Consolidated health plans are becoming increasingly popular as employers seek to offer their employees comprehensive and affordable healthcare coverage. These plans, which combine multiple health insurance products into a single, streamlined package, aim to simplify the healthcare experience for both employers and employees.

By consolidating various health insurance benefits, such as medical, dental, and vision coverage, into a single plan, consolidated health plans offer numerous advantages. Employers can streamline administrative processes, reduce costs, and improve employee satisfaction by providing a comprehensive and convenient healthcare solution.

For employees, these plans can translate into lower premiums, easier access to care, and a more seamless healthcare experience.

What is a Consolidated Health Plan?

A consolidated health plan, also known as a bundled health plan, is a type of health insurance that combines multiple healthcare services into one comprehensive package. This approach aims to simplify the healthcare experience for individuals and families, offering a single point of contact for various medical needs.

Purpose of a Consolidated Health Plan

Consolidated health plans are designed to address several key challenges in the traditional healthcare system.

- Cost Transparency and Predictability:By bundling services, consolidated plans provide a clear and upfront cost structure, eliminating surprises and unexpected bills. This transparency allows individuals to budget effectively for their healthcare expenses.

- Improved Coordination of Care:Consolidated plans emphasize integrated care, ensuring that different healthcare providers communicate and collaborate effectively to deliver seamless patient care. This reduces duplication of services and improves the overall quality of care.

- Streamlined Administration:Consolidating services under one plan simplifies the administrative process for both patients and providers. It eliminates the need to navigate multiple insurance policies and claim procedures, making healthcare management more efficient.

Key Features of a Consolidated Health Plan

Consolidated health plans typically share several key features that distinguish them from traditional health insurance models.

- Bundled Services:These plans combine various healthcare services into one package, often including medical, dental, vision, and prescription drug coverage.

- Integrated Care Networks:Consolidated plans often work with a specific network of healthcare providers, ensuring coordinated care and communication among physicians, specialists, hospitals, and other medical professionals.

- Value-Based Care:Consolidated plans frequently adopt value-based care models, which incentivize providers to deliver high-quality care while managing costs effectively. This approach encourages preventative care and proactive health management.

- Health Management Programs:Many consolidated plans offer comprehensive health management programs, such as wellness screenings, disease management initiatives, and personalized health coaching, to promote overall well-being and reduce healthcare utilization.

Types of Consolidated Health Plans

Consolidated health plans come in various forms, each tailored to specific needs and preferences.

- Employer-Sponsored Plans:Many large employers offer consolidated health plans to their employees, providing comprehensive coverage through a single provider. This option simplifies healthcare administration for both the employer and employees.

- Direct-to-Consumer Plans:Direct-to-consumer plans are offered directly to individuals, providing a more personalized and flexible approach to healthcare. These plans are gaining popularity as individuals seek greater control over their healthcare decisions.

- Government-Sponsored Plans:Some governments offer consolidated health plans to their citizens, providing access to affordable and comprehensive healthcare. These plans are often designed to address specific healthcare challenges within a particular region or population group.

Benefits of a Consolidated Health Plan

A consolidated health plan, also known as a bundled health plan, offers a comprehensive approach to healthcare, bringing together various health services under a single umbrella. This unified structure provides several advantages, impacting both employers and employees positively.

Benefits for Employers

A consolidated health plan can significantly benefit employers by simplifying their healthcare administration and potentially reducing costs. By consolidating various health services, employers can streamline their administrative processes, saving time and resources.

- Reduced Administrative Costs:Employers can reduce administrative burdens by negotiating with a single provider for multiple services, leading to fewer contracts and paperwork. This simplified process can lead to significant cost savings in the long run.

- Improved Efficiency and Coordination:A consolidated health plan fosters better coordination among healthcare providers, enhancing efficiency and reducing redundancies. This improved coordination can lead to more effective healthcare delivery and potentially lower overall costs.

- Enhanced Data Analytics and Insights:Consolidated plans allow employers to gather more comprehensive data on employee health and utilization patterns. This data can be analyzed to identify trends, improve health outcomes, and implement targeted wellness programs.

