The Massachusetts Health Care Connector is a state-run agency that plays a crucial role in providing access to affordable health insurance for residents of the Commonwealth. Established in 2006 as part of the state’s landmark health care reform law, the Connector serves as a central marketplace for individuals, families, and small businesses to compare and enroll in health insurance plans.

The Connector offers a variety of health insurance plans, including individual, family, and small business plans, with varying levels of coverage and costs. It also provides financial assistance programs to help eligible individuals and families afford health insurance premiums. The Connector’s mission is to ensure that all residents of Massachusetts have access to quality, affordable health care, regardless of their income or health status.

Overview of the Massachusetts Health Care Connector

The Massachusetts Health Care Connector, often referred to simply as the Connector, is a state-run agency responsible for administering the Commonwealth’s health insurance marketplace. It serves as a centralized hub for individuals and families to access affordable health insurance plans.The Connector plays a crucial role in facilitating access to health insurance for Massachusetts residents.

It offers a range of services, including:

Providing information and assistance to individuals and families in choosing the right health insurance plan.

Offering financial assistance, such as subsidies and tax credits, to make health insurance more affordable.

Enrolling individuals and families in health insurance plans.

Managing the state’s health insurance exchange, where individuals and families can compare and purchase health insurance plans.

Historical Context and Significance

The Massachusetts Health Care Connector was established in 2006 as part of the landmark Massachusetts Health Care Reform law, also known as “Romneycare.” This legislation aimed to achieve universal health insurance coverage for all residents of the Commonwealth. The Connector was designed to be the primary mechanism for achieving this goal, providing a platform for individuals and families to access affordable health insurance plans.

The creation of the Connector was a significant step in the state’s efforts to expand access to healthcare. It has been instrumental in achieving near-universal health insurance coverage in Massachusetts, with over 98% of residents having health insurance. The Connector has also served as a model for other states and the federal government in developing their own health insurance marketplaces.

Key Features and Services: Massachusetts Health Care Connector

The Massachusetts Health Care Connector offers a comprehensive suite of features and services to help residents access affordable and quality health insurance. This section delves into the details of these features, providing insights into the various plans available, the enrollment process, and the support services offered.

The Massachusetts Health Care Connector plays a vital role in helping residents navigate the complexities of healthcare. One important aspect of this is ensuring individuals have access to and understand their own health information, which is crucial for making informed decisions about their care.

Managing health information effectively can empower individuals to take ownership of their health and work collaboratively with healthcare providers. The Connector provides resources and tools to facilitate this process, making it easier for residents to access and manage their health records.

Health Insurance Plans

The Connector offers a diverse range of health insurance plans to meet the needs of individuals, families, and small businesses. These plans are categorized based on coverage levels and affordability.

- Individual Plans:These plans are designed for individuals and their dependents. They offer a variety of coverage options, including bronze, silver, gold, and platinum plans, each with varying levels of coverage and cost-sharing. Individuals can choose a plan that best suits their needs and budget.

- Family Plans:These plans provide coverage for entire families, including spouses and children. They offer similar coverage options as individual plans, with adjustments made to accommodate the needs of a family unit. Family plans are often more cost-effective than purchasing individual plans for each family member.

- Small Business Plans:The Connector offers a range of plans for small businesses with up to 50 employees. These plans provide a variety of coverage options and allow employers to offer health insurance to their employees, helping them attract and retain talent.

Enrollment Process

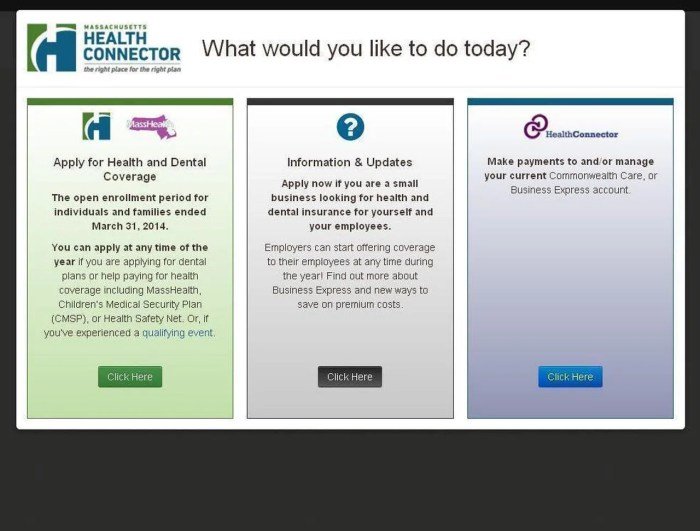

The enrollment process for health insurance through the Connector is designed to be straightforward and accessible. It involves a few key steps:

- Determine Eligibility:Individuals and families can use the Connector’s eligibility tool to determine their eligibility for financial assistance or subsidized plans. This tool considers factors such as income, household size, and age.

