What is a health insurance deductible mean – What does a health insurance deductible mean? Imagine you have a car insurance policy with a $500 deductible. If you get into an accident, you’ll need to pay the first $500 of repair costs out of pocket before your insurance kicks in.

Health insurance deductibles work similarly, acting as a buffer between you and your insurance company before coverage begins.

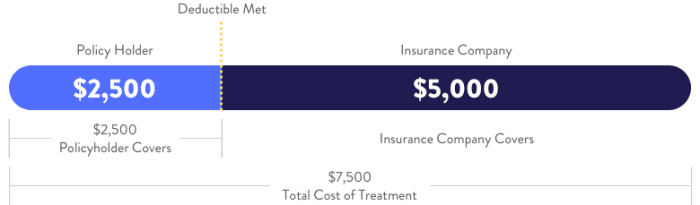

A health insurance deductible is the amount of money you must pay for healthcare expenses before your insurance plan starts covering the costs. It’s like a “threshold” you need to cross before your insurance takes over. For example, if you have a $1,000 deductible and need a $2,000 medical procedure, you’ll pay the first $1,000 yourself, and your insurance will cover the remaining $1,000.

What is a Deductible?

Imagine you have a car insurance policy with a deductible of $500. If you get into an accident, you’ll need to pay the first $500 of repair costs out of your own pocket. After that, your insurance company will cover the remaining costs.

Your health insurance deductible is the amount you pay out-of-pocket before your insurance kicks in. It’s important to know your deductible, especially when you’re looking for a provider. You can find a provider in your UnitedHealthcare network by visiting united health care find a provider.

Once you’ve found a provider, you can ask them about their fees and how they work with your specific insurance plan, including your deductible.

A health insurance deductible works in a similar way.

Deductible in Health Insurance

A deductible is the amount of money you have to pay out of pocket for healthcare services before your health insurance plan starts covering costs. It’s like a threshold you need to reach before your insurance kicks in. For example, if your deductible is $1,000, you’ll need to pay the first $1,000 of your medical expenses yourself.

Once you’ve reached that amount, your insurance will start paying for the rest of your covered medical expenses for the rest of the year.

Why Do Health Insurance Plans Have Deductibles?

Health insurance deductibles are a common feature of most plans, and while they may seem like an added expense, they play a crucial role in managing healthcare costs and ensuring the sustainability of the insurance system.Deductibles help manage healthcare costs by encouraging policyholders to be more mindful of their healthcare spending.

Knowing they need to pay a certain amount out of pocket before insurance coverage kicks in, individuals are more likely to consider the cost of medical services and explore less expensive alternatives when possible.

How Deductibles Manage Healthcare Costs

Deductibles act as a form of cost-sharing, where both the insured and the insurer bear a portion of the healthcare expenses.

- By requiring policyholders to pay a deductible before insurance coverage begins, insurers can reduce the overall cost of claims, leading to lower premiums for everyone.

- Deductibles can also help prevent unnecessary healthcare utilization. If individuals know they will have to pay a significant amount out of pocket for certain services, they may be less inclined to seek treatment for minor ailments or schedule unnecessary tests.

Benefits and Drawbacks of Deductibles

Deductibles offer advantages and disadvantages for both the insured and the insurer.

Benefits for the Insured

- Lower Premiums: One of the main benefits of deductibles is that they can help keep premiums lower. By sharing the cost of healthcare, individuals can enjoy more affordable insurance coverage.

- Greater Choice: Deductibles can give policyholders more control over their healthcare spending. They can choose plans with higher deductibles and lower premiums or opt for plans with lower deductibles and higher premiums, depending on their individual needs and risk tolerance.

Drawbacks for the Insured

- Out-of-Pocket Expenses: The most significant drawback of deductibles is the potential for high out-of-pocket costs. Individuals may face substantial expenses before their insurance coverage begins, particularly for major medical events.

- Access to Care: High deductibles can deter some individuals from seeking necessary medical care, especially for preventive services or routine checkups. This can lead to delayed treatment and potentially worse health outcomes.

Benefits for the Insurer

- Reduced Claims Costs: Deductibles help insurers manage their claims costs. By requiring policyholders to pay a portion of the expenses, insurers can reduce the overall amount they have to pay out.

- Financial Stability: Deductibles contribute to the financial stability of insurance companies. By reducing claims costs, insurers can maintain healthy reserves and continue to offer affordable coverage to their policyholders.

Drawbacks for the Insurer

- Potential for High Claims: In cases of major medical events, high deductibles can result in substantial claims for insurers. While deductibles help manage costs overall, they do not eliminate the risk of high-cost claims.

- Customer Dissatisfaction: High deductibles can lead to customer dissatisfaction. Individuals may feel frustrated by having to pay significant amounts out of pocket, potentially leading to policy cancellations or complaints.

