Washington Health Plan Finder plans provide a comprehensive platform for residents to navigate the complex world of health insurance. This online marketplace, operated by the Washington Health Benefit Exchange, empowers individuals and families to find affordable and comprehensive coverage that meets their unique needs.

From understanding eligibility criteria to comparing plan options and enrolling in coverage, the Washington Health Plan Finder serves as a one-stop resource for all things health insurance in the state.

Whether you’re seeking individual or family plans, employer-sponsored coverage, or government-funded programs like Medicaid or CHIP, the platform offers a wide range of options. The website features user-friendly tools to compare plans based on factors such as cost, coverage, and benefits, ensuring you can make informed decisions that align with your budget and healthcare priorities.

Introduction to Washington Health Plan Finder

The Washington Health Plan Finder is an online marketplace where Washington residents can shop for and enroll in health insurance plans. The platform was launched in 2013 as part of the Affordable Care Act (ACA), also known as Obamacare. The Washington Health Plan Finder aims to simplify the process of finding affordable and comprehensive health insurance for individuals, families, and small businesses.

It provides a user-friendly platform that allows users to compare different plans based on their needs, budget, and health status.

Types of Health Insurance Plans

The Washington Health Plan Finder offers a variety of health insurance plans, including:

- Individual Health Insurance:Plans designed for individuals and families who are not covered by employer-sponsored health insurance.

- Small Business Health Insurance:Plans designed for businesses with up to 50 employees.

- Medicaid:A government-funded health insurance program for low-income individuals and families.

- Children’s Health Insurance Program (CHIP):A government-funded health insurance program for children from low-income families.

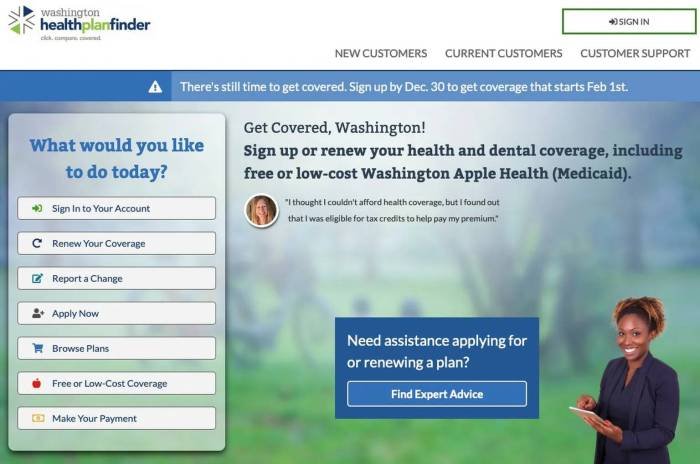

Navigating the Washington Health Plan Finder Website

The Washington Health Plan Finder website is a user-friendly platform designed to help individuals and families find and enroll in affordable health insurance plans. The website provides a comprehensive suite of tools and resources to guide you through the enrollment process.

Accessing the Website

You can access the Washington Health Plan Finder website by visiting the official URL: [Insert Website URL here].

Creating an Account or Logging In

To fully utilize the website’s features, you can create an account. To do so:

- Click on the “Create an Account” button, typically located in the top right corner of the website.

- Provide your personal information, such as your name, email address, and date of birth.

- Create a secure password and confirm it.

- Agree to the website’s terms and conditions.

- Click on the “Create Account” button to complete the process.

If you already have an account, simply click on the “Log In” button and enter your credentials.

Key Features and Functionalities

The Washington Health Plan Finder website offers several features and functionalities to simplify your health insurance search and enrollment.

Plan Comparison Tools

The website provides comprehensive plan comparison tools to help you find the best plan for your needs and budget. You can compare plans based on factors such as:

- Monthly premium costs

- Deductibles and co-pays

- Network of doctors and hospitals

- Prescription drug coverage

The website also provides a personalized plan recommendation based on your individual circumstances.

Eligibility Checks

The website allows you to check your eligibility for financial assistance, such as tax credits or subsidies, to help make health insurance more affordable. You can enter your income and household information to determine your eligibility and potential savings.

Enrollment Assistance

The website provides a variety of enrollment assistance resources, including:

- Online enrollment tools

- Phone support from trained enrollment specialists

- In-person enrollment assistance at community centers and other locations

You can access these resources to get help with the enrollment process, answer questions, and ensure you choose the right plan.