- Create an Account:Once eligibility is established, individuals can create an account on the Connector’s website or through a call center. This account will be used to manage the enrollment process and access support services.

- Choose a Plan:Individuals can browse through the available plans and compare their coverage, costs, and benefits. The Connector provides tools to assist in this process, allowing individuals to filter plans based on their specific needs and preferences.

- Complete the Application:Once a plan is selected, individuals need to complete an application form that collects personal and financial information. This information is used to verify eligibility and finalize the enrollment process.

- Enroll in the Plan:Upon successful completion of the application, individuals will be enrolled in their chosen plan. They will receive confirmation of enrollment and information about their coverage and benefits.

Support Services

The Connector offers a range of support services to assist individuals and families throughout the enrollment process and beyond. These services include:

- Consumer Assistance Programs:The Connector provides free, confidential assistance to individuals and families seeking guidance on health insurance options, enrollment procedures, and financial assistance programs. This assistance is available through phone, email, and online chat.

- Financial Assistance Options:The Connector offers financial assistance programs to help individuals and families afford health insurance. These programs provide subsidies to reduce monthly premiums and out-of-pocket costs. Eligibility for financial assistance is based on income and household size.

- Enrollment Guidance:The Connector provides comprehensive enrollment guidance to individuals and families, helping them navigate the enrollment process and make informed decisions about their health insurance plans. This guidance includes information about eligibility, plan options, and enrollment deadlines.

Financial Assistance and Subsidies

The Massachusetts Health Care Connector offers various financial assistance programs to help individuals and families afford health insurance. These programs are designed to make health insurance more accessible and affordable for everyone, regardless of their income level.

Eligibility Criteria and Types of Subsidies

The Connector provides subsidies to eligible individuals and families to reduce the cost of their health insurance premiums. To be eligible for subsidies, individuals must meet certain income and residency requirements. The Connector offers two main types of subsidies:

- Premium Tax Credits:These credits are available to individuals and families who meet certain income requirements and purchase health insurance through the Connector Marketplace. The amount of the tax credit is based on the individual’s income and the cost of the health insurance plan they choose.

- Cost-Sharing Reductions:These reductions help lower the out-of-pocket costs associated with health insurance, such as deductibles, copayments, and coinsurance. They are available to individuals and families who meet certain income requirements and purchase a silver-level plan through the Connector Marketplace.

Examples of Financial Assistance

Here are some examples of how financial assistance can help reduce the cost of health insurance premiums:

- A single individual earning $30,000 per year may qualify for a premium tax credit that reduces their monthly premium by $100.

- A family of four earning $60,000 per year may qualify for a premium tax credit that reduces their monthly premium by $200.

- An individual with a low income may qualify for cost-sharing reductions that reduce their out-of-pocket costs for doctor visits, prescription drugs, and other medical services.

Impact on Access to Healthcare

The Massachusetts Health Care Connector has had a profound impact on access to healthcare for residents of the state. Its creation has led to significant improvements in coverage rates, affordability, and equitable access to care, demonstrating its effectiveness in addressing the challenges of healthcare access.

The Massachusetts Health Care Connector offers a range of options for individuals and families seeking affordable health insurance. While you’re navigating those options, you might also want to take a moment for yourself and find a beauty salon near to me to pamper yourself.

After all, taking care of your well-being is just as important as securing your health insurance. Once you’ve found the right coverage, you can focus on enjoying all that Massachusetts has to offer.

Coverage Rates and Affordability

The Connector has played a crucial role in increasing health insurance coverage rates in Massachusetts. Prior to its implementation, a significant portion of the population remained uninsured. The Connector’s establishment, combined with the individual mandate, has led to a dramatic reduction in the number of uninsured individuals.

According to the Massachusetts Health Connector, the uninsured rate in Massachusetts has fallen from 10.3% in 2006 to 2.9% in 2020.

This reduction in the uninsured rate has been attributed to the Connector’s efforts in making health insurance more affordable and accessible. The Connector offers a range of financial assistance programs, including subsidies and tax credits, to help individuals and families afford coverage.

The Massachusetts Health Care Connector is a great resource for finding affordable health insurance options. But it’s also important to maintain your physical health, and swimming is a fantastic way to do that. If you’re looking for a way to stay active and cool off, check out health clubs near me with pool to find a facility with a pool near you.

Staying healthy can help you qualify for lower insurance premiums through the Connector, making it a win-win situation.

