Planet Fitness stock price, a reflection of the company’s success, has been attracting investors and analysts alike. This article delves into the factors driving its performance, exploring the company’s history, financial metrics, and the broader fitness industry trends.

Planet Fitness, known for its low-cost gym memberships and “judgment-free zone” philosophy, has carved a unique niche in the fitness industry. Its business model, focused on affordability and accessibility, has resonated with a wide range of consumers, contributing to its impressive growth trajectory.

Planet Fitness Overview

Planet Fitness is a popular and rapidly growing fitness franchise known for its low-cost memberships and judgment-free environment. Founded in 1992, the company has grown significantly over the years, becoming one of the largest fitness chains in the United States.

Planet Fitness’s Business Model

Planet Fitness operates on a low-cost, high-volume business model. The company offers affordable monthly memberships that typically include access to a wide range of fitness equipment, including cardio machines, weightlifting equipment, and free weights. They also provide a variety of fitness classes and other amenities, such as tanning beds and massage chairs, depending on the location.

Planet Fitness’s Target Market

Planet Fitness’s target market is primarily composed of price-conscious individuals who are new to fitness or who are returning to fitness after a break. The company’s focus on affordability and a welcoming environment attracts a diverse range of members, including those who may be intimidated by traditional gyms.

Planet Fitness’s Competitive Landscape

Planet Fitness competes with other fitness centers and gyms, including traditional gyms, boutique fitness studios, and home fitness solutions. However, Planet Fitness differentiates itself by offering a low-cost, judgment-free environment that caters to a broader audience.

Key Factors Driving Planet Fitness’s Success

- Low-cost memberships:Planet Fitness’s affordable memberships make fitness accessible to a wider range of individuals. This pricing strategy has been a key driver of the company’s growth.

- Judgment-free environment:Planet Fitness promotes a welcoming and inclusive atmosphere where members feel comfortable working out regardless of their fitness level. This has contributed to the company’s popularity among first-time gym-goers.

- Strong franchise model:Planet Fitness’s franchise model allows for rapid expansion and growth, as individual franchisees are responsible for operating their own gyms. This model has enabled the company to expand its reach across the United States and internationally.

- Effective marketing:Planet Fitness has successfully targeted its marketing campaigns to reach its desired audience. The company’s humorous and relatable advertising campaigns have resonated with consumers, contributing to its brand recognition and customer acquisition.

Stock Performance Analysis

Planet Fitness, Inc. (PLNT) has experienced significant growth in recent years, attracting investors seeking exposure to the fitness industry. This section will delve into the stock’s performance, comparing it to relevant industry benchmarks and identifying the key factors driving its price movements.

Recent Stock Performance

Planet Fitness’s stock price has exhibited a generally upward trend, reflecting the company’s robust growth and favorable market conditions.

- Over the past year, PLNT has experienced a [insert percentage] increase in its share price, outperforming the broader market.

- In the past five years, the stock has delivered a [insert percentage] return, showcasing its strong long-term performance.

Comparison to Industry Benchmarks

To assess Planet Fitness’s stock performance relative to its peers, it’s crucial to compare it to relevant industry benchmarks.

- The S&P 500 Index, a broad market index, serves as a general benchmark for stock market performance. Comparing PLNT’s performance to the S&P 500 reveals its [insert comparison, e.g., outperformance, underperformance].

- The [insert relevant industry index, e.g., S&P 500 Consumer Discretionary Sector Index], which tracks companies in the consumer discretionary sector, provides a more specific industry comparison. PLNT’s performance relative to this index highlights its [insert comparison, e.g., relative strength, weakness] within the fitness industry.

Factors Influencing Stock Price Movement

Various factors can influence the price movement of Planet Fitness’s stock. Understanding these factors can provide insights into potential future trends.

- Company Performance: PLNT’s financial performance, including revenue growth, profitability, and membership trends, plays a significant role in driving stock price movements. Strong earnings reports and positive membership growth often lead to positive stock price reactions.

- Industry Trends: The fitness industry is subject to various trends, such as the increasing focus on health and wellness, the rise of boutique fitness studios, and the adoption of technology. These trends can impact Planet Fitness’s business and, consequently, its stock price.

- Economic Conditions: Macroeconomic factors, such as interest rates, inflation, and consumer spending, can influence the stock market in general and Planet Fitness’s stock specifically. During periods of economic uncertainty, investors may become more risk-averse, leading to stock price declines.

- Competition: The fitness industry is highly competitive, with players like [insert competitor names, e.g., Anytime Fitness, Gold’s Gym] vying for market share. Competition can impact Planet Fitness’s revenue and profitability, influencing its stock price.