Understanding Deductible Amounts

Deductibles are a key component of health insurance plans, and understanding them is crucial to making informed decisions about your coverage. The deductible amount you pay can significantly impact your out-of-pocket expenses.

Deductible Types Based on Coverage

Deductibles are typically defined based on the type of coverage you have, whether it’s individual or family, and whether it’s for the entire year or a specific period.

- Individual Deductible:This is the amount you pay out-of-pocket before your insurance coverage kicks in for your individual healthcare expenses.

- Family Deductible:This is the total amount you pay out-of-pocket before your insurance coverage starts for all family members covered under the plan. This means that once the family deductible is met, all family members can access benefits without further deductible payments.

- Annual Deductible:This is the most common type of deductible, which you pay once per year for all covered healthcare expenses. Once you’ve met your annual deductible, your insurance plan will start covering a larger percentage of your medical costs for the rest of the year.

Common Deductible Amounts

Deductible amounts can vary significantly depending on the type of health insurance plan you choose. Here are some common examples:

| Plan Type | Deductible Range |

|---|---|

| High-Deductible Health Plan (HDHP) | $1,400

|

$2,800

|

|

| Preferred Provider Organization (PPO) | $500

|

$1,000

|

|

| Health Maintenance Organization (HMO) | $0

|

$0

|

High-Deductible vs. Low-Deductible Plans

The deductible amount is a key factor in determining the overall cost of your health insurance plan. High-deductible plans generally have lower monthly premiums, but you’ll pay more out-of-pocket before your insurance coverage kicks in.

A health insurance deductible is the amount you pay out-of-pocket before your insurance kicks in. It’s important to understand deductibles, especially if you’re considering a career in healthcare, like those offered by ballad health careers. Knowing your deductible can help you make informed decisions about your healthcare spending and ensure you’re prepared for any unexpected medical costs.

Low-deductible plans have higher monthly premiums, but you’ll pay less out-of-pocket for covered healthcare expenses.

Important Note:The decision of whether to choose a high-deductible or low-deductible plan depends on your individual needs and financial situation. If you expect to use your health insurance frequently, a low-deductible plan may be a better option. However, if you are healthy and rarely use your health insurance, a high-deductible plan could save you money on your monthly premiums.

How Deductibles Impact Out-of-Pocket Costs: What Is A Health Insurance Deductible Mean

Your health insurance deductible is the amount you pay out of pocket before your insurance starts covering your healthcare costs. The higher your deductible, the more you’ll pay upfront before your insurance kicks in.

A health insurance deductible is the amount you pay out-of-pocket before your insurance starts covering your healthcare costs. This can be a significant expense, especially for mental health services. If you’re interested in pursuing a career as a mental health nurse practitioner, consider enrolling in one of the online mental health nurse practitioner programs available.

These programs can equip you with the skills and knowledge to provide valuable care to patients and help them navigate the complexities of health insurance, including deductibles.

It’s crucial to understand how deductibles affect your out-of-pocket expenses. Deductibles play a significant role in determining how much you pay for healthcare, and understanding their impact can help you choose a plan that best suits your financial needs.

Impact of Deductible Amounts on Total Healthcare Costs

The amount of your deductible can have a substantial impact on your overall healthcare costs. A higher deductible means you’ll pay more upfront before your insurance begins to cover expenses.

Consider this example:

| Deductible Amount | Total Healthcare Costs | Out-of-Pocket Costs |

|---|---|---|

| $1,000 | $2,500 | $1,000 |

| $2,500 | $2,500 | $2,500 |

| $5,000 | $2,500 | $2,500 |

In this scenario, if your total healthcare costs are $2,500, a $1,000 deductible would mean you pay $1,000 out of pocket. However, with a $2,500 deductible, you would be responsible for the entire $2,500. If your deductible is $5,000, you’d still only pay $2,500 out of pocket, as your costs are less than the deductible.

Breakdown of Out-of-Pocket Costs

Out-of-pocket costs are the expenses you pay for healthcare services before your insurance covers the remaining costs. These costs can include:

- Deductible:The amount you pay before your insurance starts covering healthcare costs.

- Copayments:Fixed amounts you pay for specific services, like doctor visits or prescriptions.

- Coinsurance:A percentage of the cost of healthcare services you pay after you’ve met your deductible.

For example, let’s say your deductible is $1,000, your coinsurance is 20%, and you have a copayment of $20 for doctor visits. If you receive $3,000 worth of healthcare services, you would first pay your $1,000 deductible. Then, you would pay 20% of the remaining $2,000, which is $400.

Additionally, if you had a doctor visit during this period, you would also pay a $20 copayment.

Your total out-of-pocket costs in this scenario would be $1,420 ($1,000 deductible + $400 coinsurance + $20 copayment).

Deductibles and Preventive Care

You might be wondering how deductibles apply to preventive care services, as these services are designed to keep you healthy in the first place. Let’s explore how deductibles might impact your utilization of preventive care and the types of services that are typically covered without a deductible.

