Superior health plan insurance offers a unique approach to healthcare coverage, going beyond standard plans to provide enhanced benefits and comprehensive protection. This type of insurance is designed to cater to individuals and families seeking a higher level of healthcare security, with features that often include expanded coverage, lower deductibles, and access to specialized medical services.

By understanding the key aspects of superior health plans, individuals can make informed decisions about their healthcare needs and financial well-being. This guide will delve into the intricacies of superior health plan insurance, exploring its benefits, considerations, and practical implications for navigating the complexities of the healthcare system.

Understanding Superior Health Plan Insurance

Superior health plan insurance refers to comprehensive health insurance plans that offer extensive coverage and benefits beyond standard plans. These plans are designed to provide enhanced protection and peace of mind for individuals seeking more comprehensive healthcare solutions.

Key Features of Superior Health Plans

Superior health plans often feature a combination of key characteristics that distinguish them from standard plans. These features include:

- Broader Coverage:Superior plans typically cover a wider range of medical services and treatments, including preventive care, prescription drugs, mental health services, and vision and dental care. They may also offer coverage for specialized services such as alternative medicine or genetic testing.

- Enhanced Benefits:Superior plans may include additional benefits that enhance the overall value of the plan, such as lower copayments, deductibles, or coinsurance. They may also offer wellness programs, disease management programs, or access to specialized networks of healthcare providers.

- Higher Premiums:Due to the increased coverage and benefits, superior health plans often come with higher premiums compared to standard plans. However, the added value and protection they provide can be worth the investment for individuals with specific healthcare needs or preferences.

Examples of Superior Health Plan Providers

Several reputable insurance providers offer superior health plans tailored to various needs and budgets. Some notable examples include:

- Blue Cross Blue Shield:Blue Cross Blue Shield offers a range of superior health plans, including PPOs, HMOs, and POS plans, with varying levels of coverage and benefits. They often emphasize preventive care and wellness programs, providing comprehensive healthcare solutions.

- UnitedHealthcare:UnitedHealthcare is another leading provider of superior health plans, offering a wide array of options with different coverage levels and benefits. They often focus on personalized healthcare solutions and innovative programs designed to improve health outcomes.

- Aetna:Aetna provides superior health plans that emphasize quality care and access to a vast network of healthcare providers. They offer various plan options with varying levels of coverage and benefits, catering to diverse needs and preferences.

Benefits of Superior Health Plan Insurance

Choosing a superior health plan can provide significant advantages for individuals and families, offering comprehensive coverage and peace of mind. Superior health plans often feature a wider range of benefits, enhanced coverage, and potentially lower out-of-pocket expenses.

Comprehensive Coverage

Superior health plans typically provide extensive coverage for a broad spectrum of medical services, including preventive care, hospitalization, surgeries, and prescription drugs. This comprehensive coverage ensures that you have access to the necessary healthcare services when you need them, without the worry of financial strain.

- Preventive Care:Superior plans often cover routine checkups, screenings, and vaccinations, promoting early detection and disease prevention.

- Hospitalization:They typically cover inpatient care, including room and board, nursing services, and medical supplies.

- Surgeries:Superior plans often cover a wide range of surgical procedures, from routine procedures to complex surgeries.

- Prescription Drugs:They generally provide coverage for prescription medications, often with a formulary that includes a wide selection of drugs.

Enhanced Coverage

Superior health plans often offer additional benefits that go beyond basic coverage, providing greater protection and peace of mind. These enhanced benefits can include:

- Mental Health and Substance Abuse Coverage:Superior plans typically cover mental health and substance abuse services, including therapy, counseling, and medication.

- Vision and Dental Coverage:Some superior plans may offer vision and dental coverage, providing comprehensive care for your overall health.

- Wellness Programs:Many superior plans include wellness programs that promote healthy habits and provide resources for managing chronic conditions.