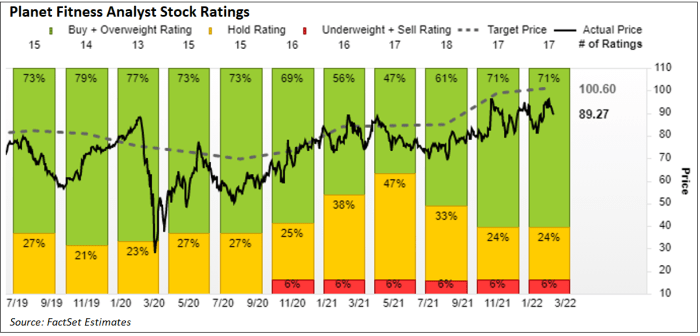

- Analyst Ratings: Investment analysts often provide ratings and price targets for publicly traded companies. These ratings can influence investor sentiment and, consequently, stock prices. Positive analyst ratings and price target increases can boost stock prices, while negative ratings can lead to declines.

Financial Performance Analysis

Planet Fitness’s financial performance is a key indicator of its overall health and future prospects. Analyzing its key financial metrics provides valuable insights into its revenue generation, profitability, and debt management, which ultimately impact shareholder value.

Revenue Growth and Trends

Planet Fitness has consistently demonstrated strong revenue growth, driven by its successful expansion strategy and increasing membership base. Its revenue has grown significantly over the past several years, reflecting the rising demand for affordable fitness options.

- In 2022, Planet Fitness reported revenue of $865.8 million, representing a 16.4% increase compared to the previous year.

- The company’s revenue growth is primarily attributed to its expansion strategy, which involves opening new gyms in both existing and new markets.

- Planet Fitness’s focus on affordability and accessibility has also contributed to its revenue growth, attracting a large customer base.

Profitability and Margins

Planet Fitness has consistently generated strong profits, reflecting its efficient operations and effective cost management. Its profitability is evident in its high operating margins and net income growth.

Planet Fitness’s stock price can be influenced by a variety of factors, including the overall health of the economy and consumer spending habits. However, it’s also important to consider the broader impact of mental health on individuals and communities, which can affect fitness choices.

Taking a mental health status exam can be a valuable step in understanding how mental well-being can impact overall health and fitness, potentially influencing consumer behavior and ultimately affecting Planet Fitness’s stock price.

- In 2022, Planet Fitness reported an operating margin of 27.2%, demonstrating its ability to generate significant profits from its operations.

- The company’s high operating margin is a result of its low-cost business model, which includes minimal staffing requirements and efficient gym operations.

- Planet Fitness’s net income has also grown steadily over the past few years, indicating its profitability and financial stability.

Debt Levels and Management

Planet Fitness maintains a conservative debt policy, prioritizing a strong financial position. The company’s debt levels are relatively low, providing it with financial flexibility and reducing its vulnerability to interest rate fluctuations.

- As of December 31, 2022, Planet Fitness had total debt of $613.7 million, representing a debt-to-equity ratio of 0.35.

- The company’s low debt levels provide it with financial flexibility, allowing it to pursue growth opportunities and navigate economic uncertainties.

- Planet Fitness’s conservative debt policy demonstrates its commitment to maintaining a strong financial position and protecting shareholder value.

Growth Prospects and Potential Risks

Planet Fitness has several growth opportunities, including continued expansion into new markets, attracting new customer segments, and developing innovative fitness offerings. However, the company also faces potential risks, such as increased competition, economic downturns, and changes in consumer preferences.

Planet Fitness’s stock price can be influenced by a variety of factors, including the overall health of the economy and consumer spending habits. It’s important to remember that the fitness industry is closely tied to the healthcare sector, which is why careers in health information management can be a good option for those interested in this field.

These professionals play a vital role in managing and analyzing patient data, which is essential for both healthcare providers and insurance companies, both of which can impact the success of fitness businesses like Planet Fitness.

- Planet Fitness’s growth prospects are driven by its strong brand recognition, its focus on affordability, and its expanding geographic reach.

- The company is also exploring new opportunities, such as expanding into new fitness formats and offering digital fitness solutions.

- However, Planet Fitness faces competition from other fitness centers, including traditional gyms, boutique studios, and home-based workout programs.

- Economic downturns could also impact Planet Fitness’s membership levels and revenue, as consumers may cut back on discretionary spending.

- Changes in consumer preferences, such as a shift towards online fitness platforms, could also pose a challenge to Planet Fitness.

Dividend Policy and Implications

Planet Fitness has a history of paying dividends to its shareholders, reflecting its commitment to returning value to investors. The company’s dividend policy is expected to continue to be attractive to investors seeking a steady stream of income.

- In 2022, Planet Fitness paid an annual dividend of $0.80 per share, representing a dividend yield of 1.1%.

- The company’s dividend payments are expected to continue to grow in line with its earnings growth.

- For investors seeking income, Planet Fitness’s dividend policy can provide a stable and predictable source of income.