- Streamlined Communication:Consolidating health services simplifies communication between employers, employees, and healthcare providers. This improved communication can lead to better care coordination and increased employee satisfaction.

Benefits for Employees

Consolidated health plans offer various advantages for employees, including cost savings, improved convenience, and potentially enhanced well-being.

- Cost Savings:By bundling services, consolidated health plans can offer lower premiums and deductibles compared to traditional plans. This can lead to significant cost savings for employees, making healthcare more affordable.

- Convenience:A consolidated health plan eliminates the need for employees to navigate multiple insurance plans and providers for different services. This simplification can save employees time and effort, making healthcare more accessible and convenient.

- Improved Access to Care:Consolidated plans can provide employees with access to a wider range of services within a single network. This improved access can ensure that employees receive the care they need, when they need it.

Impact on Employee Well-being

Consolidated health plans can have a positive impact on employee well-being by promoting preventative care and encouraging healthier lifestyle choices.

- Enhanced Preventative Care:By integrating preventative services into the plan, consolidated health plans encourage employees to prioritize their health. This proactive approach can lead to early detection of health issues, potentially reducing the need for more expensive treatments later.

- Improved Health Outcomes:By promoting preventative care and encouraging healthy habits, consolidated health plans can contribute to better health outcomes for employees. This can lead to increased productivity and reduced absenteeism in the workplace.

- Increased Employee Satisfaction:A consolidated health plan can improve employee satisfaction by providing them with more affordable, convenient, and comprehensive healthcare. This can lead to a more engaged and motivated workforce.

How Consolidated Health Plans Work

Consolidated health plans are a relatively new approach to employee benefits, and their implementation involves a collaborative process between employers, insurers, and employees. This section Artikels the key steps involved in setting up and operating a consolidated health plan, highlighting the roles of each stakeholder and the essential elements of such a plan.

A consolidated health plan can offer a range of benefits, including access to fitness facilities. If you’re looking to stay active, consider checking out l a fitness near me to see if they have a location near you. With a comprehensive plan, you can prioritize your health and well-being while enjoying the perks of a convenient fitness solution.

Implementation Process

Implementing a consolidated health plan involves a series of steps that ensure a smooth transition and optimal outcomes for all stakeholders. These steps include:

- Needs Assessment:The first step is to conduct a thorough needs assessment to identify the specific healthcare needs and preferences of the workforce. This assessment should consider factors such as demographics, health status, and existing healthcare coverage.

- Plan Design:Based on the needs assessment, employers and insurers collaborate to design a comprehensive health plan that addresses the identified needs. This involves selecting coverage options, benefits, and cost-sharing arrangements.

- Employee Communication:Clear and concise communication is crucial to ensure employee understanding and buy-in. Employers should provide detailed information about the plan, including its features, benefits, and how to enroll.

- Enrollment and Administration:Once the plan is finalized, employees can enroll in the plan and choose their preferred coverage options. The insurer then manages the plan’s administration, including claims processing, provider networks, and member services.

- Ongoing Monitoring and Evaluation:The plan’s effectiveness is continuously monitored and evaluated to identify areas for improvement. Regular feedback from employees and employers is essential for ensuring the plan remains relevant and meets the evolving healthcare needs of the workforce.

Stakeholder Roles

Each stakeholder plays a crucial role in the success of a consolidated health plan. Their responsibilities include:

- Employers:Employers are responsible for initiating the process, defining the plan’s objectives, and providing financial contributions. They also play a role in selecting the insurer and overseeing the plan’s implementation and administration.

- Insurers:Insurers design and administer the plan, including developing coverage options, managing provider networks, and processing claims. They also provide member services and support to employees.

- Employees:Employees are the beneficiaries of the plan and have the responsibility of understanding the plan’s features and benefits. They also play a role in choosing coverage options and managing their healthcare expenses.

