |

Benefits of Employer-Sponsored Health Insurance for Businesses

Offering health insurance is a strategic investment for businesses, attracting and retaining top talent, reducing costs, and improving overall employee well-being. By providing comprehensive health benefits, employers can gain a competitive edge in the marketplace and foster a more productive and engaged workforce.

Attracting and Retaining Top Talent

In today’s competitive job market, offering health insurance is a key factor in attracting and retaining top talent. Many job seekers prioritize comprehensive health benefits when considering employment opportunities. Providing health insurance demonstrates an employer’s commitment to employee well-being, which can significantly impact recruitment and retention efforts.

A recent study by the Society for Human Resource Management (SHRM) found that 78% of employees consider health insurance to be a very important factor when deciding whether to accept a job offer.

Job health insurance plans often include gym memberships as a perk, and it’s easy to see why! Staying active is essential for overall well-being, and gyms offer a wide range of equipment to help you reach your fitness goals. If you’re looking for top-notch cardio and strength training options, consider exploring the matrix fitness machines – they’re known for their durability, innovative features, and ability to provide a challenging workout.

Taking advantage of your health insurance benefits can be a great way to invest in your health and fitness, ultimately contributing to a more fulfilling and productive life.

Tax Advantages for Employers

Employers who offer health insurance can benefit from significant tax advantages. Premiums paid for employer-sponsored health insurance are generally tax-deductible, reducing the overall tax burden on the business. Additionally, employees can deduct their share of health insurance premiums from their taxable income.

For example, if an employer pays $10,000 in health insurance premiums for its employees, this amount can be deducted from the company’s taxable income, resulting in lower tax liability.

Improving Employee Productivity and Reducing Absenteeism

Healthy employees are more productive employees. By providing health insurance, employers can encourage their workforce to prioritize their health and well-being. Access to preventive care, routine checkups, and treatment for health issues can help employees stay healthy and avoid costly and disruptive absences from work.

Studies have shown that employees with access to employer-sponsored health insurance have lower rates of absenteeism and higher levels of productivity.

Challenges of Providing Health Insurance to Employees

Providing health insurance to employees is a significant responsibility for any business, but it comes with a set of challenges that employers must navigate effectively.

Increasing Healthcare Costs

The rising costs of healthcare pose a significant financial burden on employers. These costs have been steadily increasing over the years, impacting both premiums and out-of-pocket expenses for employees.

- Inflation:General inflation plays a role, pushing up the cost of medical services, medications, and technology.

- Aging Population:As the population ages, the demand for healthcare services increases, leading to higher costs.

- Advancements in Medical Technology:While beneficial, new treatments and technologies can be expensive, contributing to higher healthcare costs.

- Administrative Costs:The complex administrative processes involved in managing health insurance plans also add to the overall cost.

The impact of these rising costs on employers is substantial. They often face pressure to keep premiums affordable for employees while maintaining a competitive benefits package. This can lead to difficult decisions regarding plan design, coverage levels, and employee contributions.

Job-related health insurance is a crucial aspect of employee benefits, offering financial protection against unexpected medical expenses. One innovative approach to healthcare is offered by turquoise health , which emphasizes preventative care and personalized health plans. This innovative approach can serve as a valuable resource for employers looking to improve their employee health insurance offerings.

Trends in Job-Based Health Insurance

The landscape of employer-sponsored health insurance is constantly evolving, driven by factors like technological advancements, changing consumer preferences, and government regulations. Understanding these trends is crucial for both employers and employees to make informed decisions about health insurance coverage.

The Rise of High-Deductible Health Plans

High-deductible health plans (HDHPs) have become increasingly popular in recent years. These plans typically have lower monthly premiums but require individuals to pay a higher deductible before insurance coverage kicks in. The popularity of HDHPs can be attributed to several factors:

- Cost-effectiveness:HDHPs often have lower monthly premiums compared to traditional plans, making them attractive to employers looking to control healthcare costs.

- Consumer Choice:HDHPs offer individuals more control over their healthcare spending, allowing them to choose how they use their healthcare dollars.

- Tax Advantages:HDHPs often qualify for a health savings account (HSA), which allows individuals to save pre-tax dollars for healthcare expenses.

However, HDHPs also present challenges for individuals, particularly those with chronic conditions or who require frequent medical care. The high deductibles can be a significant financial burden, and individuals may be more hesitant to seek necessary medical care due to cost concerns.

Telehealth and Virtual Care

The adoption of telehealth and virtual care options has accelerated in recent years, driven by the COVID-19 pandemic and a growing preference for convenient healthcare access. Telehealth offers a range of benefits, including:

- Increased Access:Virtual care expands access to healthcare services for individuals in remote areas or with limited mobility.

- Convenience:Telehealth eliminates the need for travel and appointments, making it easier for individuals to receive care on their own time.

- Cost Savings:Telehealth can potentially reduce healthcare costs by minimizing the need for in-person visits.