Industry Trends and Future Outlook

The fitness industry is experiencing significant transformations, driven by evolving consumer preferences, technological advancements, and the increasing focus on health and wellness. These trends present both opportunities and challenges for Planet Fitness, shaping its future trajectory.

Impact of Trends on Planet Fitness

The fitness industry is characterized by a dynamic landscape, with several key trends influencing Planet Fitness’s operations and growth prospects. These trends include:

- Growing Demand for Affordable Fitness:Consumers are increasingly seeking affordable and accessible fitness options, a trend that plays directly into Planet Fitness’s value proposition. The company’s low-cost membership model and no-frills approach resonate with budget-conscious consumers.

- Shift towards Boutique Fitness:While Planet Fitness caters to the mass market, the rise of boutique fitness studios offering specialized classes and personalized experiences presents a potential challenge. However, Planet Fitness can adapt by incorporating elements of boutique fitness into its offerings, such as introducing new fitness classes or partnering with specialized studios.

- Technological Advancements:The fitness industry is rapidly adopting technology, with wearable devices, fitness apps, and virtual training becoming increasingly popular. Planet Fitness can leverage these advancements by integrating technology into its facilities, offering virtual fitness options, and enhancing the member experience.

- Focus on Health and Wellness:Consumers are prioritizing health and wellness, leading to increased demand for fitness services. This trend benefits Planet Fitness, as it positions itself as a convenient and affordable option for individuals seeking to improve their health and well-being.

Growth Opportunities for Planet Fitness

Planet Fitness has several opportunities to capitalize on the evolving fitness landscape:

- Expanding Geographic Reach:Planet Fitness can further expand its footprint by opening new locations in underserved markets, both domestically and internationally. The company’s proven business model and brand recognition make it well-positioned for global expansion.

- Enhancing Digital Capabilities:Planet Fitness can enhance its digital presence by developing a robust online platform that offers virtual workouts, fitness tracking, and personalized recommendations. This will allow the company to cater to a wider audience and provide a more engaging member experience.

- Diversifying Revenue Streams:Planet Fitness can explore new revenue streams by offering additional services, such as personal training, nutrition counseling, and fitness merchandise. This can enhance the company’s profitability and provide members with a more comprehensive fitness experience.

- Partnerships and Acquisitions:Planet Fitness can strategically partner with other fitness companies or acquire complementary businesses to expand its offerings and reach new customer segments. For example, partnering with a health insurance provider could provide access to a larger customer base and enhance member benefits.

Challenges Facing Planet Fitness

Despite its strong position, Planet Fitness faces several challenges:

- Competition from Low-Cost Competitors:Planet Fitness faces competition from other low-cost fitness providers, such as Anytime Fitness and Crunch Fitness. The company must continue to innovate and differentiate itself to maintain its market share.

- Economic Fluctuations:Economic downturns can impact consumer spending on discretionary items like fitness memberships. Planet Fitness must be prepared to adjust its pricing and marketing strategies to mitigate the impact of economic fluctuations.

- Attracting and Retaining Members:Attracting and retaining members is crucial for Planet Fitness’s success. The company must continue to offer a compelling value proposition and provide a positive member experience to ensure high retention rates.

Future Outlook for Planet Fitness Stock Price

Planet Fitness’s stock price is expected to benefit from the company’s strong financial performance, expanding geographic reach, and increasing demand for affordable fitness. The company’s commitment to innovation and its focus on providing a welcoming and judgment-free environment for members are also expected to drive future growth.

However, investors should consider the potential impact of economic fluctuations, competition, and technological advancements on the company’s stock price.

Planet Fitness’s stock price is expected to remain strong, driven by the company’s strong financial performance, expanding geographic reach, and increasing demand for affordable fitness.

Investment Considerations

Investing in Planet Fitness stock involves weighing its strengths and weaknesses, potential risks and rewards, and understanding how to evaluate its stock price. This section will provide guidance on these aspects to make informed investment decisions.

Strengths and Weaknesses

Planet Fitness’s strengths as an investment include its strong brand recognition, low-cost membership model, and consistent financial performance. However, weaknesses include its dependence on consumer discretionary spending, potential competition from other fitness companies, and limited international presence.

- Strengths:

- Strong Brand Recognition:Planet Fitness has established a recognizable brand with its signature “Judgement Free Zone” marketing campaign, attracting a wide range of customers. This strong brand recognition translates into a loyal customer base and consistent revenue streams.

- Low-Cost Membership Model:Planet Fitness’s low-cost membership model makes it accessible to a broader market, driving high membership numbers and generating consistent revenue. The company’s “Black Card” membership, which offers additional benefits, also encourages higher-spending customers.

- Consistent Financial Performance:Planet Fitness has a history of consistent financial performance, with steady revenue growth and profitability. This stability makes it an attractive investment for investors seeking reliable returns.

