Tennessee health care insurance is a crucial aspect of navigating the healthcare system in the state. With a diverse landscape of providers, plans, and regulations, understanding your options is essential. This guide delves into the intricacies of Tennessee’s health insurance market, exploring the Affordable Care Act’s impact, state-specific programs, and key considerations for making informed choices.

From navigating the marketplace to understanding coverage options and costs, this comprehensive resource aims to empower Tennesseans with the knowledge they need to access affordable and quality healthcare.

Tennessee Health Insurance Landscape

Tennessee’s health insurance market is a complex landscape, shaped by a mix of federal and state regulations, market forces, and individual needs. The state offers a diverse range of coverage options, catering to different income levels and health needs.

Major Health Insurance Providers

The Tennessee health insurance market is dominated by a handful of major national and regional providers. These companies offer a wide range of plans, from basic coverage to comprehensive options, catering to individuals, families, and employers.

- BlueCross BlueShield of Tennessee:The largest health insurer in the state, offering a variety of plans through the individual, employer, and government markets.

- UnitedHealthcare:A national insurer with a significant presence in Tennessee, offering a broad selection of plans, including individual, employer, and Medicare Advantage.

- Cigna:A national health insurer with a strong presence in Tennessee, offering individual, employer, and Medicare Advantage plans.

- Humana:A national health insurer with a growing presence in Tennessee, offering a range of individual, employer, and Medicare Advantage plans.

- Aetna:A national health insurer with a presence in Tennessee, offering individual, employer, and Medicare Advantage plans.

Key Characteristics of the Tennessee Health Insurance Market, Tennessee health care insurance

The Tennessee health insurance market exhibits several key characteristics, including:

- Average Premiums:Tennessee’s average health insurance premiums vary depending on factors such as age, location, and plan type. For individual plans, premiums are generally lower than the national average, while employer-sponsored plans tend to be higher.

- Coverage Options:Tennessee offers a wide range of health insurance coverage options, including individual, employer, and government-sponsored plans. These plans vary in terms of benefits, cost-sharing, and network coverage.

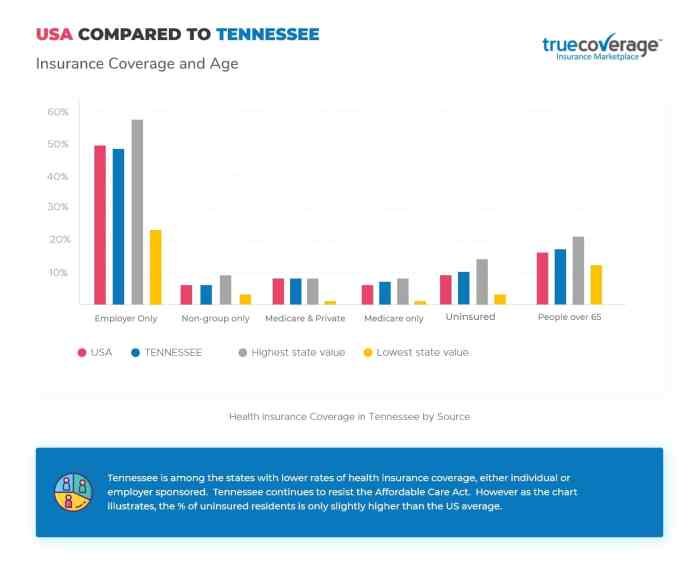

- Enrollment Trends:Tennessee’s health insurance enrollment trends have been influenced by factors such as the Affordable Care Act, economic conditions, and individual health needs. Enrollment in individual plans has increased in recent years, while employer-sponsored plans have remained relatively stable.

Affordable Care Act (ACA) in Tennessee: Tennessee Health Care Insurance

The Affordable Care Act (ACA), also known as Obamacare, has significantly impacted Tennessee’s health insurance market. The ACA aimed to expand health insurance coverage, improve affordability, and regulate the insurance industry. Its impact on Tennessee’s health insurance landscape has been multifaceted.

Tennessee healthcare insurance plans often include fitness benefits, making it easier to prioritize your well-being. If you’re looking for a gym that can help you stay active while also providing a safe and fun environment for your kids, check out fitness centers near you that offer childcare.

Taking care of your health is a key component of a healthy lifestyle, and Tennessee healthcare insurance can be a valuable resource in helping you achieve your fitness goals.

Impact of the ACA on Tennessee’s Health Insurance Market

The ACA has led to significant changes in Tennessee’s health insurance market. The law’s expansion of Medicaid eligibility resulted in a substantial increase in the number of Tennesseans with health insurance. The ACA also established health insurance marketplaces, offering individuals and families a platform to compare and purchase health insurance plans.

Tennessee health care insurance can cover a variety of needs, including preventive care and chronic condition management. Staying active is crucial for overall health, and for seniors, senior fitness equipment can be a great way to maintain mobility and strength.

