Marketplace health insurance michigan – Marketplace health insurance in Michigan provides a pathway to affordable and comprehensive health coverage for residents. The Michigan Health Insurance Marketplace, a state-run program, offers a platform where individuals and families can explore a range of plans, compare costs, and enroll in the coverage that best suits their needs.

This marketplace acts as a central hub for accessing health insurance options, simplifying the process and ensuring that residents have access to essential healthcare.

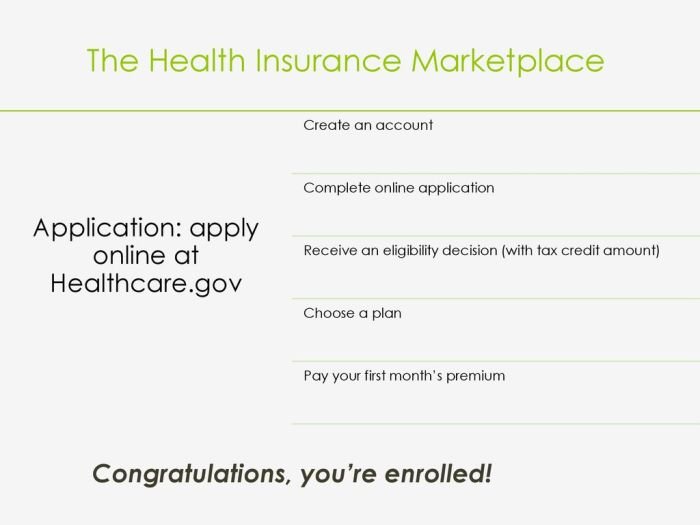

Navigating the marketplace involves understanding eligibility criteria, exploring different plan types, and comparing costs and benefits. The process can be streamlined by utilizing available resources, such as online tools, enrollment assistance programs, and support from certified brokers and navigators. By leveraging these resources, individuals can make informed decisions about their health insurance choices, ensuring they have access to the coverage they require.

Understanding the Michigan Marketplace

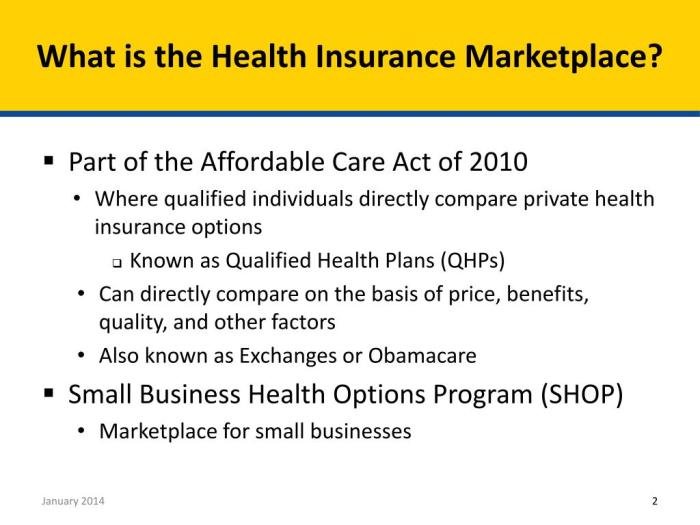

The Michigan Health Insurance Marketplace, also known as the Health Insurance Marketplace, is a platform designed to help Michigan residents find and purchase affordable health insurance plans. It acts as a central hub where individuals and families can compare different plans from various insurance companies, understand their options, and enroll in coverage that meets their needs and budget.

Eligibility Criteria for Marketplace Plans

To be eligible for coverage through the Michigan Marketplace, individuals and families must meet certain criteria. These criteria include:

- Residency in Michigan: Individuals must be residents of Michigan to be eligible for Marketplace plans.

- U.S. Citizenship or Lawful Presence: Individuals must be U.S. citizens or have lawful presence in the United States.

- Income Limits: Individuals and families must meet certain income limits to qualify for premium tax credits and cost-sharing reductions, which can significantly lower the cost of coverage. The income limits vary depending on family size and household income.

- Not Covered by Employer-Sponsored Insurance: Individuals who are covered by employer-sponsored health insurance are generally not eligible for Marketplace plans.

- Not Incarcerated: Individuals who are incarcerated are not eligible for Marketplace plans.

Types of Health Insurance Plans Available

The Michigan Marketplace offers a variety of health insurance plans, each with different coverage levels and costs. These plans are categorized into four metal tiers, each representing a different level of coverage:

- Bronze: Bronze plans have the lowest monthly premiums but offer the lowest level of coverage. They typically have higher deductibles and out-of-pocket costs.

- Silver: Silver plans offer a balance of coverage and affordability. They have lower deductibles and out-of-pocket costs than Bronze plans, but higher monthly premiums.