Employers are increasingly incorporating telehealth options into their health insurance plans, recognizing the value they offer in terms of cost savings, employee satisfaction, and improved health outcomes.

Impact of Healthcare Reform Legislation

The Affordable Care Act (ACA) has significantly impacted job-based health insurance, introducing several key provisions that have shaped the current landscape.The ACA’s impact on employer-sponsored health insurance includes:

- Individual Mandate:The ACA requires most Americans to have health insurance, either through their employer or through the individual market. This provision has incentivized employers to offer health insurance to their employees to avoid penalties.

- Essential Health Benefits:The ACA mandates that all health insurance plans, including employer-sponsored plans, cover a set of essential health benefits, such as preventive care, maternity care, and mental health services. This ensures that employees have access to a comprehensive set of healthcare benefits.

- Subsidies:The ACA provides subsidies to individuals and families who purchase health insurance through the individual market. These subsidies help to make coverage more affordable, particularly for lower-income individuals. While these subsidies are not directly applicable to employer-sponsored plans, they can indirectly influence employer decisions about health insurance offerings.

The ACA has also created new regulations for employer-sponsored health insurance, such as the requirement for employers to provide employees with a summary of benefits and coverage (SBC) and the establishment of the SHOP marketplace for small businesses to purchase health insurance.

The Future of Job-Based Health Insurance: Jobs Health Insurance

The landscape of healthcare and health insurance is constantly evolving, driven by technological advancements, changing demographics, and shifting policy priorities. These changes are likely to have a significant impact on the future of job-based health insurance, requiring employers and employees to adapt to new realities and explore innovative solutions.

Impact of Technological Advancements

Technological advancements are playing a transformative role in healthcare and health insurance, creating opportunities for greater efficiency, personalized care, and cost savings. These advancements are driving the evolution of job-based health insurance in several ways:

- Telemedicine and Remote Monitoring:Telemedicine platforms and remote patient monitoring devices are increasing access to healthcare services, especially in rural areas or for individuals with mobility limitations. Employers are increasingly incorporating these technologies into their health insurance plans, offering virtual consultations, remote monitoring of chronic conditions, and virtual mental health support.

- Artificial Intelligence (AI) and Machine Learning (ML):AI and ML are being used to analyze vast amounts of healthcare data, identify patterns, and predict health risks. This enables more personalized healthcare recommendations, early disease detection, and more efficient management of chronic conditions. Insurance companies are leveraging these technologies to develop predictive models, personalize risk assessments, and offer customized insurance plans based on individual health data.

- Blockchain Technology:Blockchain technology offers a secure and transparent platform for managing healthcare data, facilitating interoperability between different healthcare providers, and streamlining claims processing. This could lead to more efficient healthcare systems and reduced administrative costs, potentially lowering the overall cost of health insurance.

Scenario: The Future of Job-Based Health Insurance

Imagine a future where health insurance is more personalized, preventative, and integrated into the fabric of daily life. Employers offer a range of health insurance options, tailored to the specific needs and preferences of their employees.

- Personalized Health Plans:Employees can choose from a menu of health insurance plans that cater to their individual health risks, lifestyle choices, and preferences. These plans may incorporate wearable technology, AI-powered health coaching, and personalized medication management programs.

- Focus on Prevention and Wellness:Health insurance plans incentivize healthy behaviors and preventative care. Employers may offer discounts on gym memberships, healthy food options, and personalized wellness programs, aiming to reduce healthcare costs in the long run.

- Integrated Healthcare Systems:Health insurance plans may be integrated with employers’ wellness programs and employee assistance programs (EAPs), providing a holistic approach to employee health and well-being. This integration can facilitate seamless access to healthcare services, mental health support, and financial counseling.

Ultimate Conclusion

In conclusion, jobs health insurance remains an essential aspect of the employment landscape, offering both financial security and peace of mind to employees. As the healthcare system continues to evolve, employers and employees alike must stay informed about the latest trends and adapt their strategies accordingly.

The future of job-based health insurance promises a blend of technological advancements, evolving healthcare policies, and a continued focus on providing comprehensive and affordable coverage. By navigating these complexities, we can ensure that health insurance remains a cornerstone of a healthy and productive workforce.

Answers to Common Questions

What are some common health insurance plan types?

Common health insurance plan types include HMOs (Health Maintenance Organizations), PPOs (Preferred Provider Organizations), and HSA (Health Savings Account) plans. Each plan has its own unique features, costs, and coverage options.

How does health insurance affect employee productivity?

Health insurance can positively impact employee productivity by reducing stress related to healthcare costs and allowing employees to focus on their work. It can also lead to fewer sick days and improved overall well-being.

What are some trends in job-based health insurance?

Recent trends include the rise of high-deductible plans, the increasing use of telehealth and virtual care options, and the impact of healthcare reform legislation.

What are some challenges of providing health insurance to employees?

Challenges include the increasing costs of healthcare, the complexities of managing health insurance plans, and the need to provide coverage for employees with pre-existing conditions.