Potential Cost Savings

Superior health plans can potentially lead to cost savings in the long run, due to their comprehensive coverage and potential for lower out-of-pocket expenses.

“A superior health plan can help you avoid high medical bills by covering a wider range of services, potentially reducing your out-of-pocket costs.”

Choosing a superior health plan insurance can be a daunting task, but it’s crucial for ensuring your well-being. Just like Aurora in Sleeping Beauty awakens from a long slumber , a good health plan can help you recover from unexpected health challenges and get back on your feet.

With the right coverage, you can focus on your health and financial security, knowing you have a strong safety net in place.

For example, if you have a chronic condition that requires regular medical care, a superior plan with comprehensive coverage for that condition could significantly reduce your out-of-pocket expenses compared to a basic plan.

Situations Where Superior Plans Excel

Superior health plans can be particularly beneficial in various situations, including:

- Families with Children:Superior plans often provide extensive coverage for pediatric care, including well-child visits, immunizations, and specialized treatments.

- Individuals with Chronic Conditions:Superior plans can provide comprehensive coverage for managing chronic conditions, such as diabetes, heart disease, or asthma, reducing the financial burden associated with ongoing care.

- Individuals with High Healthcare Needs:If you anticipate needing frequent medical care, a superior plan with extensive coverage can help you manage potential healthcare costs.

Factors to Consider When Choosing a Superior Health Plan

Choosing the right health insurance plan is crucial, as it impacts your financial well-being and access to healthcare. A superior health plan should offer comprehensive coverage, affordability, and a network of healthcare providers that meet your needs. This section will guide you through key factors to consider when selecting a plan.

Your Health Needs

It is essential to assess your current and anticipated healthcare needs. Consider your medical history, any pre-existing conditions, and your likelihood of needing frequent medical care. If you have specific health concerns, such as chronic illnesses or a family history of certain diseases, prioritize plans that offer robust coverage for those areas.

Your Budget

Health insurance premiums, deductibles, and copayments vary widely between plans. Determine your budget and explore plans that align with your financial capabilities. Consider factors like your income, expenses, and whether you qualify for any subsidies or tax credits.