By choosing the right plan, Tennesseans can ensure they have the resources to support their physical well-being and access the equipment they need to stay active.

These marketplaces have provided Tennesseans with greater choice and flexibility in selecting health insurance plans.

Marketplace Plans in Tennessee

The ACA’s health insurance marketplaces, known as the Health Insurance Marketplace, provide Tennesseans with access to a variety of health insurance plans. These plans are offered by private insurance companies and are subject to ACA regulations. The Marketplace offers a range of plans, including Bronze, Silver, Gold, and Platinum, with varying levels of coverage and cost.

Subsidies and Tax Credits for Tennesseans

The ACA provides subsidies and tax credits to help eligible Tennesseans afford health insurance. These financial assistance programs are based on income and family size. The ACA’s subsidies and tax credits are designed to make health insurance more affordable for low- and middle-income Tennesseans.

Navigating Tennessee’s healthcare insurance landscape can be a bit tricky, especially when it comes to finding the right coverage and managing costs. A great way to save money and gain more control over your healthcare expenses is through a Health Savings Account (HSA).

If you’re looking for a reputable bank to manage your HSA, PNC Bank offers a variety of options and resources. Health savings account pnc can help you better understand how to utilize your HSA effectively, which can be especially beneficial in Tennessee where healthcare costs can fluctuate.

Tennessee-Specific Health Insurance Programs

Tennessee offers a variety of state-specific health insurance programs and initiatives aimed at expanding access to affordable healthcare for its residents. These programs cater to different segments of the population, addressing specific needs and circumstances.

TennCare

TennCare is Tennessee’s Medicaid program, providing health coverage to low-income individuals and families, pregnant women, children, seniors, and people with disabilities. It is a crucial component of the state’s healthcare safety net, offering comprehensive medical benefits, including doctor visits, hospitalizations, prescription drugs, and mental health services.Eligibility for TennCare is determined based on income and other factors.

Individuals must meet specific income thresholds and residency requirements. TennCare also has various programs within it, such as TennCare for Kids, which provides coverage for children up to age 19.TennCare plays a significant role in improving access to healthcare for low-income Tennesseans.

By providing comprehensive coverage, it helps reduce the financial burden of healthcare costs and ensures access to essential medical services.

Key Considerations for Choosing Health Insurance in Tennessee

Choosing the right health insurance plan in Tennessee can be a complex process. Understanding the various factors involved will help you make an informed decision that aligns with your individual needs and budget.

Understanding Health Insurance Plan Types in Tennessee

In Tennessee, you’ll find a variety of health insurance plan types, each with its own structure and associated costs and benefits. Here’s a breakdown of some common plan types:

- Health Maintenance Organization (HMO):HMOs typically have lower premiums but require you to choose a primary care physician (PCP) within their network. You’ll need a referral from your PCP to see specialists.

- Preferred Provider Organization (PPO):PPOs offer more flexibility as you can see providers outside their network, although you’ll pay higher out-of-pocket costs. You don’t need a referral to see specialists.

- Point of Service (POS):POS plans combine elements of HMOs and PPOs. You’ll choose a PCP within the network, but you have the option to see out-of-network providers at a higher cost.

- Exclusive Provider Organization (EPO):EPOs are similar to HMOs, but they typically offer a wider network of providers. However, you must stay within the network for all care, and you don’t have the option to see out-of-network providers.

Factors to Consider When Choosing Health Insurance in Tennessee

Here’s a table summarizing the key factors to consider when choosing a health insurance plan in Tennessee:

| Factor | Description |

|---|---|

| Coverage Options | Consider the types of coverage offered by each plan, such as HMO, PPO, POS, or EPO. Understand the differences in provider networks, cost-sharing, and out-of-pocket expenses associated with each type. |

| Provider Networks | Verify if your preferred doctors, hospitals, and specialists are included in the plan’s network. Out-of-network care can be significantly more expensive. |

| Premium Costs | Compare monthly premiums for different plans. Consider the trade-off between lower premiums and higher out-of-pocket costs. |

| Out-of-Pocket Expenses | Evaluate deductibles, copayments, and coinsurance for different plans. Higher deductibles often mean lower premiums, but you’ll pay more out-of-pocket before insurance kicks in. |

| Prescription Drug Coverage | Review the formulary, which lists the drugs covered by the plan. Ensure your medications are included and that the copayments are affordable. |

Understanding Your Health Insurance Options

To make informed decisions, it’s essential to:

- Compare Plans:Use online tools, insurance brokers, or the Marketplace to compare different plans based on your needs and budget.

- Consider Your Health Needs:Think about your current and potential future health needs. Choose a plan that provides adequate coverage for your specific requirements.

- Review Plan Documents:Carefully read the plan documents, including the summary of benefits and coverage (SBC), to understand the details of coverage, costs, and limitations.