- Gold: Gold plans provide a higher level of coverage than Silver plans, with lower deductibles and out-of-pocket costs. They have higher monthly premiums than Silver plans.

- Platinum: Platinum plans offer the highest level of coverage, with the lowest deductibles and out-of-pocket costs. They have the highest monthly premiums of all the metal tiers.

Navigating the Marketplace

The Michigan Marketplace is a user-friendly platform designed to help individuals and families find affordable health insurance plans. It’s a one-stop shop where you can compare plans, estimate costs, and enroll in coverage.

Navigating the marketplace for health insurance in Michigan can be a bit like trying to find a needle in a haystack. But, if you’re looking for a break from the stress, perhaps a binge-watching session of the beauty queen of jerusalem season 3 might be a good idea.

Once you’re back to reality, remember to compare plans, check coverage details, and choose the one that best fits your needs and budget. After all, your health is worth the effort.

Enrollment Periods and Deadlines

Knowing the different enrollment periods and deadlines is crucial for ensuring you have continuous health insurance coverage. There are specific times when you can enroll in a health insurance plan through the Michigan Marketplace.

- Open Enrollment Period:This period typically runs from November 1st to January 15th each year. During this time, anyone can apply for coverage, regardless of whether they have had health insurance previously.

- Special Enrollment Period:You may be eligible for a Special Enrollment Period if you experience a qualifying life event, such as:

- Losing your current health insurance coverage

- Getting married or divorced

- Having a baby or adopting a child

- Moving to a new state

These events allow you to enroll outside of the Open Enrollment Period.

Resources for Navigating the Marketplace

The Michigan Marketplace offers a variety of resources to assist you in navigating the enrollment process.

- Online Marketplace:The official Michigan Marketplace website provides a comprehensive guide, including plan comparisons, cost calculators, and enrollment tools.

- Phone Support:You can contact the Marketplace’s customer service team for assistance with any questions or concerns. They can help you understand your options, complete your application, and enroll in a plan.

- In-Person Assistance:Certified Application Counselors (CACs) are trained professionals who can provide personalized guidance and support throughout the enrollment process. They can be found at community organizations, health centers, and libraries.

Understanding Costs and Coverage

The cost of your marketplace health insurance plan in Michigan can vary greatly depending on several factors. Understanding these factors can help you choose a plan that fits your budget and needs.

Factors Influencing Plan Costs

The cost of your marketplace health insurance plan is determined by several factors, including:

- Age:Older individuals generally have higher healthcare costs, so their premiums are typically higher.

- Location:Healthcare costs can vary significantly by region. Plans in areas with higher healthcare costs will typically be more expensive.

- Tobacco Use:Smokers generally have higher healthcare costs, so their premiums are typically higher.

- Plan Category:Different plan categories offer different levels of coverage, with higher coverage levels typically costing more.

- Family Size:Premiums increase with the number of people covered under the plan.

Comparing Coverage Types

Marketplace plans offer a variety of coverage options, each with its own set of costs and benefits. Here’s a comparison of key coverage components:

- Deductible:The amount you pay out-of-pocket before your insurance begins to cover your healthcare costs. Higher deductibles generally mean lower premiums.

- Copayments:Fixed amounts you pay for specific healthcare services, such as doctor’s visits or prescriptions. Higher copayments generally mean lower premiums.

- Coinsurance:A percentage of the cost of healthcare services that you pay after you’ve met your deductible. Lower coinsurance generally means higher premiums.

- Out-of-Pocket Maximum:The maximum amount you’ll pay for healthcare costs in a year. Once you’ve reached this limit, your insurance will cover 100% of your remaining healthcare costs. Higher out-of-pocket maximums generally mean lower premiums.

Financial Assistance Programs

The Affordable Care Act provides financial assistance to help individuals afford their premiums. Here’s a breakdown of available programs:

- Premium Tax Credits:These tax credits are available to individuals and families with incomes below certain thresholds. The amount of the credit depends on your income and the cost of the plan you choose.

- Cost-Sharing Reductions:These reductions help lower your out-of-pocket costs for deductibles, copayments, and coinsurance. They are available to individuals and families with incomes below certain thresholds.

Finding the Right Plan

With so many different health insurance plans available on the Michigan Marketplace, finding the right one for you can feel overwhelming. It’s important to understand your individual needs and preferences, as well as the different types of plans available, to make an informed decision.