Coverage Requirements

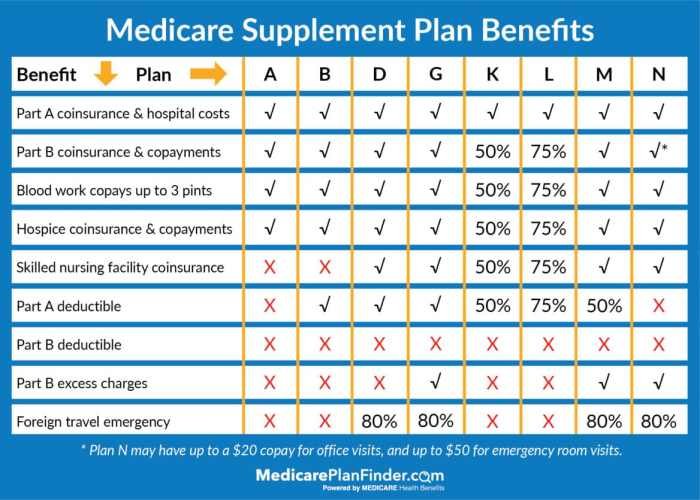

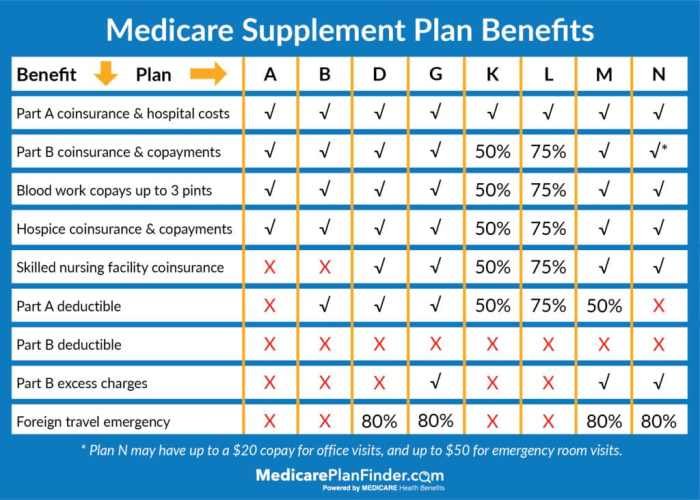

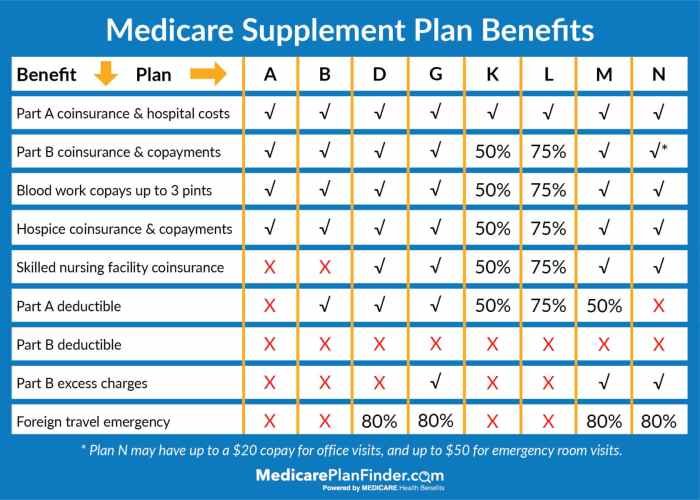

Understand the different types of coverage offered by health plans, such as:

- Hospitalization Coverage:This covers inpatient care, surgeries, and related expenses.

- Outpatient Coverage:This covers doctor visits, diagnostic tests, and other services received outside a hospital.

- Prescription Drug Coverage:This covers the cost of prescription medications.

- Mental Health and Substance Use Disorder Coverage:This covers services for mental health and addiction treatment.

- Preventive Care Coverage:This covers preventive screenings and services designed to maintain your health.

Comparing Plans from Different Providers

Once you have a clear understanding of your needs, budget, and coverage requirements, it’s time to compare plans from different providers. Research reputable insurance companies and compare their offerings, focusing on factors like:

- Premium Costs:Compare monthly premiums for similar plans.

- Deductibles:Consider the amount you need to pay out-of-pocket before coverage kicks in.

- Copayments and Coinsurance:Compare the costs you’ll share for services after meeting your deductible.

- Network of Healthcare Providers:Ensure the plan includes doctors, hospitals, and specialists you prefer.

- Customer Service and Claims Processing:Read reviews and research the company’s reputation for customer service and claims handling.

Navigating the Complexities of Health Insurance Plan Selection

Choosing a health insurance plan can be complex. Here are some tips to navigate the process:

- Utilize Online Tools:Many websites offer health insurance comparison tools that can help you filter plans based on your needs and budget.

- Consult with a Broker or Agent:A qualified insurance broker or agent can provide personalized advice and help you find the best plan for your circumstances.

- Read the Fine Print:Carefully review the plan documents, including the summary of benefits and coverage (SBC) and the evidence of coverage (EOC), to fully understand the terms and conditions.

- Ask Questions:Don’t hesitate to contact the insurance company or your broker with any questions or concerns you may have.

Types of Superior Health Plans

Choosing the right health insurance plan is crucial for securing your well-being and financial stability. Understanding the various types of plans available is essential for making an informed decision that aligns with your individual needs and circumstances.

Health Maintenance Organizations (HMOs)

HMOs are known for their cost-effectiveness and emphasis on preventive care. They typically have a lower monthly premium compared to other plans. However, they often require you to choose a primary care physician (PCP) within their network and obtain referrals for specialist visits.

- Features:HMOs operate with a closed network, meaning you are limited to receiving care from providers within their network.