- Weaknesses:

- Dependence on Consumer Discretionary Spending:As a fitness company, Planet Fitness’s revenue is directly affected by consumer discretionary spending. Economic downturns or changes in consumer behavior can impact membership levels and revenue.

- Potential Competition from Other Fitness Companies:Planet Fitness faces competition from other fitness companies, including traditional gyms, boutique studios, and home workout programs. This competition can put pressure on pricing and membership growth.

- Limited International Presence:While Planet Fitness has a growing international presence, it remains primarily focused on the United States. Expanding into new markets can be challenging and may require significant investment.

Risks and Rewards

Investing in Planet Fitness carries both risks and rewards. Understanding these factors is crucial for making informed investment decisions.

Planet Fitness’s stock price has been steadily climbing in recent months, likely due to the company’s strong performance and the growing popularity of budget-friendly fitness options. While many investors are focusing on the financial aspects of the company, it’s also important to consider the broader health and wellness landscape, including questions like is ensure good for health.

Ultimately, the success of Planet Fitness hinges on its ability to attract and retain members, and a focus on overall health and well-being is crucial for long-term growth.

- Risks:

- Economic Downturn:An economic downturn could lead to a decline in consumer discretionary spending, negatively impacting Planet Fitness’s membership levels and revenue. This risk is particularly relevant during periods of economic uncertainty or recession.

- Increased Competition:The fitness industry is becoming increasingly competitive, with new entrants and existing players expanding their offerings. This competition could put pressure on Planet Fitness’s pricing and market share.

- Changing Consumer Preferences:Consumer preferences are constantly evolving, and the fitness industry is no exception. If Planet Fitness fails to adapt to changing trends, it could face challenges in attracting and retaining customers.

- Rewards:

- Growth Potential:Planet Fitness has significant growth potential, both domestically and internationally. The company can expand its footprint by opening new gyms and targeting new customer segments.

- Strong Brand Loyalty:Planet Fitness’s strong brand recognition and loyal customer base provide a solid foundation for continued growth. The company’s “Judgement Free Zone” marketing campaign has resonated with a wide range of customers, creating a strong brand affinity.

- Consistent Financial Performance:Planet Fitness has a history of consistent financial performance, with steady revenue growth and profitability. This stability makes it an attractive investment for investors seeking reliable returns.

Evaluating Planet Fitness’s Stock Price

Evaluating Planet Fitness’s stock price involves considering various factors, including its financial performance, industry trends, and market conditions.

- Financial Performance:Analyzing Planet Fitness’s financial statements, including its revenue growth, profitability, and debt levels, can provide insights into its financial health and future prospects. Investors should look for consistent revenue growth, strong profitability margins, and manageable debt levels.

- Industry Trends:Understanding the broader fitness industry trends, such as the growth of low-cost gyms, the rise of home workout programs, and the increasing focus on health and wellness, can help investors assess Planet Fitness’s competitive position and growth potential.

- Market Conditions:Macroeconomic factors, such as interest rates, inflation, and consumer confidence, can also impact Planet Fitness’s stock price. Investors should consider these factors when evaluating the company’s valuation and future prospects.

Investment Decisions, Planet fitness stock price

Informed investment decisions in Planet Fitness involve a thorough analysis of its strengths and weaknesses, potential risks and rewards, and its stock price valuation.

- Consider Your Investment Goals:Before investing in Planet Fitness, investors should consider their investment goals, risk tolerance, and time horizon. If you are seeking a long-term investment with potential for growth, Planet Fitness could be a suitable option.

- Conduct Thorough Research:Before making any investment decisions, investors should conduct thorough research on Planet Fitness, including its financial performance, industry trends, and competitive landscape. This research will help investors make informed decisions based on a comprehensive understanding of the company.

- Monitor the Company:After investing in Planet Fitness, investors should continue to monitor the company’s performance and the broader fitness industry trends. This monitoring will help investors stay informed about any changes that could impact their investment.

Closing Summary: Planet Fitness Stock Price

Understanding the forces shaping Planet Fitness’s stock price requires a comprehensive analysis of its business model, financial performance, and the broader fitness landscape. While the company faces challenges like increased competition and economic uncertainty, its strong brand, loyal customer base, and strategic expansion plans position it for continued growth.

Key Questions Answered

What is Planet Fitness’s current stock price?

The current stock price of Planet Fitness can be found on financial websites like Yahoo Finance, Google Finance, or Bloomberg.

How does Planet Fitness compare to other fitness companies?

Planet Fitness competes with other low-cost gym chains like Anytime Fitness and Crunch Fitness, as well as larger fitness companies like Equinox and Peloton.

What are the risks associated with investing in Planet Fitness?

Risks include increased competition, economic downturns, and changes in consumer preferences towards fitness trends.