Comparing Marketplace Plans

To help you compare different plans, here’s a table outlining key features of common Marketplace plans in Michigan:

| Plan Type | Coverage | Cost | Provider Network |

|---|---|---|---|

| Bronze | Lowest monthly premiums, but higher out-of-pocket costs. | Lowest | Limited network of providers. |

| Silver | Moderate monthly premiums and out-of-pocket costs. | Moderate | Wider network of providers than Bronze plans. |

| Gold | Higher monthly premiums, but lower out-of-pocket costs. | Higher | Broadest network of providers. |

| Platinum | Highest monthly premiums, but lowest out-of-pocket costs. | Highest | Broadest network of providers. |

Choosing the Best Plan, Marketplace health insurance michigan

Here are some tips for choosing the best health insurance plan based on your individual needs and preferences:

- Consider your budget.How much can you afford to pay in monthly premiums and out-of-pocket costs?

- Think about your health care needs.Do you have any pre-existing conditions? How often do you typically need to see a doctor?

- Check the provider network.Make sure your preferred doctors and hospitals are in the plan’s network.

- Compare deductibles and copayments.These costs will impact how much you pay for healthcare services.

- Read the plan details carefully.Understand the coverage limits and exclusions before you enroll.

Pre-Existing Conditions

It’s crucial to consider pre-existing conditions when choosing a plan. The Affordable Care Act prohibits health insurance companies from denying coverage or charging higher premiums based on pre-existing conditions. However, it’s still important to ensure your chosen plan covers the specific treatments and medications you need.

Navigating the marketplace for health insurance in Michigan can be a bit overwhelming, but staying fit can help manage your overall health and well-being. If you’re looking for a great gym in Coral Springs, you might want to check out Crunch Fitness Coral Springs.

They offer a variety of fitness classes and equipment to suit different needs and fitness levels. A healthy lifestyle can contribute to better health outcomes, potentially lowering your healthcare costs in the long run, which is something to consider when exploring the marketplace options in Michigan.

Tip:Use the Marketplace website’s plan comparison tool to filter plans based on your specific needs and preferences. This can help you narrow down your options and find the best plan for you.

Marketplace Resources and Support

The Michigan Marketplace offers various resources and support services to help individuals and families navigate the health insurance process and find the right plan. These resources can be accessed through the Marketplace website, call center, and local assistance programs.

Navigating the marketplace for health insurance in Michigan can be a bit overwhelming, especially when trying to find the best coverage for your needs. However, don’t let the process stress you out too much – it’s important to take breaks and prioritize your well-being.

Perhaps a visit to the gym would be a good way to de-stress? Check out the planet fitness hours holiday schedule to see if it fits your schedule. Once you’ve had a chance to unwind, you can return to researching health insurance options and find a plan that fits your budget and health needs.

Assistance from Insurance Brokers and Navigators

Insurance brokers and navigators are trained professionals who can help individuals understand their options, compare plans, and enroll in coverage. They are available to assist individuals with the entire enrollment process, from determining eligibility to selecting the best plan for their needs.

- Insurance brokersare licensed professionals who can sell health insurance plans from multiple insurance companies. They can provide personalized advice and help you compare plans based on your individual circumstances.

- Navigatorsare non-profit organizations or community groups that provide free, unbiased assistance to individuals enrolling in health insurance through the Marketplace. They can help you understand your options, complete the application process, and resolve any issues you may encounter.

Consumer Protection Resources and Dispute Resolution

The Marketplace provides several consumer protection resources and dispute resolution mechanisms to ensure fair and transparent health insurance practices.

- Consumer Assistance Programs: The Marketplace offers consumer assistance programs to help individuals resolve issues with their health insurance plans. These programs provide information, guidance, and support to consumers who have complaints or concerns about their coverage.

- Appeals Process: If you disagree with a decision made by your insurance company, you can appeal the decision through the Marketplace’s appeals process. This process allows you to challenge a decision and present your case to an independent review board.

- State Insurance Department: The Michigan Department of Insurance and Financial Services (DIFS) is responsible for regulating health insurance companies in the state. You can contact DIFS if you have a complaint or concern about your insurance company’s practices.

Final Thoughts: Marketplace Health Insurance Michigan

The Michigan Health Insurance Marketplace offers a vital service to residents by providing a centralized platform for accessing affordable health insurance. By understanding the different plans available, comparing costs, and utilizing the available resources, individuals can find the coverage that best meets their needs and budget.

The marketplace empowers residents to take control of their health insurance decisions, ensuring they have access to quality healthcare and financial stability.

FAQ Insights

How do I know if I qualify for financial assistance?

You can determine your eligibility for financial assistance through the marketplace website or by contacting a certified broker or navigator. Factors such as income, family size, and household composition are considered when determining eligibility.

What if I have a pre-existing condition?

The Affordable Care Act prohibits insurance companies from denying coverage or charging higher premiums based on pre-existing conditions. All marketplace plans must cover essential health benefits, including coverage for pre-existing conditions.

What happens if I miss the open enrollment period?

You may be able to enroll in a marketplace plan outside of the open enrollment period if you qualify for a special enrollment period. These periods are available for certain life events, such as losing coverage, getting married, or having a baby.