- Benefits:HMOs often have lower premiums and copayments, promoting preventative care with regular checkups and screenings.

- Limitations:You need a referral from your PCP for specialist visits, which can sometimes be a hassle. You are restricted to the network, which may limit your choices.

Preferred Provider Organizations (PPOs)

PPOs offer more flexibility than HMOs, allowing you to seek care from providers both within and outside their network. While they often have higher premiums than HMOs, they provide greater choice and convenience.

- Features:PPOs operate with an open network, giving you the option to see providers both inside and outside their network.

- Benefits:PPOs offer more flexibility and choice of providers, including out-of-network options.

- Limitations:PPOs generally have higher premiums and copayments than HMOs, and you may face higher out-of-pocket costs for out-of-network care.

Point of Service (POS) Plans

POS plans combine elements of both HMOs and PPOs. They typically have a network of providers, but they also offer the flexibility to see out-of-network providers for an additional cost.

- Features:POS plans require you to choose a PCP within their network, but they allow you to seek care from out-of-network providers for a higher cost.

- Benefits:POS plans offer a balance between cost savings and flexibility, allowing you to choose between in-network and out-of-network providers.

- Limitations:POS plans may have higher premiums than HMOs and lower out-of-network coverage than PPOs.

Other Types of Health Plans

Beyond the common types of health plans, there are other options available, such as:

- High Deductible Health Plans (HDHPs):These plans offer lower premiums in exchange for higher deductibles, making them suitable for individuals who are generally healthy and anticipate minimal healthcare expenses.

- Exclusive Provider Organizations (EPOs):EPOs are similar to HMOs, but they often have a wider network of providers. They may also offer more flexibility in choosing a PCP.

- Health Savings Accounts (HSAs):HSAs are tax-advantaged savings accounts used for healthcare expenses. They are typically paired with HDHPs, allowing you to save pre-tax dollars for healthcare costs.

- Flexible Spending Accounts (FSAs):FSAs are employer-sponsored accounts that allow you to set aside pre-tax income for healthcare expenses. They can be used for a variety of expenses, including deductibles, copayments, and prescription drugs.

Superior Health Plan Insurance and Coverage

Superior health plans, also known as “high-deductible health plans” (HDHPs), offer a unique approach to health insurance, focusing on cost-effectiveness and personal responsibility. While they typically have lower monthly premiums compared to traditional plans, they come with higher deductibles, meaning you pay more out-of-pocket for healthcare services before the plan starts covering costs.

Understanding the specific coverage details of a superior plan is crucial for making informed decisions about your healthcare.

Coverage for Specific Medical Services

Superior health plans often vary in the level of coverage they provide for different medical services. This is particularly important to consider when evaluating preventative care, prescription drugs, and hospitalization.

- Preventative Care:Most superior plans cover preventive services like annual checkups, vaccinations, and screenings at 100%, meaning you don’t have to pay anything out-of-pocket. This encourages regular health maintenance and early detection of potential health issues.

- Prescription Drugs:Prescription drug coverage under superior plans can vary significantly. Some plans may have a separate deductible for prescription drugs, while others might include them in the overall deductible. It’s essential to check the formulary, which lists the specific medications covered by the plan, and their associated costs.

- Hospitalization:Superior plans generally cover hospitalization costs after you’ve met your deductible. However, the level of coverage can vary depending on the plan. Some plans might have a co-pay for each day spent in the hospital, while others may have a fixed co-insurance percentage.

It’s important to understand the specific coverage details for hospitalization to avoid unexpected expenses.

Understanding Coverage Limits and Deductibles

Coverage limits and deductibles are key elements of superior health plans.

Deductible:The amount you pay out-of-pocket for healthcare services before your insurance plan starts covering costs.

Coverage Limit:The maximum amount your insurance plan will pay for a specific service or in a given year.