Eligibility and Enrollment Process

The Washington Health Plan Finder offers a variety of health insurance plans, each with different eligibility criteria and enrollment processes. This section will guide you through understanding the eligibility requirements, enrollment steps, and available financial assistance options.

Eligibility Criteria

To determine your eligibility for different health insurance plans, the Washington Health Plan Finder considers several factors, including your income, age, household size, and citizenship status.

- Income:Your income is a key factor in determining eligibility for certain plans, particularly those with financial assistance. The Washington Health Plan Finder uses federal poverty guidelines to assess your income level.

- Age:Age is a factor for some plans, such as Medicare, which is available to individuals aged 65 and older.

- Household Size:The number of people in your household can impact your eligibility for financial assistance, as the amount of assistance is often based on household income.

- Citizenship Status:You must be a U.S. citizen, national, or lawful permanent resident to be eligible for most health insurance plans offered through the Washington Health Plan Finder.

Enrollment Process

The enrollment process for health insurance plans through the Washington Health Plan Finder is straightforward. You can enroll online, by phone, or in person.

- Create an Account:You will need to create an account on the Washington Health Plan Finder website to begin the enrollment process.

- Provide Personal Information:You will be asked to provide personal information, such as your name, address, date of birth, Social Security number, and income.

- Choose a Plan:Based on your eligibility and preferences, you can browse and compare different health insurance plans available in your area.

- Enroll in Your Chosen Plan:Once you have selected a plan, you can complete the enrollment process and submit your application.

Required Documentation

To complete the enrollment process, you will need to provide certain documentation to verify your eligibility and income.

- Proof of Identity:A government-issued photo ID, such as a driver’s license or passport.

- Proof of Citizenship or Residency:A birth certificate, U.S. passport, or green card.

- Proof of Income:Tax forms (W-2, 1099), pay stubs, or other documentation that shows your income.

Enrollment Deadlines

Open enrollment periods occur annually, typically from November to January. You can also enroll outside of the open enrollment period if you experience a qualifying life event, such as getting married, having a baby, or losing your job.

Financial Assistance Options

The Washington Health Plan Finder offers several financial assistance options to help individuals and families afford health insurance.

- Premium Tax Credits:These tax credits can help reduce the cost of your monthly premiums.

- Cost-Sharing Reductions:These reductions can help lower your out-of-pocket costs for healthcare services, such as copayments and deductibles.

Eligibility for Financial Assistance

To be eligible for financial assistance, your income must fall within certain limits. The amount of assistance you receive will depend on your income level and household size.

“The Washington Health Plan Finder provides a simple and user-friendly way to apply for financial assistance. You can use the website’s online calculator to estimate your potential savings.”

Types of Health Insurance Plans: Washington Health Plan Finder Plans

The Washington Health Plan Finder offers a variety of health insurance plans to meet the diverse needs of Washington residents. Understanding the different types of plans available is crucial for making informed decisions about your health coverage.

Individual and Family Plans, Washington health plan finder plans

These plans are designed for individuals and families who are not covered by an employer-sponsored plan. They provide comprehensive health insurance coverage, including preventive care, hospitalization, and prescription drugs. You can choose from a variety of plans based on your budget and coverage needs.

Employer-Sponsored Plans

Many employers in Washington offer health insurance plans to their employees. These plans can be offered through a variety of insurance carriers and may include options for individual and family coverage. They often offer more comprehensive benefits and lower premiums compared to individual plans.

Navigating the Washington Health Plan Finder can feel overwhelming, but it doesn’t have to be. If you’re looking for affordable healthcare options, you might consider checking out the services offered by c h i health center. They can help you understand your options and find a plan that fits your needs and budget, making the whole process much smoother.

Medicaid

Medicaid is a government-funded health insurance program for low-income individuals and families. It provides comprehensive health coverage, including hospitalizations, doctor visits, and prescription drugs. Eligibility for Medicaid is determined based on income and other factors.

Children’s Health Insurance Program (CHIP)

CHIP is a government-funded health insurance program for children from low-income families. It provides comprehensive health coverage, including doctor visits, hospitalizations, and prescription drugs. Eligibility for CHIP is determined based on income and other factors.

Understanding Plan Costs and Benefits

It’s important to understand how much your health insurance plan will cost and what benefits it will cover. This will help you make an informed decision about which plan is right for you.

Factors Influencing Plan Costs

Several factors can affect the cost of your health insurance plan.