- Seek Expert Advice:If you’re unsure about your options, consult with an insurance broker or a health insurance advisor. They can provide personalized guidance and help you navigate the complexities of choosing the right plan.

Resources for Tennessee Residents Seeking Health Insurance

Navigating the health insurance landscape can be overwhelming, especially in a state like Tennessee with diverse options and programs. Fortunately, numerous resources are available to help residents find the right plan and access affordable coverage.

Tennessee Department of Commerce & Insurance

The Tennessee Department of Commerce & Insurance (TDCI) is the primary state agency responsible for regulating the insurance industry, including health insurance. They offer a range of services and resources for Tennesseans, including:

- Consumer assistance:The TDCI provides information and guidance to consumers who have questions about their health insurance policies or claims.

- Market oversight:The TDCI monitors the health insurance market to ensure that insurers are complying with state regulations and offering fair and competitive plans.

- Enforcement:The TDCI investigates consumer complaints and takes action against insurers who violate state laws.

Tennessee Health Insurance Marketplace

The Tennessee Health Insurance Marketplace (also known as the Affordable Care Act Marketplace) is a platform where individuals and families can shop for and enroll in health insurance plans. This marketplace offers a variety of plans from different insurance companies, with varying levels of coverage and premiums.

Key features of the marketplace include:

- Plan comparison:The marketplace allows users to compare different plans side-by-side, based on factors like premium, deductible, and coverage benefits.

- Financial assistance:Many individuals and families may qualify for tax credits or subsidies to help offset the cost of their health insurance premiums.

- Enrollment support:The marketplace provides assistance with the enrollment process, including answering questions and guiding users through the steps.

Consumer Advocacy Groups

Consumer advocacy groups play a vital role in protecting the rights of consumers in the health insurance market. They provide information, education, and support to Tennesseans seeking health insurance. Some notable organizations include:

- Tennessee Citizen Action:This group advocates for affordable health care for all Tennesseans, including access to quality insurance options.

- Tennessee Justice Center:The Justice Center focuses on advocating for low-income Tennesseans, including access to health care and affordable insurance.

- Center for Medicare Advocacy:This national organization provides information and advocacy for Medicare beneficiaries, including those in Tennessee.

Local Health Insurance Brokers

Local health insurance brokers can be valuable resources for Tennesseans seeking guidance and assistance with finding the right health insurance plan. Brokers are licensed professionals who specialize in insurance and can help individuals navigate the complex world of health insurance options.

They can:

- Assess individual needs:Brokers can help determine the best type of health insurance plan based on factors like age, health status, and budget.

- Compare plans:Brokers can provide a comprehensive comparison of plans from different insurance companies, highlighting the pros and cons of each option.

- Facilitate enrollment:Brokers can assist with the enrollment process, ensuring that individuals are enrolled in the most appropriate plan for their needs.

Online Resources

The internet offers a wealth of information and tools for Tennesseans seeking health insurance. Some useful online resources include:

- Health insurance calculators:These tools can help estimate the cost of health insurance based on individual factors like age, income, and family size.

- Health insurance comparison websites:These websites allow users to compare plans from different insurance companies side-by-side, based on premium, deductible, and coverage benefits.

- State-specific resources:The TDCI website provides information and resources specific to Tennessee, including details on state-regulated insurance plans and programs.

Key Resources and Contact Information

| Resource | Website | Phone Number |

|---|---|---|

| Tennessee Department of Commerce & Insurance | https://www.tn.gov/commerce/ | (615) 741-2244 |

| Tennessee Health Insurance Marketplace | https://www.healthcare.gov/ | (800) 318-2596 |

| Tennessee Citizen Action | https://www.tncitizenaction.org/ | (615) 256-0650 |

| Tennessee Justice Center | https://www.tnjustice.org/ | (615) 244-0440 |

| Center for Medicare Advocacy | https://www.medicareadvocacy.org/ | (800) 677-1116 |

Conclusive Thoughts

Choosing the right health insurance plan in Tennessee can be a complex process. By understanding the various factors involved, such as coverage options, provider networks, and costs, Tennesseans can make informed decisions that meet their individual needs. Utilizing the resources and information provided in this guide can help ensure access to quality healthcare while staying within budget.

Questions and Answers

What are the main health insurance providers in Tennessee?

Some of the major health insurance providers in Tennessee include BlueCross BlueShield of Tennessee, Humana, Cigna, UnitedHealthcare, and WellCare.

How can I find out if I qualify for subsidies or tax credits through the ACA?

You can use the Health Insurance Marketplace website or contact the Tennessee Department of Commerce & Insurance to determine your eligibility for subsidies or tax credits.

What are the different types of health insurance plans available in Tennessee?

Common plan types include HMOs, PPOs, POSs, and high-deductible health plans (HDHPs). Each plan type has its own coverage options, provider networks, and cost structures.