Superior health plan insurance offers comprehensive coverage, ensuring peace of mind when it comes to your well-being. A great example of this is the dignity health sports park , which provides access to a wide range of fitness and wellness facilities, promoting a healthy lifestyle that can contribute to lower healthcare costs in the long run.

Knowing these limits and deductibles is crucial for budgeting and planning for potential healthcare expenses. It’s advisable to consult with your insurance provider to understand the specific coverage limits and deductibles associated with your plan.

Unique Coverage Features

Superior health plans often offer unique features that can provide additional benefits and cost savings.

Superior health plan insurance can provide peace of mind, knowing you have coverage for unexpected medical expenses. It’s important to consider your individual needs and preferences when choosing a plan, and this includes thinking about how your health insurance might impact your personal brand.

If you’re in the beauty industry, for example, you might want to consider a plan that offers coverage for services like beauty branding , which can help you attract new clients and build a strong online presence. Ultimately, a superior health plan insurance policy can help you maintain your overall well-being and achieve your personal and professional goals.

- Health Savings Accounts (HSAs):Superior plans allow you to open an HSA, which is a tax-advantaged savings account specifically for healthcare expenses. You can contribute pre-tax dollars to the HSA, which can be used to pay for eligible medical expenses. Unused funds in the HSA can roll over to the next year, providing long-term savings potential.

- Telemedicine:Many superior plans offer coverage for telemedicine services, which allow you to consult with a doctor virtually through video conferencing or phone calls. This can be a convenient and cost-effective option for non-emergency medical needs.

- Wellness Programs:Some superior plans offer wellness programs that provide incentives for healthy behaviors, such as exercise, weight management, and smoking cessation. These programs can help you improve your health and potentially reduce your healthcare costs.

Superior Health Plan Insurance and Cost

Superior health plans, while offering extensive coverage, often come with a higher price tag. Understanding the factors that influence the cost of these plans is crucial for making informed decisions.

Factors Influencing Superior Health Plan Costs

Several factors play a role in determining the cost of superior health plans. These factors can significantly impact premiums, out-of-pocket expenses, and overall costs.

- Age:Generally, older individuals tend to have higher healthcare costs due to increased susceptibility to health issues. Superior health plans often reflect this trend, resulting in higher premiums for older enrollees.

- Health Status:Individuals with pre-existing conditions or higher healthcare needs may face higher premiums for superior plans. These plans typically cover a wider range of services, including preventative care, which can contribute to higher costs.

- Location:Geographic location can significantly influence health plan costs. Areas with higher population densities, higher healthcare utilization rates, and a higher cost of living often have higher premiums.

- Plan Design:Superior health plans offer varying levels of coverage and benefits. Plans with more comprehensive coverage, such as those with lower deductibles or copayments, generally come with higher premiums.

- Employer Contributions:If you receive health insurance through your employer, the employer’s contribution to the premium can significantly affect your out-of-pocket costs.

Cost Comparison: Superior vs. Standard Plans

Comparing the costs of superior health plans with standard health plans can help you determine the value proposition.

- Higher Premiums:Superior health plans generally have higher premiums than standard plans due to their extensive coverage. However, this may be offset by lower out-of-pocket expenses in the long run.

- Lower Out-of-Pocket Costs:Superior plans often have lower deductibles, copayments, and coinsurance, leading to lower out-of-pocket costs for healthcare services. This can be particularly beneficial for individuals with chronic conditions or those who anticipate high healthcare utilization.

- Comprehensive Coverage:Superior plans typically offer more comprehensive coverage, including preventive care, prescription drugs, and mental health services, which may not be fully covered by standard plans.

Strategies for Managing Superior Health Plan Costs

Managing the cost of superior health plans requires proactive planning and utilization of available resources.

- Shop Around:Compare different superior health plan options from various insurance providers to find the best value for your needs and budget.

- Take Advantage of Preventive Care:Superior plans often cover preventive services like screenings and vaccinations at no cost. Utilizing these services can help detect health issues early, potentially reducing future healthcare expenses.