Finding the right Washington health plan can be a bit of a workout, but don’t worry, you’re not alone! Take a break from the research and check out fitness bungee for a fun and effective way to get moving.

Once you’ve recharged, you’ll be ready to tackle those Washington health plan finder plans again with renewed energy.

- Age:Generally, older people pay more for health insurance because they tend to have higher healthcare costs.

- Location:The cost of healthcare varies from state to state and even from county to county.

- Coverage Level:Plans with higher coverage levels typically cost more. This is because they cover a wider range of services and have lower deductibles and co-pays.

- Deductibles and Co-pays:These are the amounts you pay out of pocket before your insurance starts covering costs. Plans with lower deductibles and co-pays typically cost more.

Comparing Plan Benefits

Different health insurance plans offer different benefits. It’s important to compare the benefits of different plans to find one that meets your needs.

- Prescription Drug Coverage:Some plans have a formulary, which is a list of approved prescription drugs. You may have to pay more for drugs that are not on the formulary.

- Mental Health and Substance Abuse Coverage:Most plans offer mental health and substance abuse coverage. However, the coverage level may vary from plan to plan.

- Dental and Vision Coverage:Some plans offer dental and vision coverage, but others do not.

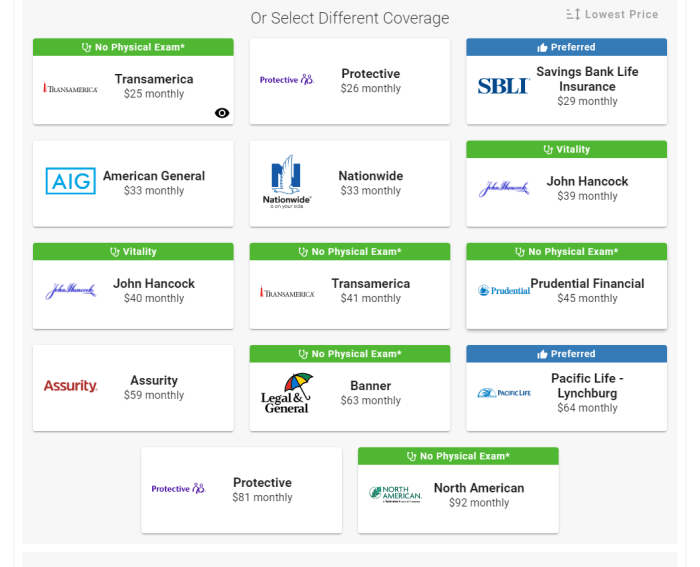

Health Insurance Plan Comparison Tools

The Washington Health Plan Finder website provides several helpful tools to compare health insurance plans and find the best option for your needs. These tools allow you to easily evaluate plans based on factors such as cost, coverage, and benefits, making the process of selecting a health insurance plan more manageable.

Using the Plan Comparison Tools

The plan comparison tools on the Washington Health Plan Finder website are designed to be user-friendly and intuitive. To effectively use these tools, follow these steps:

- Enter your information:Start by entering your personal information, such as your age, location, and income. This allows the website to tailor the plan options to your specific circumstances.

- Filter and sort plans:Once you have entered your information, you can filter and sort the plans based on your preferences. For instance, you can filter plans by cost, coverage, or benefits. You can also sort plans by premium, deductible, or co-pay.

- Compare plan details:Once you have filtered and sorted the plans, you can compare the details of each plan side-by-side. This allows you to see the differences in cost, coverage, and benefits, helping you make an informed decision.

- Use the “Compare” feature:The website offers a “Compare” feature that allows you to select up to three plans and compare them directly. This provides a clear overview of the key differences between the plans.

Filtering and Sorting Plans

The Washington Health Plan Finder website offers various filtering and sorting options to help you narrow down your choices. Here are some examples:

- Cost:You can filter plans by premium, deductible, or co-pay. This allows you to find plans that fit your budget.

- Coverage:You can filter plans based on the types of services they cover, such as doctor visits, hospital stays, and prescription drugs. This helps you ensure that the plan meets your healthcare needs.

- Benefits:You can filter plans based on specific benefits, such as dental coverage, vision coverage, or mental health coverage. This helps you find a plan that offers the benefits that are most important to you.

- Network:You can filter plans based on the network of doctors and hospitals they cover. This ensures that you can access the healthcare providers you prefer.