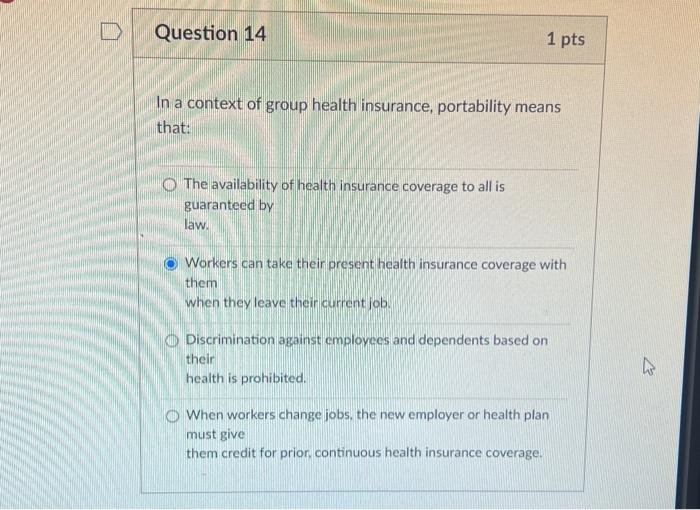

Key Elements of a Consolidated Health Plan

A consolidated health plan typically includes several key elements that contribute to its effectiveness:

- Coverage:The plan defines the range of healthcare services covered, including preventive care, medical treatment, prescription drugs, and mental health services.

- Benefits:The plan Artikels the specific benefits offered, such as deductibles, copayments, and coinsurance.

- Cost Sharing:The plan specifies the cost-sharing arrangements, which determine the proportion of healthcare expenses paid by the employer, the insurer, and the employee.

- Provider Network:The plan includes a network of healthcare providers, such as doctors, hospitals, and pharmacies, that are contracted to provide services at negotiated rates.

- Wellness Programs:Many consolidated health plans incorporate wellness programs designed to promote healthy lifestyles and reduce healthcare costs. These programs may include health screenings, fitness activities, and health education.

Considerations for Choosing a Consolidated Health Plan

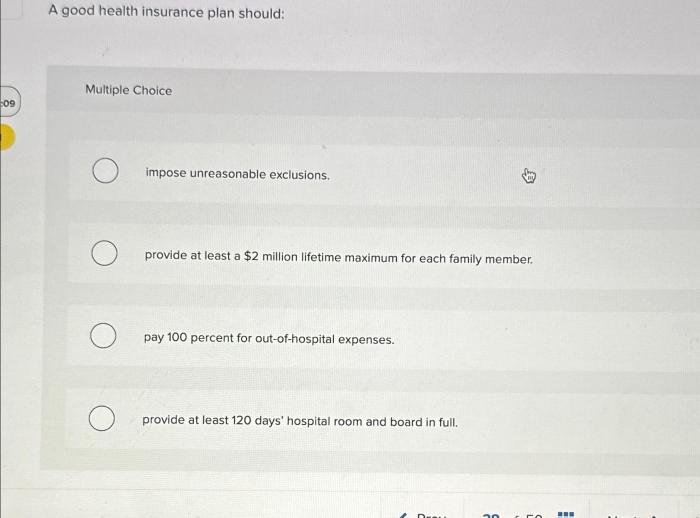

Choosing a consolidated health plan is a significant decision that requires careful consideration. It’s essential to weigh various factors to ensure the plan aligns with your needs and financial situation. This section explores key considerations and provides a framework for making an informed decision.

Factors to Consider

It’s important to consider several factors when choosing a consolidated health plan. These include:

- Your health needs:Assess your current health status, any pre-existing conditions, and anticipated future healthcare needs. This will help you determine the coverage levels required and whether the plan offers sufficient benefits for your specific requirements.

- Your budget:Consolidated health plans come with varying premiums and out-of-pocket expenses. Evaluate your financial situation and determine the maximum amount you can afford to allocate towards healthcare costs. Consider factors like deductibles, copayments, and coinsurance.

- Your lifestyle:Your lifestyle choices and activities can influence your healthcare needs. For instance, if you engage in high-risk sports or travel frequently, you might require a plan with more comprehensive coverage.

- Your coverage preferences:Evaluate the coverage options offered by different plans, such as prescription drug coverage, dental and vision care, and mental health benefits. Choose a plan that aligns with your specific needs and preferences.