- Use In-Network Providers:Choosing healthcare providers within your plan’s network can help you avoid higher out-of-pocket costs for services.

- Consider a Health Savings Account (HSA):If you have a high-deductible health plan, an HSA can help you save pre-tax dollars for healthcare expenses, potentially reducing your overall costs.

Finding and Enrolling in a Superior Health Plan

Finding the right health insurance plan can feel overwhelming, but it doesn’t have to be. By understanding your needs and taking the right steps, you can find a superior health plan that meets your requirements and fits your budget.

Researching and Finding Superior Health Plans

To begin your search, you can leverage various resources, including online platforms and insurance brokers. These resources provide comprehensive information on different health plans available in your area.

- Online Marketplaces:Platforms like Healthcare.gov and state-based marketplaces offer a wide range of plans from different insurance companies. You can compare plans based on factors such as coverage, cost, and provider network.

- Insurance Company Websites:Many insurance companies have websites where you can explore their health plans, compare coverage options, and get quotes.

- Insurance Brokers:Brokers act as intermediaries between you and insurance companies. They can help you navigate the complex world of health insurance and find plans that meet your specific needs.

The Enrollment Process

Once you’ve identified a superior health plan, you’ll need to enroll. The enrollment process usually involves the following steps:

- Create an Account:You’ll typically need to create an account on the chosen marketplace or insurance company website.

- Provide Personal Information:You’ll be asked to provide personal details, such as your name, address, Social Security number, and income information.

- Select a Plan:Based on your needs and budget, you’ll select the health plan that best suits you.

- Review and Submit:Carefully review the details of your chosen plan, including the monthly premium, coverage details, and deductible. Once you’re satisfied, submit your application.

Required Documents for Enrollment

To complete the enrollment process, you’ll need to provide certain documents. These documents are essential for verifying your eligibility and ensuring accurate coverage.

- Proof of Identity:A driver’s license, passport, or other government-issued ID.

- Social Security Number:Your Social Security card or a document that contains your Social Security number.

- Proof of Income:Pay stubs, tax returns, or other documents that demonstrate your income.

- Proof of Residency:Utility bills, bank statements, or other documents that show your current address.

Understanding the Fine Print of Superior Health Plans

Before enrolling in a superior health plan, it’s crucial to carefully review the terms and conditions. These documents contain essential information about your coverage, limitations, and potential costs. Understanding the fine print ensures you make an informed decision and avoid any surprises later.

Limitations and Exclusions

Superior health plans, like any insurance plan, have limitations and exclusions. These are specific services or conditions that may not be covered, or may have limited coverage. It’s essential to understand these limitations and exclusions to avoid unexpected costs. For example, some plans may have limitations on coverage for pre-existing conditions, mental health services, or certain types of medications.

Waiting Periods

Waiting periods are periods of time you must wait before certain benefits become effective. For example, you may have to wait a certain number of days before you can access certain preventive services or receive coverage for a specific condition.

Navigating Insurance Policies

Insurance policies can be complex and difficult to understand. Here are some tips for navigating the fine print:

- Read the policy carefully:Take your time to thoroughly review the entire policy, paying close attention to sections on coverage, limitations, exclusions, and waiting periods.

- Ask questions:Don’t hesitate to contact your insurance provider or a health insurance broker if you have any questions about the policy.

- Use resources:Several resources are available to help you understand insurance policies, including websites, brochures, and consumer guides.

The Future of Superior Health Plan Insurance

The health insurance landscape is constantly evolving, driven by technological advancements, changing demographics, and evolving healthcare needs. These trends are shaping the future of superior health plans, leading to innovative offerings and a more consumer-centric approach.

Emerging Trends in Health Insurance

The health insurance industry is witnessing several emerging trends that are poised to transform superior health plans.