Open Enrollment Period and Special Enrollment Periods

The Washington Healthplan Finder offers a yearly open enrollment period, allowing individuals to choose or change their health insurance plans. Outside of this period, special enrollment periods provide opportunities for specific life events.

Open Enrollment Period

The open enrollment period for Washington Healthplan Finder plans typically runs from November 1st to January 15th. During this time, individuals can sign up for a new plan, change their existing plan, or drop coverage. This period allows you to assess your health insurance needs and choose a plan that best suits your circumstances.

Special Enrollment Periods

Special enrollment periods provide flexibility for individuals who experience certain life events. These events can trigger a special enrollment period, allowing you to enroll in a health plan outside of the regular open enrollment period. Here are some common reasons that qualify for a special enrollment period:

- Loss of other health coverage:This includes losing employer-sponsored coverage, losing coverage due to a change in employment status, or losing coverage due to a divorce or separation.

- Moving to a new county:If you move to a new county within Washington state, you may be eligible for a special enrollment period.

- Gaining a dependent:The birth or adoption of a child, or the addition of a spouse, can qualify for a special enrollment period.

- Changes in income:If your income changes significantly, you may be eligible for a special enrollment period to adjust your plan.

- Changes in family size:If you experience a change in family size, such as a child leaving home for college, you may be eligible for a special enrollment period.

Deadlines and Enrollment Procedures

- Open Enrollment Period:During the open enrollment period, you have until January 15thto enroll in a plan or make changes to your existing coverage. To enroll, you can visit the Washington Healthplan Finder website, call the customer service line, or work with a certified application counselor.

- Special Enrollment Period:When a qualifying life event occurs, you have 60 daysfrom the date of the event to enroll in a new plan or make changes to your existing coverage. You must provide documentation to verify the qualifying life event. To enroll, you can visit the Washington Healthplan Finder website, call the customer service line, or work with a certified application counselor.

Navigating the Washington Health Plan Finder can be a bit overwhelming, but it’s important to find the right plan for your needs. If you’re looking for a change of pace, you might want to check out the beauty of Essex, New York , a charming town with stunning natural landscapes.

Once you’ve found your perfect plan and maybe even booked a trip to Essex, you can focus on your health and well-being.

Resources and Support

Navigating the Washington Health Plan Finder and enrolling in health insurance can sometimes feel overwhelming. Fortunately, there are a number of resources available to help you through the process.

Customer Support

The Washington Health Plan Finder offers various ways to get help.

- You can call the customer support line at 1-855-923- 4633. This number is available Monday through Friday from 8:00 AM to 5:00 PM Pacific Time.

- You can also find answers to frequently asked questions on the Washington Health Plan Finder website.

- For assistance with enrollment, you can contact a certified enrollment assister.

Enrollment Assistance

Certified enrollment assisters are trained professionals who can help you understand your options and enroll in a health insurance plan that meets your needs. They are available in person, over the phone, and online.

- You can find a certified enrollment assister in your area by visiting the Washington Health Plan Finder website.

- They can help you determine your eligibility for financial assistance, compare plans, and complete your enrollment application.

Insurance Brokers and Navigators

Insurance brokers and navigators are also available to help you with the enrollment process.

- Insurance brokers can help you compare plans from different insurance companies.

- Navigators can provide guidance and support throughout the enrollment process.

- You can find a list of insurance brokers and navigators in your area on the Washington Health Plan Finder website.

Closure

With its intuitive interface, comprehensive resources, and dedicated support services, the Washington Health Plan Finder empowers residents to confidently navigate the health insurance landscape. From understanding eligibility requirements to comparing plans and enrolling in coverage, the platform provides a seamless and informative experience.

By leveraging the tools and information available through the Washington Health Plan Finder, individuals and families can secure the health insurance coverage they need to access quality healthcare services and achieve peace of mind.

Key Questions Answered

What is the open enrollment period for Washington health insurance?

The open enrollment period for Washington health insurance typically runs from November 1st to January 15th each year. During this time, individuals can enroll in or change their health insurance plans.

Can I enroll in a health plan outside of the open enrollment period?

Yes, you may be eligible for a special enrollment period if you experience certain life events, such as getting married, having a baby, or losing your job.

How can I get help with enrolling in a health plan?

The Washington Health Plan Finder offers free enrollment assistance through certified navigators and brokers. You can contact them for guidance and support throughout the enrollment process.