- The provider network:Ensure that the plan’s provider network includes healthcare professionals and facilities you trust and prefer. This includes doctors, hospitals, and specialists.

- The plan’s reputation:Research the provider’s track record, customer satisfaction ratings, and financial stability. Choose a plan from a reputable provider with a history of reliable service.

Comparing Different Options

The market offers various consolidated health plans, each with its unique features and benefits. Comparing different options is crucial to find the best fit for your needs. Here are some key aspects to consider:

- Premium costs:Compare the monthly premiums of different plans and factor in deductibles, copayments, and coinsurance.

- Coverage levels:Evaluate the coverage levels offered by each plan, including medical, prescription drug, dental, and vision care.

- Provider networks:Compare the provider networks of different plans to ensure they include your preferred healthcare providers.

- Customer service:Research the provider’s customer service reputation, including response times, accessibility, and overall satisfaction ratings.

Key Questions to Ask

When considering a consolidated health plan, it’s crucial to ask potential providers specific questions to gather essential information. These include:

- What is the plan’s coverage area?Ensure the plan covers the geographic regions where you live, work, and travel frequently.

- What are the plan’s deductibles, copayments, and coinsurance?Understand the financial responsibilities associated with the plan.

- What is the plan’s provider network?Confirm that your preferred healthcare providers are included in the network.

- What are the plan’s benefits and limitations?Clarify the specific services covered and any exclusions or limitations.

- What are the plan’s customer service options?Inquire about the availability of phone support, online resources, and other customer service channels.

- What are the plan’s renewal procedures and costs?Understand the process for renewing the plan and any potential changes in premiums or coverage.

Case Studies and Examples

Consolidated health plans have proven their effectiveness in various real-world scenarios, demonstrating significant benefits for both employers and employees. Examining these case studies provides valuable insights into the implementation process, challenges encountered, and the impact on employee satisfaction and healthcare outcomes.

Successful Implementations

These examples highlight successful consolidated health plan implementations across different industries and company sizes.

A consolidated health plan can help you manage your overall well-being, and that includes taking care of your appearance. If you’re looking for high-quality beauty products that align with a healthy lifestyle, you might want to check out thrive beauty products.

By prioritizing both your physical and mental health, you can create a holistic approach to wellness, which is often a key focus of many consolidated health plans.

- Company A, a Fortune 500 technology company, implemented a consolidated health plan that integrated its health insurance, wellness programs, and employee assistance programs. This comprehensive approach resulted in a 15% reduction in healthcare costs and a 20% increase in employee engagement in wellness activities.

- Company B, a mid-sized manufacturing company, adopted a consolidated health plan to streamline its benefits administration and improve employee communication. The plan’s user-friendly platform and simplified enrollment process led to a 90% increase in employee satisfaction with benefits.

- Company C, a non-profit organization, implemented a consolidated health plan with a focus on preventive care and chronic disease management. This resulted in a 10% decrease in hospital readmissions and a 5% improvement in overall health outcomes for employees.

Challenges and Lessons Learned

Implementing consolidated health plans can present challenges, but these experiences provide valuable lessons for future implementations.

- Data Integration and Security: Consolidating multiple data sources can be complex and require robust data security measures. Companies must ensure data integrity and compliance with privacy regulations.

- Employee Communication and Education: Clearly communicating the benefits and features of the consolidated plan is crucial for employee buy-in and engagement. Providing comprehensive education and support resources is essential.

- Provider Network Management: Negotiating contracts with a wider range of healthcare providers can be challenging. Companies need to ensure access to quality care within the network.

Impact on Employee Satisfaction and Healthcare Outcomes

Consolidated health plans can have a positive impact on employee satisfaction and healthcare outcomes.

- Increased Employee Satisfaction: Consolidated plans often offer a simplified benefits experience, leading to improved employee satisfaction with benefits. This can be attributed to factors such as easier enrollment, streamlined communication, and improved access to information.

- Improved Healthcare Outcomes: By integrating health insurance, wellness programs, and other benefits, consolidated plans can promote preventive care and early intervention, leading to better health outcomes for employees. This can result in lower healthcare costs and increased productivity.