- Personalized Medicine:Advancements in genetic testing and personalized medicine are enabling insurers to tailor health plans based on individual health profiles and risk factors. This allows for more precise coverage and preventive care recommendations, leading to better health outcomes and cost savings.

- Telehealth and Virtual Care:The rise of telehealth and virtual care services is making healthcare more accessible and convenient. Superior health plans are integrating these technologies, offering virtual consultations, remote monitoring, and digital health tools to improve patient engagement and reduce healthcare costs.

- Value-Based Care:Value-based care models are shifting the focus from volume to value, rewarding providers for delivering quality care and achieving positive health outcomes. Superior health plans are partnering with providers to implement these models, encouraging preventive care, disease management, and coordinated care.

- Data Analytics and Artificial Intelligence:Data analytics and artificial intelligence are transforming how health insurance operates. Superior health plans are leveraging these technologies to analyze claims data, identify trends, and personalize plan offerings. This allows for better risk assessment, fraud detection, and cost optimization.

Innovations in Superior Health Plan Offerings

These emerging trends are driving innovations in superior health plan offerings, leading to more comprehensive and personalized coverage.

- Lifestyle and Wellness Programs:Superior health plans are increasingly offering lifestyle and wellness programs to promote healthy habits and reduce healthcare costs. These programs may include fitness trackers, nutrition counseling, stress management techniques, and incentives for healthy behaviors.

- Direct-to-Consumer Health Plans:Some superior health plans are offering direct-to-consumer plans, bypassing traditional intermediaries. These plans often feature transparent pricing, digital tools, and personalized services, giving consumers more control over their healthcare decisions.

- Flexible and Customizable Plans:The future of superior health plans is likely to see more flexible and customizable options, allowing individuals to tailor their coverage to their specific needs and budget. This could include options for different deductibles, co-pays, and coverage levels.

- Integrated Care Solutions:Superior health plans are integrating care solutions, bringing together various healthcare providers, including hospitals, clinics, and pharmacies, under one umbrella. This aims to improve care coordination, reduce fragmentation, and enhance patient experiences.

The Future of Health Insurance and its Implications for Consumers, Superior health plan insurance

The future of health insurance is likely to be characterized by a greater focus on consumer empowerment, personalization, and value.

- Increased Transparency and Choice:Consumers will have more access to information about health plans, pricing, and coverage options. This will allow them to make informed decisions based on their individual needs and preferences.

- Emphasis on Prevention and Wellness:Superior health plans will place a greater emphasis on prevention and wellness, encouraging healthy lifestyles and early detection of health issues. This will lead to better health outcomes and potentially lower healthcare costs.

- Technological Advancements:Technology will play a key role in shaping the future of health insurance. Consumers can expect more digital tools, personalized health recommendations, and remote care options.

Wrap-Up

Ultimately, choosing the right health insurance plan is a personal decision that should align with individual needs and circumstances. Superior health plans can provide a valuable solution for those seeking comprehensive coverage, enhanced benefits, and peace of mind. By carefully evaluating the features, costs, and potential advantages of these plans, individuals can make informed choices that support their long-term health and financial security.

FAQ Compilation

What are the main differences between superior health plans and standard health plans?

Superior health plans often offer expanded coverage, lower deductibles, and access to specialized medical services compared to standard plans. They may also have additional benefits like preventive care services, prescription drug coverage, and mental health support.

Are superior health plans more expensive than standard health plans?

The cost of superior health plans can vary depending on factors such as age, health status, and location. While they may be more expensive than standard plans, the additional benefits and coverage they provide can offset the higher premiums in the long run.

How can I find a superior health plan that meets my needs?

You can research superior health plans online, consult with insurance brokers, or contact insurance providers directly. Be sure to compare plans from different providers and consider factors such as coverage, benefits, and cost.

What should I look for when comparing superior health plans?

When comparing plans, consider your health needs, budget, and coverage requirements. Pay attention to factors such as deductibles, copayments, coverage limits, and network providers.