Addressing Health Disparities

The Connector has also been instrumental in addressing health disparities in Massachusetts. The state has historically seen disparities in health outcomes based on race, ethnicity, and socioeconomic status. The Connector has implemented initiatives to ensure equitable access to healthcare for all residents, regardless of their background.

The Connector’s efforts to address health disparities include outreach programs to underserved communities, language assistance services, and culturally competent care coordination.

These initiatives have helped to increase access to care for individuals who have historically faced barriers to healthcare, such as language barriers or cultural differences.

Positive Outcomes

The Connector’s impact on access to healthcare in Massachusetts is evident in various positive outcomes. The state has seen improvements in health outcomes, including lower rates of preventable hospitalizations and increased rates of preventive care utilization.

A study by the Commonwealth Fund found that Massachusetts had the lowest rate of uninsured adults in the country and the highest rate of health insurance coverage among adults with incomes below 200% of the federal poverty level.

These positive outcomes demonstrate the effectiveness of the Connector in providing affordable and accessible healthcare to all residents of Massachusetts.

Future Directions and Challenges

The Massachusetts Health Care Connector, a vital component of the state’s healthcare system, faces a dynamic landscape marked by evolving healthcare needs, technological advancements, and shifts in federal policy. To ensure its continued success and relevance, the Connector must proactively adapt and innovate, while also navigating potential challenges.

Future Directions, Massachusetts health care connector

The Connector has a significant opportunity to expand its services and enhance its impact on the lives of Massachusetts residents.

- Expanding Access to Coverage:The Connector can explore innovative strategies to reach underserved populations and individuals who may be unaware of their eligibility for financial assistance. This could involve targeted outreach campaigns, partnerships with community organizations, and streamlining the enrollment process.

- Enhancing Consumer Experience:The Connector can prioritize user-friendly online platforms, mobile applications, and personalized support services to make navigating the healthcare system more accessible and intuitive for individuals and families.

- Integrating Emerging Technologies:The Connector can leverage technological advancements such as artificial intelligence (AI) and data analytics to improve efficiency, personalize services, and identify potential fraud or waste.

Challenges

The Connector faces several challenges that require strategic planning and collaborative efforts.

- Affordability Concerns:Maintaining affordable healthcare options for individuals and families remains a critical challenge, particularly in the face of rising healthcare costs. The Connector must continue to advocate for robust financial assistance programs and explore strategies to control costs without compromising quality.

- Federal Policy Changes:Changes in federal policy, such as those related to the Affordable Care Act (ACA), can significantly impact the Connector’s operations and funding. The Connector must remain vigilant and adapt its strategies to ensure its continued sustainability and effectiveness.

- Technological Advancements:The rapid pace of technological advancements can create both opportunities and challenges for the Connector. It must embrace innovation while ensuring that its systems and processes remain secure, reliable, and accessible to all users.

Addressing Challenges and Ensuring Sustainability

The Connector can address these challenges through a combination of strategic initiatives:

- Strong Advocacy:The Connector must continue to advocate for policies that support affordable healthcare access and maintain the integrity of the ACA.

- Collaborative Partnerships:Fostering strong partnerships with healthcare providers, community organizations, and other stakeholders is crucial for expanding reach and addressing affordability concerns.

- Data-Driven Decision Making:Utilizing data analytics to identify trends, optimize programs, and improve efficiency is essential for the Connector’s long-term sustainability.

Concluding Remarks

The Massachusetts Health Care Connector has made significant strides in expanding access to health insurance for residents of the Commonwealth. Through its comprehensive services, including enrollment assistance, financial aid, and plan comparison tools, the Connector has helped millions of individuals and families secure affordable and quality health care.

As the state’s health care landscape continues to evolve, the Connector remains committed to its mission of providing access to affordable and accessible health insurance for all residents of Massachusetts.

Detailed FAQs

What types of health insurance plans are offered through the Connector?

The Connector offers a variety of health insurance plans, including individual, family, and small business plans. These plans vary in coverage and cost, so individuals can choose the plan that best meets their needs and budget.

How do I enroll in a health insurance plan through the Connector?

You can enroll in a health insurance plan through the Connector online, by phone, or in person. The enrollment process is straightforward and can be completed in a few simple steps. You will need to provide some basic information about yourself and your family, including your income and household size.

What financial assistance programs are available through the Connector?

The Connector offers a variety of financial assistance programs to help individuals and families afford health insurance premiums. These programs are based on income and household size, and they can significantly reduce the cost of health insurance.

What are the eligibility requirements for financial assistance?

The eligibility requirements for financial assistance vary depending on the program. However, most programs require that you meet certain income and household size guidelines. You can learn more about the eligibility requirements for specific programs on the Connector’s website.