Deductibles and Preventive Care Services

Preventive care services are generally designed to detect health issues early, allowing for more effective treatment and potentially reducing the need for more expensive care later. The Affordable Care Act (ACA) mandates that most health insurance plans cover preventive care services without a deductible or copayment.

This means that you can access these services without having to pay anything out of pocket, even if you haven’t met your deductible yet.

Examples of Preventive Care Services Typically Covered Without a Deductible

Here are some examples of common preventive care services that are typically covered without a deductible:

- Annual physical exams

- Routine vaccinations

- Cancer screenings (e.g., mammograms, colonoscopies)

- Well-woman visits

- Blood pressure and cholesterol checks

- Diabetes screenings

- Mental health screenings

It’s important to note that while most preventive care services are covered without a deductible, there may be some exceptions. For example, some plans may require a copayment for certain preventive services. It’s always a good idea to check with your insurance provider to confirm what services are covered and what your out-of-pocket costs will be.

Choosing a Plan with the Right Deductible

Choosing the right health insurance plan involves a careful assessment of your individual needs and circumstances. A key factor in this decision is the deductible, which represents the amount you need to pay out-of-pocket before your insurance coverage kicks in.

Factors to Consider When Choosing a Deductible, What is a health insurance deductible mean

The right deductible for you depends on several factors:

- Your Expected Healthcare Costs:If you anticipate frequent doctor visits or potential for major medical expenses, a higher deductible may not be suitable.

- Your Budget:A higher deductible typically means lower monthly premiums, but it also means a larger upfront cost before insurance coverage begins. Consider your financial situation and ability to manage a potentially high deductible.

- Your Risk Tolerance:Are you comfortable taking on more financial risk in exchange for lower premiums? If so, a higher deductible might be appealing. However, if you prefer more financial security, a lower deductible might be a better choice.

- Your Health Status:If you have pre-existing conditions or are at higher risk for health issues, a lower deductible might provide greater peace of mind.

- Your Age and Family Situation:Younger individuals and families with children may benefit from a lower deductible, as they tend to have higher healthcare utilization rates.

Decision-Making Process for Selecting a Plan Based on Deductible Amount

A flowchart can help you visualize the decision-making process for selecting a plan based on deductible amount:

[Flowchart] Start: – Estimate your expected healthcare costs:Consider your health history, family history, and lifestyle. – Assess your budget:Determine how much you can comfortably afford to pay in monthly premiums and deductibles. – Evaluate your risk tolerance:Are you comfortable with higher out-of-pocket costs in exchange for lower premiums?

– Compare plans with different deductible amounts:Look at the trade-off between lower premiums and higher deductibles. – Consider your health status:If you have pre-existing conditions or are at higher risk for health issues, a lower deductible might be more appropriate. – Factor in your age and family situation:Younger individuals and families with children may benefit from a lower deductible.

– Choose a plan with a deductible that meets your needs and budget. End:

Balancing the Trade-off Between Lower Premiums and Higher Deductibles

A key aspect of choosing a health insurance plan is balancing the trade-off between lower premiums and higher deductibles. Lower premiums mean you pay less each month, but you also have a higher out-of-pocket cost before insurance coverage kicks in.

Higher premiums mean you pay more each month, but you have a lower out-of-pocket cost before insurance coverage kicks in.

To make an informed decision, consider your individual circumstances and risk tolerance. If you are relatively healthy and anticipate minimal healthcare costs, a higher deductible plan with lower premiums might be a good choice. However, if you have pre-existing conditions or anticipate frequent doctor visits, a lower deductible plan with higher premiums might provide greater peace of mind.

It’s important to remember that your health insurance plan is an investment in your health and well-being. Choosing the right deductible is a crucial step in ensuring you have adequate coverage without breaking the bank.

Last Recap

Understanding deductibles is crucial for making informed decisions about your health insurance. By carefully considering your healthcare needs and budget, you can choose a plan with a deductible that aligns with your financial situation. Remember, a higher deductible often means lower monthly premiums, but it also means you’ll need to pay more out of pocket before your insurance coverage kicks in.

Conversely, a lower deductible might have higher premiums but provides more immediate coverage.

FAQ

What happens if I don’t meet my deductible?

If you don’t reach your deductible within a year, it resets at the start of the new coverage year. You’ll need to pay the full deductible amount again for the new year.

Can I pay my deductible in installments?

Some insurance providers might allow you to pay your deductible in installments, but it’s best to check with your specific plan.

Does my deductible apply to prescription drugs?

Yes, deductibles typically apply to prescription drugs, but there might be exceptions for certain medications. Review your plan’s formulary for specific details.

Can I use my Health Savings Account (HSA) to pay my deductible?

Yes, you can use funds from your HSA to pay for your deductible, copayments, and coinsurance.