Future Trends in Consolidated Health Plans

The landscape of healthcare is constantly evolving, and consolidated health plans are at the forefront of this change. Driven by technological advancements, changing consumer preferences, and the need for greater cost-effectiveness, these plans are poised for significant growth and transformation in the coming years.

A consolidated health plan can help you manage your healthcare costs, and staying active is a key component of overall well-being. If you’re looking for a convenient and affordable gym option, you can find an anytime fitness near me location to help you reach your fitness goals.

Ultimately, your consolidated health plan and your commitment to wellness go hand-in-hand to help you live a healthier life.

The Influence of Technology

Technological advancements are driving significant changes in the healthcare industry, and consolidated health plans are no exception. These plans are increasingly leveraging technology to enhance efficiency, improve patient experiences, and create new opportunities for value-based care.

- Artificial Intelligence (AI) and Machine Learning (ML):AI and ML are transforming healthcare by enabling personalized medicine, predictive analytics, and automated processes. Consolidated health plans can utilize these technologies to optimize care pathways, identify high-risk patients, and personalize treatment plans. For instance, AI-powered chatbots can provide 24/7 support to patients, answering common questions and scheduling appointments.

- Telehealth and Virtual Care:The rise of telehealth and virtual care platforms has significantly expanded access to healthcare services. Consolidated health plans can integrate telehealth into their offerings, providing patients with convenient and affordable access to doctors, specialists, and other healthcare providers. This can reduce unnecessary hospital visits, improve patient satisfaction, and lower overall healthcare costs.

- Wearable Technology and Remote Patient Monitoring:Wearable devices and remote patient monitoring systems enable continuous tracking of health data, allowing for proactive intervention and personalized care. Consolidated health plans can utilize these technologies to identify early warning signs of health issues, provide timely interventions, and improve patient outcomes.

For example, wearable devices can track heart rate, blood pressure, and activity levels, providing valuable insights into a patient’s overall health.

Emerging Models of Care, Consolidated health plan

Consolidated health plans are exploring new models of care delivery that focus on population health management, preventive care, and value-based outcomes.

- Accountable Care Organizations (ACOs):ACOs are groups of healthcare providers who collaborate to provide coordinated care to a defined population. Consolidated health plans can partner with ACOs to improve quality of care, reduce costs, and enhance patient satisfaction. ACOs incentivize providers to focus on preventative care and population health management, which can lead to better overall health outcomes.

- Direct Primary Care (DPC):DPC models offer patients direct access to primary care physicians for a fixed monthly fee. Consolidated health plans can integrate DPC into their offerings, providing patients with a more personalized and accessible primary care experience. This can lead to improved patient engagement and better management of chronic conditions.

- Value-Based Care (VBC):VBC models reward providers for delivering high-quality care at a lower cost. Consolidated health plans can incentivize providers to adopt VBC models, encouraging them to focus on preventative care, disease management, and improving patient outcomes. VBC models align the incentives of providers and payers, promoting a more collaborative approach to healthcare delivery.

End of Discussion

Consolidated health plans are a dynamic and evolving area of healthcare. As technology continues to advance and the healthcare landscape shifts, we can expect to see further innovation and advancements in consolidated health plans. By staying informed about the latest trends and developments, employers and employees can make informed decisions about their healthcare coverage and leverage the benefits of these comprehensive plans.

Quick FAQs

What are the potential drawbacks of consolidated health plans?

While consolidated health plans offer many advantages, it’s essential to consider potential drawbacks. These can include limited provider networks, potential for higher deductibles, and the possibility of reduced flexibility in choosing specific coverage options. It’s crucial to carefully evaluate the plan’s terms and conditions before making a decision.

How do consolidated health plans affect employee satisfaction?

Consolidated health plans can have a positive impact on employee satisfaction by simplifying the healthcare experience, reducing administrative burdens, and providing access to comprehensive coverage. However, the impact on employee satisfaction can vary depending on factors such as plan design, provider network, and communication strategies.

Employers should prioritize employee engagement and feedback to ensure that the plan meets their needs and expectations.